[ad_1]

(Source: imgflip)

Many readers have asked me if today was a good time to invest money in first – rate dividend stocks. After all, fears of a recession in 2020 are increasing and market instability has increased dramatically due to the escalation of the trade war between the United States and China.

As in most areas of finance, the answer is "it depends". So that's how I manage my retirement portfolio (where I keep 100% of my life savings, currently about $ 260,000) before a potential recession, to give you an idea of how to navigate uncertain financial waters today to improve the situation. long-term investment decisions that maximize the chances of achieving your financial goals.

The time in the market is much more than the timing of the market …

Nothing is more important than understanding the key principles in investing. That's why I regularly remind the reader what Peter Lynch, the second largest investor in history (behind Buffett), said

In this case, if you're good, you're right six times out of ten. You'll never be right nine times out of ten …A few big winners are enough for a lifetime of successful placements, and the benefits of these will overwhelm the disadvantages of stocks that do not work …Investors who are preparing corrections or trying to anticipate corrections have lost a lot more money than the corrections themselves."- Peter Lynch (we are underlining)

Investing is always probabilistic because the future is unknowable. Therefore, the first step in achieving your long-term financial goals is to adopt a sound long-term strategy that will work best in the future.

Background and market research can be an excellent guide to determining a basic strategy that can increase your income and wealth over time.

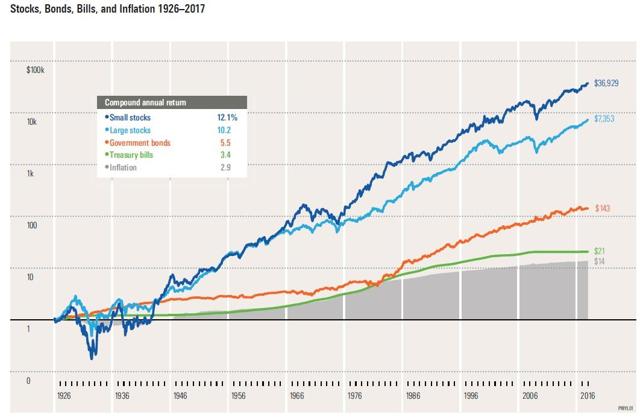

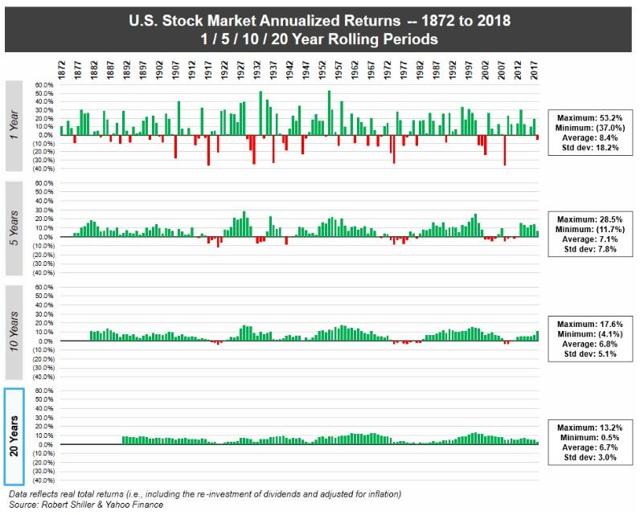

The first thing to know is that the stock market is the best wealth management factor ever discovered, stocks being the highest performing asset class in history.

In addition, the stock market is positive in 74% of the years, the probability of making money by increasing as you hold shares. Once you turn 15, the probability (at least based on historical returns going back to 1926) increases to 100%.

(Source: MarketWatch)

And since 1872, no slippery 20-year period has seen investors lose money, not even those who had bought at the peak of 1929 before the Great Depression (after which shares collapsed to 90%, the worst decline in the history of US markets).

What these data tell us is that market timing is a thing to avoid, because, as Peter Lynch points out, "market history indicates that time is running out when you own stocks of high quality companies" .

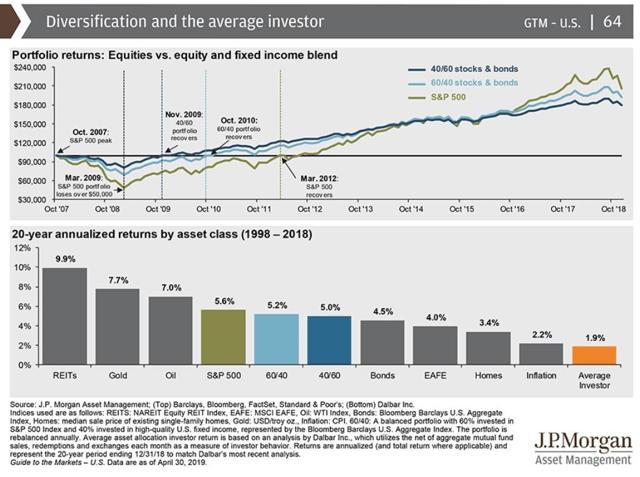

JPMorgan Asset Management, 4th the largest asset manager in the world, which found that the average investor had a total CAGR return of 1.9% over the last 20 years.

It's worse than buying and literally keeping all the other classes of assets and even losing to historically low inflation. What caused these catastrophic returns? Most of the time, investors have become greedy after the stocks have reached historically high valuations, then a panic selling after a predictable decline in them.

