[ad_1]

my February 26 The purchase recommendation for Tencent (OTCPK: TCEHY) (OTCPK: TCTZF) is already winning. The stock is now trading well above the February 26 closing price $ 44.02. Yes, China has a stricter approval process for new games. However, I insist that the games of Tencent (as the $ 1.93 billion a year China only Honor of kings) are good enough to continue to drive Tencent's growth in video games worth $ 148 billion a year.

I am now even more optimistic about Tencent. The company's latest mobile game for the Chinese market is poised to become a new multi-billion dollar franchise. Chinese authorities approved Tencent's decision Perfect World Mobile last January. Perfect World Mobile was launched in China on March 6th.

According to SuperData Research, Perfect world immediately became the most profitable mobile game in the world last month. He managed to dethrone the mobile game MOBA (online multiplayer Battle Arena) of Tencent, Honor of kings.

(Source: SuperData)

Why is it important

Ten cents Honor of kings is the most profitable mobile game in the world for two years. Based on its business turnover of $ 1.98 billion in 2018, Honor of the king the average monthly income is $ 160.8 million. I've deduced that Perfect World Mobile probably harvested more than $ 160 million last March to dislodge Honor of the king as No.1.

Of course, this estimate does not go 100% to Tencent. Apple (AAPL), the legitimate owner of the iTunes China App Store, gets a 30% discount on its purchases on iOS. The owner of the intellectual property and developer of Perfect World Mobile, Perfect World Co., Ltd., also receives royalties / shares.

Go from the front, Perfect World Mobile can probably contribute up to $ 100 million per month to Tencent's sales. This can go higher if Tencent publishes an English / International version. Tencent published an English version of Honor of Kings, Arena of Valor. The same thing could happen to Perfect World Mobile.

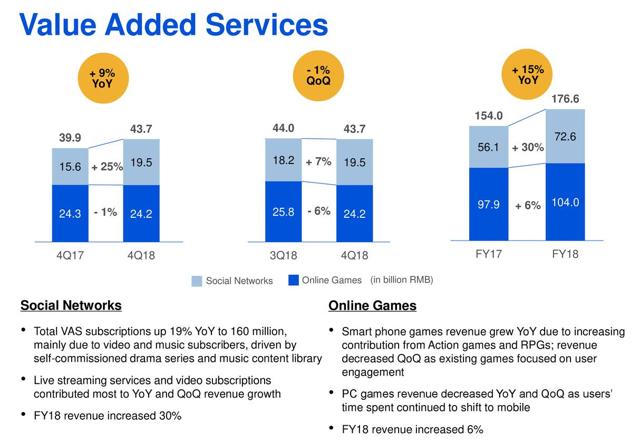

Tencent has partly blamed the slowdown in video games down its largest quarterly earnings in Q4 2018. The massive success Perfect World Mobile could help reverse the -1% drop in revenue from one quarter to the next in online gaming last quarter.

(Source: Tencent)

My turnover of 100 million dollars per month Perfect World Mobile can move the needle of the online games segment of $ 3.59 billion / quarter (24.2 billion RMB) of Tencent. It should appeal to Tencent investors that newcomers Perfect World Mobile now operates the NetEase mobile RPG game (NTES), Fantasy Westward Journey.

Like Perfect Word Mobile, Fantasy Westward Journey is a mobile port of the PC version of NetEase Fantasy Westward Journey. The release of popular PC games Android / iOS ports is a profitable habit for Tencent. Honor of kings was also a mobile touchup of Tencent property League of Legends – the current world number 2 PC games with the highest revenues ($ 1.4 billion in 2018).

