[ad_1]

(Source: imgflip)

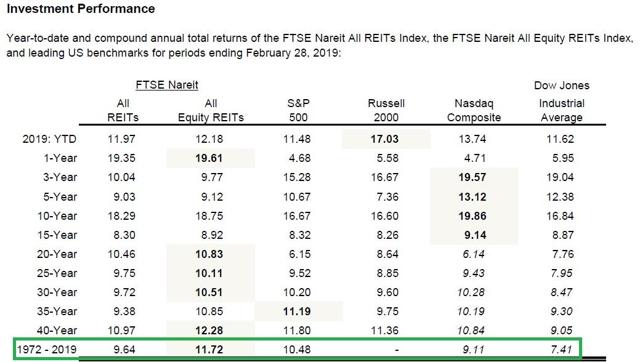

I am a strong supporter of quality REITs, which have fantastically proven to be fantastic ways to generate a generous and growing income, as well as higher total returns than the market. Even better, because of their stable, dividend-driven business models, built primarily around long-term leases, REITs also tend to be less volatile than the broader market, meaning that investors with disciplined long-term can also benefit from higher risk-adjusted returns.

However, due to the nature of real estate, income investors need to focus on a few key competitive advantages to ensure they make good use of their money.

This includes the purchase of REIT with experienced management teams, who have proven that they were competent and conservative capital distributors, able to grow steadily over time without sacrificing dividend security by contracting amounts. dangerous debt or "seeking a return" in terms of real estate liquidity returns (capitalization rate).

That's why I'm a fan of Federal Realty Trust (FRT), W.P. Carey (WPC) and STORE Capital (STOR). These three REITs are all ranked 9 or 10 on my new Sensei or SQS Quality Score of 11 points. It is a three-factor quality evaluation system based on dividend security, risk related to business models and quality of management. All three of these first-rate REITs have level 3/3 quality management, reflecting a strong track record of capital allocation and a commitment to secure and growing dividends over time. In other words, you can trust these three REITs with your hard earned money.

Let's take a look at what makes these three people sleep well at night or that SWAN quality FPIs are so special. As it is important to know why Federal Realty is the only one of these REITs that I can recommend to buy today, and at what prices W.P. Carey and STORE Capital are worth adding to your diversified dividend portfolio.

Federal Realty: the only dividend of King's REIT

- Quality level Sensei 10/11 (SWAN stock)

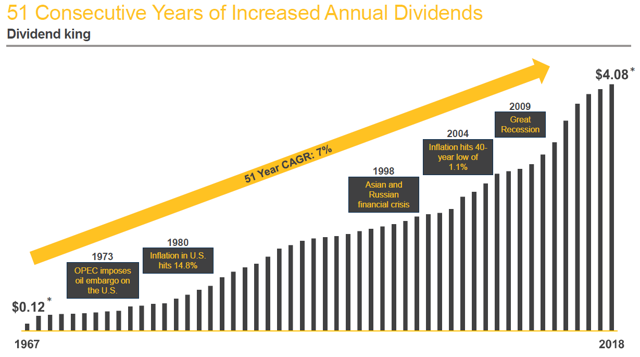

The REITs were created by the Congress in 1960 and Federal Realty was created in 1962, making it one of the oldest in the world. The fame of Federal is that it is the only king of the dividend in this sector, with an amazing growth for 51 years.

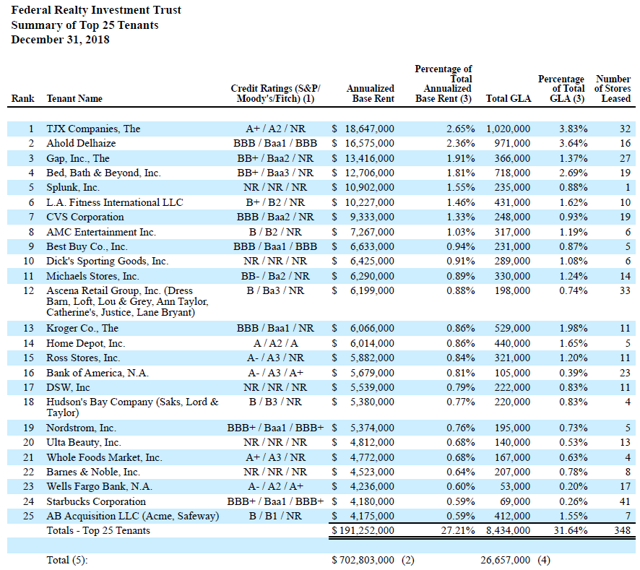

(Source: presentation to the FRT investor)

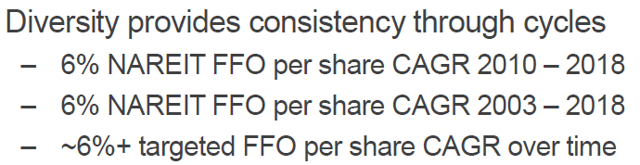

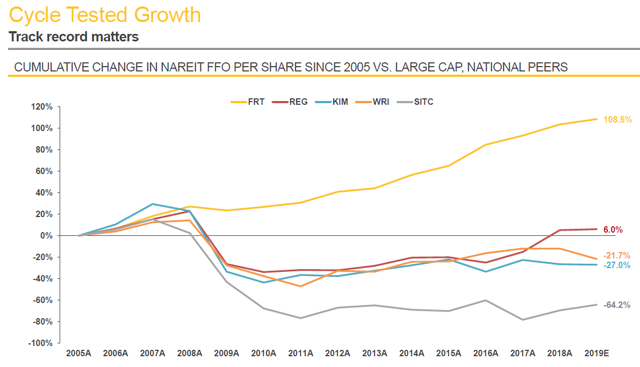

Management's ability to generate very steady and stable cash flow growth is essential to generate as consistent and optimal long-term dividend growth as the entire industry.

(Source: Investor Presentation)

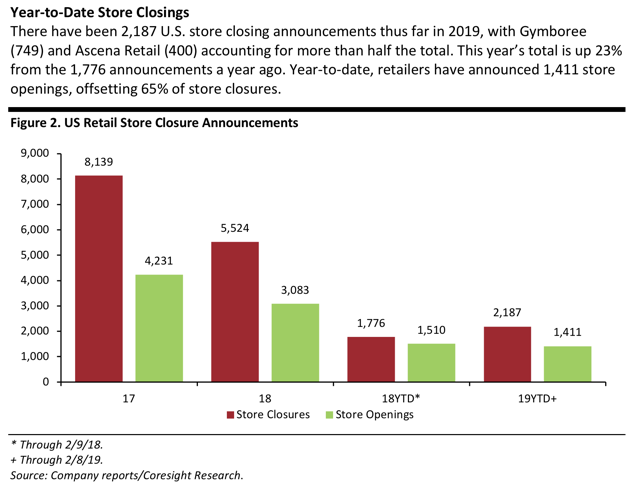

How is this possible with a record number of store closures in 2017, a negative trend that has continued in 2018 and is expected to accelerate slightly in 2019? Because even though "the apocalypse of retail" is a popular message that the media loves to peddle, retail has always been a highly competitive industry, characterized by winners and losers.

Federal Realty has 104 high-end shopping centers (not shopping malls) most of which are mixed or anchored in grocery stores (up to now resisting the rise of e-commerce). It has approximately 2,900 tenants in total and 94.6% of its occupancy at the end of 2018.

(Source: Investor Presentation)

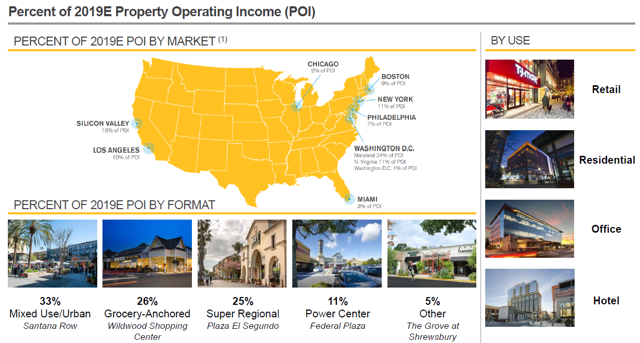

More importantly, the location of these centers is one of the greatest sources of success for Federal Realty because, it is said, in real estate, the three most important things are "location, location, location". 85% of the FRT's centers are located in the largest and wealthiest cities in America, with thriving economies and rising wages. 16% of them are located in Silicon Valley, the richest part of the country.

(Source: Investor Presentation)

With respect to commercial REITs, no one is better located. For example, the center of the FRT is located in a region with a population density three times higher and the median household income almost 50% higher than the national average. This allows it to attract growing tenants, creating a source of highly diversified, high-quality, recurring cash flow to support the most secure dividend of REITdom.

