[ad_1]

Source

Bank of America (BAC) has just announced another strong quarter. The company continues to deliver results and return capital to shareholders. Although interest rates have fallen, the bank has been able to leverage its diversified business to continue to drive earnings growth. As a long-term shareholder of Bank of America, I feel that it makes sense to continue holding stocks at these levels. Strong fundamentals and continued economic expansion should allow for a positive stock price appreciation.

Performance

Bank of America has announced first quarter results that should be well received.

Source: Looking for alpha

The company beat on the bottom line, but had a small shortfall. While revenue growth is important for long-term earnings growth, the company is still improving its operating environment. These operational measures allow the company to increase its net income while expecting a more positive banking environment to drive growth in sales. These results are very interesting for a company with a market capitalization of $ 290 billion. Although revenues decreased from the previous year, they were slightly higher than the $ 22.7 billion reported in the fourth quarter.

The company continues to increase earnings per share and pre-tax earnings, while reducing operating leverage and outstanding shares.

Source: Revenue slides

The fact that Bank of America has reduced outstanding shares by 6.6% year-over-year is quite impressive and deserves the attention of investors. As a shareholder, I am happy to see such a positive reduction because I have now become a larger owner of the company. Improved operational leverage means that the company is able to generate more profits with less revenue. Always positive.

Below is a brief overview of Bank of America's operational divisions.

Source: Revenue slides

As we can see, there were many positive points and no negative points for the quarter. As the company continues to benefit from its digital presence, earnings growth should be achieved due to the low cost of the transaction. With increased adoption by consumers, the bank can continue to reduce the overall physical presence and therefore the costs.

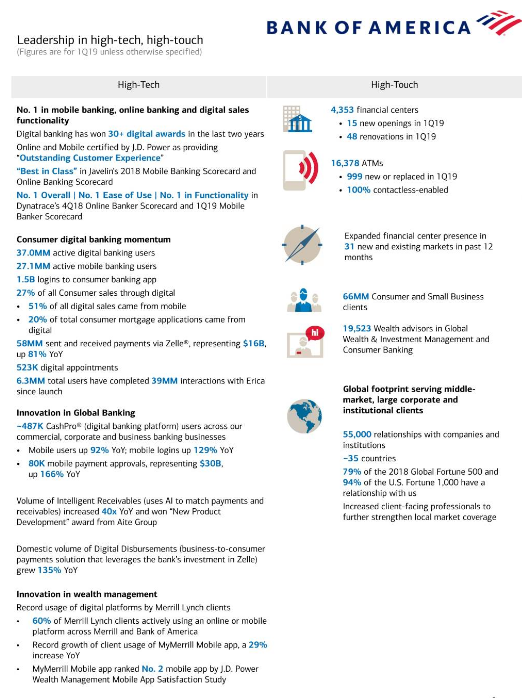

Digital deposit transactions have far outstripped transactions in physical financial centers. With 27.1 million mobile banking users, an increase of more than 9% over last year and digital sales reaching 27% of all retail banking sales, the society becomes very efficient. Unlike smaller regional banks, Bank of America can continue to make significant investments to create the best technology offering. The 58.1 million person-to-person payments through Zelle were also good, helped by the growth in user numbers to 5.4 million. All of this helped the consumer bank division reduce its efficiency ratio to 45%. Growth pretty impressive for a year. Below we see some highlights of what drives sales on digital platforms.

The company continues to increase its loans and leases, driven by strong corporate loans.

Source: Revenue slides

Loan growth has become more profitable and is expected to benefit future quarters as total return increases year-over-year and quarter-over-quarter.

The company continues to see improved financial results due to its good performance.

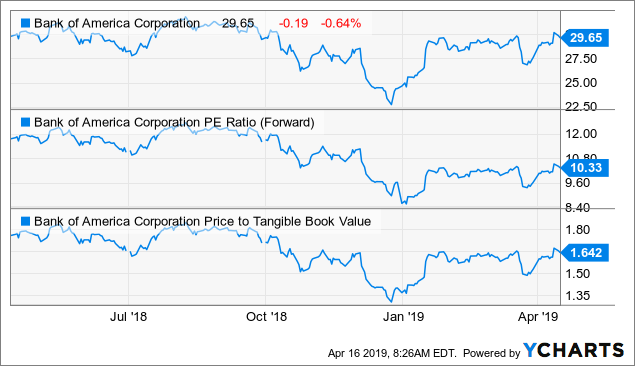

With both a book value and a tangible book value rising, shareholders should benefit from a safety net in terms of valuation. Trading at 1.5 times the book value, stocks do not seem too expensive for the solid fundamentals they deliver.

The company continues to win awards for its mobile platforms and technology investments, which should allow it to win new customers.

Source: publication of results

New customers are synonymous with long-term, revenue-generating relationships. Bank of America's continued investments in such things as branch renovations, ATM modernization and new financial advisors have contributed significantly to revenue growth and improved operating costs.

The continuation of strong growth in all divisions should propel the price of the stock up. This year, the stock has skyrocketed, but this is due more to the liquidation last December than the strong performance in general. Due to the flattening of the yield curve, the banking sector has so far been under pressure, which is strange considering the already low valuations.

