[ad_1]

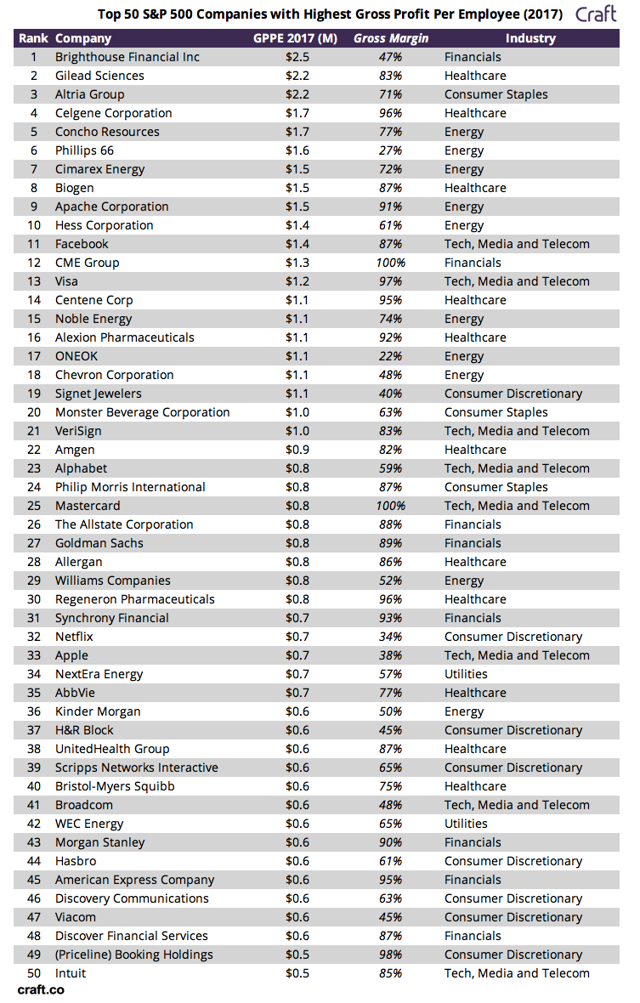

I remember watching Bristol-Myers Squibb (BMY) and Gilead (GILD) after seeing them both listed in the Top 50 Companies for Craft Gross Profit per Employee:

(Source: Craft.co)

These two actions have recently been clarified as they are approaching their 52-week low. I like these two dividend stocks, but I decided to make a comparison in response to a request. The answer to this question is that the best stock is not binary, but at least I can present certain information that investors would find helpful in choosing one of the two, if they were forced to only choose one.

Timing: near new lows, news and the business cycle

For the most part, the BMY has been the subject of more discussion than the ILDG this year. The bullish news item was that of the Celgene Acquisition (CELG), which was approved by the majority of shareholders this month. This is the largest acquisition ever made in the pharmaceutical industry.

The bearish news item was the $ 1 billion lawsuit the BMY was facing for its syphilis experiments in the 1940s, an experiment that left hundreds of beautiful Guatemalans struggling with a dangerous sexually transmitted disease. . Of course, the BMY is not that of the 1940s. Nevertheless, the billion dollar remains a problem for the company and investors.

Usually, stocks that reach new annual lows tend to undergo a continuous liquidation. In fact, this is the concept behind the "turtle trade". Turtle Dealers play the game of escape by going out once the momentum starts to fade.

Thus, the philosophy of turtle trade would provide new losses for these two companies, whatever the news. Both companies, however, have strong balance sheets and dividends, reinforcing the extent to which their shares may fall before value, and dividend investors are opting for an ongoing buyout.

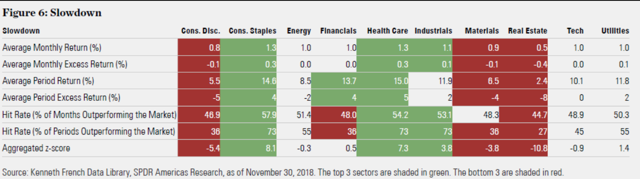

I agree with the purchase of dip at this point. We are not only looking for a potential return of 4%, whatever the action we choose, but also excess returns, on average, for our current business cycle phase. As the economy grows, we are entering a slowdown, in which health stocks are outperforming:

The dividends

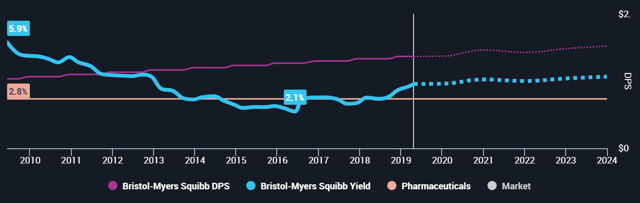

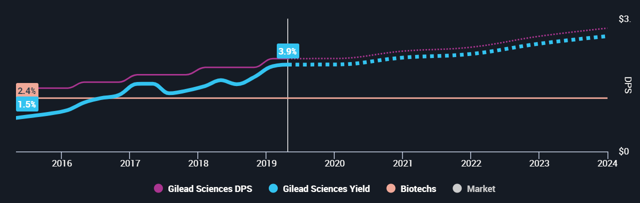

The first question we should ask ourselves, since both companies offer similar dividend yields, is whether the dividend growth is constant and stable. Many dividend investors first look at the dividend history for this type of survey and see BMY as the most reliable dividend share. GILD's dividend growth is only four years, compared to nine years of BMY dividend growth:

(Source: Simply Wall St.)

