[ad_1]

The International Energy Agency (IEA) released a report Monday stating that in 2018, "global emissions of CO2 emissions increased 1.7% to 33 gigatonnes. "This is the highest emission growth in the world since 2013.

The use of coal contributed to one-third of the total increase, mainly due to the construction of new coal-fired power plants in China and India. This is worrying as the new coal plants have a lifespan of about 50 years. But the impacts of climate change are already affecting us, and the profile of coal emissions, compared to other sources of energy, means that it will be much more difficult to reduce carbon emissions worldwide than it could seem in the United States.

Even in the United States, carbon emissions rose by 3.1% in 2018, according to the IEA. (This follows closely the estimates of the Rhodium group, which released a preliminary report in January indicating that US carbon emissions increased by 3.4% in 2018.)

"By country, China, the United States and India together accounted for nearly 70% of the increase in energy demand," Reuters wrote.

74% of unprofitable coal power in the United States?

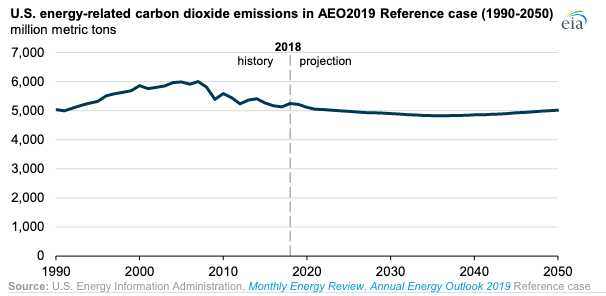

The numbers remind us that the economy alone is probably not enough to contain carbon emissions in the United States. Last week, the Energy Information Administration (EIA) of the Department of Energy said that unless significant and unpredictable changes, US carbon emissions should remain about the same until the end of the year. in 2050.

This estimate takes into account the significant carbon dioxide reduction measures already in place in many states by the end of 2018, including California's commitment to meet 100% of its energy needs with electricity without carbon dioxide emissions. (However, it does not take into account very recent political decisions, just like the similar pledge signed by New Mexico in March).

Administration of energy information

EIA projections assume that coal will be disposed of aggressively, but despite this removal, EIA expects 17% of the country's energy mix to come from coal-fired power plants. 2050.

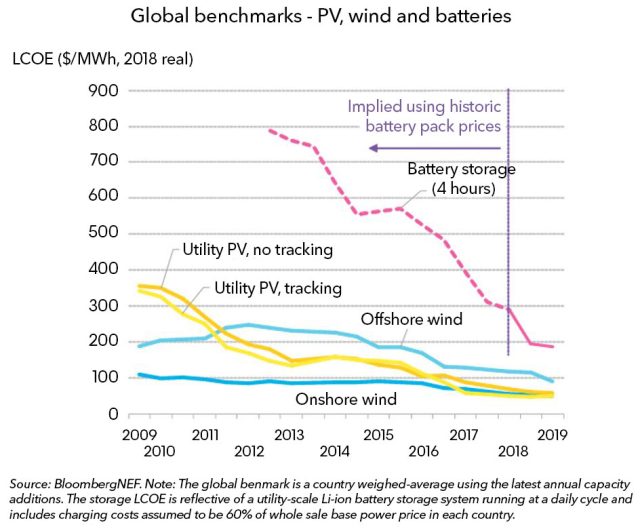

Some hope that the projections of the EIA are too conservative. The Vibrant Clean Energy (VCE) analyst firm and non-partisan Energy Innovation think tank released a report (PDF) on Monday that 74% of the US coal-producing capacity is not profitable to new local renewable energies. In other words, the report compared the marginal cost of energy (MCOE) of continued coal-fired generation with the uniform energy cost (LCOE) of replacing this capacity with new ones. wind or solar.

The result was that, megawatt hours to megawatt hours, newer renewable energy was cheaper than continuing to operate existing coal plants 74% of the time. In 2025, researchers found that 85% of the US coal fleet was not profitable compared to a brand new renewable energy.

So, why are coal-fired power plants not facing more retirements if they are such a bad deal to continue operating compared to newer, cleaner energy? In the end, the operating cost of a coal-fired power plant is different from the price that the owner of this plant receives and, in many markets, the old plants can continue to make profits on the tariffs they charge. . Utility Dive specifically notes that many coal-fired power plants in the Northeast are taking advantage of the power market selling capacity of the Regional Network Manager, which is a market on which companies in the electricity sector Energy must sell their electricity years in advance.

VCE and Energy Innovation admit that simply comparing the MCOE of coal and the LCOE of renewable energy is not enough to determine whether a coal-fired power plant will be shut down. But the company report says that any coal-fired power station that fails in this comparison should trigger "a reminder to policymakers and local stakeholders to tell them that an opportunity for productive change exists in the immediate vicinity of this plant".

Could the batteries take over?

Bloomberg New Energy Finance on Tuesday released a report stating that the LCOE grid-scale lithium-ion batteries (that is, the cost of batteries and the installation divided by the amount of usable energy that they will provide over their lifetime) has dropped 35% since the first half of 2018 to $ 187 per megawatt hour.

In comparison, the VCE and Energy Innovation report released on Monday indicated that the MCOE for most existing coal plants was between $ 33 and $ 111 per megawatt hour. If battery prices continue to drop as much as in 2018, lithium-ion battery banks may soon be competitive with a number of expensive but still-operating coal plants in the United States. And unlike wind and solar, large battery batteries provide a distributable energy that can be used, whether the wind is blowing or not, and the sun is shining.

Nevertheless, waiting until the economic situation slows down and kills coal does not solve the problem of natural gas, extremely cheap and booming in the United States. Natural gas was partly responsible for the increase in carbon emissions last year. To solve this problem, it seems at present that the policy or the technology has to intervene.

[ad_2]

Source link