Evaluation

The continuation of strong growth in all divisions should propel the price of the stock up. However, this year, due to the flattening of the yield curve, we have so far seen the price of the stock under pressure since the beginning of the year.

Data by YCharts

Even with the recent stock price hike, it is trading above recent highs and remains below the average of forward contracts and TBV programs.

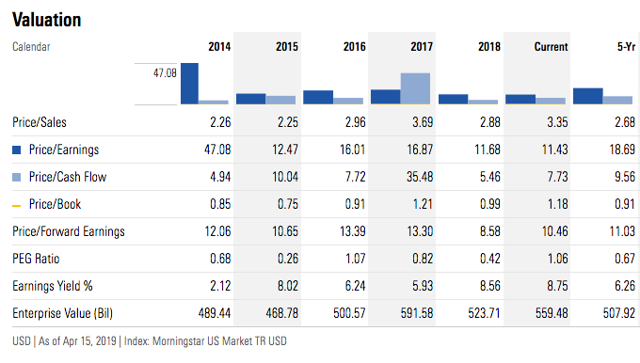

In fact, if we look at the five-year average trading intervals, we find that stocks are trading below their average despite stronger results.

Source: Morningstar

The company trades below its P / E, P / CF and P / E futures averages. This offers investors the opportunity to buy shares at a lower valuation than they would normally. It also suggests that equities may have a positive potential when they reach a normalized level.

Return on capital

The latest CCAR test results showed that Bank of America was well positioned to return capital to shareholders. Bank of America has allocated $ 20.6 billion to share buybacks, just behind the $ 20.7 billion announced by JPMorgan (JPM). In addition, LAC has announced a 25% increase in the dividend to $ 0.60 per annum. The new repurchase would reduce outstanding shares at current prices by 7%. The company has managed to use most of this program as it prepares for a new series of CCARs that will allow it to increase the dividend and renew its share buyback program. Fortunately, the fall in stock prices during the first quarter gave the bank some time to buy shares at attractive levels. Share buybacks led to a 2% reduction in total shares outstanding in two years, which is no small feat.

Buybacks are important because shareholders have been diluted several times over the past decade. Additional dilution occurred after the conversion of the preferred shares to Berkshire Hathaway (NYSE: BRK.A) common shares of Warren Buffett (BRK.B). With shares traded at a recent book value of $ 25.57, the dilution resulting from the conversion has almost been recovered.

The most attractive situation is that the company can buy back shares at a price lower than 1.2 times the book value. That is why management has chosen to buy more shares instead of further increasing the dividend. This is often better for investors for several reasons. It allows shareholders to become a larger owner of the company, it helps to increase earnings per share and reduces dividend obligations in the future, allowing further increases in dividend payouts. Over time, Bank of America should truly become a stock of dividend growth. In addition, I do not think the dividend is likely to be reduced in the future as the stress tests prove that the bank can withstand a significant negative financial event.

With strong earnings growth, improved operational efficiencies and fewer stocks, cost performance will continue to grow. What does not love?

Attractive foundations

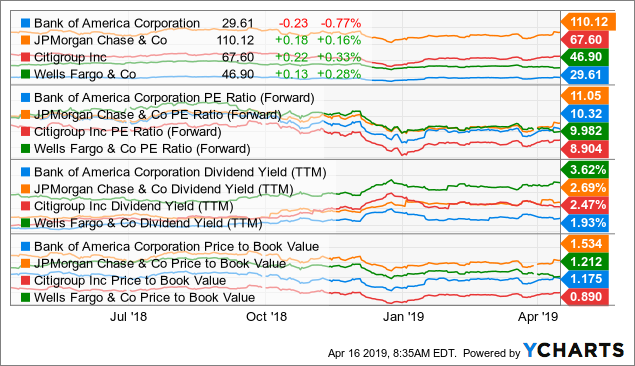

Next, we review Bank of America to its biggest peers.

Data by YCharts

As we have discussed, the advanced P / E is attractive, but it is not the lowest. The dividend is also the lowest on a TTM basis, but that could change in the coming months because of the company's ability to produce outstanding results with CCAR. This will allow it to further improve the return for shareholders. With the repurchase of stocks being one of the most aggressive, the table of the increase of the dividends improves in the long term. Less shares outstanding will allow the company to generate more earnings in the form of dividends. I assume that management will find a level to bring the redemptions to a regular level of between $ 5 billion and $ 10 billion a year. The rest will be allocated to dividends, which will make the title more utilitarian than the holding company.

Conclusion

Bank of America is of great value right now. Even after the stock price rises over the last 2 years, I think that at about 10 times earnings forecasts for 2020, stocks are undervalued. I believe that in a stable economic expansion like the one we are experiencing, equities should trade much like the S & P 500 at 15-16 times the futures earnings. Even applying a slight 14 times earnings reduction for 2019, this would give us an action price of about $ 42 the action. I agree to continue holding my shares until the stock price appreciates more. The company has reported significant shareholder benefits and should continue to do so. The dividend will continue to grow at double digits. Since the bank is limited in what it can do with its big profits, restoring it to shareholders is the most obvious option. For any new investor, I would recommend looking for a position below $ 30 per share.

Disclosure: I am / we have been for a long time BAC, JPM. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link