(Source: Investor Presentation)

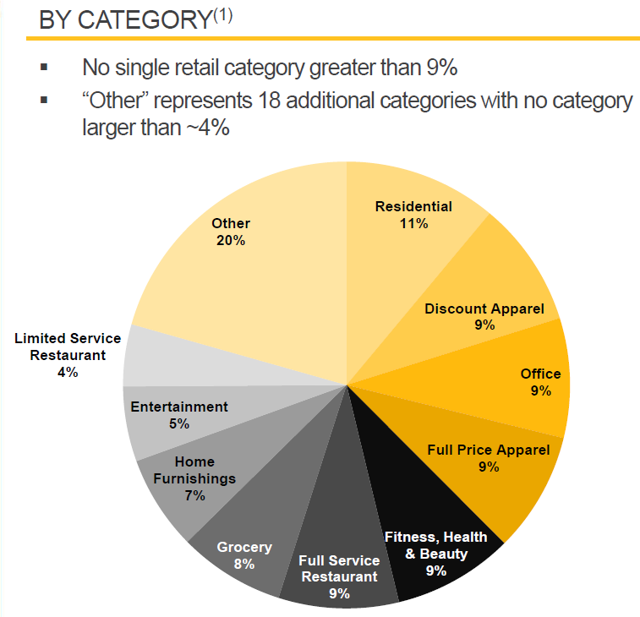

65% of the REIT's rent comes from non-e-commerce-sensitive tenants and many categories that may surprise those who view only FRT as a "retail" REIT.

(Source: Investor Presentation)

For example, the largest source of rent is 2,700 apartments, which are 97% occupied. Other important customers are grocery stores, restaurants, fitness centers, pharmacies, auto stores and entertainment operators.

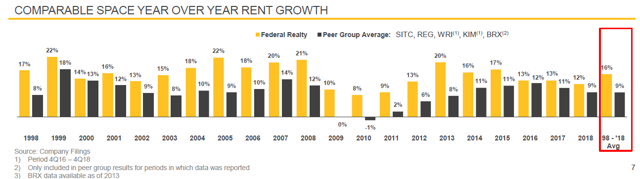

To fully understand the quality of the FRT's properties, investors must consider the leasing gap or the amount of rent that increases when existing leases (average remaining lease 7.2 years) expire. A lease gap of 10% or more is a good indicator of quality properties. Over the past 20 years, FRT's lease gap has averaged 16%, compared with 9% for its peers.

(Source: Investor Presentation)

In 2018, the year in which cash flows from operations / units grew by an impressive 8.5%, the leasing gap was 12% and 15% in the fourth quarter of 2018. Even during The Great Recession, the FRT's leasing gap never dropped below 8%, pointing out its tenants are resilient to the recession.

(Source: Investor Presentation)

This explains why, during the financial crisis, when most shopping centers experienced a loss of FFO / share in shopping centers, the FRTs have seen a slight decline and have more than doubled since 2005. In fact, FRT and Simon Property (SPG) are only two REITs (out of 24) that have been successful in generating positive growth in cash flow per share every year since 2010.

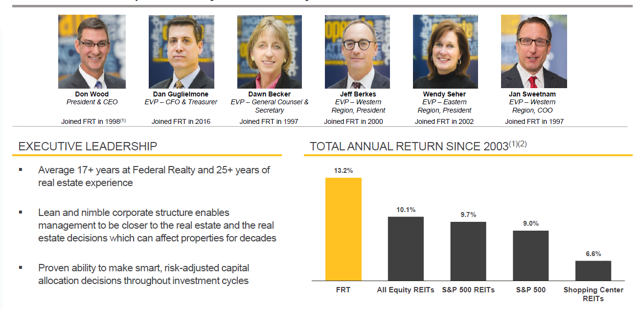

This explains why, over the last 15 years, FRT has generated annualized total returns well above the market, REITs in general or its shopping mall peers.

(Source: Investor Presentation)

That's thanks to what I consider to be the best management team in this sector, led by CEO Donald Wood. Wood has been working at FRT for 21 years, acting both as CFO and COO. In the last 17 years, he has held the highest position. Prior to joining FRT, he was President of the National Association of Real Estate Investment Companies (NAREIT) and was also a member of the Executive Committee of the International Council of Shopping Centers (ICSC). .

But a legendary CEO is just one reason why investors can trust Federal Realty to manage their money well. The average manager has more than 25 years of experience in commercial real estate and more than 17 years with the FRT itself. And the board of directors is brimming with CEOs of REITs and real estate development companies with expertise in many sectors other than retail.

This is important because, for more than 20 years, FRT has diversified into mixed-use buildings, including office buildings, hotels and apartments. These not only diversify cash flow, they also increase the value of retail businesses by increasing pedestrian traffic and making centers more dynamic.

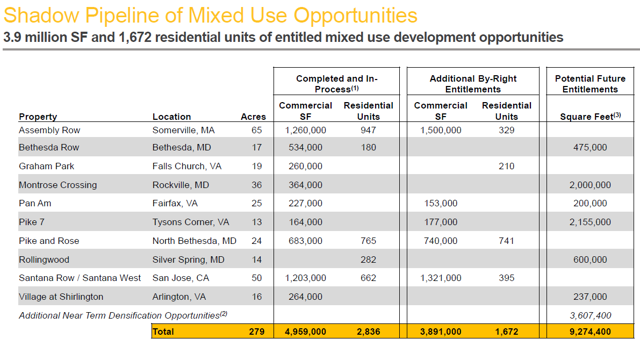

(Source: Investor Presentation)

At present, Federal Realty has a $ 1.1 billion development backlog, but also a backlog of nearly $ 3.5 billion in mixed-use properties. The ghost order book represents the management of the projects that it is planned to complete over the next 15 years if it manages to obtain enough prior licenses. The current mixed-use backlog includes a 60% increase in the number of apartments and an increase of more than 100% in square feet of stores.

But wait, there is better. Mixed use is not just a way to improve your business and diversify your cash flow to create a more secure dividend. It is also more profitable. Historically, the FRT obtains cash returns of approximately 6% on the capital invested by shopping centers, but between 6% and 12% on mixed-use properties. In 2019, the REIT expects to complete projects worth $ 132 million with a long-term cash flow yield of 7%.

The considerable backlog of redevelopment and mixed-use properties (totaling approximately $ 4.6 billion) explains why management is confident of being able to post its growth rate 6% cash flow history for many years. And in the long run, this should also translate into dividend growth of about 6%, among the fastest growth rates in the sector.

However, FRT has another key competitive advantage that makes me think that management can achieve this ambitious goal of long-term growth. This would be the REIT's excellent access to low-cost capital, the cornerstone of the REIT sector.

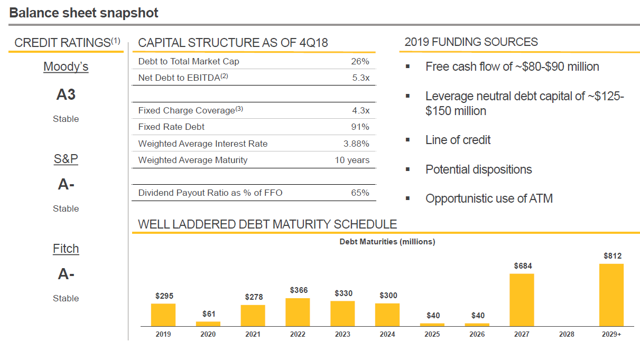

(Source: Investor Presentation)

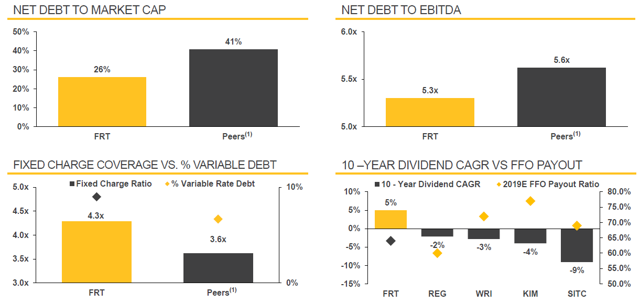

FRT is one of six US REITs rated "A" by at least two rating agencies. FRT's balance sheet is a fortress with a leverage ratio of only 5.3 and an interest coverage ratio of 4.3. As a reminder, the average REIT has a debt / EBITDA ratio of 5.8 and interest coverage of only 3.4.

(Source: Investor Presentation)

And among its malls counterparts, again, FRT stands out as the best, with much less debt and higher interest coverage. Most importantly for income investors, the FFO 2019 payout ratio is only 65%, the second lowest in the industry. This is despite the fact that the growth rate of the 10-year annual dividend is by far the fastest.

Thanks to this conservative use of debt, Federal Realty not only managed to become a dividend king, but was one of the country's 12 REITs to avoid reducing or suspending its dividend during the financial crisis. This is also why the REIT's debt is at a fixed rate of 91%, with an average maturity of 10 years and a very low interest rate of 3.9%.

Combined with its well deserved share price, this means that the FRT's cash cost of the weighted capital is approximately 4.1%, which is about half of the cash return on invested capital. In other words, the FRT has not only 15 years of strong growth potential, but also access to a mountain of low-cost money and a world-class management team to carry out its growth plans.

That's why I consider Federal Realty to be a "simple" SWAN REIT, suitable for almost all diversified dividend portfolios of the highest order (if the price is right).

W. P. Carey: The most diversified triple net leasing REIT you can own

- Quality level Sensei 9/11 (SWAN stock)

W. P. Carey was founded in 1973 by Bill Carey, who literally helped invent the triple net leasing industry, or NNN, which has proven to be a gold mine for conservative investors over decades.

