[ad_1]

I am constantly asked the question: "Why are you writing this article?" The short answer is that I am several companies on which I regularly write articles. I was accused of being an Apple fanboy (NASDAQ: AAPL), but in other articles, I was asked if I ran out of stock. To be clear, I own Apple stocks and I have never made a purchase out of stock. I also own Apple products. However, the shareholders, who do not want to believe that Apple has problems, are investing their eyes closed. The stock has been in ruins this year despite declining revenues. The company's latest earnings report clearly indicated three key challenges that Apple faced. In short, it may be time to take profits because the market is digesting the new reality of the business.

Watch for growth

For years, Apple has bundled several products into one budget item. Although the iPhone, the iPad, the Mac and the services are separate, Apple Watch has not yet earned this distinction. In fact, Apple Watch does not even mention its name. Instead, it is part of "Wearables, Home and Accessories". Investors are calling for a breakdown of Apple Watch sales for some time and, given the fact that the Watch is currently the 5th version, this recipe detail seems to be long overdue.

(Source: Apple Watch)

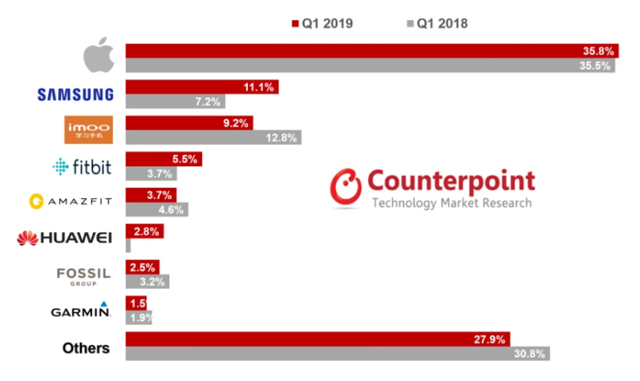

According to Counterpoint Technology Market Research, Apple holds nearly 36% of the global smartwatch market. The company said the Series 4 ECG function was stimulating demand. Tim Cook said the growth of Wearables was close to 50%. In addition, Luca Maestri, CFO, said that "three-quarters of purchases go to customers who have never owned an Apple Watch before." On the surface, it seems that Watch represents a huge opportunity for the company and investors should be enthusiastic.

(Source: Market Research Counterpoint Technology)

However, if we dig deeper into the numbers, we will see threats. This brings us to the first major challenge facing Apple. The growth of Apple Watch is likely to slow down as of this year. First, Series 4 was introduced in September 2018 and the ECG function was a unique reason to buy for the first time or as an upgrade option. However, with the approach of the anniversary of this model, Apple will have to step forward for the 5 Series if customers want to continue buying and upgrading at the same pace.

Secondly, although smartwatch sales have increased significantly, research suggests an impending slowdown. According to Allied Market Research, the smartwatch market is expected to grow at a compound annual growth rate (CAGR) or slightly above 16% by 2025. Another study suggests a compound annual growth rate (CAGR) of 16, 4% and another suggests a rate of up to 18.4%. . It seems that the biggest growth of the smartwatch market has already taken place.

Third, as Apple has seen with other devices, the company's dominant position in the market is not always safe. In the chart above, two of the significant market share gains came from companies with which Apple was all too familiar. Samsung (OTC: SSNLF) went from 7.2% to 11.1% of the world market. From Fitbit (NYSE: FIT) Interest in smartwatches has raised the company's market share from 3.7% to 5.5%. Although Apple has managed to maintain its market share despite the gains of other companies, it is logical to think that at some point, Apple's market share could suffer . With market share problems and much slower growth in the coming years, Apple Watch may not be the massive growth activity expected by some investors.

If we look at Apple's quarterly revenues, including Apple Watch, they went from $ 3.2 billion in the fourth quarter of 2017 to $ 4.2 billion in the fourth quarter of 2018. By the fourth quarter of 2018, proposed figure would be around $ 5.5 billion. If we annualize the results of the current quarter, this suggests that "Wearables, Home and Accessories" will generate revenues of about $ 20 billion in 2019. According to analysts' estimates, this amount would amount to about 7.8% of the company 's total business figure for the year. By 2020, with market growth of about 16%, Apple's other business will generate about $ 23.2 billion, or 8.6% of the total expected annual revenue. Apple Watch is the focus of concern and these other devices may be good companies, but the 50% growth could end this year.

How long can Apple aggressively buy back shares?

One of the ways that Apple has rewarded shareholders in recent years is to buy back shares. This is the second big challenge. Aggressive stock repurchases are not guaranteed forever. It's no secret that Apple seems to have hit a wall regarding the growth of the iPhone. However, there are two charts that show how much Apple has faced a daunting challenge over the last two quarters.

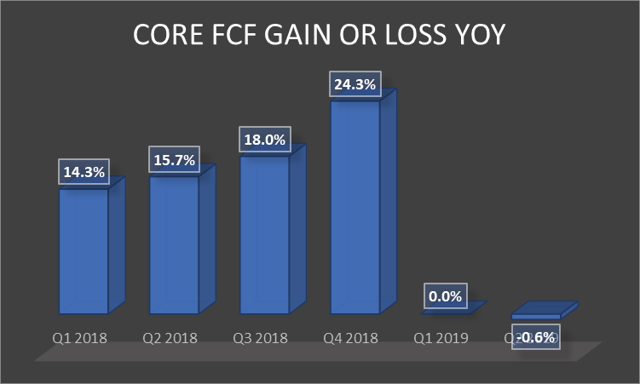

(Source: Q1 2018 – Q2 2018 – Q3 2018 – Q4 2018 – Q1 2019 – Q2 2019)

As we can see, last year, Apple sequentially increased its free cash flow. In the first quarter, this trend ended quickly, with free cash flow being essentially flat compared to the previous year. In Q2, free cash flow decreased by just under 1% per year. For investors to believe that Apple will continue to buy back shares, any assumption of declining free cash flow directly challenges this assumption.

