[ad_1]

(Bloomberg) – While Softbank Group Corp. As it tries to rebuild its reputation as a startup investor, the Japanese conglomerate will be able to report several recent successes, including an obscure Chinese real estate startup that pulled off a successful initial public offering.

SoftBank invested $ 1.35 billion last November in a Beijing-based company called KE Holdings Inc., which went public in August. Shares of the company, also known as Beike, have soared from the offer until September 30 to bring the value of SoftBank’s reported stake to $ 6.4 billion, a return of 375 %. KE’s stock has risen another 20% since the end of the quarter.

SoftBank founder Masayoshi Son is sure to highlight these winners when he announces his quarterly results on November 9. The Japanese billionaire scored some hits early in his career by supporting Alibaba Group Holding Ltd. and Yahoo! Inc. But its reputation has suffered from recent turmoil at other startups, including office-sharing company WeWork, leading to record losses in the last fiscal year.

“SoftBank is recovering from the worst,” Shinji Moriyuki, analyst at SBI Securities Co. “Internet companies can generate huge returns. SoftBank should find a company that will become like Alibaba in the future. “

SoftBank shares rose 5.2% on Monday and have gained nearly 50% this year.

The KE investment, coupled with likely gains on several U.S. tech giants, could help SoftBank beat estimates for the second fiscal quarter. The company is expected to report net profit of 150.3 billion yen ($ 1.4 billion) for the three months ended Sept. 30, according to the average consensus of three analysts compiled by Bloomberg. It recorded a loss of 700 billion yen for the quarter of the previous year.

Estimating the company’s profits became increasingly difficult as it moved away from the predictable telecommunications industry and turned to complex financial instruments. The company said in August that it would stop disclosing its operating income because it does not reflect gains from its equity investments and dividends.

In October, Son spoke about Beike at SoftBank World, an event he holds every year to explain the company and its startups. He highlighted how the company is using artificial intelligence to match buyers and sellers in the Chinese real estate market.

“It’s a great company,” Son said, showing charts to detail the company’s activities. “It is growing rapidly and is already making huge profits.”

SoftBank staged a comeback this year after missteps with startups like WeWork and concerns about the fallout from the coronavirus pandemic. He has unveiled plans to sell 4.5 trillion yen in assets and buy back a record 2.5 trillion yen of his own stock, pushing stocks to a two-decade high in October.

The IPO market has also improved, paving the way for SoftBank’s portfolio companies to go public. ByteDance Ltd., the developer of the TikTok app and backed by Son, is considering listing in Hong Kong, Bloomberg News reported. Even WeWork plans to revisit IPO plans after its disastrous attempt in 2019.

“As investors get used to the COVID-19 pandemic, the unicorns’ shares are appreciating,” Yoshio Ando, analyst at Daiwa Securities Co., said in a report dated Oct. 26. “We expect the profile of Softbank Group to change dramatically this year. We rely on the company to navigate a world unknown to investors. “

New WeWork CEO Considering IPO Again – After Making Profits

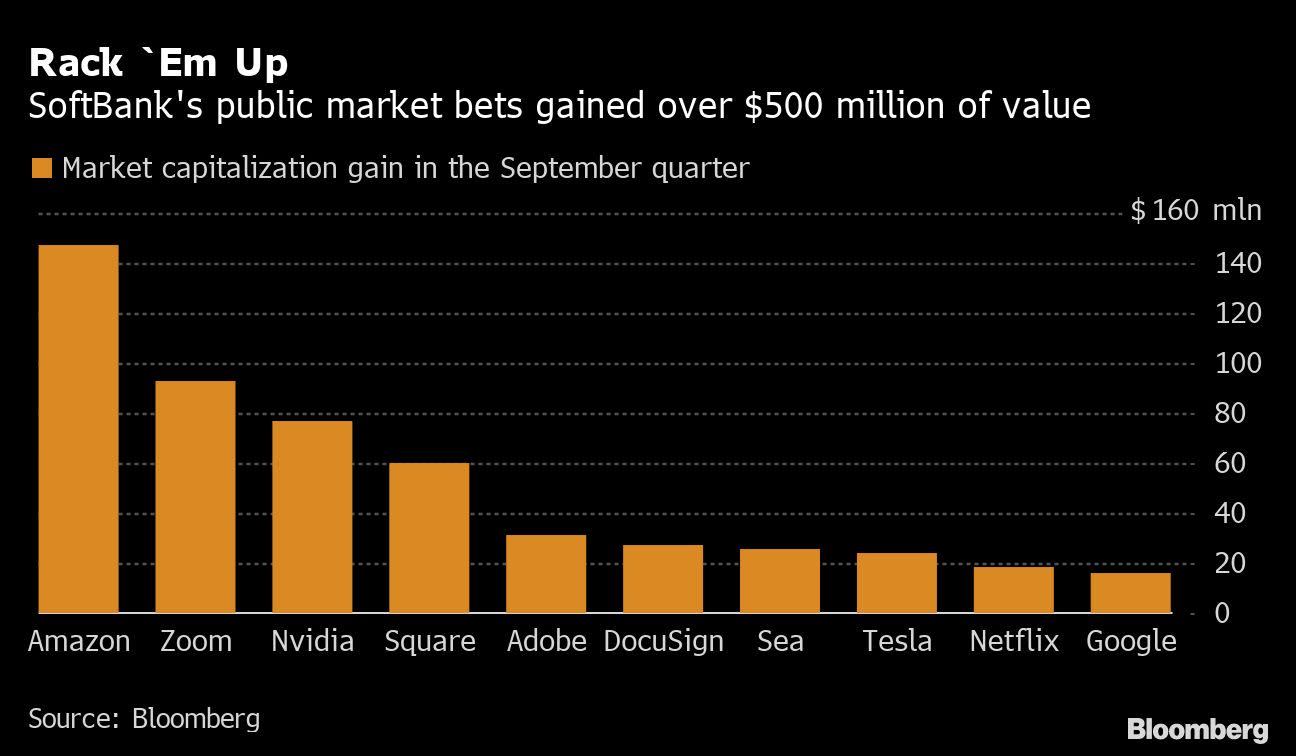

SoftBank also benefited from the good third quarter of the Nasdaq. If it held its stakes in Netflix Inc., Amazon.com Inc. and 23 other US companies disclosed in US securities filings for the period, its gain on paper would be around $ 570 million, according to Bloomberg calculations. The return for these stocks was 15%, compared to 11% for the index.

Son has increasingly discouraged investors and analysts from focusing on quarterly earnings – one of the reasons he has eliminated disclosure of operating income. While profit was a reasonable indicator of performance when SoftBank was primarily a telecommunications operator, it is less relevant as the company has become an investment holding company, he said.

Accounting rules mean that investment gains or losses are treated differently in SoftBank’s income statements whether they come from the Vision Fund or the parent company – even though the effect on the business is essentially the same. He would prefer investors to focus on the value of SoftBank’s holdings, like its stakes in Alibaba and KE Holdings, rather than net income.

“What’s more important is shareholder value,” he said during the earnings call in August.

(Updates with SoftBank actions in fifth paragraph)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted source of business news.

© 2020 Bloomberg LP

[ad_2]

Source link