This is because triple-net Leasehold REITs such as WPC use a so-called "leaseback" business model in which they buy a property from its current owner and then sign long-term leases (generally 20 to 25 years in the case of WPC) to: rent them out. The tenant receives money to develop his business and is then responsible for the payment of maintenance, property taxes, utilities and insurance.

WPC is literally the owner, perceiving a steady stream of contracted and high margin rents. 99% of its leases are triple net leases and are indexed to inflation, of which 64% are related to the CPI. In total, the rent of the WPC portfolio increases by 1.4% per year.

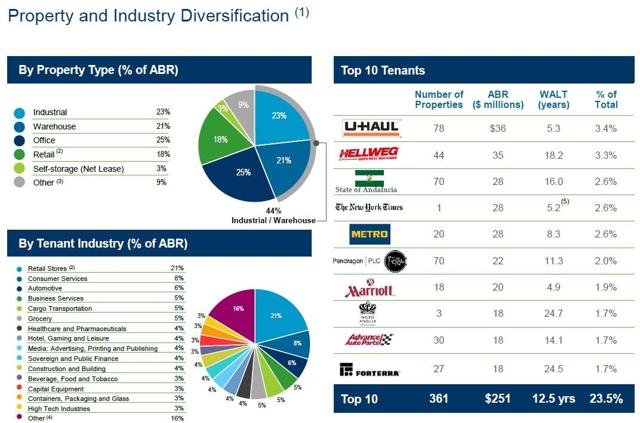

The thing that makes W.P. Carey is an incredible diversification compared to most REIT NPIs. The FPI owns

- 1,163 properties

- in 19 countries

- rented to 304 tenants in dozens of industries

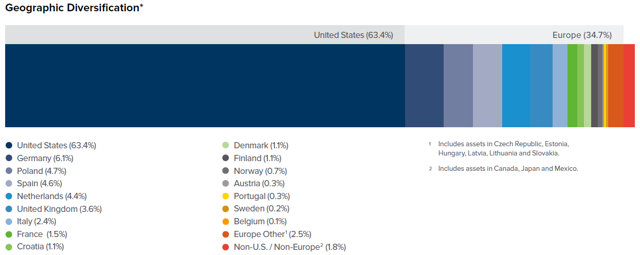

(Source: Annual report)

37% of the rent comes from foreign countries, 35% of which are from Europe. WPC is literally the only NNN REIT to have significant global exposure, thanks to a management team that has been acquiring European properties at Amsterdam's regional headquarters for almost 20 years.

But the incredible diversification of WPC is not limited to geography. It is by far the most diversified NNN REIT.

(Source: Investor Presentation)

While most triple-net leasehold REITs are highly retail-oriented (80% of Realty Income rent comes from retail), W.P. Carey's focus is 44% on warehouses (including distribution centers for e-commerce) and industrial properties. Retail trade (excluding car dealerships) accounts for only 18% of the rent.

In addition, the vast majority of its retail businesses are located in Europe, where overcapacity is much lower than in the United States. Management decided several years ago, in a fine example of foresight, that the US retail industry could have problems if e-commerce disrupted it. They were right and therefore positioned themselves to take advantage of the growth of online retail.

An excellent management team is one of the main reasons to love WPC because it has shown itself extremely conservative with the shareholders' money and has always put the emphasis on the quality rather than growth. The management is led by CEO Jason Fox, who has been with W.P. Carey for 12 years and oversaw profitable investments of over $ 10 billion.

This includes the property acquisitions as well as the REIT's private real estate funds. W.P has decided to simplify its business model by converting to a pure play NNN REIT. In 2013, it bought one of its real estate funds for $ 4 billion of shares, and in 2018 bought out $ 5.9 billion of CPA 17, which represented about 50% of its assets. its remaining portfolio of private real estate management.

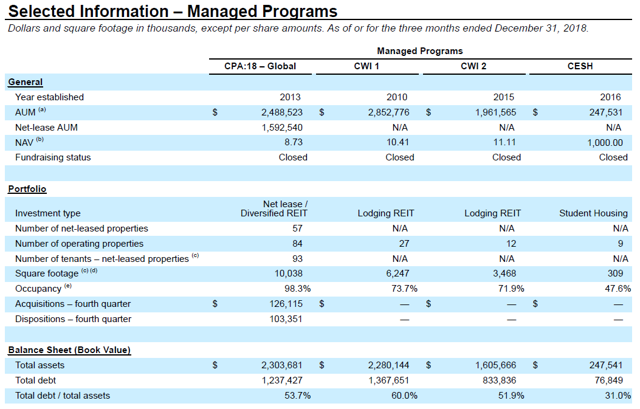

(Source: Income Supplement)

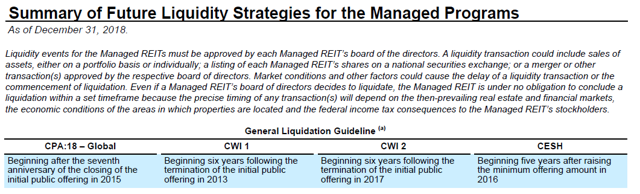

Today, W.P manages four real estate funds managed by private investors, which collectively represent $ 7.6 billion in assets under management and are closed to new capital. They pay about $ 22 million in annual management fees (about 2% of revenues) and W.P. Carey plans to consolidate them between 2019 and 2023.

(Source: Income Supplement)

Once these funds are absorbed by WPC, the REIT expects growth in two main ways. The first concerns the acquisition of properties, such as properties acquired in 2018, worth $ 940 million (compared to $ 525 million in dispositive sales). The average capitalization rate of these properties (cash yield) was 7% and the average lease term was 20 years.

(Source: Income Supplement)

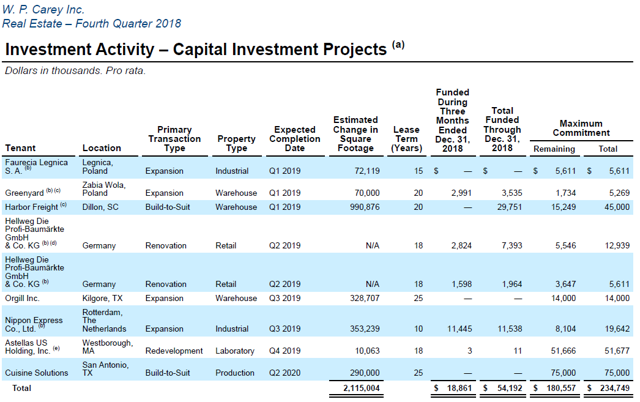

The other catalyst for growth comes from the redevelopment of projects, including $ 235 million of projects under construction at the end of 2018. It generally involves high-yield, short-term and high-yield investments. long-term.

By improving its properties, WPC makes them more valuable to tenants and allows them to order higher rent when the leases expire. They also allow the REIT to opportunistically sell properties at better prices, and then recycle the capital into more profitable properties later.

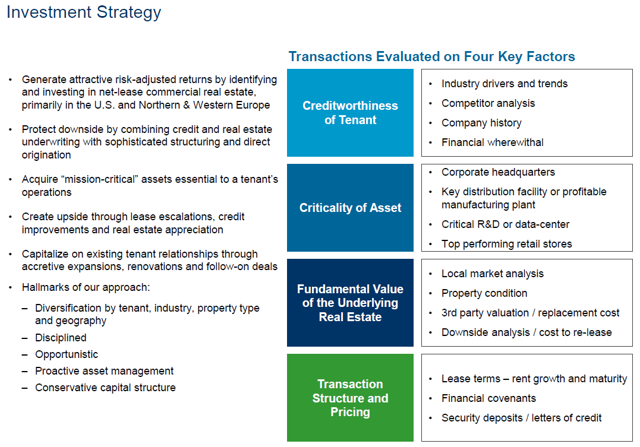

But the best part of W.P. Carey is focusing on Buffett, as the investment of value, always seeking quality assets generating revenue at attractive prices.

(Source: Investor Presentation)

An excellent return on long-term investments means that we must focus primarily on risk management and portfolio management. Carey's management has proven to be an expert in risk-weighted probability investing. Before investing in a new property, it always takes into account the financial strength of the tenant and the property in question in particular (what will be the quality of the rental coverage).

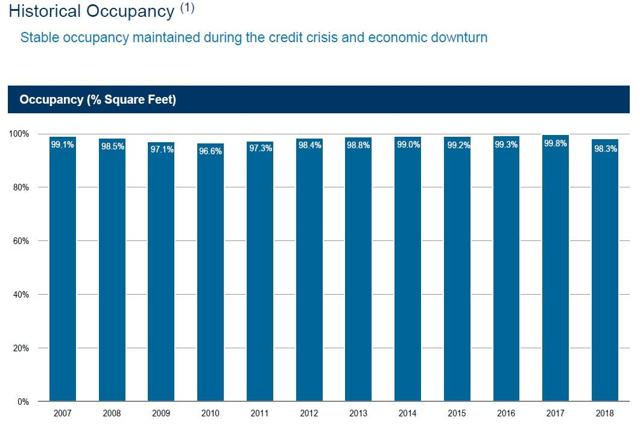

This concern for quality rather than quantity is the reason why W.P. Carey, despite its strong exposure to cyclical industrial properties, has been able to maintain a very high occupancy and cash flow over time.

(Source: Investor Presentation)

Even during the Great Recession, as global industrial companies struggled with the worst of decades, the occupation of WPC has never fallen below 96.6 percent.

