[ad_1]

The Fed and GDP under discussion Points:

- Despite the increase in Amazon's profits and a stronger release of US GDP in the first quarter, the S & P 500 would not turn a record to a real uptrend

- The dollar will be overloaded with event risk over the coming week, including trade and national focal points, but the list at the top of the list is the FOMC decision.

- Crude oil recorded its largest decline in a day since Dec. 24, while President Trump said he was pressuring OPEC once again

Do you trade on fundamental themes or on the risk of an event? See what live events we will cover on DailyFX in the coming week (including euro area GDP, Fed and BOE rate decisions) as well as our series of regular webinars designed to help you refine your trading.

The fundamental primacy passes revenues to economic growth

Much of last week's fundamental attention was focused on event or surprise risk, but the real influence lay in the underlying themes. The earnings season for US companies took off last week. Some of the largest companies have informed investors of their performance, while some groups have inadvertently updated critical systemic themes: trade wars, growth, monetary policy, and so on. The assessment of risk trends by region and asset class shows that US indices continue to outperform most of their major counterparts in liquidity. This trend has continued over the last week as the "rest of the world" segment (I am using VEU) has struggled and emerging market assets have weakened. the S & P 500 and the Nasdaq 100 closed at record highs. There are movements that are in the lead and those that deviate – the first insinuates that the rest of the market will eventually catch up and the last finds the most dramatic collapse as systemic reality comes into play. which is remarkable, is that US equities as an asset class did not climb uniformly last week – the technology sector showed a distinct dynamic, which manifested itself at a very different pace between the Nasdaq and the Dow. Despite this existing advantage, however, the high afternoon figures released by Microsoft (Wednesday night) and Amazon (Thursday night) did not translate into a strong Nasdaq expansion. That said, the key lists for the coming week will struggle to overcome inertia. Google and Apple will be reporting on technology while General Motors, General Electric and Pfizer will be tackling different – but equally small – trends.

Chart of Nasdaq report on S & P 500 and daily variation (daily)

As we look at other systemic drivers over the coming week, we will be looking at the full range of known drivers. Commercial wars are another tide that is still high on the fundamental horizon. Japan's prime minister and finance minister traveled to Europe and North America last week in anticipation of the G20 summit that the country will host at the end of July. Trade was on the agenda, but progress generally seemed symbolic. An interesting note was made to suggest that the talks should not include the currency (Yen), which is ironic given that Japan has already targeted exchange rates and that President Trump has increased the frequency with which he has weighed on the dollar. The sentiment surrounding US-China relations is not clear and the market is therefore lacking in skepticism. and here too, the question of exchange rates is discussed. My real concern in this regard is the Trump Administration's constant threats to European interests – direct and indirect. Monetary policy is another theme to watch. This is not an active catalyst in itself, but a point of acceleration. If the market finds itself in a stalemate that would force the world's largest central banks to fight another financial fire, their ability to avoid crises would be quickly lost. The real impact of monetary policy stems from its consequences on growth, which one more appropriately qualifies as a fear of a stalled global economy or even a pure recession. and simple. US and Chinese GDP figures for the first quarter were beat expectations, but concern for the future seems to have subsided.

US 10-year 3-month US yield curve chart with US recessions in red and SPX in orange (monthly)

The dollar will be loaded by a dense economic calendar

Moving to the new trading week, the dollar remains the "principal" that exerts the greatest fundamental pressure. Whether it's the trade-weighted DXY index, my own equal weighted measure or just the EURUSD key pair; we come to the same conclusion: the bank note got an impressive breakout last week. The closetwo–The peaks of the year alone attract a considerable speculative appetite, but many technical breaks occurred after takeoff. So do not be surprised that the achievements of the dollar at the close of last week are remarkably reluctant. In fact, the reports that the US economy grew by 3.2% On an annual basis throughout the first quarter, which was better forecasted, there was a real slide in the dollar. The headlines are questionable, such as the large contribution of temporary factors (1.7 percentage points from net exports and stocks) and the slowdown in consumer spending with an increase of only 0.8%. That said, I think the market simply can not get more out of the growth theme. Over the coming week, we will harness multiple aspects of the greenback 's role through event risks, such as the Fed' s favorite inflation statistics (deflator 's). ECP), an important update of consumer confidence, an early reading and the monthly NFPs still very popular. The list of the best, however, will be the FOMC's decision on Wednesday rates. The group will not change its actual policy parameters, but the market is listening because it has slowed its growth, mainly due to a decline in the growth forecast. Well, the 1Q GDP figure seems to challenge that reasoning.

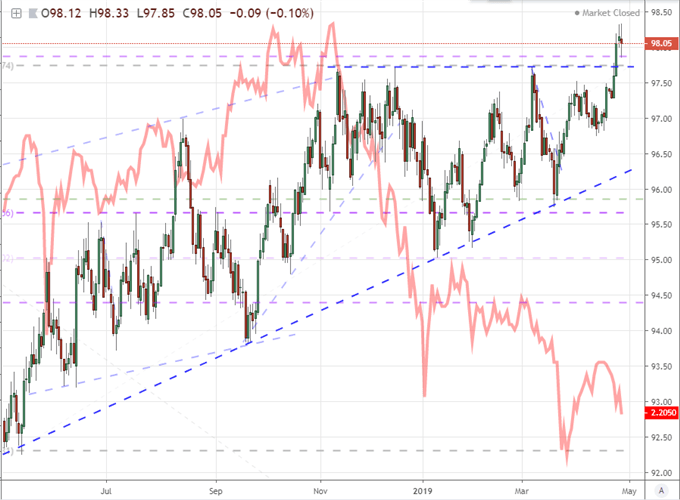

Chart of the DXY Dollar Index and the implied yield of December 2019 Futures Contracts (Daily)

