[ad_1]

Arista Networks (ANET) posted slightly better than expected results in the first quarter, but forecasts for the next quarter disappointed the market. In the context of the impressive rise in share prices since the beginning of the year, the 14.5% decline in share prices is not that significant.

Despite a disappointing revenue growth forecast, the company is still outperforming many network providers. In this article, I explain why this weak perspective is a temporary event rather than a structural problem.

Despite the fall in share prices, the stock market valuation still offers no margin of safety.

Source of the image: Arista.com

Disappointing tips

Arista delivered slightly better than expected results in the first quarter. Revenues and gross margin in accordance with GAAP of $ 595.4 million and 63.9%, respectively, both exceeded the midpoint of the forecast.

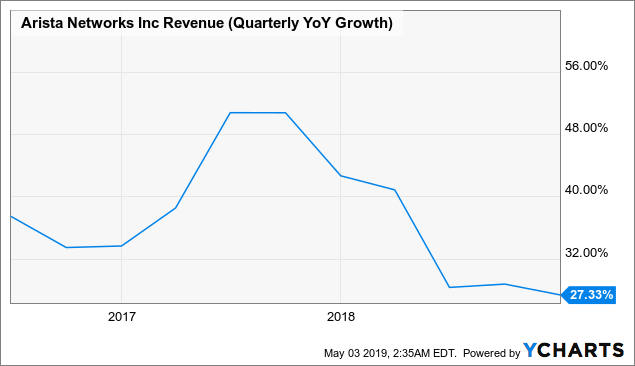

Of course, the weak outlook for the next quarter is due to a 15% drop in stock prices. In recent quarters, the company has grown at over 25%.

Data by YCharts

As society grows, a declining rate of revenue growth is expected. During the previous quarter, management indicated that she was comfortable with a 21% growth rate for 2019.

Thus, the forecast growth rate for the second quarter of 16.3% was disappointing. During the call for results, the management justified the weak forecasts by a slower activity of some cloud titans:

"While 2019 is a good start, we are experiencing a slowdown in the second quarter of 2019. We experienced normal orderly declines in late March and April, so we expect slower growth in the second quarter of 2019. The major reasons that contributed to this situation include the many cloud titan providers completed in 2018 that led to an absorption period in the first half of 2019. In particular, a cloud titan suspended most of the T2 orders 2019. "

The market's reaction was strong with the stock falling by 14.5%. But given the 47.5% increase in the share price since the beginning of the year, the decline is not as important. At $ 265, this still represents a 25.8% increase since the beginning of the year.

In addition, despite disappointing forecasts, management still expects sales to increase 16.3% in the second quarter. In contrast, Extreme Networks (EXTR) and Juniper Networks (JNPR) both experienced year-over-year revenue declines during this quarter. And both network providers expect a drop in revenue for the next quarter. Cisco (CSCO) has not published its results yet. The giant network provider has announced strong revenue growth in recent quarters. But it is safe to assume that Cisco is not forecasting double-digit revenue growth for the next quarter.

The problem with cloud titans is temporary

Beyond the comparison with other network providers, the most important aspect to consider is that the disappointing guidelines are not due to structural problems. Instead, I consider this evolution as normal and temporary volatility.

The strongest segment of Arista is the cloud's titans, and that depends on some big customers. In a previous article, I had talked about Arista's impressive marketing advantage because of its trading relationships with the cloud's titans. But this type of activity, in addition to penalizing gross margins due to the trading power of the cloud giants, involves volatility.

This volatility was favorable when the company generated revenue growth above expectations. For example, after the fourth quarter results, I pointed out in a previous article that Arista's excellent results contrasted with the negative results of other cloud data center vendors. The concentration of customers also means that some quarters will be less favorable.

But the big picture does not change. Cloud titans have invested with Arista to build scalable and integrated cloud data centers. There is no technological change in the data center of the network. Network designs always rest on the elegant and simple principle of the spine. Once the backbone (backbone) is in place, it is easy and inexpensive to expand the network with a switch. In addition, the application of the same existing network design and integrated software reuse provide economies of scale to cloud computing users when building data centers.

No safety margin

In addition to the temporary problems with some of the cloud's titans, management spoke of the flexible business activities with security providers and the encouraging performance of the corporate sector.

Given these moving parts, management still expects its operating margin to be at least 35% and indicates that 21% is a fair tax rate to consider.

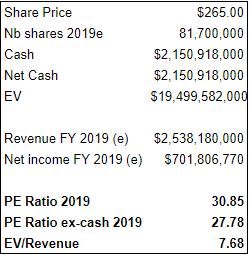

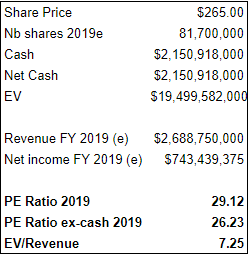

In my previous article, I estimated a growth rate of 25% in 2019. With a growth rate lower than expected in the second quarter, I now imagine that revenue growth will reach 18% in 2019. The table below presents valuation ratios based on these assumptions:

Source: Author

Even with a 14.5% drop in the stock price and based on the estimated results for 2019, the market still values the company at a near-27.8x PE ratio and an EV ratio / business figure of 7.6x.

Assuming revenue growth of 25% in 2019, the market is still valuing the company at a PE ratio of 26.2 times, excluding cash.

Growth rate, high margins and strong activity justify high ratios. But at the current assessment, I do not see a margin of safety.

Conclusion

The weak forecast for the next quarter eclipsed the good results of the first quarter. The long-term potential of Arista does not change, however. Volatility of results is a natural consequence of managing a limited number of large customers such as cloud titans. Network technology has not changed and cloud giants have invested with Arista to implement integrated and scalable architectures.

The good results justify the high valuation ratios. However, even with the 14.5% drop in stock prices, the stock market valuation offers no margin of safety.

NoteIf you enjoyed this article and would like to receive updates on my latest searches, click on "To follow"next to my name at the top of this article.

Disclosure: I am / we are long CSCO. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link