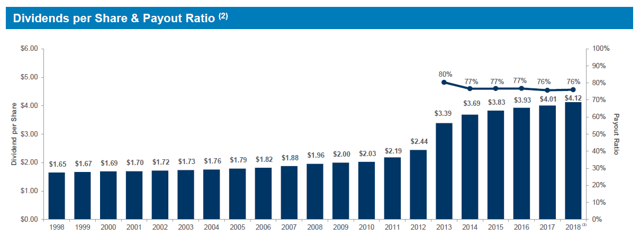

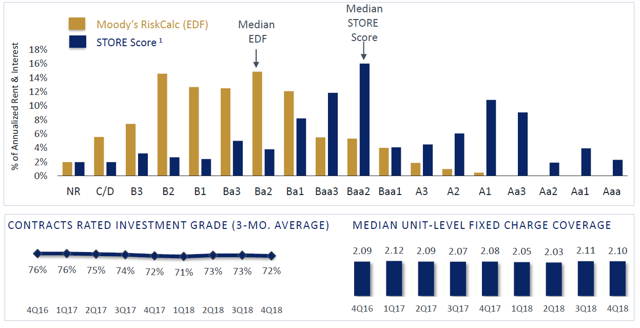

This is what is allowed to W.P. Carey to achieve elite dividend status among REITs, including 20 consecutive years of growth (aristocratic dividend in 2023).

(Source: Investor Presentation)

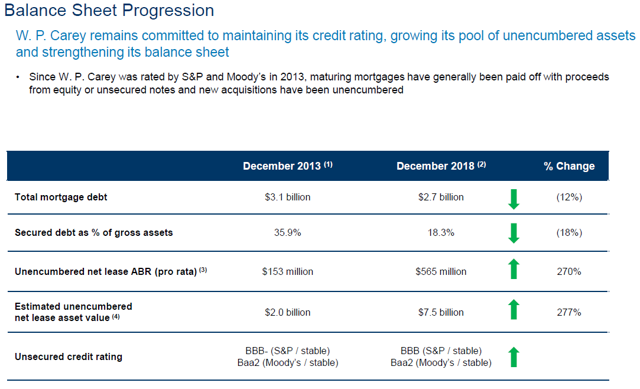

And since the conversion of an MLP in 2012, the management has focused on laser refining the last big competitive advantage of the REIT, namely access to low capital. cost.

(Source: Investor Presentation)

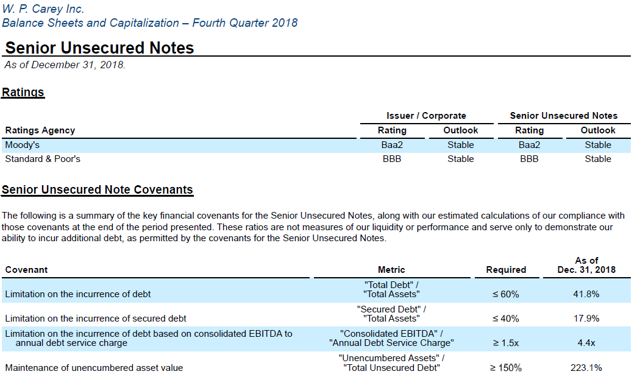

Do you notice W.P. Carey's record has always been one of the best in the REIT sector, which is why it avoided dividend reduction, unlike 87% of equity REITs, during the financial crisis. However, over the last five years, management has focused on continuously improving its credit indicators, which has raised its credit rating to BBB.

(Source: salary supplement)

While indebtedness and interest coverage are important credit indicators to watch for, they are just two of the many factors that concern investors in bonds. W. P. Carey is strong in all areas, including being far from violating its debt commitments. These are parameters that must be at minimum levels of security or creditors can call for loans immediately, triggering the type of liquidity crisis that overwhelmed the vast majority of REIT dividends during the Great Recession.

Thanks to its solid balance sheet (which improves over time) and its significant borrowings in Europe, where bond yields are well below those of the United States, the average interest rate of WPC n & # It is only 3.6% with a weighted capital cost of 4.8%. .

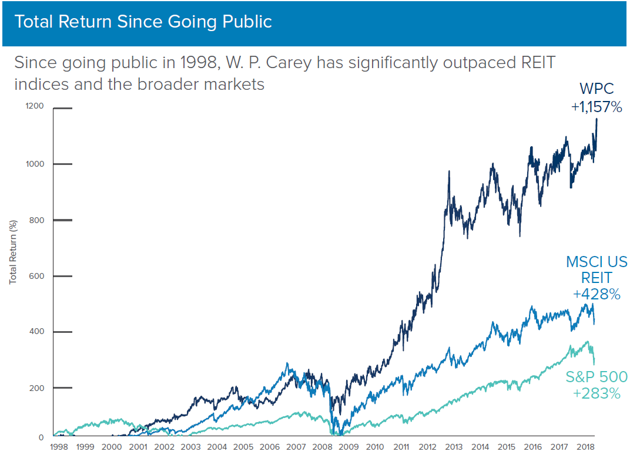

This means investment margins (investment return minus cost of capital) of 2.2%. As a reminder, most NNN REITs are happy to obtain investment spreads of 1% to 2%, and WPC exceeds these levels. While focusing on a portfolio of high-quality, low-risk properties leased to powerful tenants around the world. This has allowed this slow-growing REIT (dividend and long-term cash flow growth of 4%) to generate sector and unprecedented returns since its IPO in 1998.

(Source: WPC datasheet)

In other words, WPC is the kind of well-managed, high-yielding blue-chip dividend that proves it pays to focus on quality fundamentals.

STORE Capital: A booming industry with state-of-the-art management you can rely on

(Source: imgflip)

- Quality level Sensei 9/11 (SWAN stock)

The most important thing that any income investor needs to focus on is capital preservation. You can not compose wealth or income if you make stupid mistakes. Or, as Buffett has said, there are two essential rules to investing. "Rule # 1: Never lose money. Rule # 2: Never forget rule # 1 ".

In fact, STORE Capital is the only REIT owned by Berkshire Hathaway (NYSE: BRK.B), having invested $ 377 million in 2017 to directly acquire a 9.8% interest in the company (this interest has fallen to 8%). 4% due to equity issues). .

And as all fans of Shark Tank know, the biggest thing that venture capitalists focus on when they study an investment proposal is the likelihood of getting their money back. The same goes for the companies that I recommend and that I have on my watchlist to possibly buy at the right price.

I want to make sure that you and I put our money in good hands, that is to say, proven capital distributors that will allow our wealth and our income to grow safely, with a minimal risk of permanent loss.

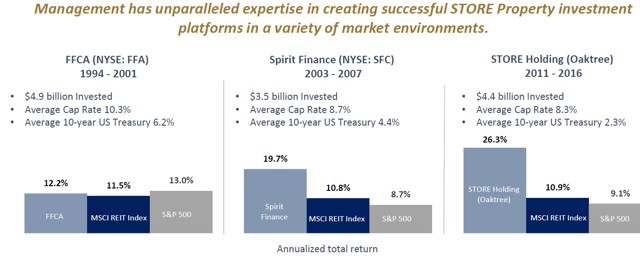

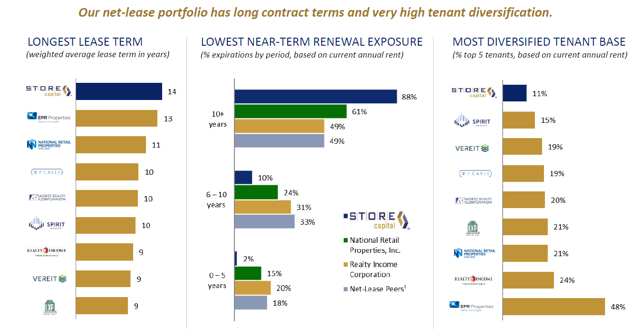

STORE Capital is one of the first-class REITs (based on my quality criteria) in North America. It became public in 2014. However, if I have enough confidence in the management to recommend this REIT triple rent, is that the leaders of STORE are confirmed masters in this space.

STORE's management team has over 110 years of collective real estate investments and since 1994 has invested more than $ 17 billion in more than 9,600 single-tenant properties. They focus on the niche of the lower middle market, where the quality of tenants is slightly lower but the money yields are much higher.

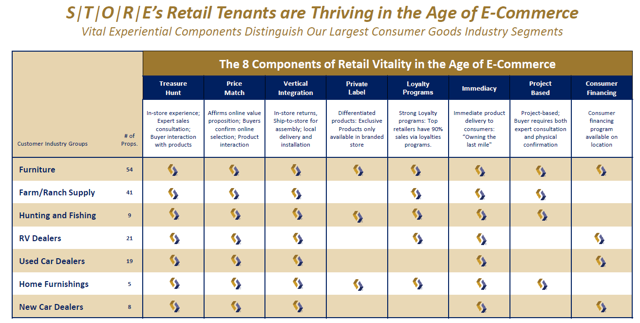

(Source: STOR investor presentation)

As you can see, the management of the three previous real estate funds is remarkable. These guys are good at executing and making money for investors.