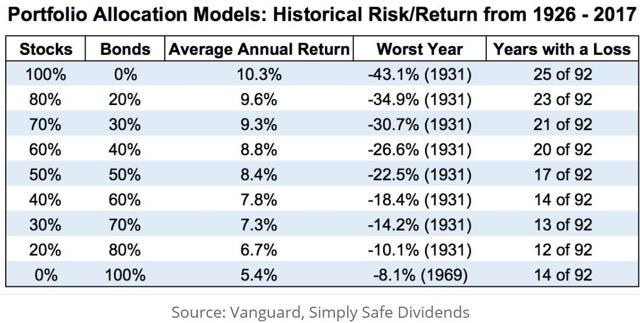

On the other hand, a super-conservative portfolio of 40/60 stocks and bonds managed to generate a total CAGR return of 5%, 2.5 times what private investors managed to obtain, and with much less volatility (allowing you to sleep well at night).

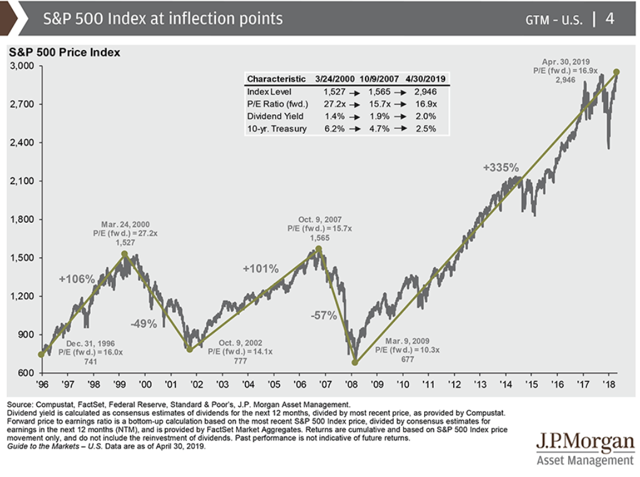

The S & P 500's average 25-year forward price / earnings ratio is 16.2. For bear markets based on valuations and mild recessions (such as the crash of the tech bubble), the market tends to fall to settle at a P / E of around 14. The financial crisis has saw valuations drop to 10.3, although it's a historical anomaly Do not expect to occur frequently.

For context, December 24th The S & P 500's low expected price / earnings ratio reached 13.7, about the valuation level seen at the lowest of the usual downtrend recession markets.

Today, the market shows an advanced P / E of around 16.5, roughly the historical fair value (taking into account interest rates corresponding to approximately the same amount). half of the historical norm).

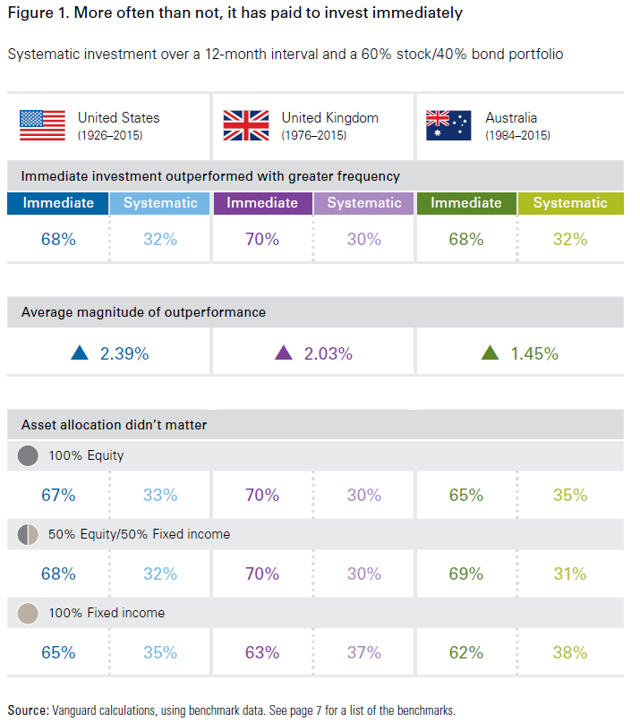

What about the issue of putting money to work as fast as it came back (average dollar costs) compared to lump sum investments (storing dry powder for corrections? )? Well, Vanguard has an answer to that.

In reviewing historical data on the United States, United Kingdom and Australia markets, Vanguard found that in 60% to 70% of cases, the most likely approach to obtaining Higher returns consisted of immediately placing money on the market. Your asset allocation mattered little, whether you're 100% stock, 100% bond, or somewhere in-between.

What do all these data tell us (and Peter Lynch's advice)? Placing your discretionary savings in income-generating assets (such as stocks), and keeping them in the long-term is the most likely way to grow your income and wealth over time.

However, as I said earlier, finances are complicated and there is no absolute. There are indeed times when it is appropriate to store dry powder before better future buying opportunities.

… but we must not ignore the risks

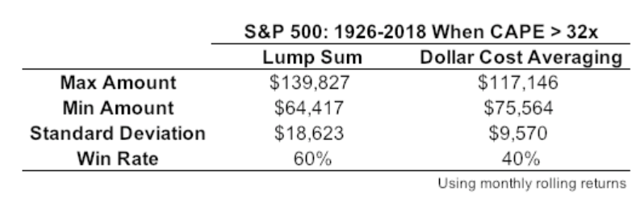

First of all, evaluations always count. The monetary average (to be fully invested all the time) generally works better than saving money to deploy during a correction (which since 1950 has taken place on average every 1.9 years ). But not always, as when market valuations are at historical extremes.

