[ad_1]

This year's Mobile World Congress – the CES for Android Device Manufacturers – was inundated with 5G handsets.

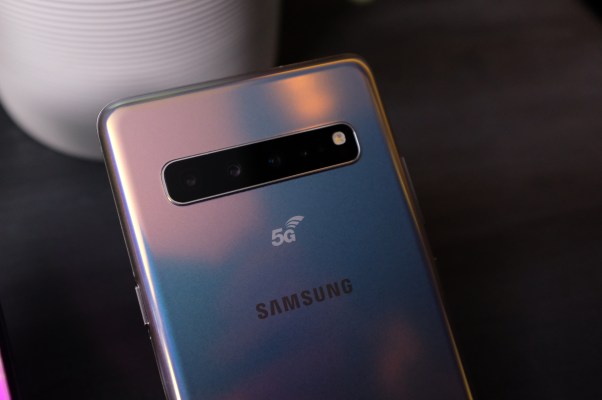

Samsung, the world 's number one smartphone sharing market, Samsung, has taken the lead with a stand – alone launch event in San Francisco, featuring two 5G devices, just before Android competitors are hurrying to market. Explode their own 5G phones during launch events in Barcelona this week.

We have rounded all these 5G handset launches here. Prices range from $ 2,600 for the Mate X – foldable tablet from Huawei to a collapsible tablet – and $ 1,980 for the equally appealing Samsung Galaxy Fold; Another 5G handset that folds – a more reasonable $ 680 for the Mi Mix 3 5G from Xiaomi, although the device is otherwise halfway. The other prices for 5G phones announced this week are to be confirmed.

Android OEMs are clearly hoping that the hype around next-generation mobile networks will allow for some marketing magic and boost smartphone growth. Especially with reports suggesting that Apple will not launch an iPhone 5G until at least next year. So, the 5G is a space that only Android builders can acquire for a while.

The chip maker Qualcomm, involved in a fierce patent battle with Apple, was also on stage in Barcelona to support the launch of Xiaomi's 5G phone, claiming loud and clear that next-generation technology is coming fast and improving "everything ".

"We love working with companies such as Xiaomi to take risks," Qualcomm chairman Cristiano Amon confessed to his hosts, using the 5G's involvement to implicitly encroach on Apple. "When we look at the opportunity that awaits us for 5G, we see an opportunity to create winners."

Despite the hype, Xiaomi's live demo – which she said was the first live 5G video call outside of China – seemed strangely staged and was not lacking in latency.

"Really 5G – no fake 5G!", Concluded Donovan Sung, director of product management for Chinese OEMs. As a 5G presentation, everything was very disappointing. Many more things, while "must have".

It is highly unlikely that the 5G's hype will convince consumers that it is time to upgrade to the next version.

The phones are selling features rather than connectivity per se, and – what Qualcomm claims – the 5G is being launched smoothly on the market by operators with limited resources, whose boom period is behind them, that is, that is to say, before the over-sized players have swallowed up their messaging revenues and the eyes of the monopolized consumers.

All this makes the 5G a proposal for additional consumer upgrading in the short and medium term.

The use cases of next-generation network technology, supposed to support speeds up to 100 times faster than the LTE and provide a latency of a few milliseconds (as well as the connection of a more devices per cell site), are also in progress. applications and services formulated, not to mention, created to take advantage of 5G.

But sell the network upgrade to consumers claiming that great apps are going to be amazing, but you can not show them any, but it's as difficult as trying to turn the theater into a slightly less janky video call.

"5G could potentially help [spark smartphone growth] In a few years, prices are falling and availability is increasing, but even then, growth rates may not be similar to those of the transition to 3G and 4G, "suggests Carolina Milanesi, Senior Analyst at Creative. Strategies, in an article about Samsung's strategy. with its latest device launches.

"Just because 5G is not important, but because it's incremental for phones and other devices will provide a unique experience, we do not even think that was possible. Consumers could end up sharing their budget more than when smartphones come on stream. "

The "problem" of 5G – if we can call it that – is that 4G / LTE networks skilfully provide everything consumers like at the moment: games, applications and video. Which means that for the vast majority of consumers, there is simply no reason to rush to buy a 5G compatible device. Not if 5G is the most successful innovation.

LG V50 ThinQ 5G with a dual screen accessory for games

Use cases such as RA and virtual reality are also difficult to sell, given weak consumer demand on these fronts (with the exception of a few brands).

The reality is that 5G commercial networks are as rare as goose bumps, outside of a few limited geographic areas in the United States and Asia. And the 5G will remain a very uneven patchwork in the near future.