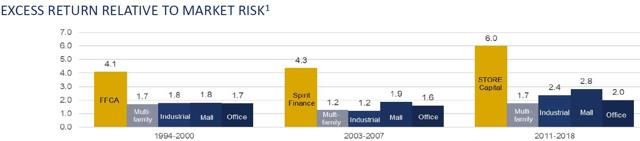

But wait a second? Did not I just throw in WPC's high-quality portfolio and the potentially damaging impact of the increase in capitalization rates? This is certainly the case, but in the hands of expert risk managers like those of STORE, it can create an extremely lucrative and highly profitable dividend machine.

(Source: STOR investor presentation)

Management's risk-adjusted returns over the last 25 years have been even more impressive than its absolute total returns. This is a matter of extreme discipline in underwriting contracts, which means that STORE's due diligence on any potential contract is first-rate. What is the quality of the risk management of STORE? Since 2011, the year in which the current REIT began operations, credit losses represented only 0.2% of the capital invested.

In other words, these guys know what they do and are experts at their niche. The key to STORE's success lies in excellent risk management, including diversification.

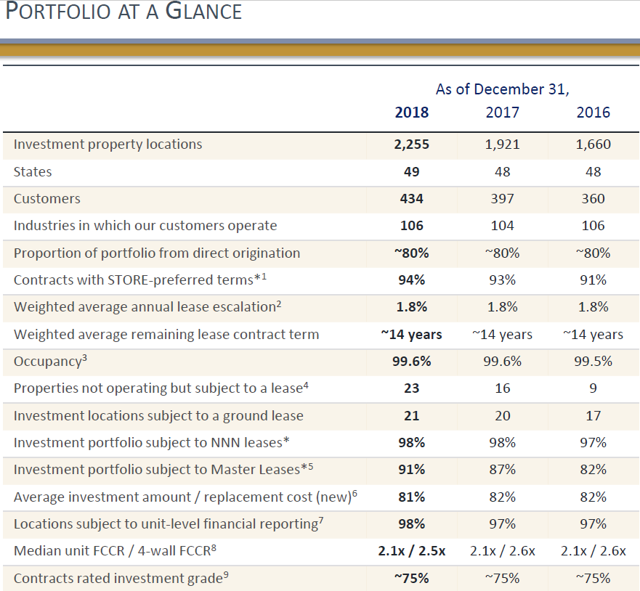

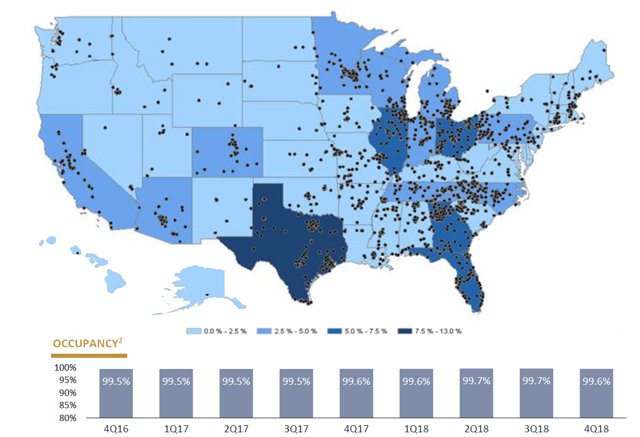

Today, the REIT owns more than 2,200 properties in 49 states, leased to 434 companies in 106 industries. Management is not only trying to balance higher money yields without taking too much risk with specific properties, but in such a diversified portfolio, with average triple net leases remaining at 14 years, the stability of its cash flows cash flow should prove solid throughout the period. business cycle.

(Source: presentation to investors)

STORE focuses primarily on lower and mid-market companies, which means smaller tenants than those targeted by National Retail Properties (NNN) and Realty Income (O). Its median and average tenant has annual sales of $ 54 million and $ 862 million, respectively. In total, 73% of its tenants have an annual turnover of at least $ 50 million and the median rental coverage rate of its customers is stable at 2.1 (above the 1.5% security level). the sector) since its IPO. According to STORE, the average tenant should see his sales fall by 40% before his ability to pay rent is threatened.

80% of the REIT's property acquisitions come from private channels, with management leveraging its decades of experience to find non-public offers at better terms than you or I could achieve in the real estate transactions in public markets. To minimize the risk of cash flow disruption, 91% of leases are "master leases" in which a tenant must pay the rent for all properties, even those that are likely to lose money. Money individually.

(Source: presentation to investors)

How can investors say that the management of STORE is managing risks well? Well, on the one hand, the rental coverage ratio has remained stable at around 2.1 for several years. Similarly, the occupancy rate has been extremely stable at almost 100%, the highest rate in this industry.

While it is true that during a recession, the business may decline slightly, so far, STORE has managed to balance its niche approach with respect to high capitalization rates with ultra underwriting. -conservative in the manner of a champion.

(Source: 10-K)

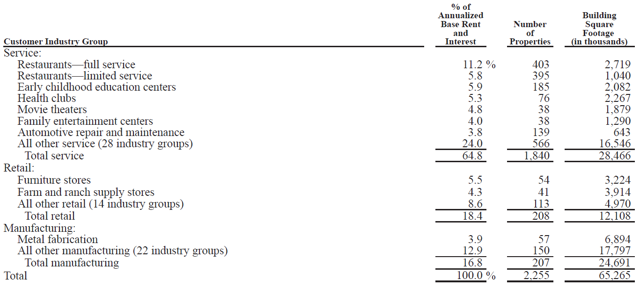

Part of that takes a W.P. Carey enjoys diversification, with only 18% of retail revenues. 65% of the revenue comes from service / experiential operators and, like WPC, STORE is also heavily exposed to manufacturing.

(Source: 10-K)

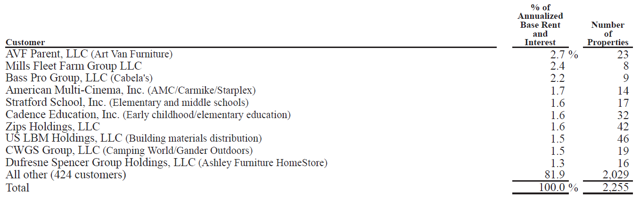

Among the most important tenants, the top 10 represents only 18% of the total rent, with no tenant representing more than 2.7% of the rent. Management has been very focused on selecting quality tenants that it believes are relatively resilient to e-commerce and are therefore able to pay a stable rent (with a 1.8% growth rate sector) over time, particularly during a recession.

(Source: presentation to investors)

Fundamentally, STORE's management is well aware that its mid-market and bottom-line customers are riskier than larger companies. As a result, it strives to ensure that the REIT's overall risk profile is the lowest of its competitors.

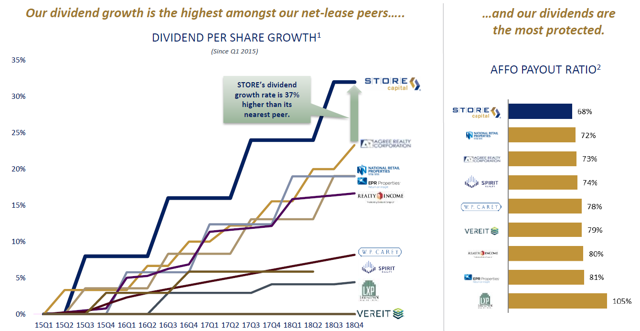

(Source: presentation to investors)

And despite the sector's fastest dividend growth rate since its IPO, STORE has the lowest AFFO distribution rate at just 68%. In terms of context, the average distribution ratio of REITs is 81% and the average distribution ratio of NNN REITs is 83%.

(Source: presentation to investors)

This is what gives me such confidence that the dividend of this REIT will remain safe and will increase during the next economic downturn, whatever the time.

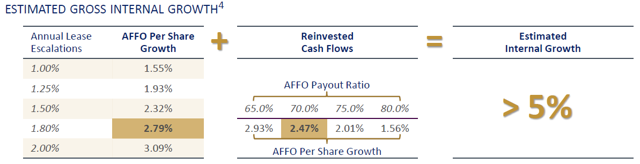

What I like about STORE is that the fact that management focuses on the LMM tenant, combined with a high amount of free cash flow, means that the REIT has the best organic growth potential of all its peers .

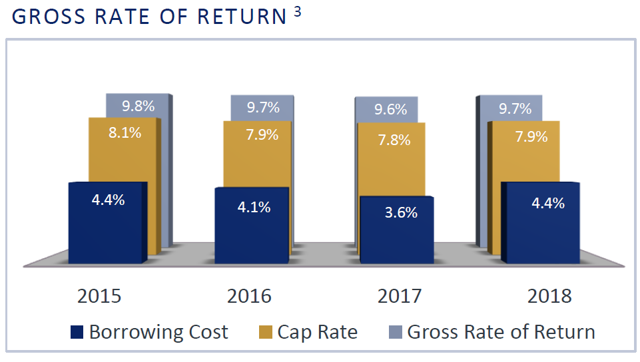

(Source: presentation to investors)

Given the long-term goal of 70% of the distribution ratio of funds from the operation of the adjusted business, management believes to increase its cash flow by 5%, in much thanks to this growth factor of fat rental, the highest of all NNN REITs.

