[ad_1]

The subject of Boeing's delayed production balance (BA) on the Dreamliner program is extremely interesting. Free cash flow will always be better for evaluating Boeing's overall performance. However, the burn rate of Boeing 787 in deferred production costs and unamortized tooling costs is significant and interesting for two reasons. The first is that if Boeing does not reduce its costs, it could eventually have to account for a charge, although we do not consider this a plausible scenario. Secondly, because if you understand the balance quite well, you can get an idea of the profitability of the aircraft relative to the program's margin. The Boeing 787 is one of the main drivers of Boeing's cash flow profile, so it's great to see how the balance is going. These two factors make the balance carried forward extremely interesting to examine each quarter.

Source: Boeing

Every three months, exclusively on Seeking Alpha, readers receive three articles as part of a regular coverage of the Boeing 787, which is probably one of the most comprehensive covers available for this particular program. An article examines the forecasts from a rather thorough model and the second method, using a simple pattern of trend curve fitting. It should be noted that there is a fairly big difference between the model in depth and the model of the trend line.

In the deep model, assumptions are made about the composition of shipments, products and margins, and these data are processed in a proprietary model, which gives an estimate of the balance carried forward to the next quarter as well as the last quarter. delivery in the accounting block. The trend line model does not go beyond providing an indicator on unit cost improvement based on past performance and only does so for the next quarter. It is very important to understand the difference between the approaches used in both models and their objectives, even if the results provided by the two methods are the same.

Two out of three reports therefore deal with the estimate of the balance carried forward during the following quarter and one even until the last delivery of the block. A third report examines the actual cost evolution and its comparison with the models, and determines whether the cost reduction was satisfactory during the quarter. This report reviews Boeing's actual progress on the program in the first quarter of 2019, how it differs from our developed model, and whether these differences can be explained.

In order to understand the challenge Boeing faces in the Dreamliner program, it is of utmost importance that readers understand the program accounting method and explain why the Boeing 787 costs have risen to unexpected levels.

Boeing 787

Source: Boeing

The Boeing 787 is the aircraft that Boeing launched after rising oil prices and the airline sector that was facing the crisis that followed the attacks of September 11th. The competitor Airbus (OTCPK: EADSF) (OTCPK: EADSY) has bet on the star network by focusing on congestion at airports and launched the Airbus A380.

Boeing relied on the point-to-point network that required smaller aircraft, such as the Boeing 787. The jet manufacturer aimed to reduce costs by 20% over the Boeing 767. This aircraft was revolutionary in almost all aircraft. the meanings of the term. jet maker generated 1,441 orders for its Dreamliner.

The aircraft is delivering on fuel efficiency promises, but development delays have dramatically increased development costs. In fact, the development costs are so high that they are generally considered sunk costs that will never be recovered. A production system, in which Boeing transfers risks to its supply chain, has turned against it as a central part of the supply chain, preventing it from increasing production or delivering products that meet the desired quality standards.

This led Boeing to accumulate deferred costs at a much faster rate and much higher than expected, and recalcitrant problems after service entry did not improve the results of the Dreamliner program.

Even before Boeing delivered a single cell, she had accumulated about $ 10 billion in deferred costs.

Meanwhile, Airbus has developed the Airbus A350, an aircraft that can be considered an alternative to the Boeing 777 and 787. Thus, the marketplace is not reserved for Boeing or the Dreamliner's Boeing.

Program Accounting

Source: www.airlinereporter.com

Boeing uses program accounting for its commercial aircraft programs instead of unit cost accounting. To understand what the costs are, it is important to know how program accounting works. For programs where initial production costs are high, such as aircraft programs, it makes sense to amortize costs over a greater number of productions than the few initial productions. In other words, the costs are spread over an accounting block and it is not only the costs that are distributed, but also the revenues. For the Boeing 787 program, the accounting block currently stands at 1,600 units, compared with 1,500, 1,400, 1,300 and 1,100 previously.