(Source: Ben Carlson, Vanguard)

Here's what the Vanguard vs DCA study revealed when Robert Shiller's famous cyclical-adjusted price / earnings ratio or CAPE was greater than 32. When stocks were overvalued compared to inverse probabilities capital investment (dry powder / correction) became higher probability strategy.

Today, the CAPE is at 30.3. This figure is historically high, but it will drop significantly over the next 18 months as the low income of the Great Recession will soften this 10-year average and the risk-adjusted private equity ratio (no crash). Is therefore necessarily likely).

Agree, but what about the specific macro risks we face, such as the escalation of the trade war between the US and China?

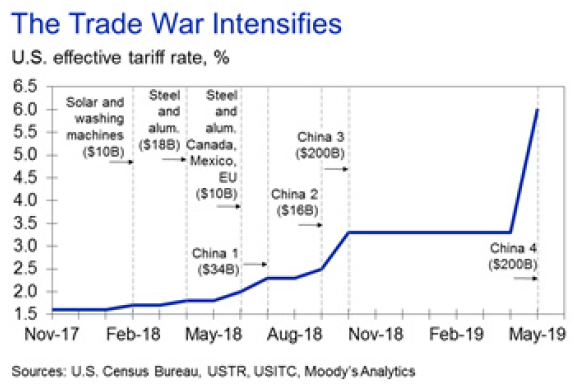

May 10thIn 2019, the effective tariff rate applied by the United States reached 6%, nearly four times what it was 18 months ago, due to the imposition by the United States 25% duty on Chinese exports worth $ 200 billion (more than 5,700 different goods). If the last tranche of Chinese tariffs of $ 300 billion (also 25%) comes into force, the United States will impose tariffs higher than 10% on all their imports.

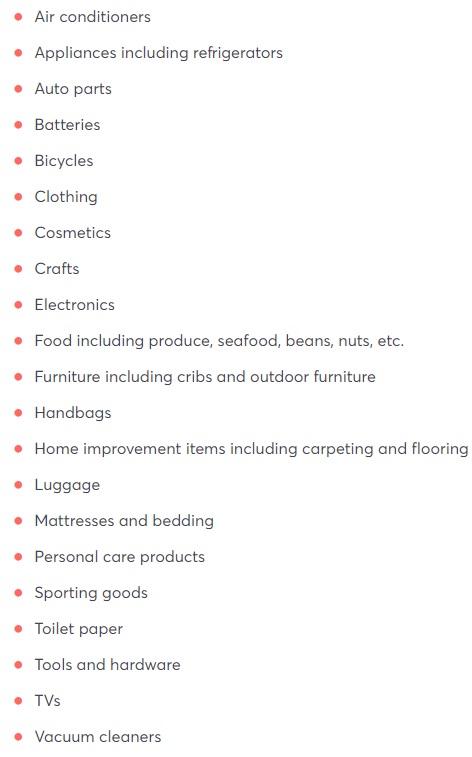

Chinese final tariffs would affect

(Source: National Retail Federation)

The latest series of duties (which could come into effect in August or September 2019 after a 90-day comment period) would particularly affect US consumers, because until now, most tariffs were for intermediate goods. and not those intended for consumers.

These latest 25% tariffs in China would cost the average American family of four between $ 767 and $ 2,294 a year as long as they remain in effect. This equates to a 1.3% to 3.9% decrease in annual household income, as the US Census Bureau estimates the median household income at $ 59,000.

But the worst case scenario is 25% tariffs on all Chinese imports. As Moody's Analytics recently pointed out in his weekly research note,

We still hope that the United States and China will reach an agreement in the coming weeks …This is our most likely scenario too. Given the difficulties encountered so far in the discussions, the costs to the economy and the stock market if the war goes on and Trump's innate desire to deal, chances are good that some type of arrangement be concluded by the end of the grace period in mid-june. We attach a 60% probability to this baseline scenario. "- Moody's Analystics (that's us underlining)

The basic estimate of Moody's also takes into account other US business risks and the effects that this would likely have on the US economy.

Trump's trade deal with Canada and Mexico at the end of last year has not yet been adopted by Congress.. The baseline therefore assumes that the the previous NAFTA rules will continue to apply and that the President will not act on his threats to deny NAFTA or, even more seriously, to increase tariffs on imports of vehicles from Canada and Mexico, where the industry is important. Under these basic assumptions, the economic outlook will not change significantly. US real GDP growth is expected to reach 2.5% in 2019 and unemployment is expected to decline slowly but surely throughout the year. China's growth is not affected either, with real GDP growth of 6.3 percent and The global economy continues to grow at a potential close to 3%."- Moody's Analytics (it's us who underline)

So, if Moody's high probability outlook materializes (which I also expect), then the US economy should be fine and no risk of recession / bear market is to be feared.

However, to invest well, one must also keep in mind the least likely risks (long term). That's why Moody's also offers two alternative and less optimistic scenarios.

An alternative scenario is that Trump does not find a way to shake President Xi's hand, and the higher 25% rates stay in place longer, for example until the end of the year… The highest rates will have a significant impact on the US, Chinese and global economies. International companies can handle the impact of a 10% tariff … but Navigating around a 25% fare will prove impossible. Global supply chains will be disrupted, which will hurt business investment and manufacturing output. This alternative scenario has a probability of 30%and would reduce US real GDP growth by nearly half a percentage point this year, bringing it closer to 2%."- Moody's Analytics (it's us who underline)

There is also the worst likely probable scenario on which many bears concentrate. Here is the estimate of Moody's on this grim result.