(Source: Simply Wall St.)

Both companies cover their dividends equally with their profits, up to 2x. We really do not see much difference in terms of security here. We have little to say outside of history, so I suggest looking at dividends from a slightly different angle; interpret them as you can.

Here is the dividend of BMY compared to the share price, which explains the decline in the yield in the graph above:

(Source: Damon Verial, ADVFN data)

And here is GILD, explaining again the yield trend in the graph above:

(Source: Damon Verial, ADVFN data)

Feeling of gains

Personally, I think both companies offer stable dividend growth and that the main factor in your choice between BMY and GILD will be the fundamentals, not the dividend itself. New information for both companies is coming to the market and will certainly be included in the price. This is already happening for the BMY because it announced a profit on April 25; GILD will report on May 2nd.

Let's take a look at the sentiment of the results as it provides information to predict the stock's performance over the next quarter. It's usually what I do comparing the last quarter's sentiment to the history of the company, but as we're comparing two companies right now, I'm just going to compare the sense of direction between the two companies. In other words, we will examine the relationship between optimistic statements and pessimistic statements (as defined by the best practices of financial lexical analysis, such as the categorization of detailed plans as positive sentiment and enslavement in as negative feeling) in the transcripts calls for results and determining if is always more optimistic than the other.

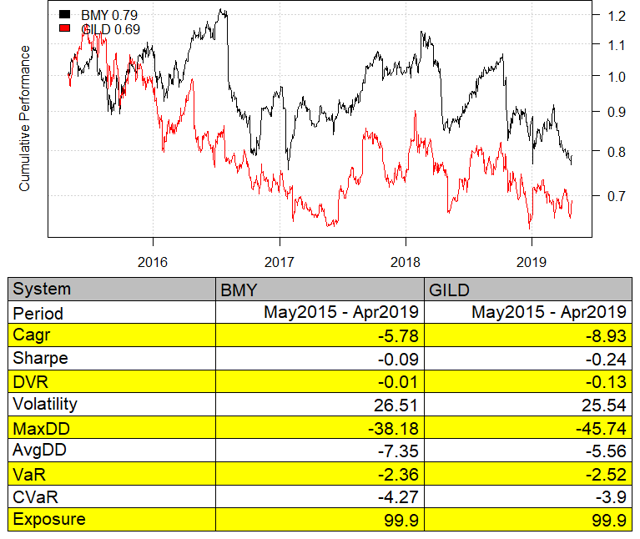

By looking through my code on the transcripts of the results calls for these two companies, we find that BMY is generally more optimistic in its forward-looking statements than GILD. The BMY was on average 30% more optimistic than GILD. This corresponds to the outperformance of BMY (or rather underperformance) compared to GILD during my retrospective period (starting with the increase in dividends in GILD):

(Source: Damon Verial, Yahoo Finance data)

Q1 2019 results

However, it should be noted to BMY buyers that the recent call for BMY results was much less optimistic than the average, although it was still positive. We are seeing a 40% drop in positive sentiment with the current results appeal. We will have to wait for the GILD results report in May to see if a similar change has occurred. (If this is of interest to investors, please let me know so that I can run a detailed income analysis at the time of this article).

The gains are hard to predict, although we can still try. Biktarvy, GILD's new anti-HIV product, will most likely increase the company's revenues. Seasonal business trends point to a decline in sales of GILD products, particularly for its HCV products, as HCV becomes more common in the spring and summer.

Pipeline updates will be important here but hard to guess. Investor reactions to these updates are even more difficult to guess. But for the moment, I imagine that, according to the most tangible and predictable aspects of the GILD results, the feeling towards GILD will decrease in the same way as that of BMY.

Other factors

Two other factors that potential investors should take into account are market risk and speculation. BMY has a beta lower than 1, while GILD has a beta version greater than one, roughly the same distance from the other side. This does not say anything about volatility, but it does show that the BMY is safer for market bears, while GILD probably offers a risk premium for bulls.

In terms of speculation, the options market implies a 4% upward movement by May's expiry date for the BMY. Speculators are positioned more negatively for GILD, with a downward bias of 2%. The difference is small, but the options market still has the ability to put pressure on the stock market for a multitude of reasons.

Overall, I think the BMY is better for your money here. The BMY offers less market risk, upward pressure on the options market and more reliable dividend growth (historically). Although GILD has the same dividend yield, the company is lagging behind in many areas (earnings growth, return on capital, assets and assets, in addition to the issues discussed above) relative to the BMY.

Although I'm not bearish on GILD, I think BMY is the best choice. With both stocks close to their lowest level in 52 weeks, you can buy one with a discount. For me, one clearly seems to offer more value, although none is a bad choice at these prices.

What do you think? Is the longer BMY dividend growth history irrelevant? Is the difference in value from BMY to GILD explained by GILD's more powerful potential pipeline?

Let me know in the comments below.

Exposing Earnings is a newsletter of the results (with live chat). We base our forecasts on statistics, probabilities and backtests. Trades are recommended with option strategies to create high-paying, low-risk games. We have 100% accuracy for our forecasts in 2019.

If you want:

- A definitive answer on how a stock will go on profits …

- The probability that the prediction is paying off …

- The risk / reward of the game …

- A well-designed options strategy for gambling …

…click here.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link