[ad_1]

The management team of Western Oil (OXY) has taken a big step forward in order to fly Chevron (CLC) a significant opportunity. In an announcement made, Occidental announced to the world its bid for acquisition Anadarko Petroleum (APC) at a price significantly higher than the conditions agreed by Anadarko and published by Chevron. Based on the data provided, this transaction more accurately reflects the fair value of Anadarko than Chevron's, even though it is still at the bottom of what should probably happen. At a minimum, this offers investors Anadarko an opportunity, perhaps, to generate an additional hike and trigger an auction war for the oil and gas company.

A look at the offer

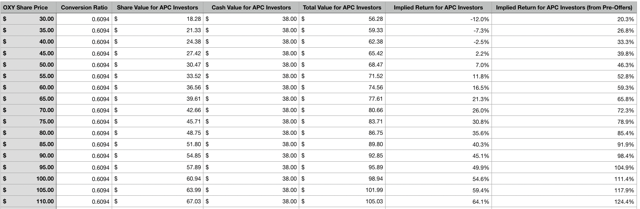

In its press release relating to the offer, Occidental said the company would be willing to buy all of Anadarko as part of a deal valued at $ 76 per share. If agreed, Anadarko's investors would receive $ 38 per share in cash, in addition to 0.6094 Occidental common stock for each share held by them. In total, according to Occidental, the equity in Anadarko is valued at 38 billion USD. In addition, if you add a net debt, the EV value (business value) of the transaction would rise to 57 billion USD. This includes the company's share of the debt of Western intermediary partners (WES) and its non-controlling interests.

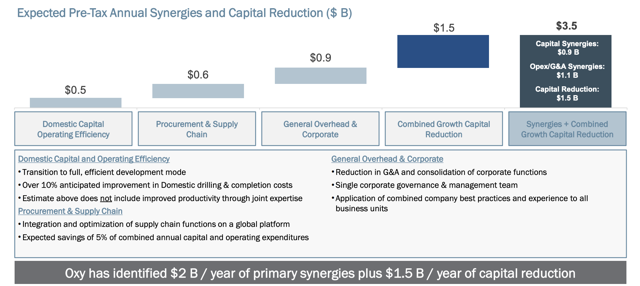

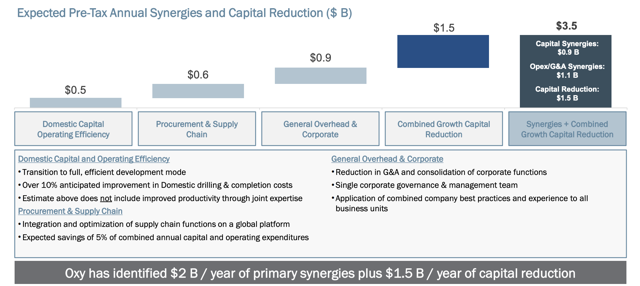

At the end of the transaction, which would see Occidental issue about 309 million additional units, Anadarko's shareholders would own 29% of the merged company, the current shareholders of Occidental holding the rest of the company. Occidental's management team believes that if this transaction is completed, significant synergies could be generated. As you can see in the image below, synergies of approximately $ 3.5 billion could be generated, with $ 2 billion in cost savings associated with the company's ongoing operations and the balance of $ 1 billion. $ 5 billion from a reduction in capital expenditures.

