[ad_1]

(Source: imgflip)

I have been a professional analyst and investment writer for five years now. One of my fundamental principles is to always strive to improve my analysis and investment strategy by learning from history and the greatest investors of all time (such as Buffett, Lynch, Dodd and Graham). This applies not only to the research I do at Simply Safe Dividends (covering over 200 companies a year), but also to my Seeking Alpha articles and the way I manage my retirement portfolio, which contains all my savings for life.

Recently, I put an end to the recession of my retiree portfolio by adopting a Buffett-inspired "intrinsic value" style of investing focused solely on blue-chip values and a good night's sleep or on SWAN shares, including the 14 limit purchase orders I currently have. in place. I define blue-chips and SWANs (which have nothing to do with the short-term price risk but the quality of society and the security of dividends) using my new exclusive Sensei quality score system or SQS. This scale ranks all the companies on my watchlist (now 119 companies and growing as I make annual SSD updates) on an 11-point scale based on three criteria:

- Dividend security (5 points): payout ratio, balance sheet, cash flow stability

- business model (3 points): "mold", ability to generate returns on capital above cost of capital, long-term growth potential

- quality of management (3 points): history of capital allocation, including dividend profitability

All dividend stocks can be ranked from 3 to 11 on this scale, but personally, I only plan to recommend that readers invest in those with a score of 7 or higher.

- 7: "dirty value" only buy deep discount at fair value, maintain positions at 2.5% of the portfolio or less

- 8: blue-chip: seek a modest discount to fair value, maintain positions at 5% or less

- 9+ years: SWAN equities: buy at fair value or better, limit positions to 5% to 10%

You'll notice that even for SWAN 9 or higher, I still recommend good risk management through a diversified portfolio. This includes position ceilings (5% to 10% of employment for most people), sector ceilings (15% to 20% is a good rule of thumb), and adequate asset allocation (enough liquidity / bonds to avoid selling stocks during a bear market). pay the bills).

The reason why risk management is so important is that any investment is probabilistic and even the best blue chips can fail. The legendary investor Peter Lynch, who generated 29% of the annual total annual return (CAGR) between 1977 and 1990 and who manages the Fidelity Magellan Fund, said

"In that case, if you are good, you are right six times out of ten. You'll never be right nine times out of ten …A few big winners are enough for a lifetime of successful placements, and the benefits of these will overwhelm the disadvantages of stocks that do not work …The typical big winner…usually takes from three to ten years to play."- Peter Lynch (we are underlining)

Lynch, who also said that some of his best ideas had taken up to four years to begin to bear fruit, exemplifies the best long-term investment approach, which includes tight risk management, a strong focus on fundamentals and a well diversified portfolio (sometimes the Magellan Fund had up to 700 positions).

The more I learn and grow as an analyst (and focus more and more on risk management), the better my recommendations and the performance of my retiree portfolio.

(Source: Tipranks)

Only time will tell if my success rate will remain above Lynch 's 60% benchmark for good analysts, but I am confident that my never ending quest to constantly improve my work, my methods and my recommendations will ultimately prove very lucrative for myself and for my colleagues. readers. However, the focus on risk, especially with regard to security and dividend valuation, is one of the main reasons for my increasing success rate.

When I explained the three reasons I had invested $ 7,000 in my retirement portfolio at Tanger Factory Outlet (SKT), at $ 20.25 per share, I cautioned readers that Whatever the value of the real value of buying a business, you should never bet the farm by taking too big a position.

All companies have risks that could break their investment thesis. When that happens, you sell better, rather than driving a broken business to zero (as was the case with Sears, once the world's largest retailer).

Last week, I did my annual Tangier dive for Simply Safe, which is part of our annual blue chip review. It's also when I update my quality scores to minimize the chances of recommending a broken business to its readers (or buying it for me). own wallet).

Unfortunately, I must point out that Tangier is downgraded from a level 9 SWAN to a level 8 blue-chip, because of his persistent difficulties with his third turnaround. Let's see now how my SQS Tangier class now, what high-yield investment opportunities currently represent and especially what would be required for Tangier's thesis for it to be totally broken and for me to retrograde into a sale.

Dividend Safety 4/5: Always safe, but above all a dividend growth

The first thing I look at with any dividend stock is the security of the payment. After all, my goal and that of most of my readers is to have a secure and growing income over time, regardless of market, economy or interest rate. That's why 45% of my quality level is based on dividend security.

| Stock | yield | 2019 Trust Fund Distribution Ratio | Simply Safe Dividend Score (out of 100) | Sensei Dividend security score (out of 5) |

| Tangier | 7.0% | 75% | 72 (sure) | 4/5 (sure) |

| S & P 500 | 1.9% | 33% | N / A | N / A |

(Sources: Simply Safe Dividends, Management Tips, Analyst Estimates, Yardeni Research)

Tangier remains a 4/5 on the security metric of my dividend, and the Simply Safe Dividends algorithm also gives it a high score and considers it a safe payment. Even after management announced on April 1 the sale of four of its oldest and worst performing stores.

Tangier totals $ 129 million for these four centers, representing a gain of $ 44 million over 6.5% of square footage and 5.1% of net operating income. Chief Executive Officer Steven Tangier says the sale is a strategic decision to improve the REIT's overall quality profile as part of its turnaround efforts.