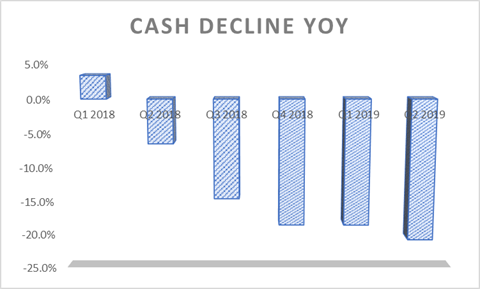

In addition, the net cash of Apple is the subject of much press, but what the investors lack, it is the speed with which the cash of the company is in decline. In the last 18 months, Apple has moved from increasing its cash balance to depleting its cash at an increasing rate.

(Source: Q1 2018 – Q2 2018 – Q3 2018 – Q4 2018 – Q1 2019 – Q2 2019)

As recently as the first quarter of 2018, Apple's cash was increasing from year to year, even by distributing billions of dollars in dividends and stock repurchases. In the second quarter of 2018, Apple began to spend more money on dividends and redemptions than it would generate in free cash flow. Over the last four quarters, the Company's net cash balance decreased by 14% to almost 21% per annum. Doubly worrying is Apple's net cash position, which declined the most in the second quarter, as the company's annual free cash flow declined.

Apple has more than $ 124 billion in net cash in the last quarter. Part of Apple's investment thesis is that its cash could allow it to make a transformative acquisition. If Apple 's free cash flow does not grow and as net liquidity decrease by 20% per year by 2022, Apple' s cash reserve will have been reduced by more than half, for reach about $ 55 billion. It 's still a huge amount of money, but it just proves that Apple' s aggressive stock repurchases can not last forever.

A beautiful story with several holes

Some analysts suggest that Apple's future lies in its Services business. Last year, the revenue growth of this division was impressive. In the most recent quarter, Services revenues of more than $ 11 billion accounted for just under 20% of the company's total revenue. In this spirit, revenue growth in the Services segment increased by just over 16% per year in the last quarter. Unfortunately, it was the lowest growth rate of last year.

(Source: Apple TV +)

While the amount of revenue from services is making headlines, which is understated is that this growth rate has been almost two months earlier. In addition, Apple's own projections suggest that services will not grow fast enough to offset the potential weakness of the iPhone industry. In the current quarter, revenue from products decreased by more than 9%, while services increased. By 2020, Apple is forecasting a quarterly Services business figure of $ 14 billion. If we combine Apple's forecasts for Services with analysts' forecasts for overall revenue, we have an idea of the challenges facing the company over the next two years.

By 2020, analysts are asking that Apple 's revenue reach nearly 270 billion dollars. If services are $ 14 billion a quarter, that's $ 56 billion a year. Using these numbers, it would suggest that revenues would generate $ 214 billion, an average of $ 53.5 billion per quarter. To attribute a growth percentage to these figures, Revenue would increase revenue by 14.6%, while revenue from Services would increase by 22.3%.

These assumptions imply two important challenges. First, Services revenue increased by 16% in the last quarter. It is possible that new services such as Apple Arcade, Apple News +, Apple Card, etc., help this product to grow. However, going from an annual growth rate of 16% to over 22% next year is a daunting challenge. Apparently, the recovery of society that these numbers imply represents a greater challenge.

Apple says its price cuts, trade and financing options are helping its iPhone business to recover. However, investors must examine the breakdown of the product. In the last quarter, iPhone sales reached $ 31 billion, down 17% annually. Excluding services, other Apple products generated a turnover of $ 15.5 billion, up just over 13%. Achieving a growth of more than 14% of products by 2020 means not only a massive turnaround in the iPhone business, but also a better growth rate of other products. It does not look like a challenge; it sounds like an impossibility.

The bottom line

The relative value of Apple seems to have declined while the stock has gone up. Over the past 90 days, analysts' estimates of Apple's profits for 2019 and 2020 have decreased by 4% annually each year. Some analysts believe that the Apple Watch will be an important revenue engine for the company. However, research by several companies suggests that smartwatch sales will increase over the next few years, but at a slower pace. In addition, companies such as Samsung and Fitbit are looking to break through.

Apple has a ton of money and could make a deal. The problem is that it seems like the company is comfortable buying small companies and investing its cash in stock repurchases. Unfortunately, Apple's free cash flow growth turned negative for the last quarter for the first time in a long time. In addition, the company 's cash is depleting at its fastest pace for more than a year.

Finally, service growth seems to have matured and the 30% growth period is probably over. Bottom line, Apple 's action seems to have taken a step ahead of the reality. Challenges abound, estimates have been reduced, but the stock is progressing higher. Long-term investors would do well to wait for what appears to be an inevitable correction of the title.

Disclosure: I am / we are long AAPL. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link