Much more serious, worst-case scenario and increasingly plausible does Trump engage in a all the commercial war, followed through most of what he threatened to do. This includes putting a Customs tariff of 25% on all Chinese imports to the United States, which comes to some 520 billion dollars for the past year, about one-fifth of all imports into the country. In this dark scenario, Trump is also going all-in on the 25% tariffs on imports of vehicles and spare parts (from Europe)…The probability of this total trade war scenario is 10%and is the recipe for an American, Chinese and global recession later this year. the The Federal Reserve will try to mitigate the economic shock by reducing rates, and the Chinese will revive monetary and fiscal stimulus, but these efforts will be in vain. the the length and depth of the slowdown will depend on the time it takes Trump to call a trucebut considering the the presidential election is fast approaching, he is hard to imagine that he would let the war continue much next year. – Moody's Analytics (underline added)

In the case of the worst-case scenario (10% probability estimate), Moody's estimates that US GDP could be impacted by 2.6% by the end of 2020. This equates to a decline about 1.8% of annual GDP, which could result in zero or slightly negative loss. growth next year (and 3 million job losses resulting in net job creation of almost zero).

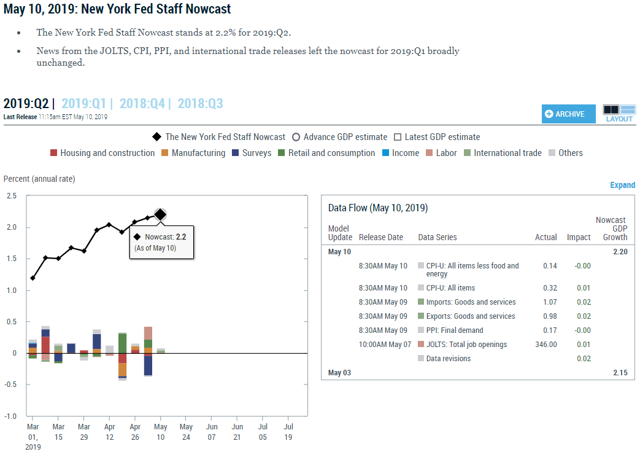

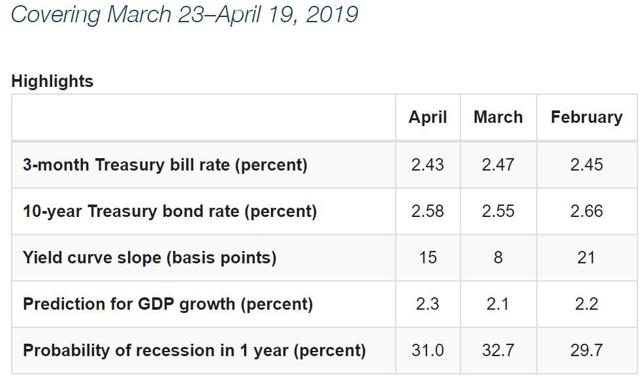

(Source: New York Federal Reserve)

In the second quarter, the New York Fed's real-time economic growth model (based on key economic indicators) forecasts economic growth of 2.2%. This roughly parallels the Cleveland Fed's economic model which forecasts GDP growth of about 2.2% to 2.3% this year.

(Source: Cleveland Federal Reserve)

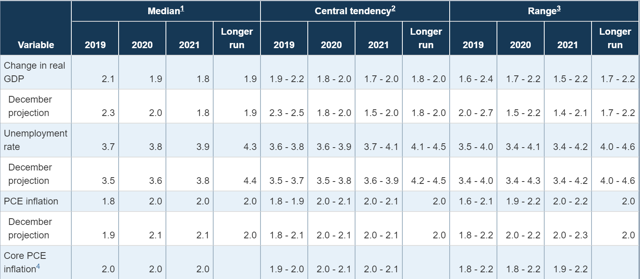

And this also corresponds to the expectations of the Fed this year, with growth in 2020 and 2021 slowing to just under 2%.

(Source: Federal Open Market Committee)

The bad news is that in the worst case, the trade war could potentially plunge the United States into a moderate recession (2001, when the peak of GDP declined by 0.9% due to the break-up of the technological bubble).

The good news is that Moody's is confident that it will not happen (just like me). But such probabilities are only rough estimates, and one can always be wrong (Goldman Sachs (NYSE: GS) estimates only a 40% chance.thtariff increase would occur but this was the case).

Thus, when it is to predict important economic outcomes such as the trade agreement, there is a valuable source to which I turn, the so-called "smart money" in the world of finance; the bond market. The bond market is much larger and more liquid than the stock market and dominated by institutions (such as pension funds, endowments and sovereign wealth funds) whose task is to focus primarily on capital preservation. and capital.

It is probably for this reason that the bond market, thanks to the famous yield curve, has managed to predict each recession since 1955 with a single false positive (mid-1960s, when growth slowed to near zero but never became negative).

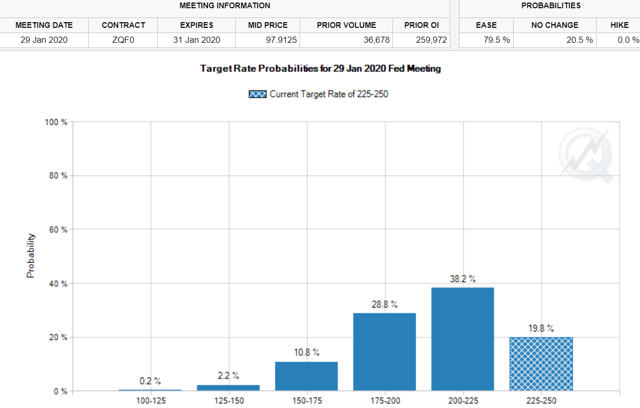

I check two specific things when I consider what the bond market says about the economy. The first is the bond futures market, where large institutions spend billions to protect themselves against interest rate fluctuations.