"By completing these asset sales, we strengthen the overall quality, reduce the average age and improve the portfolio's long-term growth profile. We believe that the benefits of these term sales will more than offset the expected dilution of short-term earnings, as these assets are not expected to generate the long-term growth in cash flows we expect from our core portfolio. Our dividend remains well covered even with the sale of these assets."- Steven Tangier (we are underlining)

(Source: press release of the sale of the center of Tangier)

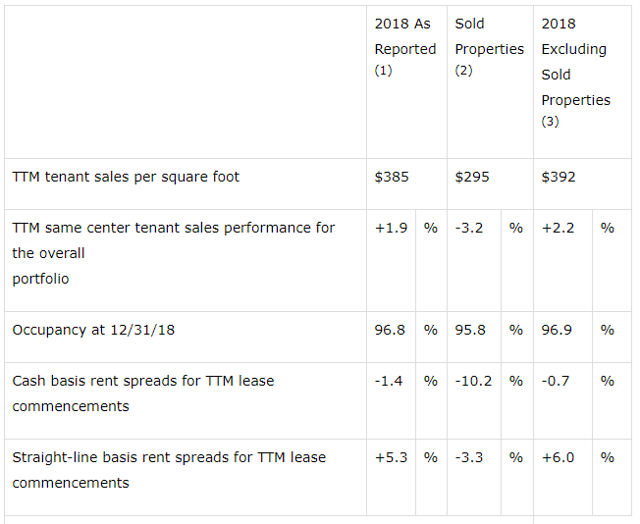

The sale will significantly improve the quality of Tangier's portfolio because, as you can see, the four centers sold had

- 23% less sales per square foot

- Negative growth in sales per square foot in 2018

- low occupation

- horrible rental margins of -10.2%

Leasing margins are one of the two most important quality parameters to be monitored with Tangier because they represent the additional amount that he can claim for rent, as existing leases expire and are replaced by new ones. new. Leasing margins of 10% are considered a good indicator of the quality of an REIT's property portfolio and its ability to attract strong and dynamic tenants.

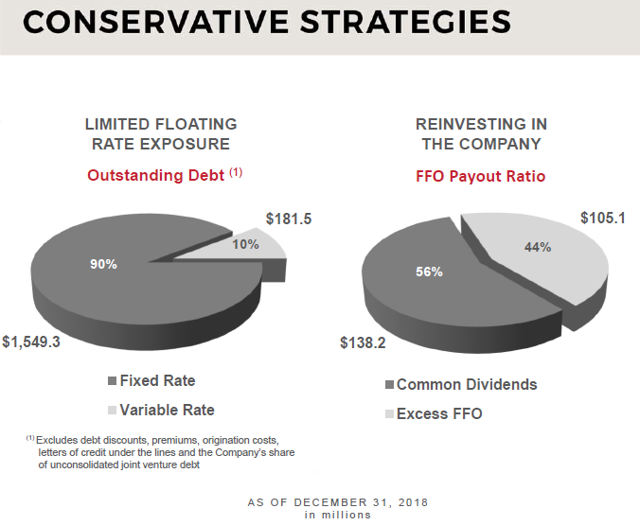

Proceeds from the sale of assets will help reduce debt, especially on the revolving credit facility.

(Source: Investor Presentation)

This $ 129 million will be used to repay 7.5% of Tangier's debt and to improve an already strong balance sheet, which is the second half of the secure dividend equation.

|

REIT |

Leverage ratio |

Interest coverage ratio |

S & P Credit Rating |

Average interest rate |

|

Tangier |

5.9 |

5.2 |

BBB (stable) |

3.7% |

|

Sector average |

5.8 |

3.4 |

N / A |

N / A |

(Sources: Income Supplement, Gurufocus Teleconference, Morningstar, FastGraphs)

Prior to the sale of the assets, Tangier's leverage ratio was close to the REIT average, but its interest coverage ratio was much higher. After the sale, Tangier's leverage will drop to around 5.5 and its interest coverage ratio will further increase (and it is already among the highest in the sector).

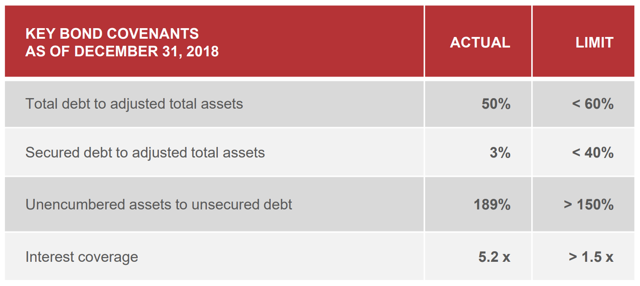

Tangier has always been very conservative in terms of debt, especially beyond the restrictive clauses.

(Source: Investor Presentation)

Restrictive covenants are key credit indicators that, in the event of a breach, allow creditors to immediately call loans. The fear of breaches of the commitment is the reason why 87% of the REITs reduced or suspended their dividends during the financial crisis. Tangier was one of 12 equity REITs to avoid this fate and, in fact, continued to increase the dividend, albeit at a symbolic rate.

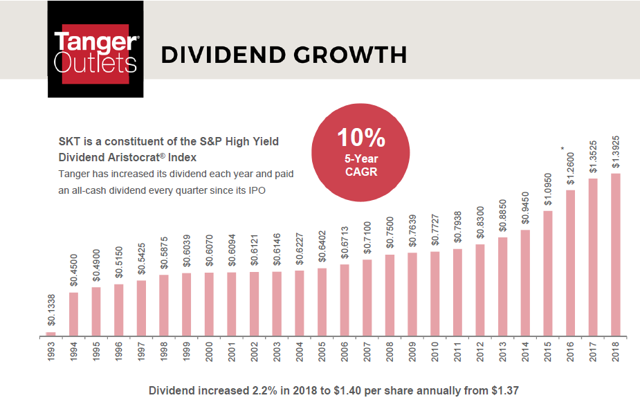

(Source: Investor Presentation)

This is why Tangier has been able to increase its dividend (by 1.4% in 2019) only for the 26th year in a row. This makes him a dividend champion and, though he was big enough to be part of the S & P 500, an aristocrat of dividends.

