[ad_1]

Last month, Micron Technology (MU) was downgraded by Cowen (target price of 45 USD) and Morgan Stanley (target price of 32 USD), while David Wong, analyst Nomura Instinet, initiated the coverage of Micron with a neutral valuation and a price target of 45 USD.

At the same time, the lack of visibility in the market has also had an impact on MU's actions, due to instinctive reactions to profits or advice from other technology sector or channel companies. 39; supply. For example, UM's Compute and Networking (CNBU) business unit, which includes memory products sold in the data center, customer, graphics, and network markets, accounted for 44% of total revenues. first half of 2019. This was down from 49% in 2018. The mediocre financial results of the Microsoft (MSFT), Xilinx (XLNX) and Intel (INTC) data centers were negative for MU, down 1 , 5% on April 26th. Nvidia (NVDA), which receives 30% of its revenue (excluding memory) generated by the data center, down 4.72%.

I first tried to identify the drivers of demand in an article in Alpha Seeking of February 3, 2019 titled "Micron Technology: Where Are the Drivers of Demand?"

Based on SK Hynix memory provider (OTC: HXSCL) advice and investment spending from cloud server companies for memory, the DRAM slowdown is expected to end on 2H 2019, as planned. I have submitted preliminary data in an April 1, 2019 article, entitled Seeking Alpha, titled "The DRAM and NAND Memory Markets in 2S 2019, Assuming the CEO of Micron Technology is Right". This article tries to develop new evidence that requires engines for DRAM, which gives a turnaround.

Background of DRAM forecasts

At Micron Technology's 2013 First Quarter Results Conference on December 18, 2018, Sanjay Mehrotra, Chief Executive Officer, said:

"Based on our current demand estimates, our DRAM bit shipments for the second quarter of the fiscal year will decrease sequentially, but most importantly, they will likely be stable on an annual basis, consistent with quarterly for the memory sector. and significantly lower than the growth rate of long-term demand. This shows that our customers' inventory adjustments are going well. Unless macroeconomic conditions are weaker, we expect sequential demand growth in DRAM bits during the third quarter of our fiscal year. "

The recovery in the third fiscal quarter (completed in May 2019) from the growth in demand for bits was welcomed by the end of the slowdown in memory. Subsequent calls a month later from Samsung Electronics and SK Hynix also indicated a turnaround at 2H2019.

Prior to Mehrotra's forecast, MU's shares had risen from a high of $ 62.62 on May 29, 2018 to $ 34.11 at the date of the call for results, but almost immediately began to to recover, closing at $ 40.13 on March 20, 2019, just before the T3 Earnings Appeal. That's 17.6% growth over the three-month period.

In its call for 2019 second quarter results of March 20, 2019, Mehrotra's CEO presented an update of its forecast for the growth of DRAM bits, noting:

"Let's move on to the perspectives of our DRAM sector. Since our last call for results, prices for DRAMs have fallen more than expected. The demand outlook for the 2019 calendar has moderated, mainly due to somewhat higher inventory of customers, weaker demand for servers at several OEM and enterprise customers. of the processors shortage worse than expected. We believe that macroeconomic uncertainty also contributes to hesitations in the buying behavior of some customers. However, as we discussed during our last earnings call, we still expect DRAM bit shipments to increase in our third fiscal quarter as demand grows more and more in the second half of the year. 2019, with most customer inventories likely to return to normal by the middle of the year.

Despite the confirmation of a third-quarter fiscal turnaround, the MU's share rose only 4.9%, from $ 40.13 to $ 42.10 on the 26th. April. Given his five weeks only and during that same period,

- S & P 500 rose 4.0%,

- SOXX rose 11.1%,

- Samsung Electronics (OTC: SSNLF) grew by 1.8%,

- SK Hynix increased by 11.5%.

Thus, the recent market performance of MU are in the same range as his peers.

Capex Cloud

I've mentioned above the importance of data centers on integrated circuits, whether it's MU memory chips or NVDA logic chips. I talked about MU and its cloud server activity in an article by Alpha Research on Nov. 15, 2018 titled "How Will Micron Technology Benefit from Demand for Cloud Servers"? I noticed:

- Cloud investments are slowing down, but only after major service providers have spent nearly 50% over the last two years, 62% of which since the beginning of last year in 2018 compared to the first quarter.

- While capital spending in the cloud is expected to slow in 2019, an increased amount of DRAM per server will mitigate the impact of lower Micron Technology revenue.

- The possibilities of Micron technology beyond 2019 are not limited to DRAMs, but also the popular 3D XPoint technology, due to Google's migration to the chip.

