[ad_1]

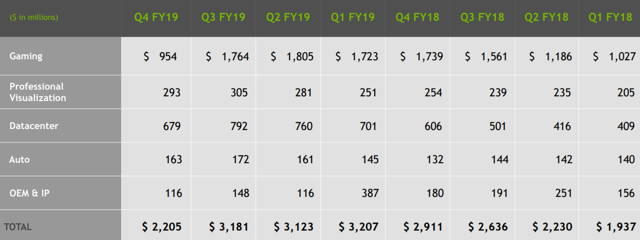

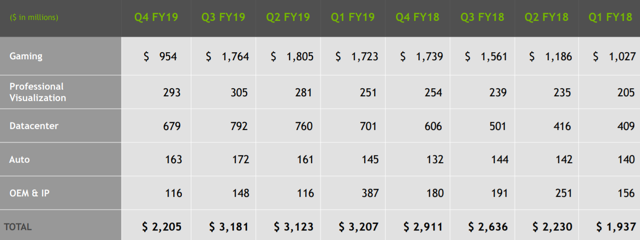

Nvidia (NVDA) Q1 results are on tap for Thursday after close. The company's revenues break down as follows in the first quarter:

Management has guided first quarter revenues to about $ 2.2 billion, with margins of about 59%.

As such, we were negative about Nvidia's outlook due to crypto burst and market share gains from Advanced Micro Devices (AMD). Faced with these headwinds, Nvidia struggled to meet its already weak forecasts for the first quarter. On top of that, Nvidia has experienced new headwinds since the beginning of the quarter:

- According to all indications, the data center is weaker than expected, as shown by the results of Intel (INTC).

- Although Nvidia appears to have eliminated the high-end GPU market, new RTX products required unusual price declines in the middle of the quarter.

- It appears that channel stocks at the lower end of the GPU market remain.

As a result, we find that Nvidia is missing the already difficult indications of the first quarter. Our income splitting expectations for the first quarter are as follows:

Games: $ 850 million; Pro: $ 290 million; Data Center: $ 600M; Auto: $ 150 million; OEM and IP: $ 110M

This brings revenue estimates for the first quarter to $ 2.0 billion – a shortfall of $ 200 million over forecast and consensus. We also expect Nvidia to sacrifice about 300 basis points of its margin so that its sales reach the $ 2 billion mark. As a result, Nvidia is expected to record a much larger loss on the EPS front.

Nvidia may have achieved the quarter by shipping in advance as in the past. If this is the case, the balance sheet will show signs of tension. We are going to watch.

Although the results of the first quarter are interesting to see, the real risk for Nvidia shares lies in the indications. The first quarter seems not only anemic, but society faces several headwinds for the remainder of fiscal2020:

- The trade war between the United States and China is expected to have a negative impact on the 2010 financial year

- The low-end graphic inventory is expected to last until the second quarter.

- AMD continues to execute the roadmap for its product and has just confirmed that Navi, a competitor of the mainstream GPU market, will be launched in the third quarter. This will make the second exercise even more difficult for Nvidia.

- Finally, in the third quarter, AMD is poised to defeat Intel in the high-end market of workstation and server processors.

If our assessment is accurate, it is impossible for Nvidia's management to maintain its current forecast for FY 2010. As such, it would be easy for management to blame the trade war and reduce the guidelines now. without having to recognize the challenges of competition. As a result, we now expect Nvidia executives to drop their revenue guidance for the 2010 fiscal year by approximately 10%. Analysts and investors will have a hard time getting a good $ 4 BPA north with these indications and downgrades are likely.

Such a move can push the stock well below its lowest level in 52 weeks, around $ 127.

In the future, we expect investors to understand more and more the reality:

- Much of the hyper growth that fueled Nvidia's valuation was not gambling, but crypto and this segment is now largely irrelevant.

- Nvidia has far fewer gaps in the gaming and data center markets and is losing more and more to AMD.

- Autonomous driving, Nvidia's next supposed growth driver, remains a futuristic market with no significant income prospects in the short term.

- The overpaid Nvidia, Mellanox and Mellanox, will contribute only marginally to the growth difficulties of Nvidia.

We continue to see the fair value of the company close to $ 50.

Subscribers to Beyond the hype have access to all related articles that might otherwise be inaccessible. For cutting-edge information, analysis and investment ideas in the technology, semiconductor, solar, battery, autonomous vehicle and other emerging technologies sectors, discover Beyond the hype. This Marketplace service gives you quick access to my best investment ideas, as well as arbitrage and event opportunities when they are more focused and actionable.

Disclosure: I am / we are short NVDA. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: Long AMD

[ad_2]

Source link