So, if Tangier's balance sheet is sound, its distribution ratio good and its dividend growth record among the REITdom's elite, why is not it a payment security score of 5? / 5? And why did I just downgraded from a level 9 SWAN to a level 8 blue chip?

It is there that the problems with the business model come into play.

Business Model 1/3: High Recession Uncertainty in the Business Model

The Tangier CEO has a quote that he likes to use to explain why Tangier has been so successful over time. "In good times, everyone loves bargains, in bad times, they need bargains."

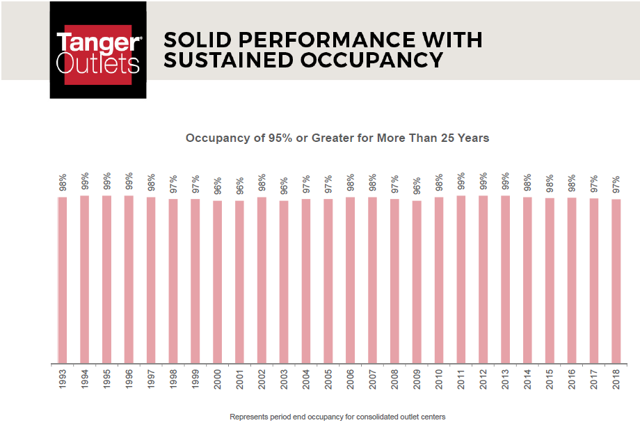

(Source: Investor Presentation)

It is probably for this reason that Tangier has been able to maintain a remarkably high and stable occupancy rate throughout the various economic cycles.

However, this also explains why Tangier's forecasts for 2019 are so troubling and sent shares down 5% when it was released.

- FPE 2019 / share: $ 2.34 (-6%) now -9% after the sale of assets

- Average occupancy 94.3%

- NOI of identical central store: -2.4%

It should be noted that after the sale of the assets, the forecast for cash flows from operations / shares in 2019 fell to $ 2.25, a 9% decrease in cash flow per share. . Growth forecasts for SS NOI are unaffected.

Since its IPO in 1993, Tangier's annual occupancy has never dropped below the 95% mark, not even during the Great Recession. However, after a record number of store closures in 2017 and 2018 and several tenant bankruptcies, Tangier is expected to post the weakest financial results ever recorded in 2019.

Here is Steven Tangier's explanation of the Citi Global Property Conference

Another big disruptor of our company was private equity fall in love with specialty retailers, taking a big deal with great brands managed by real merchants and destroying them by adding a huge amount of debt. This has caused at least 20 bankruptcies in the last 3 years…Bankruptcies save us overnightWhereas if we had had a normal and orderly process of working with our tenants one or two years in advance, knowing their plans and knowing our plans, we could make a transition of space if they did not choose to continue. "- Steven Tangier, (emphasis added).

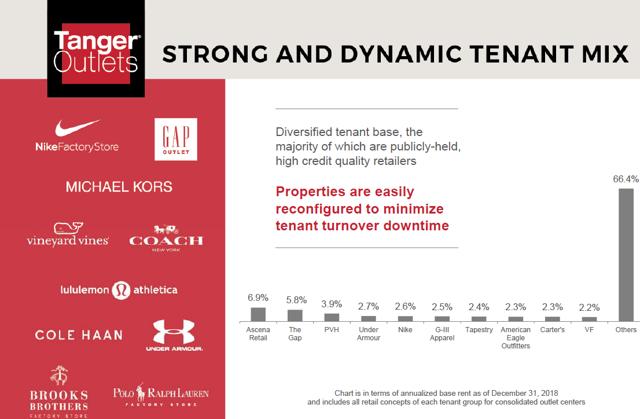

Tangier essentially claims that an unprecedented number of bankruptcies, as well as distressed clothing companies (many of which are its biggest tenants), are causing these unprecedented financial difficulties.

(Source: Investor Presentation)

Due to many unexpected store closures, Tangiers needs to use low-cost, short-term rental contracts to maintain good occupancy and generate continuous pedestrian traffic (maintaining the health of its center and its many retail customers).

(Source: Investor Presentation)

However, this has serious repercussions on its rental margins, which, even taking into account the sale of assets that had just been announced, reached 6% in 2018. This represents less than half of the levels. recorded during the Great Recession.

The good news is that Tangier is confident that he can adapt and overcome the current problems of tenants, which he considers temporary.

I would also like to point out that the main tenants 10 years ago and 15 years ago on our properties are no more than a distant memory, and we have always been able to find new names. That's what we do … We look for new tenants and talk to them wherever we can find them – find them. "- Steven Tangier (not underlined in the original).

In order for Tangier to meet its deadlines, Tangier must maintain quality properties, with significant traffic and comparable sales on the rise. This is essential to create an attractive proposition for retailers, without which normal organic growth of SKT would become impossible.