Indeed, in many countries, national coverage can take a long time, even if the 5G ends up spreading on all the edges. (There are also alternative technologies that could help fill the gaps where the return on investment is simply not there for 5G.)

Again, consumers who buy phones with the inflated idea of being able to use 5G here (for now, according to Qualcomm, 2019 will be "the year of 5G!") Will be limited to a handful of urban areas around the world.

Analysts are clear that 5G deployments, while coming, will be measured and targeted as operators tackle what is touted as a multi-industry wireless technology transforming cautiously, keeping an eye on their capex while trying to find the best way to restructure their businesses need to engage with all the partners they will need to build business relationships, across all sectors, in order to successfully sell the 5G transformation potential to all kinds of businesses. companies – and to position themselves "in the space where 5G makes sense".

It is therefore likely that enterprise deployments will take precedence over the mainstream 5G – as was the case for 5G launches in South Korea at the end of last year.

"4G was much more consumer-oriented and it was clear that you wanted national coverage that was never really a question and that you were keeping the promise of data that 3G has never really delivered … so there was a lack of technology. it had to be filled. It's a lot less clear with 5G, "explains Sylvain Fabre, of Gartner, when he discusses the hype of technology and reality with TechCrunch, ahead of MWC.

"4G is very good, you have several networks reaching Gbps or higher and continue to increase on the downlink with multi-carrier aggregation … and other densification systems. So the 5G does not have … so much gap to fill. It's great, but again the applicability of a unique position is a bit like a very narrow niche right now. "

"It's such a change that the real power of 5G lies in creating new business models that use network-based networking: assigning certain aspects of the network to a particular use case," says analyst Dan Bieler. of Forrester. "All of this requires rethinking what connectivity means for a business customer or for the consumer.

"And for telecom sellers, the marketing approach of telecom companies is not based on selling use cases, but rather technologies. This is an important change for the average distribution channel of the telephone companies. And I think that will slow down a lot of the medium-term 5G ambitions. "

To be clear, operators are actively taking on the tires of 5G, after years of hype, and are struggling with technical challenges to better enhance their existing networks to add and develop 5G.

Many of them pilot pilots and test what works and what does not work, for example, where to place the antennas to get the most reliable signal, and so on. And some have set foot in the water with commercial launches (globally, there are 23 networks with "some form of 5G live in their commercial networks" at this stage, according to Fabre.)

But at the same time, the 5G network standards are not yet fully finalized, so the core technology is not completely cooked. And since these are the first days "There is still a long way to go before we have a significant impact on 5G services, "says Bieler.

The availability of the spectrum is also to be taken into account and the acquisition cost of the necessary spectrum. As well as the time required to clean it and prepare it for commercial use. (On the spectrum, government policy is essential for things to happen quickly (or not), so this is another factor that moderates the speed with which 5G networks can be built.)

And despite some industry wishful thinking at MWC this week – calling on governments to "support large-scale digitization" by distributing free spectrum (ehhhh yeah yes), it's just whistling in the wind.

The deployment of 5G networks will undoubtedly be very expensive, at a time when telecommunication companies are already facing increased costs (linked to increased data consumption) and poor growth forecasts for revenues.

"The world is now working on data" and telecom operators are "at the heart of this change", as explained by Chua Sock Koong (Singtel, CEO of the Single Operator), in an introductory speech to the CMM in which she explores opportunities and challenges for operators. from traditional connectivity to a new era of smart connectivity. "

Chua argued that it would be difficult for operators to compete "solely on the basis of connectivity" – suggesting that operators will have to rotate their business to create stand-alone commercial offers offering all kinds of B2B services in order to take support digital transformations of other industries. the promise of 5G – and this will certainly waste a lot of time and spirit in the foreseeable future.

In Europe alone, the cost of deploying 5G is between 300 billion euros and 500 billion euros (about 340 billion to 570 billion dollars), according to Bieler. The numbers underline the slow growth of 5G and the thoughtful construction of networks; in the b2b space, this basically means on a case-by-case basis.

Carriers simply need to save the savings. Which does not mean "huge huge bets with 5G". And an ubiquitous pressure on return on investment pushing them to try to earn a bonus.

"A lot of network equipment providers have reduced the hype a bit," says Bieler. "If you compare that to the hype around 3G many years ago or 4G a few years ago, the 5G appears as a smooth launch. A kind of evolutionary technology. I have not come across any network equipment providers these days that would say that everything will change by 2020. "

As far as consumer prices are concerned, operators are just starting to struggle with 5G business models. The 5G home service from Verizon, a parent company of TC, is one of the earliest examples. It positions next-generation wireless technology as an alternative to fixed-line broadband with discounts if you opt for a wireless smartphone data plan and 5G broadband.

