[ad_1]

Despite the strong recovery of the majority of software stocks this year, investors have left names in the shadows, including Dropbox (DBX), the famous cloud file storage company that was released last year at $ 21 per share. Today, more than a year later, the company is trading just 10% higher than its initial IPO price, as it is still plagued by sluggish preoccupations and concerns. competition issues. Faced with such a negative noise within the company, Dropbox has also become one of the best value offerings in the SaaS sector:

Dropbox just released its first quarter results, which offer an upbeat update of all of last month's investor metrics that were causing concern. Growth rates were virtually unchanged from the fourth quarter, driven by an increase in the number of new users and the continued expansion of the ARPU. In addition, the Company has achieved operating margins well above those originally indicated.

Points of evaluation at a purchase

Before analyzing the latest results of Dropbox, let's quickly see the company's assessment. Since the last quarter, Dropbox shares have continued to oscillate around the $ 23 mark, despite the company's progress, particularly in terms of profitability. At current stock price, just above 23 USD, Dropbox market capitalization of $ 9.90 billion. After deducting $ 915.2 million of cash and $ 70.7 million of debt, we come to a business value of 9.05 billion dollars.

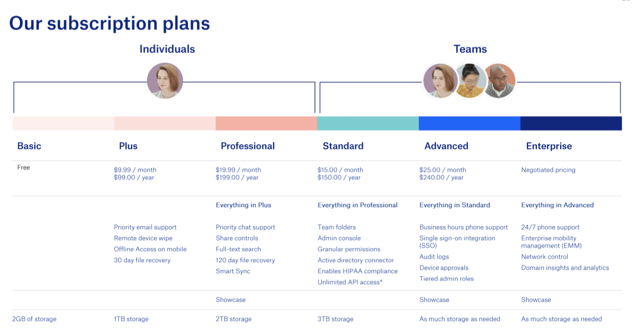

Here's how it compares to the latest update of the company's instructions:

Figure 1. Dropbox Guidance

Source: Dropbox Investor Supplement

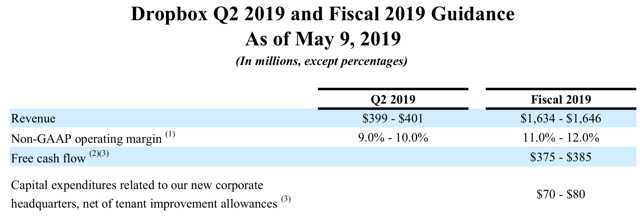

In the middle of the fiscal year 19 income range of $ 1.63 to $ 1.65 billion (18% year-over-year growth from $ 1.39 billion in fiscal 18), Dropbox is currently trading at 5.5 times EV / FY19 incomes. This compares quite favorably with other software vendors in the growth range of around 20% y / y, with the exception of Box (BOX), which is growing at a slower pace than Dropbox, although it is half its size and generates much thinner FCF margins:

It should also be noted that Dropbox is trading at 19.7x adjusted FCF EV / FY19, If we adjust the company's forecast under the FCF from $ 375 to $ 385 million, the non-recurring capex of approximately $ 75 million that it should commit to the construction of its new head office in San Francisco.

Overall, both in terms of turnover and FCF, Dropbox shares appear to be significantly undervalued. I would use the weak feeling surrounding the stock as a timely point of entry.

Q1 download

Now let's move on to the first quarter results of Dropbox:

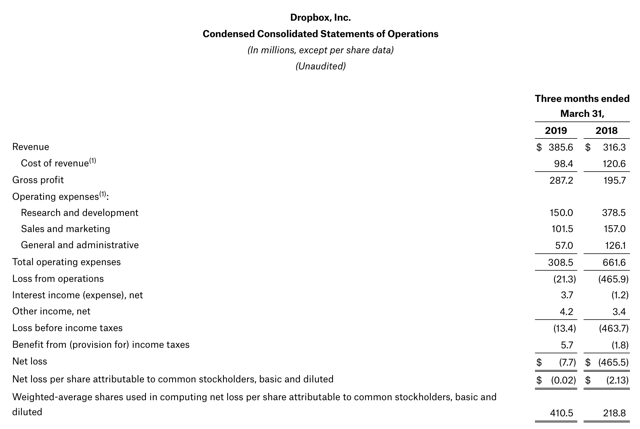

Figure 2. Dropbox Results 1Q19

Source: Dropbox Results Release

Revenues increased 22% year-over-year to $ 385.6 million, exceeding Wall Street's estimate of $ 381.6 million (+ 21% YoY) with a respectable margin of 130 bps. This revenue was driven by an increase in the number of paying users, with an increase of about 15%, to reach 13.2 million, and an increase of 6%, compared to the ARPU, which was $ 121.04.