While the stock market reached a new absolute record on May 3rd expectations that a final trade deal would be announced by May 10th, the bond futures market announced a 66% probability of at least a rate cut by the Fed in 2019 (with a zero chance of hike).

I interpret this as if the bond market correctly predicted that trade negotiations would come up against an obstacle and that the trade war would intensify (which could potentially hurt the economy enough to require a reduction in the size of the economy). Fed rate). So what does the bond futures market say now?

(Source: CME Group)

In January 2020, the bond futures market estimates that there is no chance of rate hikes, 20% rate stability and 80% chance for the Fed to reduce at least once ( and more than 50% she will need). to be cut more than once). It's a very bearish signal and I'm watching it closely.

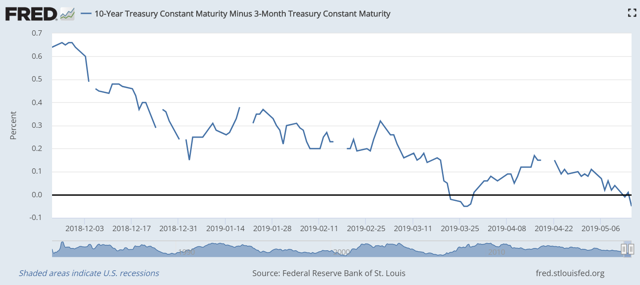

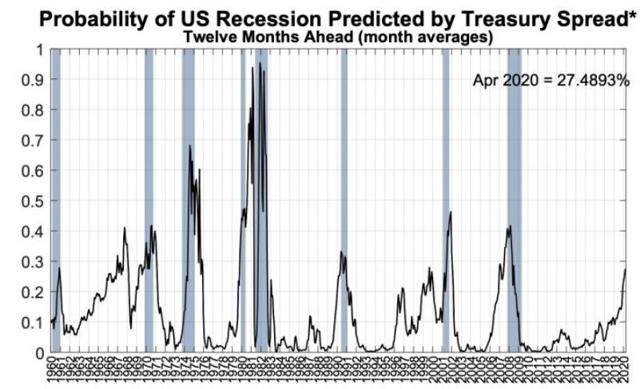

The second way I watch the bond market is the 10y-3m yield curve itself which, according to a August 2018 study by the San Francisco Fed, concluded that "The best synthetic measure (of the risk of recession) is the gap between the ten months-yields. "

This is probably because the survey conducted by the Dallas Fed in October 2018 revealed that banks were watching the 10y-3m curve closely to determine credit policies (especially when starting to tighten the credit). In other words, banks see "a moderate and prolonged reversal" of the yield curve as a warning of the imminent recession and the fact that it is time to reduce the credit of riskier borrowers. This reduces the money supply (financial loans represent 85% of the US money supply), creating the recession they feared.

The yield curve has been reversed twice now, once at the end of March (for 6 consecutive trading days) and is now stable after four consecutive days of negative spending.

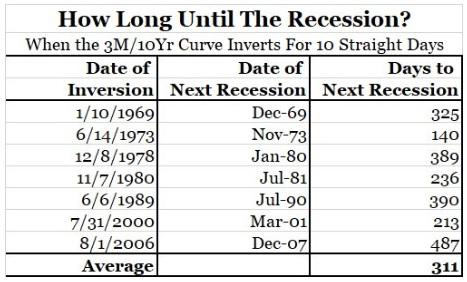

In the next section, we will discuss the different criteria for confirmation of the yield curve and the recession (there are four main ones), but one of the most important is 10 days of reversal (of any amount). ).

(Sources: Bianco Research, MarketWatch)

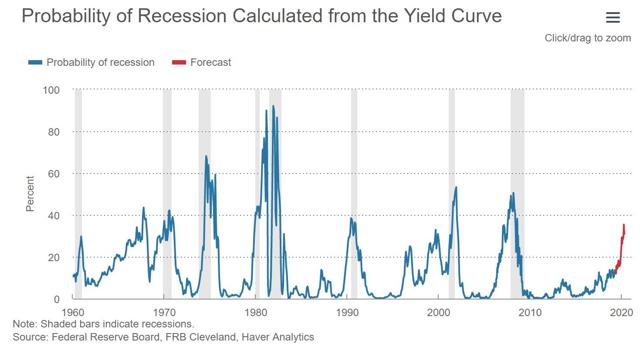

Since 1969 (the last 7 recessions), the curve has remained negative for 10 consecutive trading days, but a recession has always followed, on average in the space of 10 months and a half. Although seven data points are not statistically significant enough to assert with certainty that such an event ensures that a recession is preparing for 2020, this would certainly increase the risks of a risk that has already reached its highest level in 10 years, according to Cleveland and New York. Federal reserves.

(Source: New York Federal Reserve)

The uncertainty surrounding the escalation of the trade war could easily raise these risks to more than 35%, and the maximum risk of recession 12 months before the last three recessions was between 35% and 50%.

In other words, the United States may be on the verge of deciding whether the longest economic expansion in history has occurred (as of July 1st, 2019) will continue for several more years or will end in 2020. The trade war could prove to be the catalyst that will push us to the brink of recession.