From the point of view of the consumer, the conundrum of the 5G operators' business model boils down to this: What is the price that my operator will charge me for 5G? And early users of any technology tend to get stung on this side.

Although in mobile services, price premiums stay a long time as long as operators are inevitably forced to drop premiums to unlock the scale – via user-friendly price plans for all consumers.

However, in the short term, operators should experiment with 5G pricing and bundling – essentially seeing what they can charge for first users. But it's still far from clear that people will pay a premium for better connectivity only. And this again requires caution.

5G associated with exclusive content could be a way for operators to try to extract a premium from consumers. But without a huge and / or convincing brand content inventory, it may also be too hollow a proposition. And the more operators share their 5G offerings, the more consumers might feel they do not need to worry and end up staying with 4G longer.

It will also take time for a "flagship application" 5G to appear in the consumer space. And such an application would probably need to be able to fall back on 4G again, again to ensure scale. Thus, the experience of 5G will have to be really different for the technology to sell itself.

On the handset side, the 5G chipset hardware is still in its first wave. This week, Qualcomm announced a new generation 5G modem to the MWC, reinforcing the Snapdragon 855 chipset architecture of the past year – which it has heavily touted as being designed for 5G (although it does not take support the 5G natively).

If you want to buy and keep a 5G handset for a few years, then you risk getting caught at the earliest level of the chipset, that is if you end up with a device with a battery more longer than later versions of 5G hardware. where more performance issues have been resolved.

Intel warned that its 5G modems would not be available on phones until next year. This suggests once again not to have an iPhone 5G by 2020. And Apple is of course an excellent advocate of mainstream consumer technology; the company only intervenes when it thinks that a technology is ready for prime time, rarely earlier. And if Cupertino thinks that 5G can wait, this will also be true for most consumers.

By zooming out, the specter of network security (and potential regulation) is now very important with respect to 5G, as East-West trade tensions have infused a new, strange world of geopolitical uncertainty. in an industry that has never really had to struggle with this type of network. of the commercial risk before.

Guo Ping, acting president of Chinese kit maker Huawei, took advantage of the occasion of a speech by the MWC to defend the company and its 5G solutions against the United States claim that its network technology could be reused by the Chinese state as a cutting-edge way to spy on the West – literally telling delegates: "We do not do bad things" and asking them to: "Please , choose Huawei! "

Huawei Rotating Resident Guo Ping Defends Security of Live Network Kit at MWC 2019

When established technology providers have to use a high-level conference to advocate for trust, the situation is strange and uncertain.

In Europe, operators' choice of 5G network kits may soon be regulated due to security issues with Chinese suppliers. That's what the European Commission has suggested this week, stating in another CMM speech that it was preparing to step in to try to prevent security issues at the level of the EU member states. EU to fragment 5G deployments throughout the block.

Stéphane Richard, President and CEO of Orange, explained that the risk of destabilization of the global supply chain 5G was a "big concern", adding: "This is the first time we have encountered such a high risk in our sector . "

Geopolitical security is another problem that carriers need to consider when deciding how quickly to go to 5G. Retaining upgrades, while regulators and other regulatory bodies are trying to find a trusted solution, might seem like the most sensible thing to do: block 5G upgrades in the meantime.

Given all the uncertainties, there is no reason for consumers to rush.

Smartphone upgrade cycles have generally slowed down for a reason. Mobile hardware is mature because it serves consumers very well. The handsets are both powerful and able to last for years.

And there is no doubt that 5G will radically change things in the future, including for consumers – by allowing many more devices to be connected and retrieve data, with potential to realize the concept of "smart home" (very fashionable but also quite recent) – the first selling point of 5G consumers is essentially the same thing.

"Over the next 10 years, 4G will be phased out. The question is how fast does this happen in the meantime and again, I think it will be slower than in the past because [with 5G] you do not live in a vacuum, you do not fill a big void, "suggests Fabre de Gartner. "The 4G is great, it's getting better and better, there is no better … The story of building a large national network to make 5G on a large scale [for all] it just does not happen. "

"I think we'll start very, very simple," he adds about the 5G consumer proposal. "Things like caching data or just doing more broadband faster. So more of the same thing.

"It will be great though. But you will continue to watch Netflix and maybe there will be some applications that will appear … Maybe a more interactive collaboration or something else. But we know that these products are used today by businesses and consumers and will continue to be used. "

In summary, the 5G mantra for the sensible consumer is really a wait-and-see attitude.

[ad_2]

Source link