[ad_1]

Here are three factors that indicate that the price of bitcoin has not only bottomed out, but is also poised to break the $ 20,000 high that it set at the end of 2017.

Reason # 1: moving averages imitating the historical pattern of 2015

Yesterday, Peter Brandt, author of Factor Trading, suggested that the price of bitcoin could reach $ 19,800 in the future.

He confirmed his forecasts using a weekly moving average indicator, noting that the trend was now lower than the spot price of bitcoin.

The last such operation took place in November 2015 and preceded the triumphal bitcoin march from $ 340 in 2015 to $ 19,800 in 2017.

The last time MA, Factor's weekly reference, was going from bottom to top, it was in November 2015, just like $ BTC started his transfer from $ 340 to $ 19,800. pic.twitter.com/uFJSkV9NwM

– Peter Brandt (@PeterLBrandt) May 2, 2019

Robert Sluymer, technical strategist at Fundstrat, a Wall Street-based strategy company, also believes that bitcoin is in full swing in a bull market.

The financial expert said that the asset could initially experience a dip on its moving average to 200 weekly as a result of its most recent hike to $ 6,000.

But after that, he could enter a gigantic phase of accumulation that, as Fundstrat co-founder Thomas Lee says, could raise the price to $ 20,000.

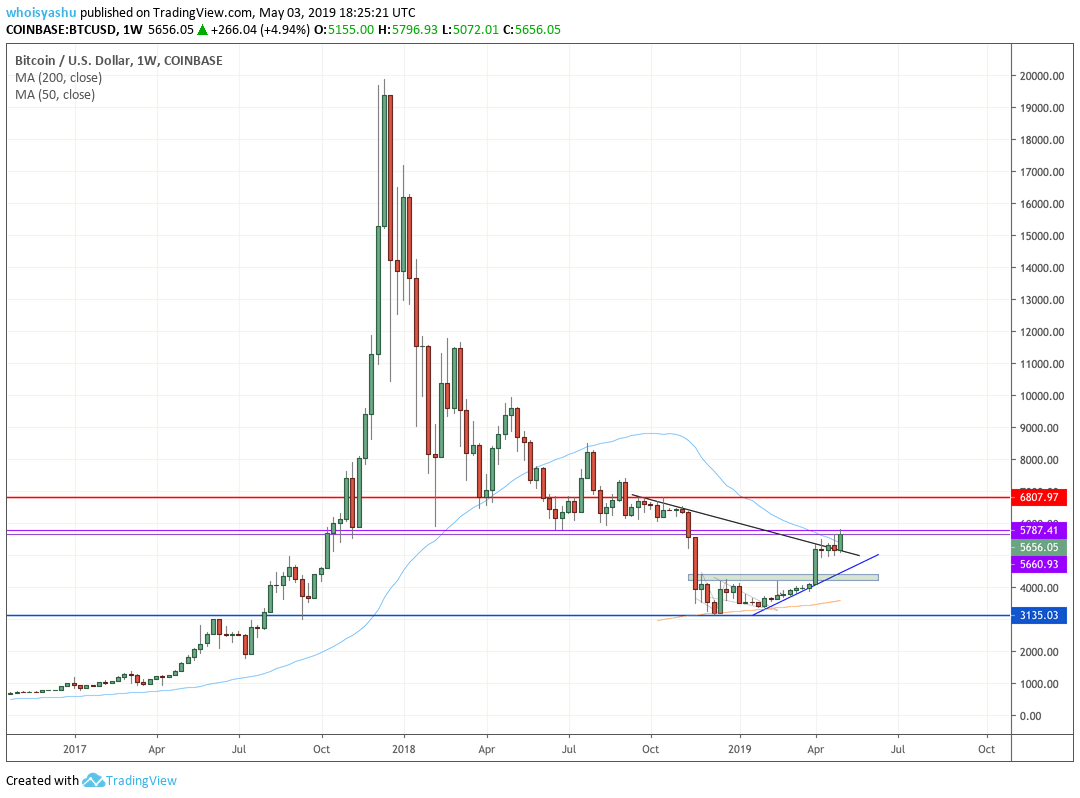

THE BITCOIN PRICE IS NOW OVER THE AVERAGE OF 50 WEEKS | SOURCE: TRADINGVIEW.COM, COINBASE

The last jump also closed the price of bitcoin above its 50-week moving average, as shown by the blue curve in the graph above.

