[ad_1]

HodlX Guest Blog Submit your message

Bitcoin

To the extent that the soaring price of the BTC has an explanation, the prevailing notion is that an anonymous party placed a buy order of 20,000 BTC on April 2, which unbalanced supply and demand . This order may have been able to cause stops, creating even more demand and increasing purchases. In addition, liquidations of large positions on BitMEX may have fueled the fire.

This rally was well publicized in the media, which theoretically could have led people to experience a "FOMO", which pushed it even higher – similar to what we saw at the end of 2017, but to a smaller one ladder. At one point, this cycle has run out of steam (apparently around $ 5,500 at the moment), reaching a point where sellers have balanced supply and demand, bringing the most recent price to a new standard level around $ 5,000.

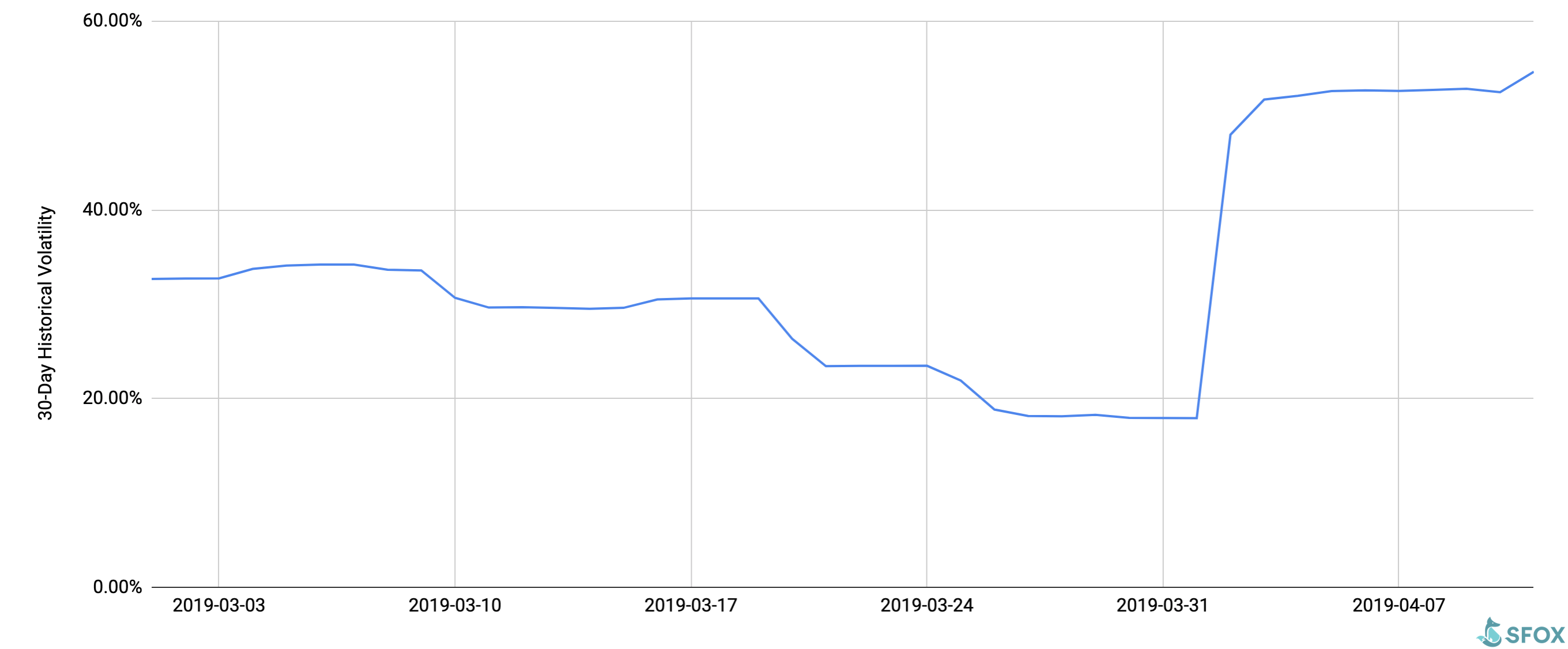

This analysis is consistent with the constant increase in BTC volatility observed since its peak at the beginning of the month.

Volatility of BTC, March to April 2019

30-Day Historical Volatility of CTB / USD

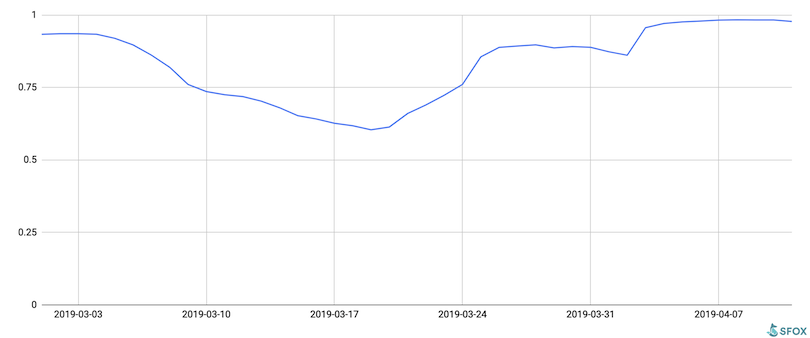

litecoin

SFOX has previously cited five factors that may have contributed to LTC's price increase in 2019: increased adoption, lower fees, shorter transaction times, exploration in private transactions, and a near 50% reduction in profits for the company. mining. These fundamentals may have caused LTC's correlation with BTC to collapse in the near term, but we found that LTC followed BTC during this recent major slowdown. This suggests that BTC's recent pricing activities have simply dominated the movements in the cryptography market, regardless of the fundamentals of the altcoin.

LTC correlation with BTC, March – April 2019

BTC: 30-day LTC correlation

Report compiled by the SFOX research team, which provides global analysis of the cryptography market for sophisticated institutional investors and investors. This report was originally published on the SFOX blog.

Join us on Telegram

Follow us on twitter

Discover the latest titles

Disclaimer: The opinions expressed in Daily Hodl do not constitute investment advice. Investors should exercise due diligence before making high risk investments in Bitcoin, Cryptocurrency or digital assets. Please note that your transfers and transactions are at your own risk and that any loss you may incur is your responsibility. The Daily Hodl does not recommend buying or selling crypto-currencies or digital assets, and the Daily Hodl is not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

[ad_2]

Source link