The decision on rates and the update of growth were considered, one of the most productive factors for the dollar was undoubtedly the trouble suffered by the most liquid counterparts of the benchmark. The yen struggled to cope with risk trends because of the appeal of the carry trade that the market is supporting. This was settled last week. The pound sterling is first and foremost drawn into Brexit, but we should not expect serious progress on this theme until the government / parliament has announced some breakthroughs. Let 's not forget that we are entering the super Thursday of the Bank of England (BOE). This update includes a rate decision, Governor Carney Presser and the Quarterly Inflation Report. That said, what the central bank will do will be determined by Brexit, not the reverse. The economic record of the euro will be perhaps one of the most critical fundamental stories in itself – but also an indirect motivator for the dollar -. Until Sunday, Spain will be at the polls and another country will vote on how it intends to be in tune with the European Union. The most likely impact comes from the GDP period in the 1T of the calendar. There are a number of countries that need to update their growth, but I will look closely at the figures of the euro area and Italy.

Beware of the Japanese yen, it is unlikely that oil is active despite its threats

Looking at next week, we will probably derive much of our market's intention from what is specifically intended for the role of the United States or what appears in the headlines of the region. That being said, other systemic issues should be kept in mind in the event that the conditions permit a speculative response. One of the most interesting environmental distortions to come concerns the Japanese markets. The world's third largest economy is expected to be offline all week for the week's gold holidays. However, due to certain circumstances, vacation conditions will extend even further to include the longest drift period we have seen in the country since the Second World War. Normally, traders would assume that this gives them permission to simply ignore the Japanese yen and associated assets because the primary cash market will be absent. However, the volatility from Jan. 3 should serve as a reminder market distortions can lead to unexpected and serious movements. At the beginning of the year, the yen (with the Australian, the Kiwi and a few others) suffered a flash crash that was stimulated largely by low liquidity. We could reasonably run the same risk in the coming week if several probable events would ignite the fire. It must be said that these developments are not easily negotiable because they are unpredictable and their execution unreliable given the thin conditions.

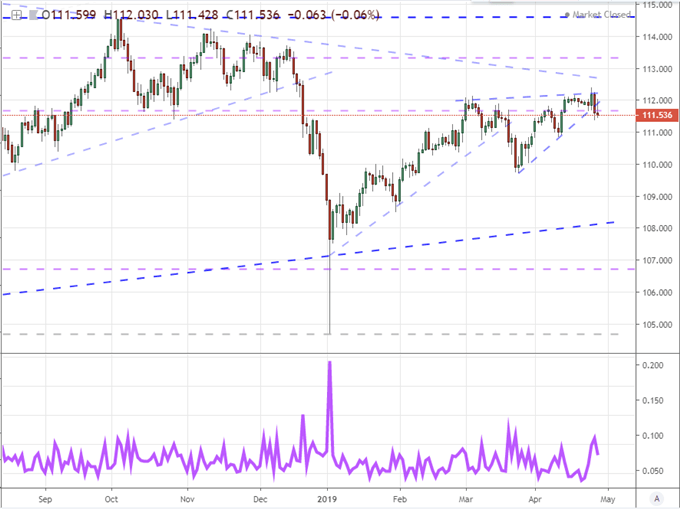

Chart of the USDJPY and the ratio of daily average daily range to one day (daily)

Commodities are another market that will need to be monitored next week. Gold is a class in itself, because the precious metal shows how much investors are upset about risky assets and the instability of the future in the face of the fundamental tensions we face. Last week's rebound should certainly raise some eyebrows given the appetite for risk that we are lacking through benchmarks such as US indices. Yet, my interest in the physical products market is shifting towards products associated with risk trends and growth expectations. There is no more tied asset than crude oil, and it took an obvious plunge last week. The drop below $ 65 has occurred despite the impressive figure of US GDP that has passed the milestones. It's troubling, even though there was a fundamental wind of competition. This type of weather was US President Donald Trump who commented that he had spoken to OPEC members to encourage them to reduce the cost of the raw material so thatt the savings could result in more refined products (gasoline). That said, the president has already deployed these efforts several times and most of the time, they failed the next day. Will it prove something different? This probably has much more today with the contributions of global risk trends and growth than what President Trump is able to affect. We discuss all this and more in this weekend Trading Video.

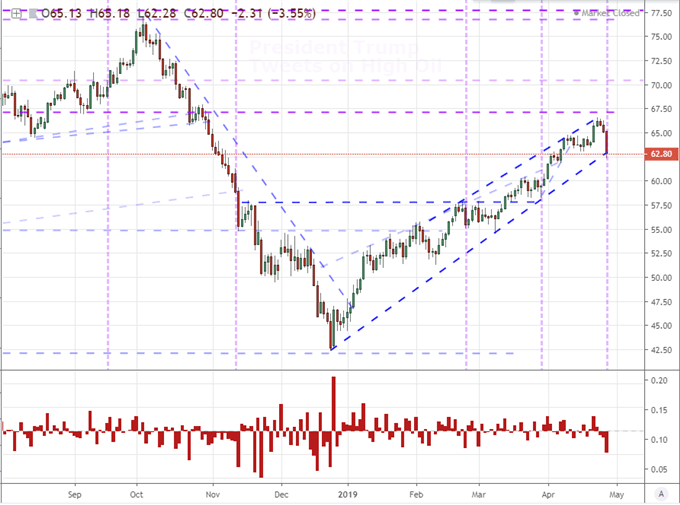

Graph of the US oil exchange rate and the daily (daily) rate

If you want to download my Manic-Crisis calendar, you can find the updated file. right here.

[ad_2]

Source link