The 50-WMA has historically reported a strong upward bias each time the price was rising above it. The bitcoin crashed under the 50-WMA in May 2018 during an excessive stock market action, after which the price dropped to $ 3,100.

With bitcoin now above the 50-week MA, Bull Bull's probability is high.

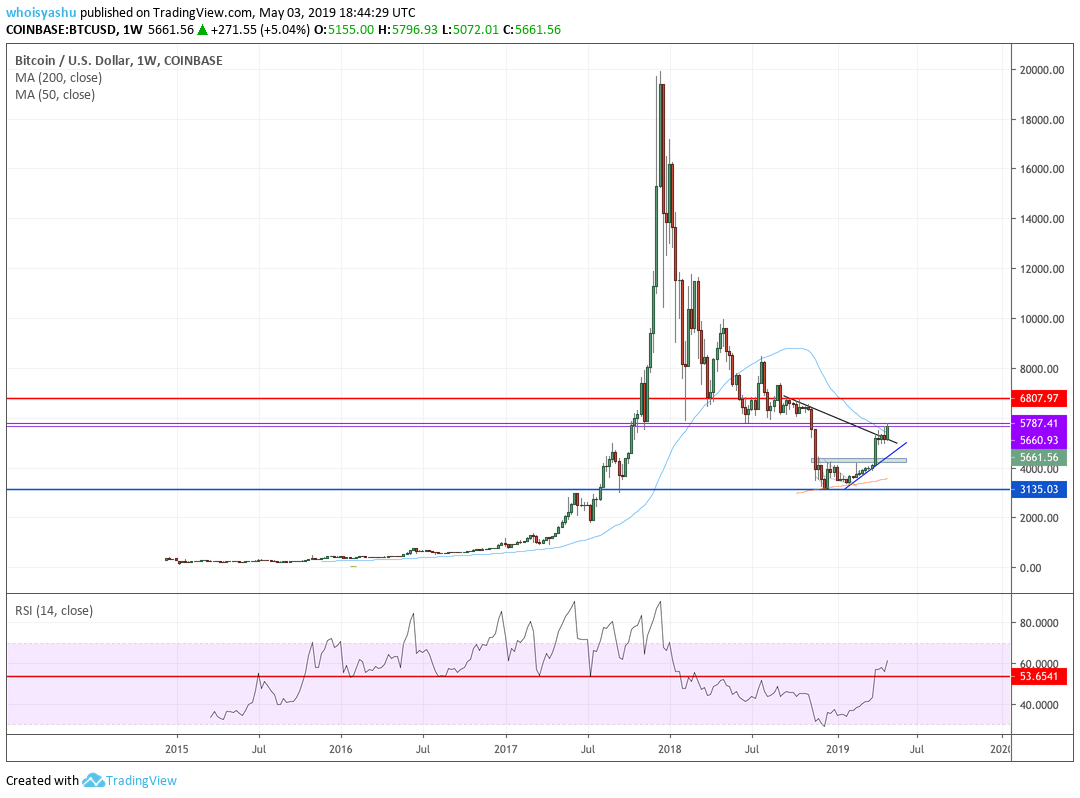

Reason 2: The relative strength index rages bullish

THE WEEKLY ROI OF BITCOIN IN THE BULL AREA | SOURCE: TRADINGVIEW.COM, COINBASE

The weekly bitcoin relative strength indicator has recently surpassed 53.65, its highest level since October 2015.

