[ad_1]

Survey: 94% of endowment funds are exposed to the crypto industry

Global Custodian and TRADE Crypto, in partnership with BitGo, revealed in a survey that 94% of 150 endowments had invested in crypto initiatives over the last year in an intense bear market.

The survey found that 141 endowments had invested in the cryptography market in the last 12 months, indicating a notable increase in institutional demand in the asset class.

Jonathan Watkins, editor-in-chief of Global Custodian and The TRADE, said:

"It's fascinating to see that, despite the high-profile concerns about regulation, custody and liquidity, endowment funds account for cryptography-related investments in their allocations, and very few of them have intention to move away. Over the last 18 months, institutional investors will start investing in cryptocurrency, but it turns out that they have already arrived, in the form of endowment funds. "

Investment firms such as Grayscale and Morgan Creek Digital have also reported an increase in capital inflows from institutions in recent months.

This morning, our Morgan Creek Digital team announced a new $ 40 million crypto venture capital fund anchored in two public retreats.

Institutions do not come.

They are already there. ?

– Pomp (@APompliano) February 12, 2019

In 2018, Grayscale's fourth quarter report indicated that 66% of all investment in its investment vehicles, such as Bitcoin Investment Trust, came from institutional investors.

Why has institutional demand increased during an intense bear market in crypto?

Previously, Gaboracs, digital asset strategist and director at VanEck, said the price of bitcoin or other cryptographic assets was not a concern for institutional investors.

For institutions, the structure and transparency of investment vehicles or custodial services available on the cryptocurrency market are of utmost importance for any investment in the sector.

"Large financial institutions focus more on market structure than on short-term price fluctuations. How do we value digital assets correctly? How do we keep digital assets? Are their ETFs available with adequate market and investor protection? Most major institutions do not really care if Bitcoin ends in 2019 at 3,000 or 10,000. I think the market structure is improving every day and that crypto is starting to look more and more like to commodity and equity markets, "said Gurbacs.

Recently, with the decision of major financial institutions such as Fidelity to offer regulated custodial cryptocurrency, it has become safer for institutions and family offices to engage in the asset class.

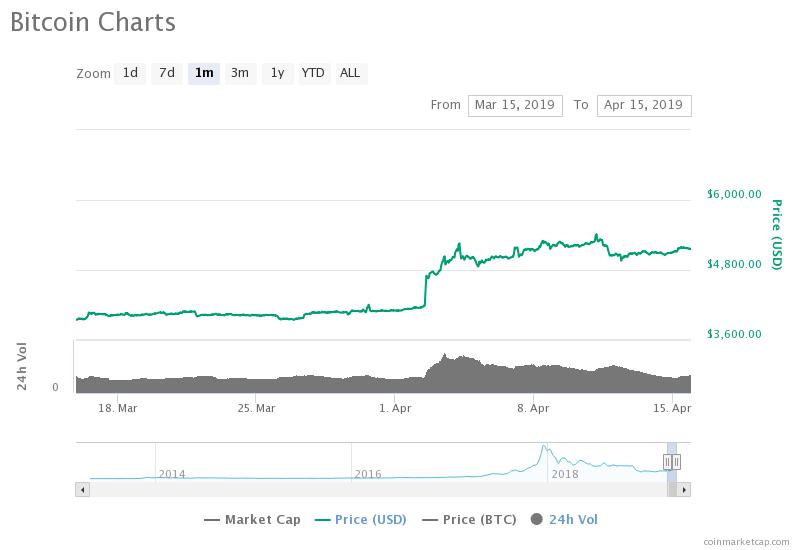

The price of bitcoins rose by more than 20% last month. | Source: coinmarketcap.com

Perhaps more importantly, as Wences Casares, CEO of Xapo, said, it is possible that activity in the cryptography sector following an 80% drop in value could prove to investors that the asset class and the sector that surrounds it is not a fad.

As Casares said in his essay titled "The Case of a Small Bitcoin Allocation", the dominant cryptocurrency is likely to succeed after a decade of uninterrupted exploitation. and a steady increase in the number of users.

"But after 10 years of uninterrupted work, with more than 60 million incumbents, more than a million new incumbents per month and more than $ 1 billion a day worldwide, he has a good chance of succeeding" said Casares.

Will the institutions fuel the next wave of Bitcoins?

CCN recently announced that Harvard Endowment had invested in Blockstack, a company behind the stacks Token digital asset.

Alternative crypto-currencies represent a riskier investment option than bitcoins because of the question of their longevity and survivability. Yet institutions seem to be taking risks in the cryptocurrency market as well as investing in bitcoin, indicating that institutional confidence remains relatively greater than before.

The bull market of 2017 was mainly driven by small investors, who raised the value of bitcoin to about $ 20,000. It remains to be seen whether the next wave of Bitcoin bulls will be run by institutions.

[ad_2]

Source link