Boeing indicates that accounting block units are units for which it can credibly estimate costs and revenues but should not be considered as an indication of a break-even point. Unless the company has defined an average program spread of 0% – which has not been the case – a zero deferred balance is not a break-even point and should not be considered as such. Analysts pay close attention to the balance carried forward, as do investors. The reason is that it is likely that Boeing must account for a charge if it has not eliminated the deferred costs before the delivery of the 1,600th consignment (the number of units in the quantity taken into account). ) or announced another block extension, which seems more likely.

At the same time, be aware that if Boeing recovers its deferred balance by the 1,600th delivery, it will have realized the profits it had estimated for the accounting block and the benefits it had declared for the program. Thus, the accounting block of 1,600 units is far from profitable. Even if Boeing does not reset the balance on the last delivery and must recognize a charge, it may still have recorded a profit if the expense noted is less than the realized program profit.

The cost and revenue assumption means that Boeing assumes an average profit for each aircraft currently delivered. If the actual profit is less than the expected profit, the deferred balance increases. If the profit is greater than the expected profit, the deferred balance decreases. Thus, the balance reported tells you how much the program has been profitable to date compared to the program's supposed benefits.

Deferred balance of the Boeing 787

According to Boeing data, the balance carried forward from the Dreamliner program reached $ 28.65 billion in the second quarter of 2016 and our data shows that this occurred at the 431st delivery. On average, for the first 431 deliveries, each delivery was about $ 66.5 million less profitable than the average expected profit of the book block.

In the second quarter of 2016, Boeing removed two tested devices from the accounting block and reclassified them as research and development costs. As a result, the balance carried forward decreased by approximately $ 1 billion. According to an email exchange with Boeing spokesman, Doug Alder, we understood that the removal of the test plane from the book block had resulted in a slight rise in the assumed average profit. underlying per cell, while the production costs of these aircraft were completely removed from the deferred account. balance of production.

The removal of the test device, which is considered inappropriate for placement at the customer's premises, is a welcome risk. However, to have a clear idea of the progress made in zeroing deferred costs, which is the obvious target for Boeing here, it is necessary to correct the removal of the recorded amount from the aircraft. trial.

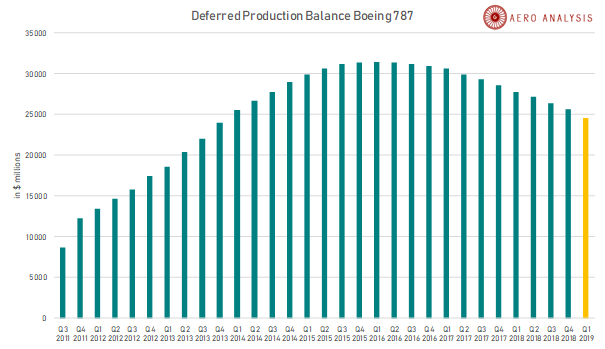

In doing so, we obtain the following graph:

Figure 1: Cumulative Carryover Costs by Quarter (Source: AeroAnalysis International)

Figure 1 shows how the sum of the deferred balance and unamortized tooling and other non-recurring costs has increased over time, but has begun to decline over the past few quarters. Figure 1 already gives a pretty good visualization and one can imagine how the trend would continue in the future. It can be seen that the balance carried forward has decreased significantlye 12th the inconvenientspast quarter and this trend will not be reversed.

The deferred balance after 817 deliveries was $ 24.6 billion, compared with $ 25.6 billion the previous quarter, or $ 30.1 million per cell, compared to $ 32.8 million per cell delivered in the last quarter. This marks an improvement of $ 1.044 billion. To do things more visible, we can plot the differences in the total deferred balance per quarter divided by the number of deliveries.