The level, indicated by a red horizontal line in the graph above, has so far been used as a yardstick for measuring an uptrend or downtrend.

When it surpassed 53.65, the sentiment of buying in the bitcoin market has improved. And when the RSI went under this brand, as it did in January 2018, it triggered a sell-off.

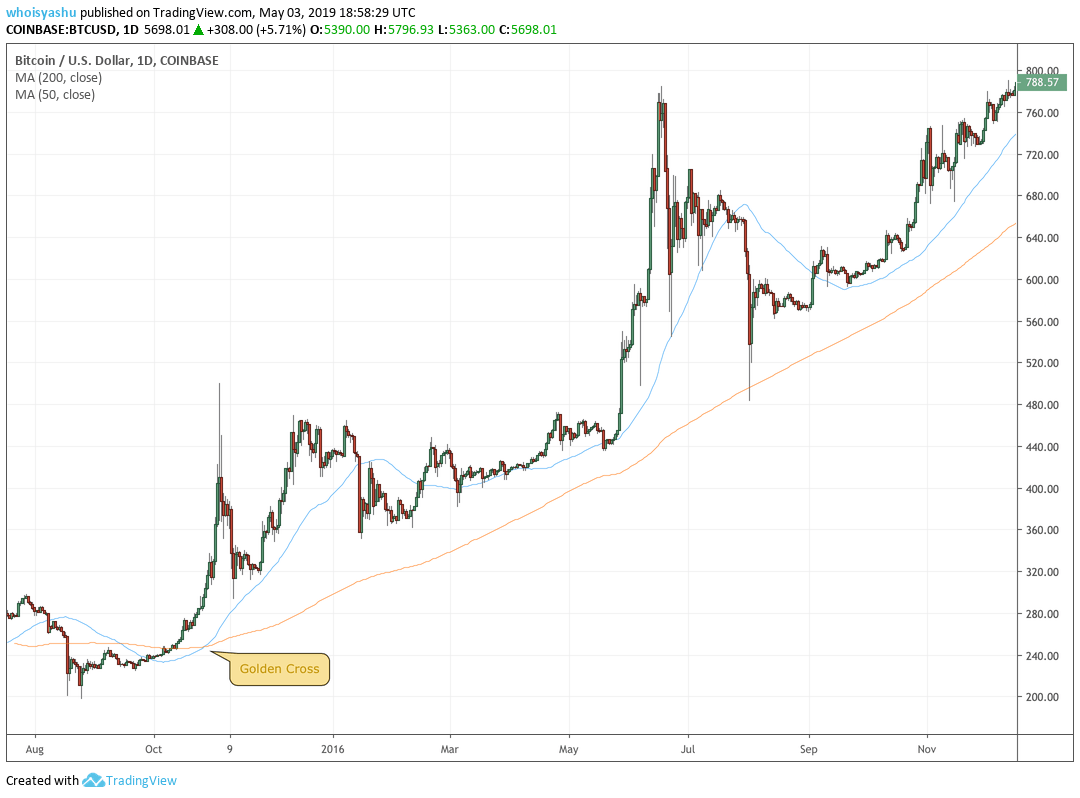

Reason # 3: The price of bitcoin has formed a "gold cross"

GOLDEN CROSS TRAINED IN BITCOIN AND A UPSIDE RALLY ENSUED | SOURCE: TRADINGVIEW.COM, COINBASE

A gold cross is reached when the short-term moving average of an asset exceeds its long-term moving average.

The price of bitcoin witnessed one of these formations in October 2015, while it was trading close to $ 300. Later, the asset experienced one of its longest bullish periods, which eventually brought the price to nearly $ 20,000. He again formed a gold cross in April 2019, signaling a potential long-term upside scenario.

These three factors reinforce the argument that the price of bitcoin returns to $ 20,000, perhaps even earlier than many bulls predict. For the moment, bitcoin is trading at $ 5,700.

[ad_2]

Source link