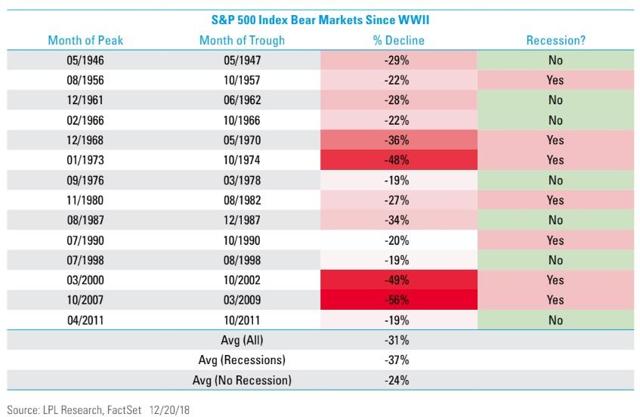

And while historical data tells us only more or less what is likely to happen (never what will happen), the fact is that since 1946, no recession has ever resulted in a bear market, which sees on average a decrease of its stocks of 13% higher than that of non-rececessors. each.

Which brings me to what I am going to do with my retirement portfolio, where I keep 100% of my savings. How can I balance the overwhelming data that supports buy and hold strategies and average dollar investments with the average dollar cost with the growing risk that we could face a large stock market crash (where best deals will be advantageous)? Via a hybrid strategy that incorporates everything I've learned during my five years as a professional analyst / copywriter.

My pension portfolio plan for the next recession

Since my investment strategy is focused on maximizing safe and growing dividend income, I have two very simple rules about selling.

- Never sell stocks just because you think they could fall short-term

- Sell shares only if the thesis is broken (the dividend is no longer safe or likely to grow) or possibly if they become too expensive (50% or more).

Do not forget that any investment is probabilistic and that the goal of all successful investors is to maximize the probability that their money and passive income will increase over time.

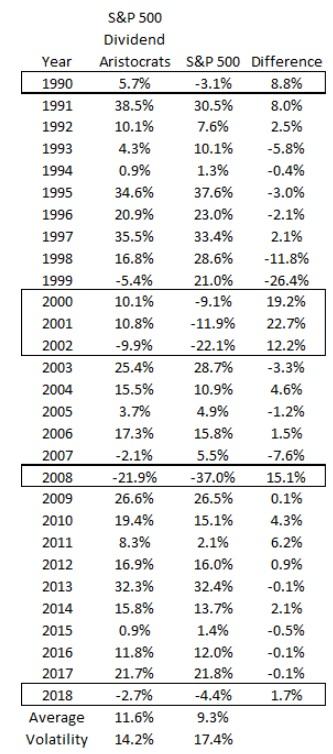

(Source: Research Ploutos)

Given that stocks spend the majority of their time on the rise, including blue chips like the famous dividend aristocrats (S & P 500 companies with more than 25 consecutive years of dividend growth, which historically outperform the market with a much lower volatility), my 100% blue-chip The focus on dividends and strong fundamental statistics of the portfolio indicate that not selling, except in very rare occasions, is the most likely strategy .

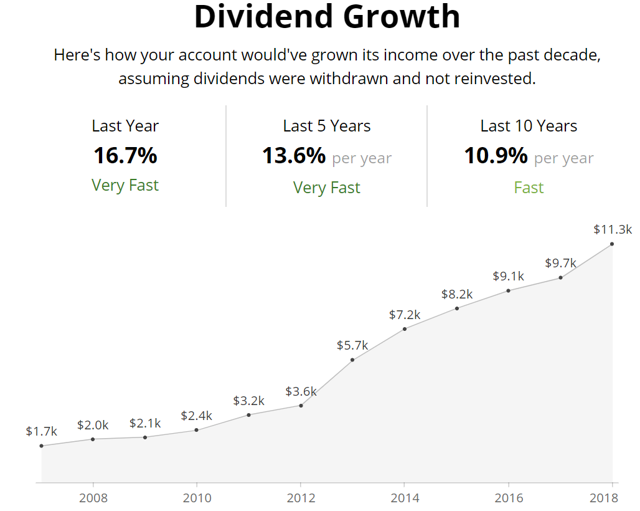

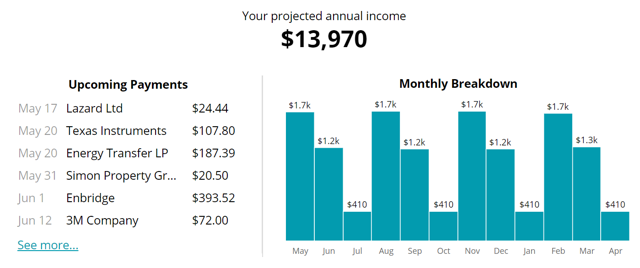

- Total Annual Portfolio Dividends: $ 13,970

- Portfolio performance in cost: 5.2%

- Growth of the organic dividend over 1 year (only from price increases): 16.7%

- Average organic growth over 5 years of the dividend: 13.6% CAGR

- 10-year average organic dividend growth: 10.9% CAGR

- Five-year consensus consensus dividend growth (courtesy of Morningstar): 6.7% (likely due to recession forecast)

My goal is to be able to eventually retire with 50% after-tax dividends. This will give me the financial freedom to work only for what I love (this job) and as much as I want (four days a week, not six).

The portfolio is now 100% blue chip (or higher quality) (based on my 11-point quality score taking into account dividend security, business model, and quality of management) . So I'm confident that even in a recession, my dividend income will continue to increase (albeit more slowly).

