[ad_1]

Perhaps the biggest surprise result of the settlement between Qualcomm (QCOM) and Apple (AAPL) was the sudden exit of the 5G modem business by Intel (INTC). The failure in the smartphone modem market is another example of Intel 's failure in a period of questionable leadership decisions and the weak signal of a $ 15 billion buyout . Stock prices are bursts here, but investors should be more discreet in the pursuit of this rally.

Source of the image: Intel Web site

5G failure

Due to ongoing lawsuits with Qualcomm over royalty rates on patented wireless technology, Apple has desperately sought to replace the modems used in its iPhones. The company has decided to partially use Intel modems in 2017 with the release of iPhone 7 and 7+.

In these cases, Intel was developing 4G modems based on old technology at that time. As emphasized by ZDnet, the market was not impressed by the modems because of reliability and signal strength issues. The move to 5G this year only worsened the number of problems that arose and the question of whether Intel would have a viable chip ready for an iPhone 5G in 2020.

ZDnet thinks that some of the recent patent losses were problematic with current iPhones connected to 4G LTE networks using Qualcomm technology. Other problems were expected with the 5G carrier networks using Qualcomm 5G equipment massively marketed in 2020. These networks would be fully optimized for Qualcomm Snapdragon baseband chips and not for chip chips. Intel that might not even be ready for use. 2020 smartphones.

The problem for Intel is that Qualcomm is the one that develops the standards of wireless technology, leaving the chip giant in a lower technological position. So much so that Intel has decided to completely withdraw from the 5G smartphone modems market via this statement in its press release just hours after the announced settlement.

The company will continue to meet current customer commitments for its existing 4G smartphone modem product line, but does not plan to launch 5G modem products in the smartphone space, including those originally planned for 2020 .

This raises many questions about how Intel will compete for all connected devices requiring modems. From smartwatches to IoT devices, most products will want to be able to connect to 5G mobile networks. The company made this vague statement about the market beyond smartphones.

… perform an assessment of the possibilities offered by 4G and 5G modems on personal computers, devices for the Internet of Things and other data-centric devices. Intel will also continue to invest in its 5G network infrastructure business.

Intel literally admitted to having no idea what to do with 5G in society. Remember that the company is already facing extreme pressure from server and desktop chips due to the re-emergence of Advanced micro systems (AMD).

Financial blow

The title has risen 3% on news because Intel is facing a limited financial blow by leaving the 5G smartphone modems sector. Mizuho analyst, Vijay Rakesh, sees the company losing about $ 1 billion in revenue over 20 years and impacts on limited margins with potential cost savings.

The chip giant may be able to redirect some expenses to the data centers where AMD is taking shares. An important problem is the 10 nm flea market, which remains very late.

Saving money does not really place Intel in a better position to think about the fact that not developing 5G modem technology for smartphones still allows the company to focus on other client devices. . Raymond James analyst Chris Caso poses the question that Intel should have known before answering a press release about the bankruptcy of the 5G modem industry.

Although Intel's decision is likely to generate short-term costs, it raises the question of what happens to Intel customers' businesses in the long run because we believe that all Customer peripherals will have a long-term 5G modem.

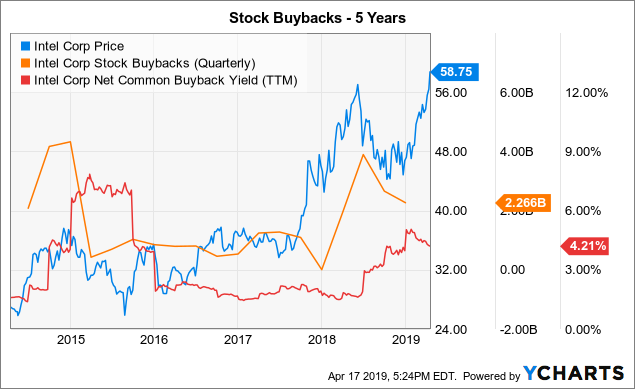

My previous investment thesis was tough on Intel, which had not really decided to buy back its shares when it announced the $ 15 billion plan. While the stock is reaching new heights, Intel has a stock market valuation of about $ 265 billion.

If business is booming with the chip strains that the business was facing in 2018 due to high demand, why not implement a more than 25 billion shares buyout? of dollars? In the last 5 years, Intel seems to have bought only shares at highs and not lows.

Data by YCharts

In the past 12 months, Intel has spent a lot less on the stock buyback than in 2015, when the stock was weak and trading in the bottom $ 30. The suggestion is that the board does not see big result in the short term with the loss of 5G modem activity and the difficulty of switching to 10nm chips.

Analysts believe that EPS gains will be limited by 2020; therefore, even one stock trading at only 12.4 times the estimated $ 4.73 is quite expensive. Intel will only have increased its profits by 3% over a two-year period by reaching these estimates.

To take away

The main benefit for investors is that Intel remains a flea market company in disarray. Failure in the 5G modems sector is not a reason for rushing into the stock.

Disclosure: I am / we are long QCOM, AAPL. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: The information contained in this document is for informational purposes only. Nothing in this article should be considered as a solicitation to buy or sell securities. Before you buy or sell shares, you must do your own research and reach your own conclusions or consult a financial advisor. The investment includes the risks, including the loss of capital.

[ad_2]

Source link