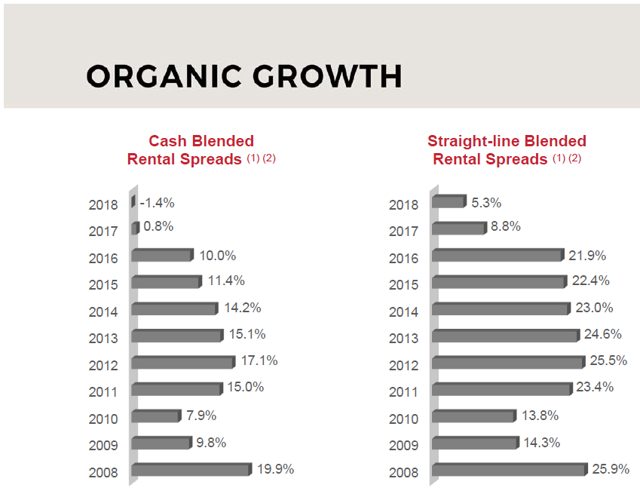

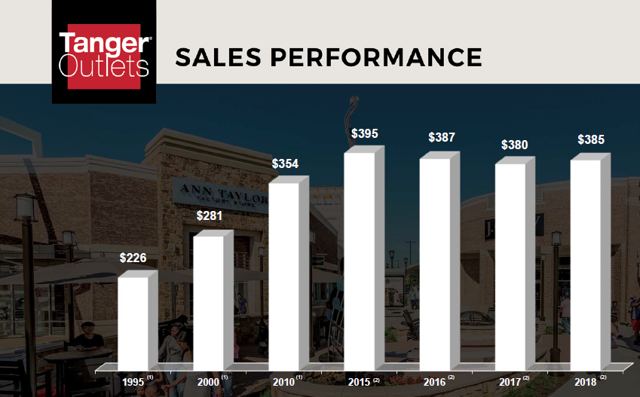

(Source: Investor Presentation)

Square sales in Tangier peaked in 2015, then declined for two years. In Q4, they returned to $ 392, which is close to its record level. And thanks to these four provisions, sales per square foot of the remaining properties for the full year also amounted to $ 392. This highlights an important element of Tangier's bullish thesis on which my recommendation was made (as well as my investment of $ 7,000).

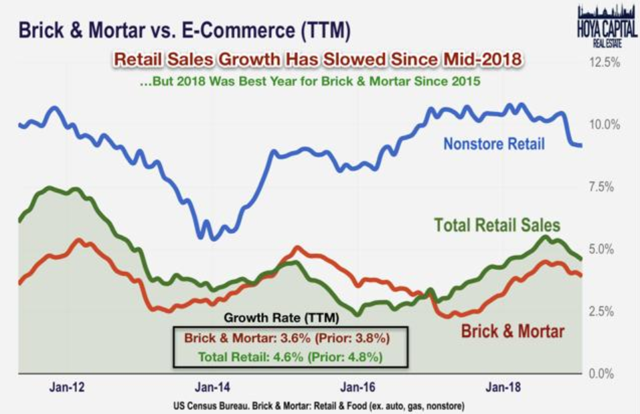

(Source: Hoya Capital Real Estate)

While there has been a record number of store closures and bankruptcies in recent years, this does not mean that the retail itself is dying. The industry as a whole is booming, but some retailers who can not compete in this fierce industry are going belly up.

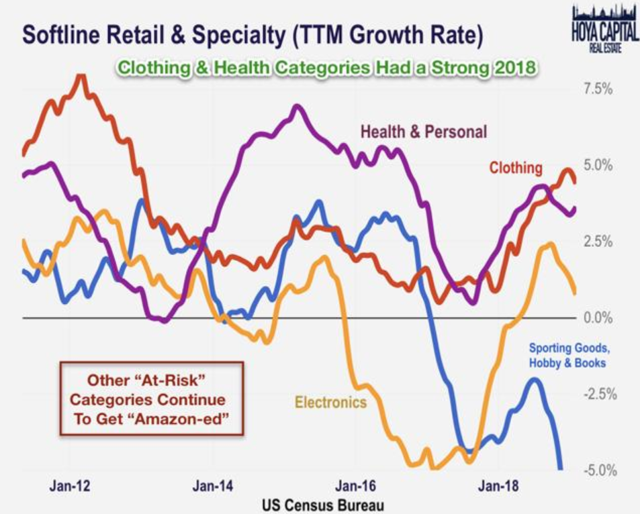

And clothing, although challenged by the rise of e-commerce, is also not in the direction of the dodo.

(Source: Hoya Capital Real Estate)

Overall clothing sales also recorded a strong rebound, indicating that Tangier's optimism about the possibility of replacing troubled tenants with healthier tenants, as has always been the case, seems to be justified.

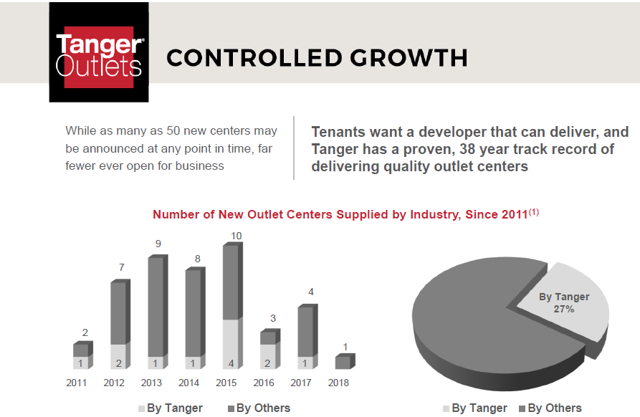

This explains why Tangier decided to prepare to build a new 280,000 square foot center in Nashville, a 1.9 million metropolitan area with 14.5 million annual visitors. Although this center has not yet been put in place, management probably would not have announced its intention to complete it in 2021 or 2022 unless it was confident that 75% of the leases required for the lease could be obtained before the construction of a new center.