(Source: Simply Safe dividends)

This confidence is based on the fact that even during the worst economy since the Great Depression, the organic dividend income of my portfolio (without dividend reinvestment) would have

- increased by 18% in 2008

- increased by 5% in 2009

- increased by 14% in 2010

As a reminder, the median S & P 500 dividend growth rate over the past 20 years (and therefore a good estimate of long-term market dividend growth) was 6.6%.

Since 1954, the Gordon Dividend growth model, used by Brookfield Asset Management (BAM) for decades, is the best way to estimate future total returns. This simply indicates that total returns over time = return (current income) + long-term earnings growth / cash flow (which dividends follow assuming a constant payout ratio). Long-term cash flow growth is essentially an estimate of capital gains because valuation multiples tend to mean a decline over time.

To this model, I add a valuation adjustment because if you buy stocks at historically low valuations, a return to historical multiples will result in stocks outperforming earnings / dividend growth over time. Historically, this valuation-adjusted total return model is accurate to 20% (margin of error) over periods of 5 years or more (when sentiment disappears and only fundamentals matter).

Total return = return + long-term growth of earnings / cash flow + revival of valuation (return to fair value over 5 to 10 years)

- Portfolio yield: 5.3%

- Earnings growth consensus of analysts: 6.7%

- Total expected returns in the absence of a valuation change: 12.0% (compared with the historical 9.1% of the market)

- Valuation: 15% discount to fair value (Morningstar DCF estimates)

- Expected valuation valuation over 5 to 10 years: 1.7 to 3.4% of CAGR

- Adjusted Total Return Potential for Valuation: 13.7% to 15.4%

- Margin of error corrected for expected total returns: 11.0% to 18.5%

That 's why all my recession plan is based on what I do with new money, not on the savings I' ve already invested. After all, when you only own quality companies, buy for a discount of about 15% over fair value (using a very conservative estimate) and generally enjoy a long-term total return. At least 11% of the time expect the S & P 500 to be effective over the next five to ten years, the time is only on your side.

Success is about staying patient and letting your businesses do the heavy lifting while you watch healthy, exponentially growing dividends (about $ 40 a day on average).

Ok, so that answers why I'm not going to sell what I own, no matter how high the risk of recession (since market data, historical studies and Peter Lynch say not to do it), but that's I intend to do with my new money? who arrives every week.

First, as I explained earlier, my default strategy is to buy undervalued dividend values (on a watch list of 166 companies) in order to maximize my long-term income, while possibly respecting my risk management rules.

Given my personal circumstances (average expenditure of $ 1,000 per month, disability pension of $ 1,800 per month and $ 14,000 per month of total income from 32 sources), I do not have need to own bonds and cash. So, under normal economic conditions (no recession is likely), I am in 100% stock.

I am working on diversification right now, with energy and REITs currently accounting for 22% and 21% of my portfolio. I currently own 27 companies, six of which exceed the preferred holding size of 5% (so I can not buy at the moment).

I like to use limits to get great value for money.

Current limits of the open pension portfolio

| Business | Teleprinter | Limit price | Yield at the limit | Average yield over 5 years | Estimated discount at fair value (dividend yield theory) | Estimated Morningstar Fair Value Discount (NYSE: DCF) | Estimated discount at fair value (average of DYT and Morningstar) | Expected total return (CAGR next 5 years) |

| A.O. Smith | (AOS) | $ 39.99 | 2.2% | 1.1% | 50% | 15% | 33% | 18% |

| British American Tobacco | (BTI) | $ 36.72 | 7.3% | 4.0% | 45% | 38% | 42% | 24.5% |

(Sources: Simply Safe Dividends, Morningstar, Gordon Dividend Growth Model, Dividend Yield Theory, F.A.S.T. Charts)

British American I recently added to diversify its holdings, sectors and maintain a secure and growing dividend (at 4% over three years, then between 7% and 9% per year over the long term).

A.O. Smith, I bought May 16th the day of the crash caused by a short-lived attack (speculative allegations of possible accounting fraud and falling Chinese sales).

I like to be opportunistic with aristocrats, especially when the market collapses and drops them by more than 10% in a day. That's why I bought Walgreens (WBA), 3M (MMM) and now A.O. Smith in 2019, on such accidents.

Historically, such accidents are not milestones, but great long-term buying opportunities.

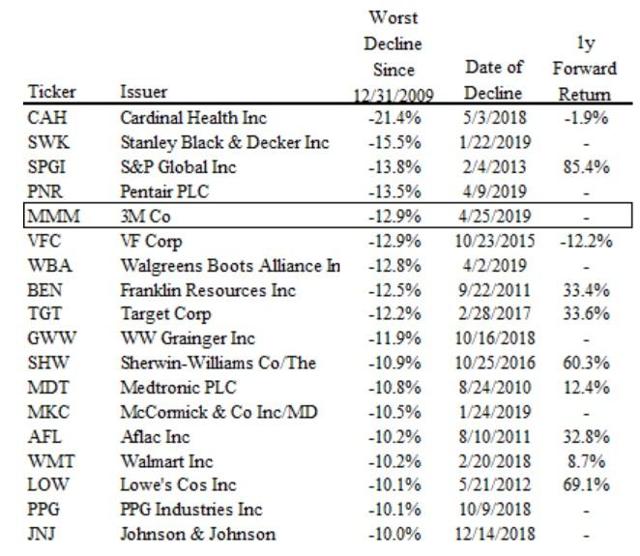

Dividends of aristocrats at term 12 months after a crash of more than 10%

In the last 10 years, 18 aristocrats have lost at least 10% or more in a day. 80% of the time, they rebounded in 12 months, with an average gain of 32% and a median gain of 33%.