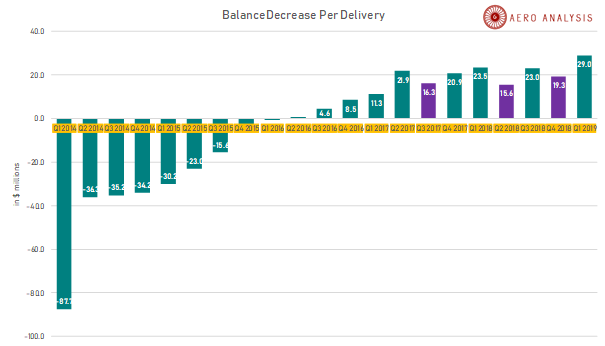

Figure 2: Decrease in Boeing 787 Delayed Balance by Delivery (Source: AeroAnalysis International)

Figure 2 shows that the decrease in the deferred balance per unit decreased from $ 87.7 million per cell in the first quarter of 2014 to $ 29 million in the first quarter of 2019. The decrease in the balance reported per cell is improved by almost $ 10 million per unit, which is the best quarter. recent quarterly improvement. This is partly due to the improved models of improvement of the previous quarter due to an accounting block extension. Nevertheless, the recent improvement is impressive and reflects the cost reduction efforts deployed throughout the chain.

In the third quarter of 2017 and the second quarter of 2018, the improvement in unit cost was offset by Boeing's decision to expand the accounting block by 100 units during the quarter. The result is that Boeing has added 100 highly profitable devices to the accounting block. This translates into an increase in the average profit per plane in the block and means that the gap between the average profit and the profit made has widened in previous deliveries. The same thing happened in Q4 2018.

After the block expands in the third quarter of 2017, we asked Boeing to provide specific numbers, as was the case when the company removed the aircraft from the accounting block, but a spokesman for Boeing said refused to provide further clarification on this case, which is of course disappointing the importance of the Dreamliner program for Boeing's future earnings as well as its free cash flow profile. Keeping in mind that the benefits achieved per unit Dreamliner are the decrease per unit plus a margin of the program, which has been increased twice in one year and which should benefit from more accretive measures over the next quarters, the program Dreamliner seems extremely solid for Boeing. . In fact, the reduction in the first quarter seems so strong that if there is still room for Dreamliner to cut costs, this program will look a lot like the Boeing 777 program a few years ago.

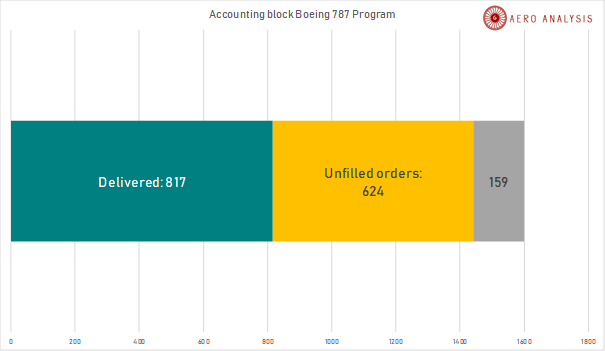

Figure 3: Boeing 787 Accounting Block (Source: AeroAnalysis)

Boeing has defined an accounting block of 1,600 units. It took the company 393 deliveries to put an end to the increase in the balance carried forward. In the quarter following this peak, the company reclassified the costs incurred for the first tests, which were subsequently deemed unmarketable. This led to a lower deferred balance. If we add those fees or deduct them over the range, which is better, the actual peak was 431 deliveries with a deferred balance of $ 25.498 billion. Boeing has 783 units left to recover the balance of $ 24.6 billion. All units already sold do not fall under the accounting quantity, but for the sake of simplicity, we can say that Boeing will still need 159 sales to reach 1,600 devices, which corresponds to the size of the accounting quantity. Boeing has sold more than 1,400 Dreamliners, exceeding 1,300 units originally included in the accounting block, which is important given rumors that Boeing has extended the block that Boeing would never sell as many aircraft. They do it now. Market demand is strong to support more than 1,600 deliveries of Dreamliner. This is important to keep in mind. Orders can be canceled, but people who say Boeing would not even sell 1,100 units are wrong.

Currently, it appears that each time the remaining units in the block fall below 100 units, the block is expanded.

