[ad_1]

What happened

Actions of Lyft (NASDAQ: LYFT)No. 2 in the country, the carpooling service was confronted with the reality in April after the sharp fall of the title following the sharp increase of March 29, the day of its opening. Skepticism about the future of the company has increased because it still loses nearly $ 1 billion a year. Investors also reacted to Uber's filing of its rival for an initial product offering (IPO).

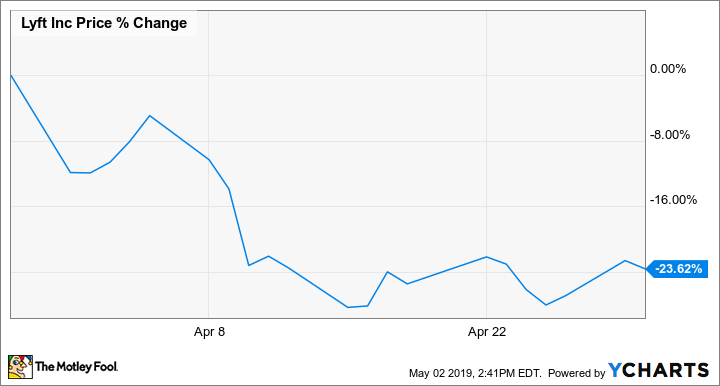

The stock sold 24% in the month, according to data from S & P Global Market Intelligence. As shown in the chart below, stocks fell sharply at the beginning of the month and stayed behind.

LYFT data by YCharts

So what

Lyft's stock dropped rapidly after its IPO on March 29. In fact, on that day, the stock closed down 9% from its opening price and fell 10% on April 1, as investor enthusiasm dissipated and investors Analysts began to cover the title by calling it "neutral," often considered a euphemism for sale.

Source of the image: Lyft.

The stock actually recovered those losses, coming back briefly above its IPO at $ 72 that week, and then collapsed again the following week, after the announcement. April 11 announcement that his rival Uber was about to run for his IPO. Lyft shares lost 11% on April 10 as investors reacted to the IPO. Uber's IPO will not only distract Lyft's attention, it may also prompt some investors to switch their Lyft shares to Uber, the industry leader; it will also give the company billions of dollars more to try to stimulate growth in the United States and around the world.

From there, Lyft's shares hovered around $ 60 for the rest of the month.

Now what

May should be another big month for Lyft as the company releases its first quarter earnings report after market close on May 7, and investors will have to react to Uber's debut on the market, which should take place in the coming months. weeks.

Analysts estimate that Lyft's revenue is $ 740.2 million and expects a loss per share of $ 1.81. With Lyft's first financial results as a public company and Uber ready to begin operations, the volatility of Lyft's shares is expected to continue.

[ad_2]

Source link