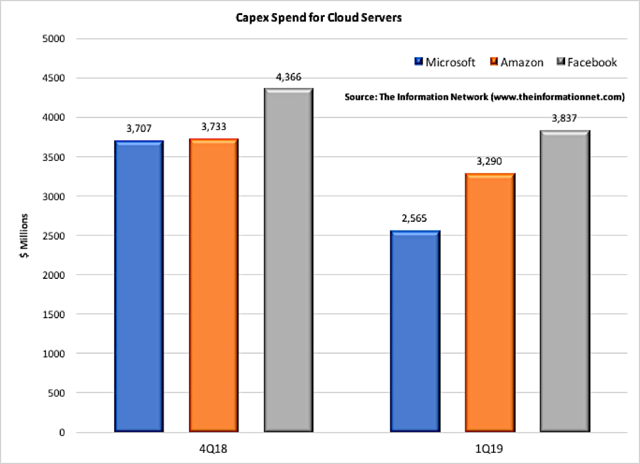

Chart 1 shows the decrease in cloud server investment expenditures for MSFT, Amazon (AMZN) and Facebook (FB) for 4Q2018 and 1Q2019, according to the information network report "Hot ICs: Analysis of the Artificial Intelligence (AI) market, 5G ". , CMOS image sensors and memory chips. "Investment spending for these three companies fell 17.3% quarter-on-quarter.

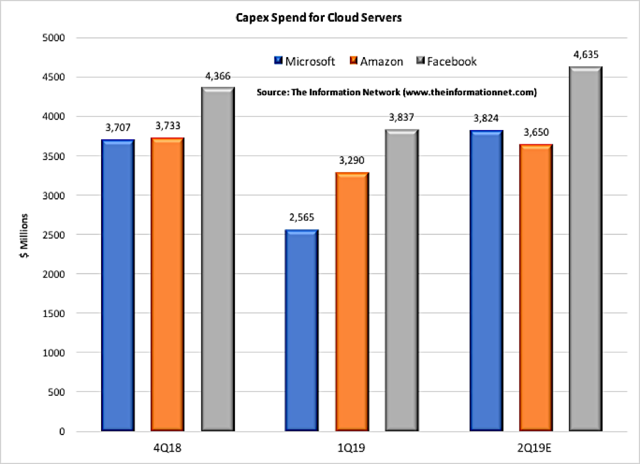

Amy Hood – The Executive Vice President and Chief Financial Officer of Microsoft said during the company's third quarter earnings conference call of 2019, April 24, 2019:

"CapEx, our outlook for the entire year remains unchanged. As a result, we expect a sequential increase in capital expenditures in the fourth quarter as we continue to invest to meet growing customer demand. "

Dave Wehner, chief financial officer of Facebook, said in a conference call on the company's first quarter results of 2019, April 24, 2019:

"On the CapEx guide, it really is a better visibility on how the expenses will be spent. An important component of the construction of the CapEx data center. These are large, complex projects. The timing of these expenses allows us to obtain better visibility throughout the year, but no change in the outlook. We continue to invest heavily in the business. "

The two cloud server companies indicate that investment spending should quickly resume. SK suggested that the demand for chips used by the servers was starting to increase gradually as of 3Q 2019. If the three companies reverted to capex spending that they initially estimated for 2Q 2019, they expected to grow 2.6% from the fourth quarter of 2018 and 24.9% from the second quarter of 2019. This growth may seem ambitious, but the two companies' capital expenditures for the third quarter of 2018 increased by 17%, 5% qoq and 54.4% year-on-year.

Growth of DRAM shipments

According to SKI Hynix's first quarter results report of April 25, 2019:

"The slowing of demand has continued because of the inventory correction and the cautious buying behavior of the server client. The share of DRAM and server SSD revenue has been reduced due to increased ASP erosion of server-related applications. "

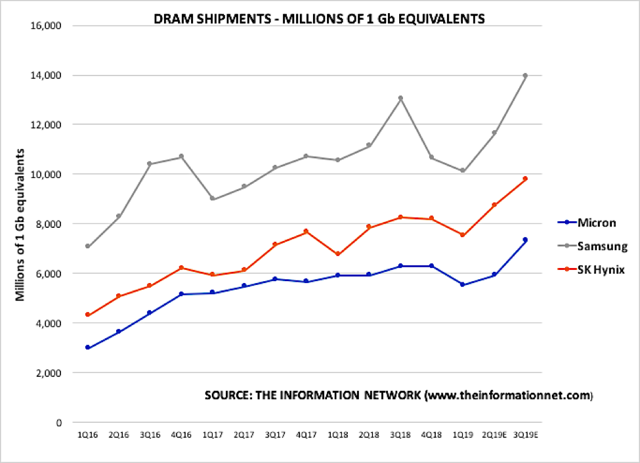

For the first quarter of 2019, SK Hynix reported that DRAM shipments fell 8.0% qoq. According to the company's guidance, we expect DRAM shipments to increase 15% in the second quarter and an additional 20% in the third quarter. DRAM SK Hynix shipments are shown in Figure 3 along with shipments estimated for Samsung Electronics based on its first quarter results and for MU, following its recent call for results.

Investor to take away

New financial data and SK Hynix guidelines, and capital expenditure statements from cloud server vendors, a 2019 2H forecast initially predicted by Micron Technology in its December 2018 earnings call appears to be correct.

Investors and traders must forget the negative financial data from peers and suppliers during this latest wave of calls for results. These are late indicators. In addition, negative indications presented by peers and vendors do not correlate directly with MU and other memory companies. For example, revenue from memory increased by 61.5% in 2017, compared to 11.7% for Logic's revenues. Memory increased by 27.4% in 2018, compared to 6.9% for Logic.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Editor's Note: This article describes one or more securities that are not traded in a major US market. Please be aware of the risks associated with these stocks.

[ad_2]

Source link