In other words, the management of Tangier is convinced that "this time, it is not different" and that the headaches related to its growth are temporary.

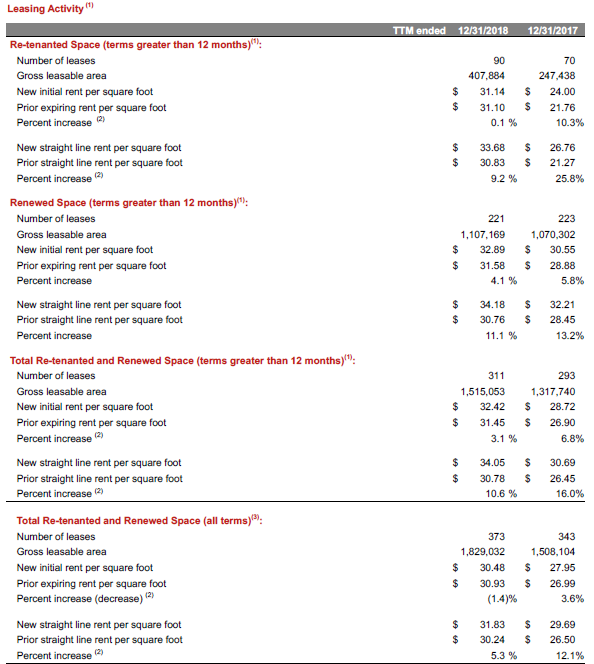

The other important criterion that I look at is the proof that the business model remains intact, it is the long-term rent differentials of the REIT.

(Source: Investor Presentation)

Successful tenants in Tangier want to keep costs down over time and therefore prefer to use long-term leases. The REIT's linear lease variance for 2018 (taking into account total rent on the entire lease, including annual indexing) was 11.1% on leases renewed long-term. Although this figure is down from 13.2% in 2017, it is still a high figure, but above that 10% threshold of quality, that I 'd still expect. used to monitor the viability of this REIT's fundamental business model.

Essentially, the growing margins of square-foot sales and long-term double-digit rental margins in Tangier tell me that fundamental trade is contested, but not broken, as management has said in recent years.

But it's not just me and Tangier who believe that. On March 12, Moody's downgraded its outlook on Tangier's Baa1 debt to Baa1 negative. Baa1 is the S & P equivalent of BBB +. Moody's explained in her downgrade note that she was concerned about the deterioration in the REIT's operating fundamentals, but also that she asserted that her rating was equivalent to BBB +.

Moody's statement on the unsecured note of Tangier incorporates his good financial flexibility with no significant maturity of the debt until 2023 when $ 250 million of senior unsecured notes expires … negative outlook reflects Moody's expectation that Tangier's operating results will remain disputed and without a sustained recovery in SS NOI's positive growth, its current rating may downgrade. Any downward revision of the results forecasts would also lead to a deterioration. Any positive rating measure would require improved operational NOI SS and occupancy rate (at least 95%) with sustainability.. Maintaining its current credit indicators, with a net debt / EBITDA ratio of less than 6.0 and a fixed charge coverage greater than 4.0, would also be necessary. "- Moody's (not underlined in the original)

Moody's therefore considers that Tangier's credit is worthy of a BBB + credit worthy of the latter if it can put an end to the decline of its SS NOI and the stability of its indicators. credit. The debt repayment of $ 129 million this year, after $ 50 million in 2018, is Tangier's effort to ensure that Moody's will not lower it to the same premium grade rating as S & P just got it.

But speaking of S & P, here is what he had to say about his degradation from BBB + to BBB stable.

The stable prospect reflects S & P's conviction that Tangier will be able to effectively manage rental disturbances while maintain stable credit protection measures for the next two years, despite a difficult operating environment. "- S & P (not underlined in the original)

In other words, if Moody's and S & P thought that Tangier's economic model was doomed, they would have downgraded their ratings and provided a negative outlook as to the possibility of further cuts.

Agree, the management said that it could finally regain historical growth rates and that the major rating agencies do not think Tangier is flowing. But is there any other evidence that Tangier is a safe value of intrinsic value potentially worth buying at levels as low as ten years?

In fact, there is. Analysts have reviewed their latest growth forecasts to take into account Tangier's asset sales and what management said at the latest analyst conference.

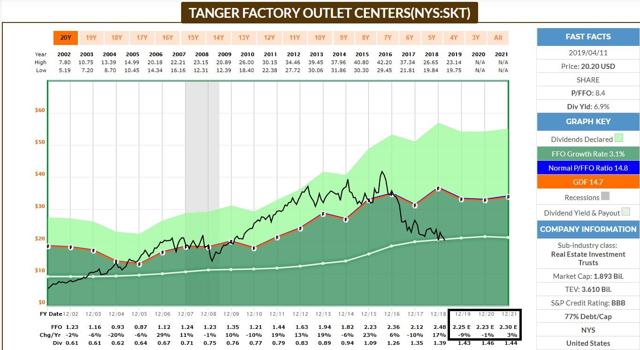

In 2019, they believe management expects -9% growth in cash flow from operations / equities and forecasts -1% growth in 2020 and a return to 3% growth in 2021. During Last 20 years, Tanger's cash flow per share has increased by 3.1% CAGR, which means that despite all the obstacles and challenges facing Tangier, Wall Street continues to believe that management will succeed.

