[ad_1]

The release of Intel's (INTC) first quarter results seemed mixed, with the group slightly exceeding the expectations of the first quarter, while giving a soft focus for the second quarter and also moving away from forecasts for the first quarter. Fiscal year 2019 (all images in this article are taken from the company's earnings report).

Why did Intel give any guidance on the second quarter over what is traditionally a bullish quarter? Why has Intel sharply reduced forecasts for 2019 after exceeding expectations in the first quarter?

A careful look at the numbers suggests that appearances can be misleading and that Q1 time is not what it seems to be..

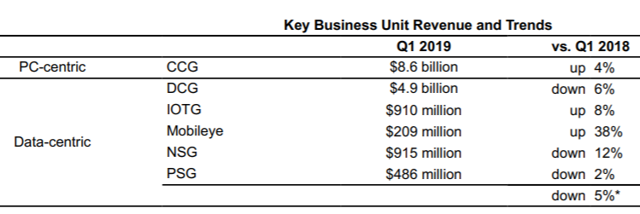

Let's first look at the revenues and trends of the key business units (image below):

Among the major segments, fortunes seem to be somewhat reversed compared to 2018, with the client computing group posting 4% growth, while the previously high growth data center group had growth of -6%. From the outset, we can see that these numbers hurt Intel's growth in recent quarters. The data center segment, the main driver of growth, has now declined for the first time.

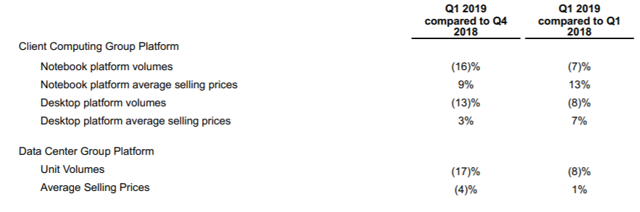

Another breakdown of the performance of these segments shows that as ASPs increase, ASPs in data centers decrease.

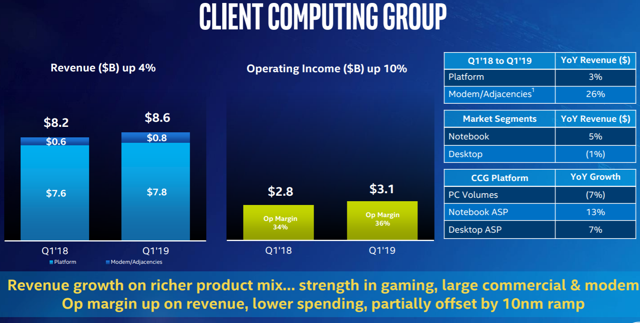

The increases in the ASP client can be explained by the recent shortages of Intel chips. Intel used product shortages to reduce sales of weak ASP components, increasing the total number of ASP components. In addition, the company has also significantly reduced costs to improve operating margins. Therefore, note that a revenue growth of 4% in this sector resulted in a 10% increase in operating profit (image below).

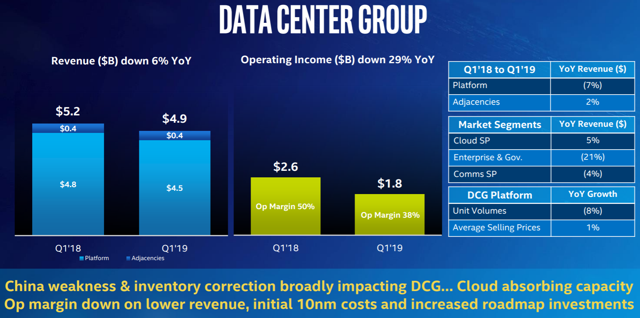

However, in terms of the data center, Intel has seen a decline in the number of ASPs. We think this is due to Intel's market share battles with Advanced Micro Devices (AMD). While the market share of AMD's servers is still within 5% (we will know Q1's share after AMD's announcement), it is clear that the impact of AMD on Intel is disproportionate. Intel not only loses units, but also sees ASP compression. The gross margins of the data center chips being very high, the loss of units and ASP poses gross margin problems. This dynamic results in disproportionate reductions in net margins of the company (picture below)

Note in the image above, the yellow text refers to the weakness of China and the correction of stocks. Management states that Chinese customers bought more than their needs in the third and fourth quarters of last year due to trade war concerns and that stocks had not yet been processed in the system. .. This overshoot and other cloud purchases in 2018 were presented as the main reason for the lower forecast for the T2 as well as the lower forecast for 2019.

While management's comments are accurate, this excess inventory has implications for the entire industry and, as a result, many data center names, including AMD, Micron (MU), and Nvidia (NVDA) have been deleted after the news.. Among these names, Nvidia is more of a concern as it is far more exposed to data centers than AMD, which has barely exceeded the 10% mark in the fourth quarter of 2018.

In this context, let's examine Intel's claims against its financial report.

The first thing that strikes in the balance sheet is the RA (picture below).

It should be noted that the ARs jumped from $ 6,722 to $ 6,957 in one quarter, which corresponds to a 14% sequential decline in revenues. For reference, compare the AR number to Q1 2018 when Intel generated a very similar business figure of about $ 16 billion (image below).

Stunning! From one year to the next, with the same level of revenue, Intel's RAs have gone from 4.88 to 6.96 billion dollars!

Note that Q4 2019 ARs reached record highs and supported management's affirmation of inventory build-up in 2019. But the new increase in Q1 AR does not show the intention of direction to reduce inventories. This indicates that Intel has probably generated revenues of several hundred million dollars, probably about $ 500 million or more in the first quarter. Due to the pull-in, instead of Q1 accounting for about $ 15.5 billion and the second quarter, about $ 16.1 billion, the numbers have reversed.

Essentially, Intel would have missed a lot in the first quarter without the pull-in. It is therefore not surprising that the budget forecasts have been reset to account for AMD's competitive incursions as well as the weakness of the date center market..

Prognosis

When Intel announced the fourth quarter 2019 forecast, we were skeptical about the possibility of getting a 1% growth against the AMD attack and we felt that # It was necessary to expect negative growth. In the space of a quarter, Intel has lowered its previous forecast by 3%. We find that too optimistic. Given the competitive dynamics, it is unlikely that Intel will even produce the revised forecasts for the year. We expect the company to further reduce its guidance for fiscal 2019 after the Q2 or Q3 results.

Our point of view on INTC: Sell

Beyond The Hype subscribers have access to all related articles that may otherwise be inaccessible. For leading-edge information, analysis and investment ideas in the areas of technology, solar power, batteries, autonomous vehicles and other emerging technologies, check out Beyond the Hype. This Marketplace service gives you quick access to my best investment ideas, as well as arbitrage and event opportunities when they are more focused and actionable.

Disclosure: I am / we have been for a long time. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: NVDA runs.

All positions disclosed by the author are part of a diversified portfolio. The author considers that the lack of diversification is one of the most serious mistakes made by many investors.

Short circuit is a sophisticated investment strategy that requires superior investment skills and should be avoided by all investors except experienced investors with appropriate skills and resources.

[ad_2]

Source link