(Source: presentation to investors)

And thanks to its LMM niche goal, capitalization rate compression has not been as big a problem for STORE as it is for other triple net rent REITs. The STORE investment gap has generally varied between 3% and 4% since its IPO, the highest in the industry. C'est l'avantage de poursuivre ce créneau de taux de capitalisation plus élevés, tout en gérant le risque au moyen d'une diversification et d'une souscription rigoureuse.

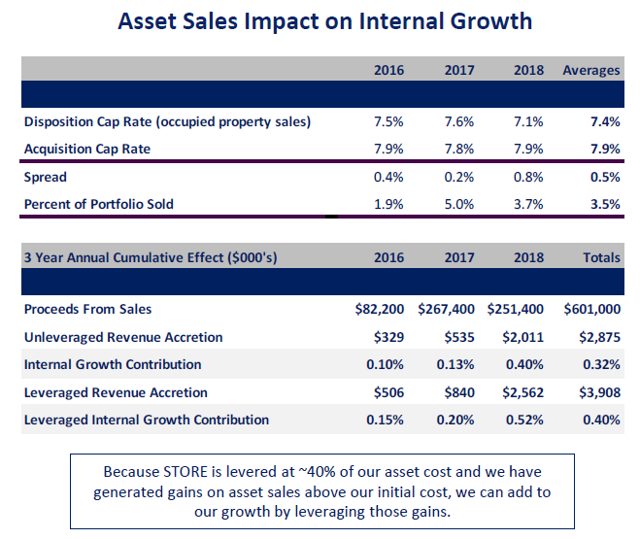

Une autre preuve de la répartition du capital qualifié réside dans les antécédents de la FPI en matière de recyclage ou de vente de propriétés de façon opportuniste et rentable, afin de réinvestir le produit dans des propriétés à taux de capitalisation plus élevé ultérieurement.

(La source: présentation aux investisseurs)

Au cours des trois dernières années, STORE a réalisé en moyenne 3,5% de ventes immobilières par an et a vendu des propriétés à des taux de capitalisation (rendements financiers) inférieurs de 0,5% à ceux pour lesquels il les avait achetées. Cela génère à lui tout seul une croissance annuelle du cash-flow par action de 0,4%.

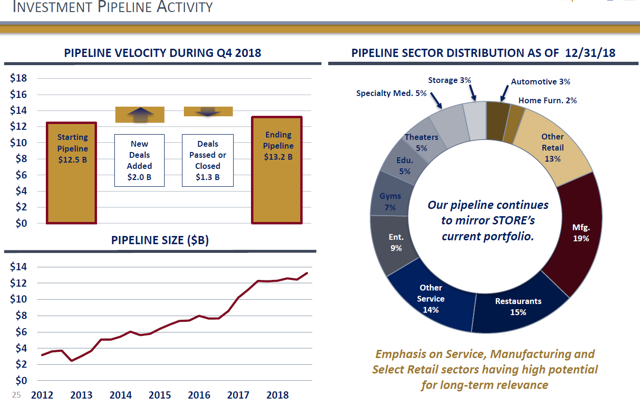

Mais le plus important catalyseur de croissance de STORE est son portefeuille d’acquisitions, qui a plus que triplé depuis 2012 et qui s’est terminé en 2018 à 13,2 milliards de dollars. Malgré des acquisitions record de 1,6 milliard de dollars de biens immobiliers l’an dernier, soit environ 13% du portefeuille d’acquisitions au début de l’année (le double de son niveau normal). Les AFFO / parts de STORE ont augmenté de 7,6% en 2018, parmi les taux les plus rapides de toutes les FPI.

(La source: présentation aux investisseurs)

Pour 2019, la direction prévoit des acquisitions d'un montant de 1,1 milliard de dollars avec un taux de capitalisation d'environ 7,9%, soit le même taux qu'en 2018, ce qui devrait générer une croissance de 5% des FPAA / action.

Quatre-vingt-sept pour cent des acquisitions potentielles sont axées sur le commerce de détail, ce qui maintient le cap actuel de STORE sur un portefeuille largement diversifié axé sur les industries et les services. La direction est convaincue que le pipeline continuera de croître fortement avec le temps, grâce à la petite taille de STORE (7,6 milliards USD d'actifs) et à la taille du marché.

Le nombre total de bâtiments à occupant unique aux États-Unis est estimé à 2 millions et évalué à 3,4 billions de dollars. La direction estime qu'environ 200 000 d'entre elles se trouvent sur son marché cible, ce qui signifie que la part de marché de STORE dans son créneau est d'environ 0,2%. Cela implique une très longue piste de croissance pour STORE, qui devrait récompenser largement les investisseurs en revenus dans les années et les décennies à venir.

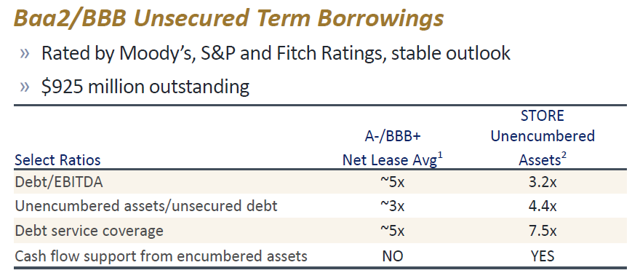

Mais comme dans toute FPI, le potentiel de croissance ne suffit pas. Pour mener à bien ses ambitieux plans de croissance, STORE a besoin de disposer de beaucoup de capitaux à faible coût, mais heureusement, son bilan est de qualité supérieure.

(La source: présentation aux investisseurs)

Le ratio d'endettement net total de STORE est de 5,5, ce qui correspond à la fourchette basse de l'objectif à long terme de la direction allant de 5,5 à 6,0. C'est assez sûr pour supporter une cote de crédit stable de BBB ou équivalente des trois agences de notation. Cela permet à STORE d’emprunter à 100% des obligations à taux fixe (durée moyenne de 6,2 ans) à 4,4% et, grâce à l’extension de sa facilité de crédit renouvelable en 2018, le Fonds dispose de liquidités totales de 1,4 milliard de dollars. C'est assez pour financer la totalité de la croissance prévue pour 2019, bien que les émissions d'actions opportunistes et le recyclage des capitaux soient également utilisés pour éviter de trop désendetter le bilan.

Fondamentalement, STORE est l’une de mes REIT de leasing triple net les plus rapides en raison de son taux de croissance rapide, de ses écarts de rendement de premier ordre et de sa gestion éprouvée en matière de gestion du risque pour générer une croissance importante et durable des dividendes.

Mais alors que je suis un grand fan de STORE, Federal Realty et de W.P. Carey, cela ne signifie pas nécessairement que les trois FPI représentent un bon achat aujourd'hui.

Total Return Potential / Valuation: Potentiel de rendement total à deux chiffres si vous achetez au juste prix

Que je recommande ou non un titre de dividende ou que je l’achète pour mon portefeuille de retraite (où je conserve 100% de mes économies), cela dépend non seulement de la qualité de la société, mais également de son évaluation et de son profil de rendement total.

Cela signifie que je regarde le rendement, la sécurité des dividendes, le potentiel de croissance à long terme et la valorisation.

| Business | yield | Le ratio de distribution | Niveau de qualité Sensei (sur 11) | Croissance attendue des flux de trésorerie à long terme | Rendement total attendu (pas de changement de valorisation) |

Potentiel de rendement total ajusté à la valorisation |

| Immobilier fédéral | 3.0% | 65% | 10 (NYSEARCA: SWAN) | 6% | 9,0% | 9,7% |

| W.P. Carey | 5,2% | 76% | 9 (SWAN) | 4% | 9,2% | 7,7% |

| MAGASIN Capital | 4,0% | 68% | 9 (SWAN) | 5% à 6% | 9,0% à 10% | 7,6% à 8,6% |

| S & P 500 | 1,8% | 33% | 6,4% | 8,2% | 1% à 7% |

(Sources: Simply Safe Dividends, graphiques F.A.S.T., Morningstar, estimations des analystes, Moneychimp, Multpl.com, Yardeni Research, modèle de croissance de Gordon Dividend, théorie du rendement du dividende)

Par rapport au S & P 500, les trois FPI offrent des rendements attrayants, bien que les TFR soient inférieurs à la moyenne de 3,9% pour les FPI selon NAREIT. En utilisant les estimations de croissance des prévisions de la direction ou du consensus des analystes (validées par les taux de croissance historiques) et en supposant une valorisation constante, les investisseurs qui achètent ces FPI aujourd'hui pourraient s'attendre à des rendements totaux à long terme compris entre 9% et 10%.

Cependant, les évaluations des FPI ont tendance à être des conversions moyennes, ce qui signifie que vous devez toujours envisager de commencer les évaluations.

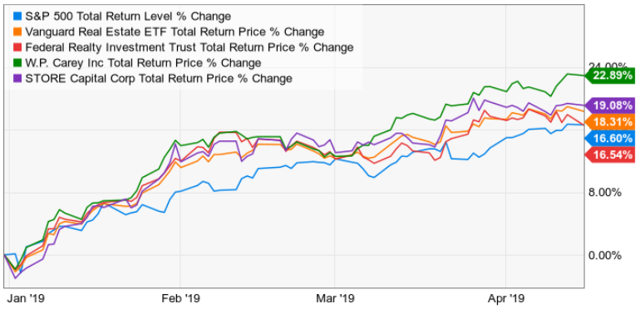

(Source: Ycharts)

Les sociétés de placement immobilier ont connu des hauts et des bas en 2019, surperformant ainsi l'indice S & P 500, qui connaît lui-même le meilleur début d'année de la décennie. Les REIT de crédit-bail triple net telles que WPC et STORE sont devenues très populaires, surperformant les REIT en général et le marché au sens large.