But if Tangier's thesis is not broken and analysts, management and rating agencies believe that the REIT will eventually return to form, why have I degraded the prospects of the Tangier business model and slumped one point of my quality level? Two words, "risk of recession".

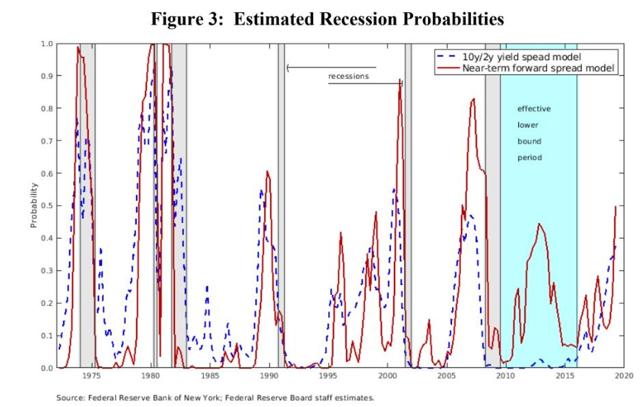

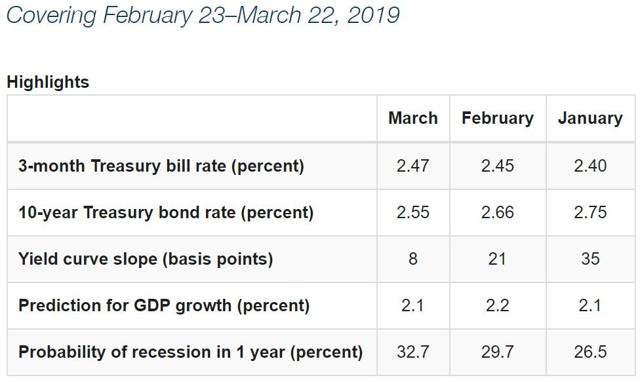

In February, the New York Fed has updated its estimate of a recession starting in January 2020 at around 50%, its highest level in a decade. The Cleveland Fed has its own recession probability model, based on the most accurate recession predictor of history, the 10y-3m yield curve.

(Source: Cleveland Federal Reserve)

The Cleveland Fed monthly recession probability model estimates at 33% the risk of a recession beginning within a year. And no less than Steven Tangier told analysts at the Citi property conference that he thought a recession would probably start in 2021.

But given Tangier's excellent track record in no less than two recessions since its IPO, including the worst economic downturn since the Great Depression, why am I reducing the bank's score by one point? commercial model of Tangier? Because the business model score is based on the long-term growth potential over five years.

Tangier's balance sheet is more than ever a fortress and its dividend is safe, thanks to a low payout ratio and a self-financed business model that is not dependent on stock markets.

However, we can not forget what Steven Tangier said about the current mix of tenants being totally different from that of 10 or 15 years ago. In other words, the score of the business model must take into account the risks that "this time COULD be different". In the case of Tangier, this means that the current composition of its tenants may not be as resilient in a future recession as in the last two.

Moreover, even if analysts believe that growth of Tangier will return to its history of 3% by 2021 (when this recession looks likely according to its CEO), this assumes that Tangier is not confronted with store closures unexpected, which discourages her a lot. the last two years.

Decommissioning 2/3 to 1/3 is not an indication that I think Tangier is doomed to ruin history. Rather, it takes into account that Tangier's delay in execution continues to be delayed. If a recession occurs in 2020, there is a real risk that Tangier will face many more short-term rental challenges, squeezing its rental margins or possibly making them negative.

Although this should not result in a reduction in the dividend, this could extend Tangier's lead time beyond 2021 to cover the entire next five years. That, in turn, could mean a flat cash flow growth up to 2024, which is a lot less than what I had been expecting before. That's not to say that such a scenario is likely, but simply that the risk has risen compared to a few months ago.

But if the risks of Tangier have increased, the reason why I do not sell stocks, or do not recommend them, is the quality of the management team, in which I have every confidence for good manage our hard earned money.

Management Quality 3/3: If everyone can adapt to the harsh conditions of the industry, it is Tangier

Tangier was founded by Stanley Tangier in 1981 and was literally the pioneer of the premium brand center model. Today, it is led by CEO Steven Tangier, the founder's son. Steven has been working at the REIT for 26 years since his IPO in 1993. He was CEO or COO for 24 of those years, which meant he was directing daily operations. In the brand center industry, Steven Tangier has few people who have more experience adapting to changes in consumer tastes and risks.

Over the past 38 years, we have demonstrated our ability to navigate effectively in the ever-changing retail landscape. and expect that we will overcome the challenges we face today while we are actively looking for new tenants and opportunities to improve Tangier's performance. Our focus is on maintaining a strong balance sheet and the stability of our well-covered dividend."- Steven Tangier (we are underlining)

That's what Tangier said at the Citi Property conference and I really like that my money is managed by a person who does not only care about the long-term future by turning around, but focuses on the laser on balance sheet and dividend security. After all, I bought Tangier at a rate of return of 7%, which means that I am paid almost the historical rate of return of the market (9.1% since 1871) in dividends.

If Tangier stabilizes for a few years, I will not be too disappointed, as long as management can eventually follow my thesis of a return to a historic growth of 3% cash flow and dividends.

(Source: Investor Presentation)

In the end, good management depends on the distribution of capital, especially knowing when and where to invest the shareholders' money when times are tough. Tangier has been very disciplined with its approach to organic growth by building new centers. It does not build too much and never lets its growth ambitions lead to dangerous debt levels that could jeopardize the dividend.