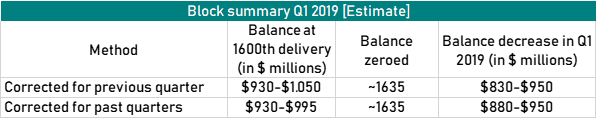

With 783 still to be delivered, Boeing needs to recover $ 31.4 million per cell on average, in addition to the average program margin, to fully eliminate the balance. With Boeing currently generating profits in excess of $ 29.0 million per cell, the path to zeroing the deferred balance is within reach. The Boeing 787 family price tag is between $ 115 million and $ 155 million, which means that Boeing will need profit margins above 20 percent above the assumed average margins for the balance to be totally nil. With Boeing's Boeing 777, Boeing's best-selling widebody jumbo, operating in an almost unmatched market, at 25% margins, Boeing's task seems to have become easier to manage after the launch. implement three block extensions of 100 units each time. 300 units in total since 2017. Beyond 1,600 to 1,700 aircraft, the balance should be reduced to zero and Boeing will continue to extend the blockage according to its usual practice, but investors and analysts will remain silent on these extensions "business" as usual "and Boeing will not divulge more details on the balance.

Performance vs. Quarter Expectations

Each quarter, AeroAnalysis provides some projections and these are very interesting to do, but it is important to check if they are close to the actual performance. Using the quadratic improvement trend for the decrease in the balance carried forward by delivery, AeroAnalysis the decrease is expected to be between $ 18.5 and $ 21.5 million. It is interesting to note that a few quarters ago, the improvement in unit costs began to flatten out and this trend began to become quadratic instead of linear. The most recent improvement is exactly between the quadratic and linear trends.

For the detailed model, a decrease of $ 26.5 million was expected. The decrease reported by delivery during the quarter, however, was $ 29 million per cell. The actual reduction of $ 29 million, or $ 1,044 million, exceeded expectations by $ 100 million. This was motivated by a favorable mix, which our model does not understand perfectly, after adjusting our range of deviation a little too tight. Boeing also achieved the rate of 14 aircraft per month in the factory at the end of the first quarter, a few months ahead of schedule and anticipated in the beginning, and the costs of the suppliers were reduced; who took advantage of the performance. The program's cost execution was strong during the quarter and we have seen for some time that things are getting complicated for Boeing. We are not yet fully convinced that the balance will be reduced within the current bloc, but Boeing is certainly making great strides in this area.

Conclusion

The performance of the Dreamliner program in the first quarter seemed extremely strong and bodes well for the rest of the year. It will still take years for the balance to come back to zero, but I even think that beyond the amount of accounting blocks set for the moment, Boeing can achieve hundreds of extra sales with the Dreamliner .

For investors, we see no reason to worry about Dreamliner's long-term challenge of eliminating the balance carried forward. We currently believe that the Dreamliner is a good addition to Boeing's free cash flow and we expect the Dreamliner program to be a major accelerator for the future.

We believe that Boeing is getting closer to the stage where its actual profits are approaching maturity. In the future, the combination of orders and deliveries and lower supplier prices should provide the next increase in margins.

What is important to note is that as long as the balance is not reduced to zero, block extensions are considered by some investors as a bad thing. In part, we can understand this because it seems to suggest that profit growth is progressing more slowly. On the other hand, block extensions are executed as the number of planned sales increases. Boeing is starting to sell more and more slot machines in the accounting amount. And as the number of "unordered" units in the total block decreases, Boeing will begin to add more sub-blocks. If sales continue to grow and earnings are mature, they could start doing so more regularly, increasing program margins. There is therefore a huge positive impact on this strategy, often underestimated by investors, and we believe that the Boeing 787 will be one of the main generators of cash and profits in the years to come. We expect that if Boeing maintains sales momentum for the Boeing 787, block extensions could begin to occur regularly.

If you enjoyed reading this article, do not forget to click the "Follow" button at the top of this page (under the article title) to receive updates of my upcoming articles.

If you like our regular coverage, please join The Aerospace Forum, which gives you more detailed tools to understand the industry, access over 750 reports and previously published resources (live chat with the group and face-to-face conversations ) for the aerospace industry. * Start your free trial today *

Disclosure: I am / we are a long time BA, EADSF. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link