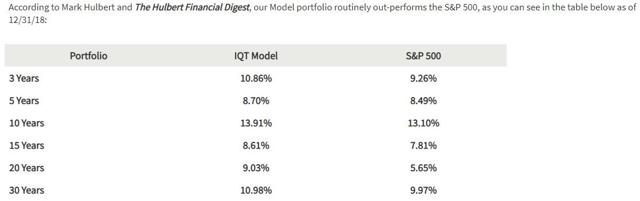

Mais une telle reprise signifie que les rendements futurs pourraient être tirés en avant, en raison des évaluations historiquement élevées qui pèseront sur les rendements futurs. Pour estimer l'ampleur du problème, je me tourne vers ma méthode d'évaluation préférée pour les actions de dividendes de premier ordre, la théorie du rendement des dividendes ou le DYT. C’est la seule stratégie utilisée par Investment Quality Trends, gestionnaire de fortune / éditeur de bulletin, depuis 1966.

(Source: Tendances de la qualité des investissements)

Selon Hulbert Financial Digest, des décennies de rendements exceptionnels (et le meilleur historique de tous les bulletins d'ajustements au cours des trente dernières années, ajusté au risque) confirment cette approche. DYT compare simplement le rendement d'une action à son rendement historique, car à moins que la thèse ne soit brisée, les rendements tendent à fluctuer autour d'un niveau relativement stable se rapprochant de la juste valeur.

| Business | yield | Rendement moyen sur 5 ans | Remise estimée à la juste valeur | Juste valeur historique | Augmentation de la valorisation à long terme |

| Federal Realty Trust | 3.0% | 2.8% | 7% | 145,70 $ | 0,7% |

| W.P. Carey | 5,2% | 6.1% | -14% | 68,15 $ | -1,5% |

| MAGASIN Capital | 4,0% | 4.7% | -15% | 28,30 $ | -1.6% |

(Sources: Dividendes Simply Safe, Théorie du rendement du dividende, Moneychimp)

Les cinq dernières années ont été marquées à la fois par une bulle de FPI et par un marché baissier. Je considère donc le rendement moyen sur cinq ans comme une approximation raisonnable de la juste valeur historique de chaque action.

Aujourd'hui, le FRT se négocie à un prix légèrement inférieur à la juste valeur historique, tandis que WPC et STOR se négocient à environ 15% surévalués. Cela signifie que les investisseurs du FRT peuvent probablement s'attendre à une augmentation modeste du rendement à long terme (0,7%) de 0,7%, mais les actionnaires de WPC et de STOR verront probablement les actions progresser plus lentement que les flux de trésorerie et les dividendes.

En fin de compte, cela signifie que je m'attends à ce que FRT fournisse les meilleurs rendements à long terme, proches de 10% au cours de la prochaine décennie, tandis que WPC et STOR dégageront des rendements totaux bons, mais pas excellents, de 7,5% à 8,5%.

Ce chiffre est légèrement inférieur au rendement historique de 9,1% du marché, mais il devrait encore surperformer les rendements totaux du TCAC de 1% à 7% qui ressort du sondage auprès des analystes de Morningstar en 2019, est l'estimation des rendements totaux du TCAC du S & P 500 pour les cinq à dix prochaines années.

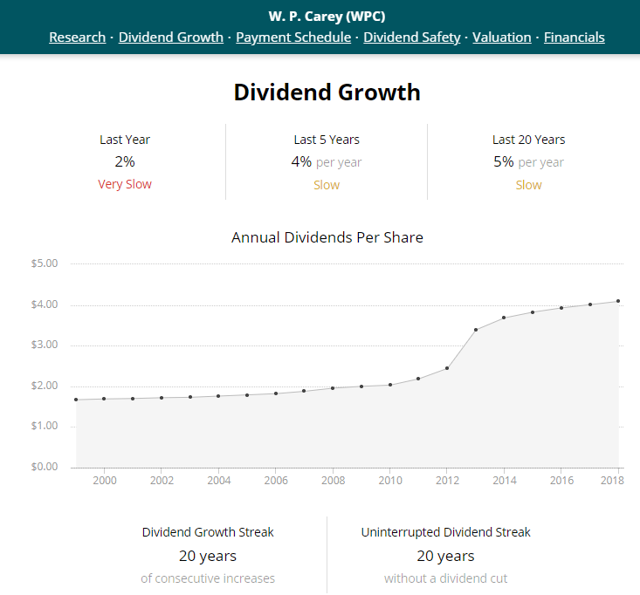

Personnellement, j'utilise l'échelle d'évaluation suivante avec mes recommandations, raison pour laquelle je considère Federal Realty comme un "achat", mais WPC et STOR comme un "investissement" pour le moment.

Buying today may not necessarily lead to horrible returns in the future, but given there are so many great undervalued dividend growth stocks worth buying right now, I personally don't recommend overpaying for WPC and STOR, even though I consider them top quality REITs worth owning in most diversified dividend portfolios. Of course, that's assuming you're comfortable with their risk profiles.

Risks To Consider

Let me be very clear that when I say a stock is a "blue-chip" or "SWAN" I don't mean it can't be hammered hard by short-term price volatility. I only mean the dividend is likely safe throughout the economic cycle, including during recessions.

All stocks are "risk-assets" that can face certain challenges that current and potential investors need to be aware of.

In the case of STORE Capital, there are two things to keep in mind. The first is that the industry-leading investment spreads are a result of management focusing on lower and middle market tenants, which is what allows cap rates on new properties to be so high.

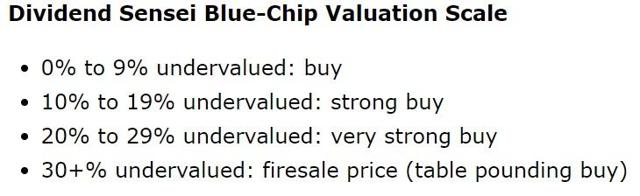

While management's track record on managing past REITs is impressive and shows incredible discipline in terms of risk management and underwriting deals, STORE Capital's estimate of 72% investment grade customers is based on a proprietary model of management's own design.

(Source: STOR investor presentation)

The reality is that most of its tenants are too small to have credit rating agencies (who charge up to $500,000 per year for that service). Thus management is using individual tenant financial data to estimate what it thinks each customer would be rated if they paid for it.

As you can see above, Moody's also has a quantitative model for credit risk, which can be applied to non-rated companies. This model ranks STORE's tenants as lower quality than management. That's not to imply that STORE's tenant profile is high risk, or unsafe. The median tenant rental coverage ratio is indeed safe, and highly stable over time.

That being said, STORE is renting mostly to smaller companies, including nearly 20% of rent being from restaurants. In a recession its median rental coverage ratio is going to suffer, though likely not fall low enough to threaten the safety of the dividend.

STORE's own credit rating, at BBB stable, is firmly investment grade, and its payout ratio is the lowest in the industry. That supports the idea that the dividend will likely remain safe during any future recession. But at the same time, STORE is the newest one of these three REITs and we don't yet have confirmation of its dividend's recession-resistant nature during a downturn (the reason it's a 4/5 dividend safety score and not a 5).

Another thing to keep in mind with STORE is that analyst expect 5% to 6% long-term FFO/share growth, which I consider a reasonable estimate given the REIT's acquisition pipeline and access to low-cost growth capital. However, that's a slower growth rate than in the past, when STORE was growing off a smaller property base.

80% of the acquisitions are sourced from management's B2B industry connections, which should allow for steady growth rates along those lines for many years. However, STORE isn't likely to be able to replicate its previous industry-leading growth rates, so investors need to have realistic expectations and avoid overpaying by chasing this red hot REIT at current prices.

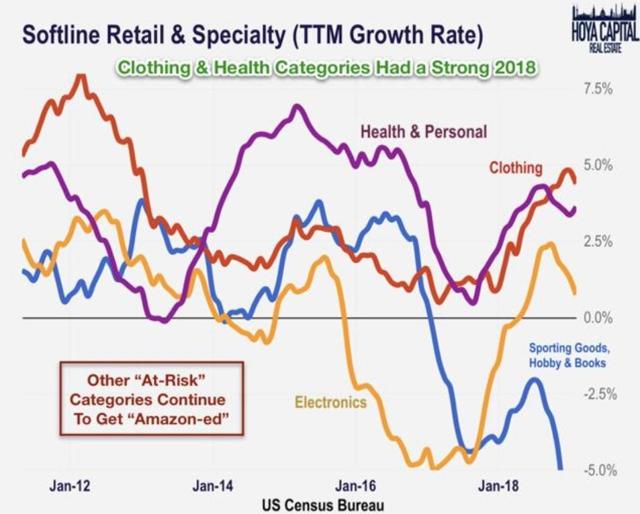

In terms of Federal Realty's risks, there are again two main things to consider. The first is that about 35% of rent is from e-commerce sensitive tenants, such as apparel and electronics companies.