Of course, a good management team can only be composed of a rockstar CEO. Fortunately, the Tangier bench is deep and includes

- Thomas McDonough: COO, 35 Years of Industry Experience, Stanford Graduate and Harvard MBA

- CFO James Williams: Who is with Tangier since its IPO in 1993

- Trustees Thomas Robinson, Bridget Ryan-Burman and Susan Skerritt, who together accumulate 90 years of experience in industries related to Tangier activities.

The bottom line is that all blue-chip companies are experiencing difficulties, even dividend champions like Tangier. While adjustments are never guaranteed, maximizing the likelihood of a company returning to historic size, it is an excellent management team and a solid financial base that gives it enough time to adapt and overcome obstacles. inevitable related to growth.

Tangier retains enough of my trust to recommend it not only to investors who are comfortable with deep value reversals, but also to own a large portion of the shares (3% of my total life savings).

The key to a good deep investment is to recognize the fundamental quality (represented by a quality score greater than or equal to 8) and to buy a title most hated when the margin of safety is high enough to allow you to compensate for the risks related to the rupture of the thesis.

But as a good investment is all about good risk management, you should also define what "breaking a thesis" really means. This is so that you avoid owning the next General Electric (GE) and reduce the dividends to huge losses when the wheels come off the bus completely.

How to know when it's time to sell Tangier

J'ai acheté Tanger à cause de la thèse de la croissance des dividendes à long terme qui reposait sur trois choses

- un dividende sûr de 7%

- croissance à long terme revenant finalement à son taux historique de 3%

- expansion multiple par rapport à la norme à peu près historique (forte augmentation de la valorisation générant un très fort potentiel de rendement total) à l'issue du redressement

Pour que cela se produise, j’observe deux indicateurs en particulier, de plus près. Ce sont

- ventes par pied carré: elles devraient continuer à augmenter si la direction fait son travail correctement

- Les écarts de bail à long terme: devraient rester à deux chiffres, nous indiquant ainsi que les locataires prospères trouvent toujours de la valeur dans les propriétés de Tanger

Tant que ces choses resteront vraies, je reste confiant que le redressement de Tanger réussira à terme et que les investisseurs patients à long terme seront richement récompensés. Cependant, en période de récession, le risque que ces deux paramètres, le canari de la mine de charbon, en termes de viabilité du modèle commercial fondamental de Tanger, commence à clignoter en rouge.

Si ces deux paramètres critiques se retournent contre Tanger, je devrai réévaluer mon classement au sein de l'équipe de direction, le faisant éventuellement passer de 3 à 2, ce qui abaisserait le niveau de qualité de Tanger à 7 et en ferait un stock "sale", convient uniquement aux investisseurs plus tolérants au risque et à une position maximale de 2,5% dans un portefeuille diversifié. Si ces mesures vont dans la mauvaise direction pendant deux années consécutives, je devrai déclarer que la thèse de Tanger est sans fondement et ne sera plus en mesure de la recommander (ou de l'approuver).

Ok, alors maintenant que nous avons couvert les risques de Tanger, pourquoi je crois toujours en ce blue-chip de qualité 8 et ce qui me pousserait à le vendre, voici pourquoi je considère que Tanger vaut la peine d'être détenu.

Profil de rendement total / Valorisation: La détérioration des fondamentaux signifie un potentiel de rendement total potentiellement plus faible sur cinq ans, mais le potentiel sur 10 ans reste intact

(Source: YCharts)

Je comprends parfaitement la colère ressentie par de nombreux investisseurs de Tanger à l’égard de toute personne qui écrit un article positif sur le FPI. Depuis ses sommets de la mi-2016, Tanger a largement sous-performé les deux FPI en général, ainsi que le marché au sens large.

Mais c’est pourquoi l’évaluation est si importante. À son plus haut de 2016 (pendant la bulle immobilière), Tanger se négociait à 18,1 fois les FFO, contre une moyenne de 14,8 sur 20 ans. Cela signifie que le stock était historiquement surévalué d'environ 20%. Payer près de 20 fois ses liquidités pour une FPI qui croît généralement de 3% au fil du temps n’est jamais une bonne idée.

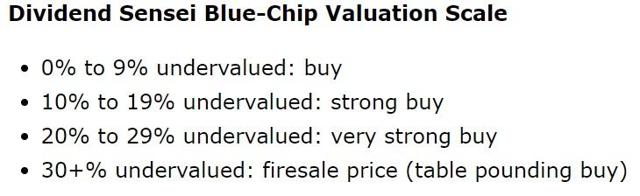

En revanche, aujourd'hui, Tanger se négocie à seulement 9 fois les prévisions des flux de trésorerie liés aux opérations pour 2019 par la direction, ce qui représente une décote importante par rapport à la juste valeur historique. En fait, si les analystes ont raison et que Tanger renoue éventuellement avec une croissance de 3% (en 2021 et au-delà), l'action est probablement sous-évaluée à 38% aujourd'hui.

|

P / FFO |

P / FFO moyen sur 20 ans |

Taux de croissance des flux de trésorerie liés aux opérations / actions implicites à long terme |

Taux de croissance attendu par l'analyste |

|

9,0 |

14.8 |

0,7% |

0,5% à 3,0% |

(Sources: conseils de gestion, graphiques F.A.S.T, Benjamin Graham)

Le plus gros risque pour la propriété de Tanger, mis à part le modèle économique totalement novateur, est la durée du redressement. Aujourd’hui, le cours des actions prévoit une croissance à long terme d’environ 0,7%. En raison des prévisions de croissance négatives pour 2019 et 2020, il pourrait en résulter plusieurs années de rendements faibles.