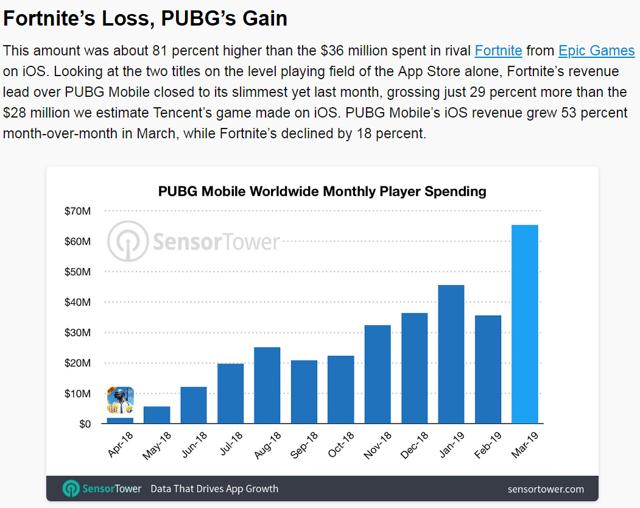

The success of Tencent PUBG Mobile is an Android / iOS port of the hit game Battle Royale on PC Battlefields of PlayerUnknown. According to the March estimates of Sensor Tower, PUBG Mobile Brute $ 65 million last month. This may increase once Chinese regulators have approved the monetization of the Chinese version of PUBG Mobile.

Tencent is also an effective distributor of its PC-inspired mobile games. The graph below shows the tenacious growth of Tencent PUBG Mobile Monthly income.

(Source: Sensor Tower)

My fearless prediction is that PUBG Mobile may become a tailwind of $ 100 million a month for Tencent once Chinese regulators approve the monetization of this transaction inside the Middle Kingdom. PUBG Mobile China the version has been playable since last year, but has not yet been approved for monetization.

No cannibalization

Investors should not worry Perfect World Mobile cannibalize the strong revenue stream of $ 1.93 billion / year from Honor of kings. These games belong to different genres. Perfect World Mobile is of the MMORPG type (massively multiplayer online role-playing game). MMORPG players are different types compared to MOBA players.

Most MMORPG players like leveling solo (or up to 4 or 5 players in a group) and hunt boss monsters for powerful weapons / items. Once they reach a decent level and have excellent gears / weapons, they will join fights based on a guild or a kingdom against other players. Real-time multiplayer fights in MMORPGs typically involve fifty to thousands of players.

The MOBA game usually requires a team of 5 men against another team of five players. They seek to destroy the defensive tower and the large base of each opposing team. MOBA is based on heroes. Players try to acquire (and master) as many heroes as they can to be more effective in 5-on-5 skirmishes.

Tencent has become the king of MOBA PC and mobile games with a 100% stake in League of Legends and Honor of kings. Tencent has also become the king of MMORPG mobile games thanks to Perfect world. Success in more genres of games will help Tencent retain its no. 1 position in video games. This is very important because the video game industry worth $ 148 billion has shown no sign of slowing down.

The continued release of more advanced / powerful smartphones and tablets will force more people to play PC-level games on their mobile devices.

Conclusion

I bet the early financial success of Perfect World Mobile will spur more retail / institutional investors to strengthen their position on Tencent. I hope TCEHY will return to its 54-week high, the highest in 52 weeks. This company did not deserve the shock of last year, sparked by the fear of the more restrictive approval process of the games in China.

Chinese regulators again approve monetization of new games for the local market. Tencent has another promising monetizable mobile MMORPG game called Journey to fairyland 2. This new game can join Perfect World Mobile and PUBG Mobile in the $ 3.59 billion / quarter online games segment of Tencent. My estimate is that Perfect World Mobile and PUBG Mobile this quarterly revenue can increase by $ 600 million.

We should all raise our bets on TCEHY / TCTZF. The forward price / earnings ratio of 5.10 of this stock is significantly lower than the forward price / earnings ratio of NTES of 25.15. This unfair evaluation will not last long. Let's make a purchase before the largest group of investors starts tackling Tencent's current stock market status.

Disclosure: I am / we have been for a long time TCEHY, AAPL, NTES. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link