* Excerpt from Occidental Petroleum

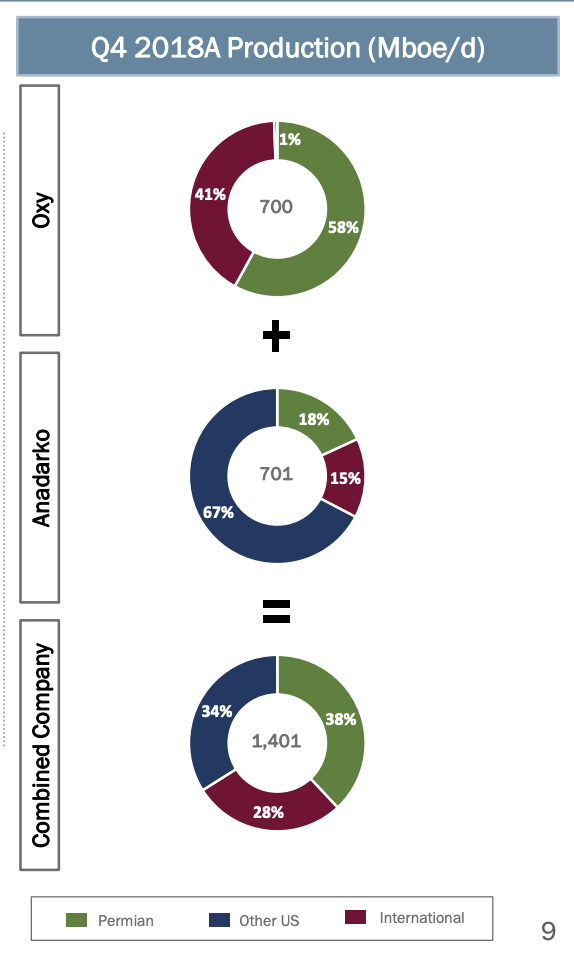

Not only would synergies be on the table, but asset sales over time would be as well. Over the next 12 to 24 months, Occidental intends to dispose of $ 10 billion to $ 15 billion in assets, likely to use this product to repay a portion of the debt incurred to make this transaction work. . It is very difficult to know which assets will be sold, but if you look at the picture below, you may have an idea.

* Excerpt from Occidental Petroleum

In total, Occidental generates about 41% of its production today internationally. Anadarko receives only 15% of its production from abroad. Anadarko produces 67% of the total production of the Permian and, as we have seen this year, large companies such as Exxon Mobil (XOM) and Chevron, the Permian is more desirable than ever. In all likelihood, the sales of assets generated by Occidental would come from abroad, following a similar movement by Murphy Oil Corporation (WALL).

In addition to the synergies that would exist under the agreement, management has forecast that, at a price of $ 60 per barrel for WTI crude oil and $ 3 per Mcf for natural gas, free cash flow generated by the company would increase by 270 million increase in the price of a barrel of oil. With a daily production of 1.4 million barrels (equivalent barrel of oil), of which a significant amount in the form of oil, the impact in a bullish environment is undeniable.

Investors are better with Occidental

Without a doubt, I consider that the contract with Occidental is far superior to the current contract with Chevron. For starters, the transaction represents a premium of $ 11 per share (using pre-market reaction prices to news) versus Chevron's offering. This translates into a premium of 16.9%. In addition, the $ 38 per share Western bid in cash is less than $ 16.25 per cash share offered by Chevron. This means less volatility for the shareholders of Anadarko if the price of its buyer drops. It also gives investors in Anadarko the opportunity to decide more easily whether they want to use that money and invest more in Occidental after the deal or not.

The upper share price offered by Occidental should be considered not only by price, but also by valuation. Forget the synergies and the fact that, as expected, these are far more important in the framework of the agreement with Occidental than the $ 2 billion planned by Chevron for its wedding project with Anadarko. I forget them because management can really say whatever it wants, which may not be fair, and shareholders will have very little recourse if they are not. Let's look at the assessment as it was last year.

According to my calculations, Anadarko's EBITDA was $ 6.97 billion last year, while its operating cash flow was $ 5.93 billion. With a VE of $ 57 billion, the price paid by Occidental equates to an EV / EBITDA multiple of about 8.2. This is certainly within the range of values just for a company like Anadarko, but it is probably too low, with a reading of 9 or even 10, not out of the question. On the basis of market capitalization / operating cash flow, the transaction multiple with Occidental is 6.4, which is quite low.

All in all, I think these ratings are lower than they should probably be, but they are certainly better than what Chevron was willing to pay. His EV / EBITDA multiple was below 7.2, while his multiple market capitalization / cash flow was 5.2. These readings are interesting compared to most energy companies I've seen recently, but the whole industry and its multiples are depressed because of the considerable pessimism of investors.

To take away

Based on the data provided, I must say that I very much like the offer offered by Occidental at the moment. Even if the firm has to pay a termination fee, the deal is attractive and investors must push the management to go where the money is. That said, I believe there could still be interesting potential from this point, not only with the Anadarko stock giving investors an additional 4.3% potential, but also in the form of a counter-offer of Chevron. If he wants Anadarko, he can win against Occidental, but he will have to pay a lot, probably with a multiple EV / EBITDA of 9 or more.

Crude Value Insights offers an investment service and community focused on oil and natural gas. We focus on cash flows and the companies that generate them, generating value and growth prospects with real potential.

Subscribers can use a standard account of more than 50 years, in-depth analyzes of E & P's cash flow and a live discussion of the industry.

Sign up today for your free two week trial and get a new lease on oil and gas!

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link