En effet, le cours de l'action est actuellement basé sur le même taux de croissance que celui attendu par les analystes au cours des cinq prochaines années. Toutefois, étant donné que les multiples d'actions sont généralement fonction des prévisions de croissance, le ratio de Tanger devrait commencer à augmenter rapidement si la direction peut atteindre les prévisions de croissance de 3% attendues en 2021.

Si le retournement se prolonge pendant plusieurs années au-delà, par exemple en raison d'une récession, le multiple bon marché de Tanger pourrait persister, ce qui entraînerait des rendements totaux à un ou deux chiffres.

| Stock | yield | Croissance attendue des flux de trésorerie à long terme | Rendement total attendu (pas de changement de valorisation) | Potentiel de rendement total ajusté à la valorisation |

| Tanger | 7,0% | 0,5% à 3,0% | 7,5% à 10,0% | 15,4% à 20,4% |

| S & P 500 | 1,9% | 6,5% | 8,4% | 1% à 7% |

(Sources: Dividendes Simply Safe, Multp.com, graphiques F.A.S.T., estimations des analystes, Morningstar, Modèle de croissance de Gordon Dividend, Moneychimp)

En fin de compte, Tanger devrait continuer à faire un bon investissement, même si l'évaluation ne revient pas aux normes historiques avant une décennie. C'est grâce à ce dividende de 7% qui pourrait surperformer le marché à lui tout seul (d'après l'enquête 2019 de Morningstar auprès des principaux gestionnaires d'actifs).

Qu'est-ce que cela signifie pour ceux qui envisagent Tanger aujourd'hui? Eh bien, avec une décote historique de 38% par rapport à la juste valeur, je considère toujours cela comme un prix exceptionnel. Cependant, rappelez-vous que, en tant que stock de redressement, seuls les investisseurs à l'aise avec le profil de risque (qui est pour le moins complexe) et la patience de laisser la direction travailler sur son plan pendant plusieurs années devraient envisager d'investir dans cette FPI.

Bottom Line: Tanger reste une opportunité solide de rendement élevé à haut rendement mais n'est plus un stock SWAN jusqu'à ce que nous voyions des progrès sur le redressement

Je suis sûr que je vais prendre beaucoup de critiques pour cet article, en particulier de la part d'ours Tanger qui avaient prédit que le FPI serait condamné. Je ne considère pas la thèse comme cassée, mais simplement affaiblie, suffisamment pour justifier un déclassement du statut SWAN (selon les mesures de mon score de qualité).

Permettez-moi de préciser que je n’ai jamais dit que Tanger ni aucun titre de dividende était une «chose sûre», car tous les titres sont des actifs à risque, c’est pourquoi chaque article spécifique à une entreprise que j’écris inclut une section de risque l'article complet).

Le travail d’un bon analyste est de ne pas essayer d’être populaire à court terme (par exemple en pompant des actions "chaudes") ou d’ignorer aveuglément les fondamentaux changeants (les opposants qui refusent d’admettre qu’ils ont tort). Même les plus grands investisseurs de l’histoire n’évitent pas de commettre des erreurs, et le risque lié à un stock de retournement de valeur profond, ce que Tanger est certainement, c’est que le redressement échoue.

Tanger ne l'a pas encore fait, mais de plus en plus de preuves indiquent que le FPI ne reviendra pas à une croissance positive de ses flux de trésorerie avant 2021, et même les prévisions des analystes sont assorties de beaucoup d'incertitude. Si Steven Tanger a raison et qu'une récession survient en 2021, il est possible que les problèmes d'occupation des locataires et d'occupation de la FPI persistent encore plus longtemps que je ne l'avais prévu initialement (ainsi que tous les autres).

Bien que le dividende puisse rester sûr même en période de récession, la thèse à long terme selon laquelle j'ai acheté et recommandé Tanger ne repose pas uniquement sur un rendement sûr de 7%, mais sur un retour aux taux de croissance historiques de 3%.

Pour y parvenir, il y a deux paramètres cruciaux que je vais surveiller, cela me dira si la thèse de la bourse est cassée ou non.

- ventes par pied carré: si elles commencent à baisser, les marges de location à long terme vont probablement diminuer

- Les spreads des contrats de location à long terme: s'ils tombent sous la barre des 10%, la croissance organique ne sera pas en mesure de générer une bonne croissance des flux de trésorerie et des dividendes à long terme

For now, Tanger remains a good potential deep value buy BUT only for those who are comfortable with turnaround stocks like this, and who owns it as part of a well-diversified portfolio. For me, Tanger is 3% of my life savings, and given the quality of the management team, strong balance sheet, and safe dividend, plus the valuation I bought it at (near a 10 year low), I'm not losing sleep over Tanger's downgrade.

But if the turnaround struggles continue for long enough and fundamentals keep deteriorating, I'll be forced to downgrade the stock and eventually sell it. In that case, I'll likely be looking at a small loss of capital (under 0.5% including dividends).

This highlights the importance of good risk management, no matter what you buy. Never forget that all companies have the potential to fail, which is why analyzing a stock's fundamentals on an annual basis is a good idea. That allows you to spot trouble early enough to avoid owning the next General Electric when the wheels totally fall off the bus and long before a dividend cut sends the stock plunging to once unimaginable lows.

Disclosure: I am/we are long SKT. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link