[ad_1]

Warren Buffett became Berkshire HathawayCEO since 1965, when the company was valued at around $ 19 per share. The Oracle of Omaha led the investment conglomerate to legendary success after taking office as chief executive. Today, Berkshire Class A shares are trading at around $ 429,700 per share, and the company’s returns throughout Buffett’s tenure are even more impressive if you factor in dividend payments.

With that in mind, three Motley Fool contributors identified three dividend paying stocks in Berkshire Hathaway’s portfolio: Verizon Communications (NYSE: VZ); MasterCard(NYSE: VZ); and Apple (NYSE: VZ). These stocks look set to continue to deliver big long-term gains. Read on to see why our backers believe these Buffett-backed income-generating stocks have what it takes to stand out in your portfolio.

Image source: The Motley Fool.

Verizon is a dividend juggernaut

Jamal Carnette (Verizon): Who Said Warren Buffett Wasn’t A Tech Investor? After shunning the industry for years, Buffett has now invested billions in tech companies, including owning 3.8% of Verizon Communications. At current prices, Berskhire’s position is worth almost $ 9 billion.

Verizon’s dividend has always been underestimated. Despite its hefty 4.5% return, many income investors favored the larger 7% payout provided by its telecommunications competitor. AT&T. However, that is about to change.

Earlier this year, AT&T announced the split of its WarnerMedia division and its merger with Discovery with the split occurring next year. As a result, the company reduced its dividend. While the move may free up value for AT&T, it also makes Verizon relatively more attractive to income investors in the telecommunications space.

Buffett is a value investor, and Verizon certainly fits the bill. The company is currently trading at 10.5x futures earnings compared to 22.3x for the S&P 500. Verizon’s 4.5% return is three times the top index return, and investors expect another increase announcement in September, continuing the series of increases that have occurred each year since 2006.

Certainly, Verizon stock carries risks. Revenue growth was difficult to achieve, and revenue in 2020 was lower than in 2015. The company has significant exposure to fixed line and cable TV companies, and significant debt, most of which comes from the $ 49 billion. show that she has committed to buy VodafoneVerizon Wireless’ 45% stake in 2014.

Despite this, Verizon’s dividend is secure. Last year, the company generated more than $ 20 billion in free cash flow, more than double the dividend payout. Verizon’s predictable subscription-based business will keep investors looking for dividends (and increases) for years to come. Warren Buffett and Berkshire know a solid business when they see one.

Don’t let this payments giant’s low performance – or huge size – hold you back

Jason hall (MasterCard): With a dividend yield below 0.5% at recent prices, yield-seeking investors often overlook Mastercard. Ironically, growth investors could too Avoid the business, assuming that with a market cap of over $ 351 billion its growing days are over.

I think investors in That is camp make a mistake by omitting Mastercard. Simply put, this mainstay’s scale and brand power allows it to ride a massive wave of digital payments growth around the world for decades to come.

Mastercard has a huge economic gap in its trusted and well-known payment network, which gives it a huge advantage in terms of the network effect. Having a relationship – whether as a cardholder, accepting merchant, or Mastercard-issuing bank – gives you access to the other two. And the more everyone is a Mastercard partner, the more others want to access it. It is a deadly advantage.

This economic divide is why the Mastercard stock has consistently outperformed the S&P 500 roughly every three, five and 10 years since its IPO, and is likely to continue to outperform. This is also probably the reason why Mastercard is part of the Berkshire Hathaway wallet.

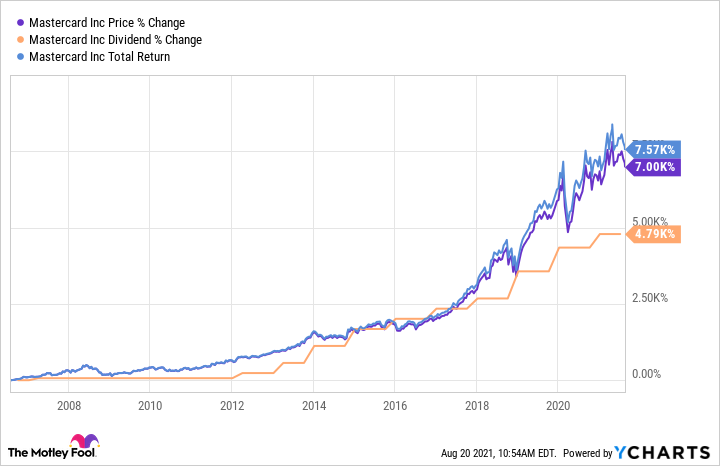

One more thing: the yield may be low, but the dividend growth It’s incredible. Here’s how much it has grown since its inception, with Mastercard’s total return rising an additional 570%:

MA data by YCharts

It’s a parcel of juice from a relatively low dividend yield, fueled by incredible growth.

Investors Can Win With Berkshire’s Largest Stock

Keith Noonan (Apple): The company has had an incredible run. It has posted a total return of around 675% over the past decade, with gains driven by strong sales for its hardware and impressive growth in the software and services space. In light of this gravity-defying performance, it’s not unreasonable to question whether the tech giant still has room for strong growth.

Apple already has an eye-catching market cap of around $ 2.45 trillion and is at the top of the list of the world’s most valuable companies. While relative growth will be more difficult to achieve as the size of the company continues to grow, Apple still has an unmatched position in the consumer electronics industry. Technology will only become more and more important in the everyday life of the average individual, and Apple is uniquely positioned to capitalize on some of the biggest emerging tech trends in the world.

The company’s phones and tablets will play a huge role in ushering in the era of 5G networks, which will enable significantly faster upload and download speeds that will make new types of software applications possible. Apple is also likely to be a leader in augmented reality (AR). Next-generation network technology will help pave the way for new AR hardware and software applications, and Apple’s current leadership position in mobile and wearable computing suggests the company will likely be one of the most big winners if augmented reality takes off.

With the company’s dividend yield hitting around 0.6% despite years of strong payout growth, it may come as a surprise to learn that Apple’s dividend has shown a much higher yield on earlier dates. Consider that the stock returned over 2.6% for a period of time in 2013. Apple has increased its payout by 132.5% since it started paying a dividend in 2012, but capital appreciation overwhelming market has exceeded the growth of payments. Do not worry. The tech leader should be able to continue posting strong earnings growth and increasing dividend payouts, and long-term investors are likely to see impressive returns from the stock.

This article represents the opinion of the author, who may disagree with the “official” recommendation position of a premium Motley Fool consulting service. We are heterogeneous! Challenging an investment thesis – even one of our own – helps us all to think critically about investing and make decisions that help us become smarter, happier, and richer.

[ad_2]

Source link