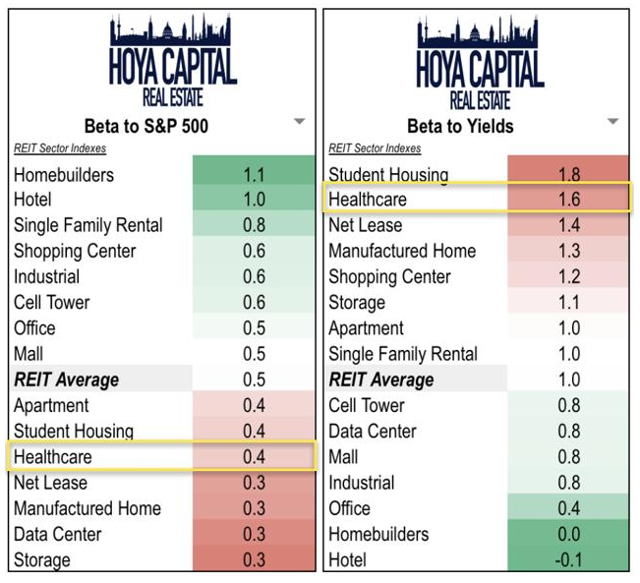

(Source: Hoya Capital Real Estate)

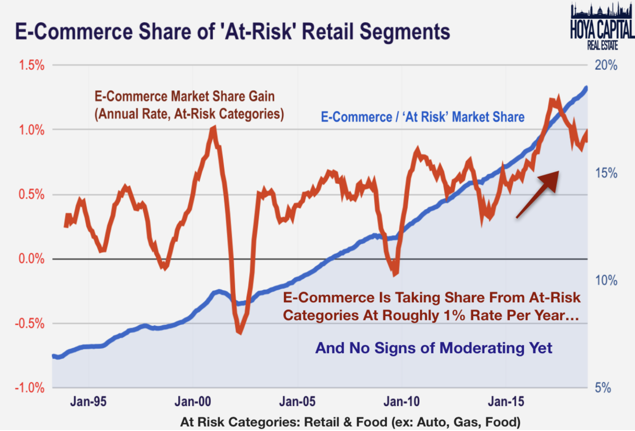

While apparel sales rebounded nicely in 2018, electronics have recently once more been under pressure. That's likely to continue because certain e-commerce sensitive industries have been consistently losing market share to online sales, a trend that's not likely to reverse soon, if ever.

(Source: Hoya Capital Real Estate)

The good news is that Federal Realty's premier locations mean that it can likely adapt to any short-term tenant issues, as its management team has always done.

However, it's important to remember that, while the REITs' long-term growth rate is remarkably consistent, in any given year cash flow per share growth can be lumpy and volatile. For example, for 2019 management's mid-range guidance is for just 2.4% FFO/share growth, a far cry from the 8.5% it achieved in 2018.

Remember that Federal Realty's biggest growth potential is from redevelopment projects. The completion schedule of these is variable from year to year, and that means that investors shouldn't expect the kind of steadier growth that triple-net lease REITs often generate (due to smaller and more frequent property acquisitions).

And while the REIT's exposure to any individual e-commerce sensitive retailer is relatively small (3% or less) given the naturally slow-growing nature of this business, any short-term tenant issues could have significant negative results on growth rates and the share price.

W.P. Carey's exposure to international properties is both a blessing and a curse. On one hand, access to global property markets means that the REIT's growth runway is the largest in the industry. And management's 20+ year track record of investing in overseas NNN properties means that investors can rest easy that management is probably putting their money to work effectively.

However, 35% of revenue from Europe also means that WPC has the most currency risk of any triple-net lease REIT (or pretty much any US REIT). Management does hedge its currency exposure but eventually, those hedges runoff. If Europe's economy continues to weaken (and the UK especially due to Brexit uncertainty), then eventually W.P's growth rates might take a hit in the medium-term.

Currency fluctuation (typically well under 1% of sales) tends to cancel out in the long-term, but in the short-term, even a modest decrease in growth due to currency translation can have a significant impact for a REIT that historically grows at just 4% per year.

(Source: Simply Safe Dividends)

And while W.P. Carey's dividend growth is impressive in terms of reliability, the growth rate is also variable, with most years seeing token 2% growth. The REIT's buyouts of its private funds are generally stock-based deals and the amount of accretion to FFO/share depends on the share price being high enough. Those are typically what leads to sharp spikes in dividend growth which likely won't occur beyond 2023.

Today the high share price would make such a roll-up more accretive than the 2018 CPA 17 buyout, which didn't result in dividend growth acceleration such as in 2013. But given that management is wisely focused on steadily improving the REIT's balance sheet over time, investors might have to settle for roughly 2% dividend growth for the next few years.

One final risk to consider is that REITs have been hot in 2019 due to long-term interest rates falling as economic growth expectations cool.

(Source: Hoya Capital Management)

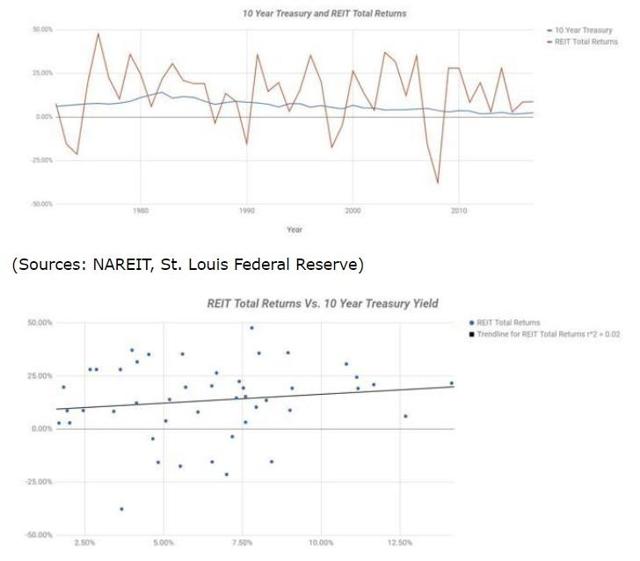

As you can see, while REITs tend to be a low volatility sector (half as volatile as S&P 500 in recent months), they can be sensitive to long-term interest rates in the short-term. Triple-net lease REITs like WPC and STOR, and shopping center REITs like FRT, have above average short-term rate sensitivity due to the long-term nature of their leases (higher inflation risk).

The good news is that over the long-term there is virtually no correlation between REIT total returns and 10-year yields. The bad news is that you may not personally have time to wait out a period of high rate sensitivity that causes a sector-wide bear market (like mid-2016 to early 2018).

This brings up the vital concept of proper asset allocation and the fact that, despite what many investors might believe, no REIT is a true bond alternative.

REITs are a great asset to own, especially high-quality ones like FRT, WPC, and STOR. But REITs are still equities and tend to fall during a recession/bear market (just typically less than the S&P 500). In contrast cash (t-bills) and bonds tend to remain stable or appreciate in value, due to falling rates and a flight to safety.

If you're someone who will need to sell stocks every year to pay the bills (like a retiree living on the 4% rule), replacing bonds/cash with REITs (or any dividend stock), can lead to disaster. Asset allocation, the mix of cash/stocks/bonds you own, is vital to achieving your long-term financial goals.

The purpose of cash and bonds is to own income producing assets you can sell at a stable or higher price should we hit another bear market, rather than quality blue-chip REITs which are likely to fall, especially from today's historically high valuations.

Remember that all of my dividend stock recommendations are purely meant for the equity portion of your portfolio. WPC, STOR, and FRT are great dividend stocks to own, but NOT meant to be a replacement for the cash/bond mix that's best suited to your time horizon/risk profile.

Bottom Line: FRT, WPC and STOR Are 3 REITs You Can Trust For Safe And Growing Dividends

There are few things I love more than top quality REITs, of which Federal Realty, W.P. Carey, and STORE Capital are three of my favorites. Each one benefits from a skilled and proven management team, which has proven itself conservative, disciplined, and effective capital allocators of shareholder money.

That's why all three have delivered great long-term total returns, above that of their peers and the market as a whole. And thanks to the fact that REITs are a sector where proven winners tend to keep on winning, I expect all three SWAN level quality REITs to continue delivering generous, safe and steadily rising income for the foreseeable future.

Just remember that valuation always matters. REITs are a naturally slow growing sector, where 4% to 6% long-term cash flow is the norm. That's why you want to be as disciplined as these management teams and avoid adding or initiating a position when the yield is below its historical norm (overvalued).

Today Federal Realty is the only one of these REITs trading at a level I can recommend buying. W.P. Carey and STORE Capital are about 15% overvalued, which means they are great watchlist stocks, but not necessarily good buys today.

That's especially true given that REITs, while a low volatility sector, are also economically sensitive. While near-term recession risks remain below 50%, the chances of an economic downturn and bear market beginning in the next 12 months have risen to its highest level in about a decade.

This means that it's more important than ever to focus the stock portion of your portfolio on top-quality blue-chips trading at attractive valuations. And never forget that no dividend stock is a true bond alternative and that proper asset allocation is essential to creating a truly recession-proof retirement portfolio. One that can help you sleep well at night, no matter what the economy or stock market is doing.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link