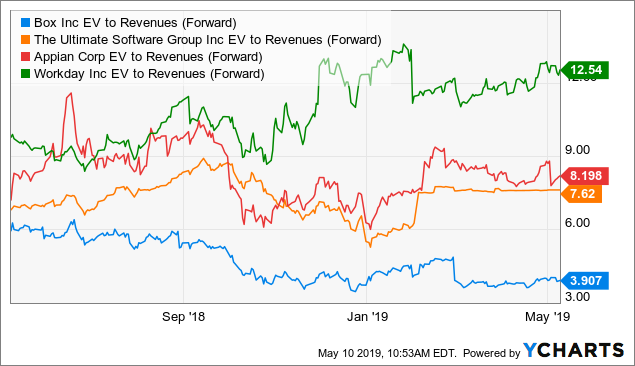

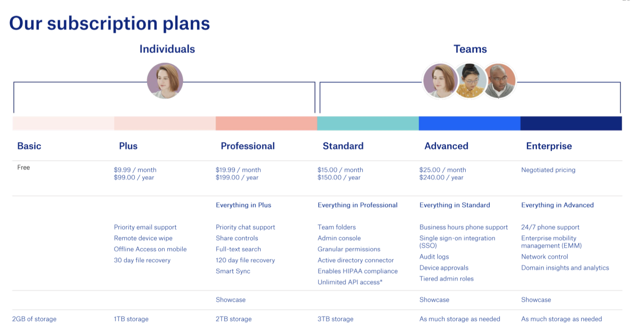

The extension of the ARPU is an important point to consider as it is a stable source of revenue growth for Dropbox in recent quarters. As most people know, Dropbox offers a tiered subscription. Ajay Vashee, chief financial officer of Dropbox, said customers are increasingly opting for higher priced professional and advanced packages:

Figure 3. Dropbox subscription levels

Source: Dropbox results presentation

The company has also done more work on migrating its free "basic" users to a paid level, as noted in Vashee's comments on the first quarter earnings call:

In addition, we've recently introduced a device limit for Dropbox Basic that invites users to upgrade to a paid SKU if they are signed in to more than three devices on their account. The range of operating systems and peripherals we support is one of the key benefits of our platform. We found that users who associate multiple devices to their accounts often used Dropbox for their work. This revision of our device management policy is an opportunity for us to generate value, where we bring value to our users. "

Within its installed enterprise base, Dropbox has also implemented an exclusive machine learning algorithm to identify teams from an installed company that are not yet part of the Dropbox Business Plan. Dropbox can then send sales representatives to these highly targeted teams in order to improve its utilization rates within this customer, in line with its "land and development" strategy.

The growth in the number of users and the use of Dropbox also resulted in improved margins. Pro forma gross margins reached 75.4% this quarter, up 120 basis points from 74.2% in the same quarter of last year, thanks to the efficiency of equipment volumes. infrastructure used by the company to host the cloud storage of its customers.

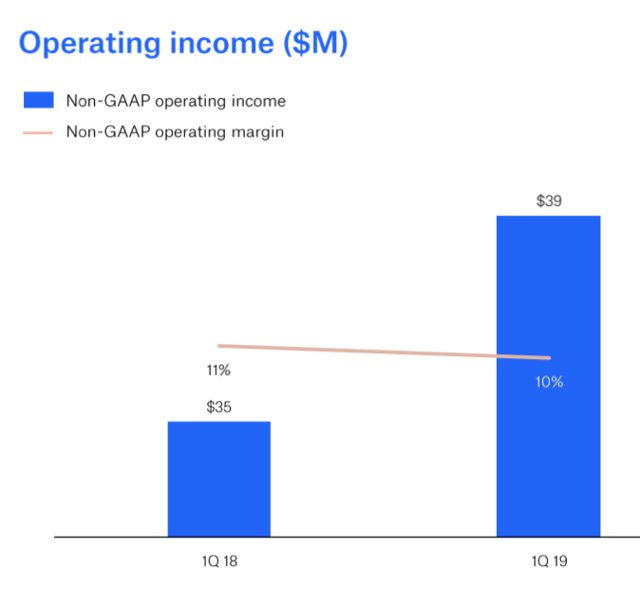

Most encouraging, however, is the fact that Dropbox has managed to achieve a pro forma operating margin of 10% during the quarter, with an operating profit of $ 39 million:

Figure 4. Dropbox operating result

Source: Dropbox results presentation

You will recall that last quarter, Dropbox's shares had belied management's expectation that the company would only earn 7% to 8% of its operating margins in the first quarter, which is several points lower than the 11% reported by the company. She had seen at 1T18. The company cited new investments in data centers and employee facilities as the main factor behind the expected decline in margins. However, Dropbox's gross margin gains enabled it to exceed a decrease in operating margin.

Management noted that 50bps Expenditures would increase from Q1 to Q2, and as a result, Dropbox is moving to pro forma operating margins of 9% to 10% in Q2. However, as we have seen with the results of this quarter, Dropbox tends to be conservative in terms of profitability targets, and it is likely that we will again be surprised by the upside potential in the second quarter.

Dropbox pro forma EPS of $ 0.10 also broke the Wall Street consensus at $ 0.06, while operating cash flow increased 2% year-over-year to $ 63.2 million.

Take away food

There are of course risks for the story of Dropbox. Competition is an omnipresent threat to the growth of Dropbox, Box and Microsoft OneDrive (MSFT) following it constantly. However, I would say that this presents several points of differentiation with respect to these competitors. Dropbox Paper, a new collaborative document offering that, according to CEO Drew Houston, has generated many additional subscriptions, is one of those differentiators. as is the recognition of the Dropbox brand among individual and non-professional users. Dropbox has managed to maintain a growth rate of about 20% over a period of several quarters. Until we observe a marked decline in these growth rates, we can not say that the competitive landscape has changed.

Dropbox offers exceptional value of 5.5 times the term income and less than 20 times the FCF to investors willing to be patient. Stay long on this name.

Disclosure: I am / we have been DBX for a long time. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link