Although such data do not guarantee huge gains over the next 12 months, they certainly argue for the opportunistic purchase of first-rate dividend stocks. Remember that my period is over 5 years (because some of Lynch's biggest winners have taken up to 4 years to break even).

Buying AOS at $ 43.71, then setting a limit at a really absurd price, would allow me to add a position in a large company to around 4% of my portfolio.

British Tobacco est la limite la plus susceptible de se déclencher (ma dernière du mois) et représente l'une des opportunités de rendement total à faible risque les plus élevées que je connaisse actuellement (potentiellement 25% au cours des cinq prochaines années).

Mais que se passera-t-il si le risque de récession augmente, si le ralentissement économique et le marché baissier deviennent probables l’année prochaine? Pendant les marchés baissiers, même les valeurs les plus fortement sous-évaluées peuvent chuter (trois aristocrates / rois seulement ont réussi à générer un rendement total égal ou supérieur à 0% pendant la Grande Récession).

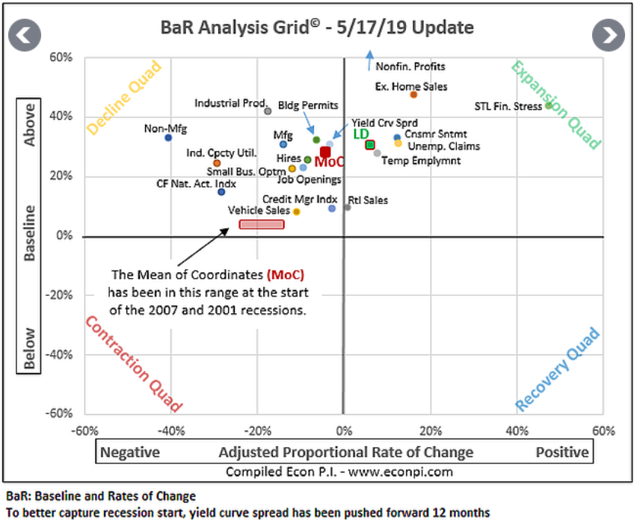

C’est là que ma macro analyse probabiliste entre en jeu. Les analystes utilisent l’inversion de la courbe de rendement de 10y-3m avec les principales périodes de confirmation de récession.

Jusqu'à présent, aucune de ces quatre confirmations ne s'est produite. De plus, les données économiques réelles, basées sur 19 indicateurs économiques avancés, indiquent désormais une accélération de la croissance par rapport à ses récents bas niveaux (indicateur avancé, le point vert montre une fois de plus une expansion et où la moyenne des coordonnées devrait dépasser prochaines semaines)

(Source: David Rice)

Cela signifie que la guerre commerciale reste simplement un risque (quelque chose qui pourrait nuire aux fondamentaux) mais les fondamentaux économiques eux-mêmes restent solides.

C'est pourquoi je continue à acheter de manière opportuniste. Cependant, si deux confirmations de la courbe de rendement se déclenchent, je vais désactiver mes limites et commencer à accumuler des liquidités via mes économies hebdomadaires entrantes.

- Inversion de 10 jours consécutifs: éliminez les limites et commencez à acheter le FNB PIMCO actif à maturité améliorée à court terme (MINT) – 2,5% sur un FNB d'obligations à très court terme et à versements mensuels (équivalent de trésorerie)

- Confirmation de l'inversion sur un mois: conversion de l'épargne hebdomadaire en achat du FNB Vanguard Trésor à long terme (VGLT) – FNB US Trésor à très long terme (rendement de 2,7%) (couverture pendant le marché baissier)

La logique derrière l'achat de MINT est que, si la courbe des rendements monte et descend au-dessus de zéro (le marché obligataire est incertain quant à la probabilité de récession), il est alors possible de détenir cet actif extrêmement stable, qui se négocie à plat comme si on l'attendait d'un équivalent en espèces. acheter des actions de manière opportuniste tant qu'une récession reste peu probable.

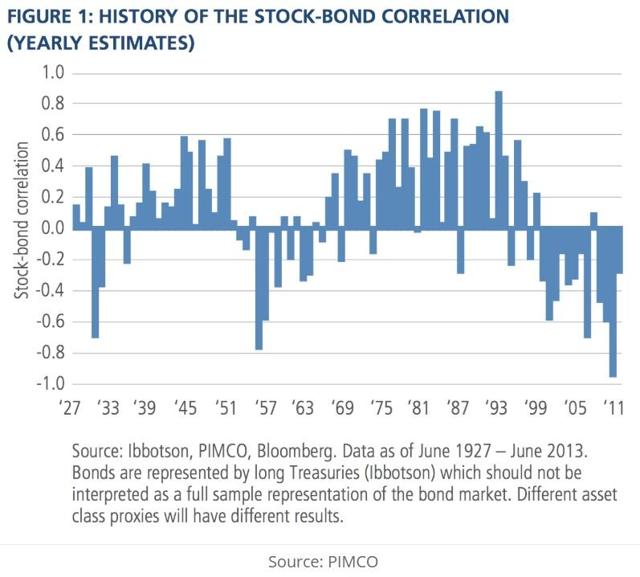

VGLT est utile comme couverture lors d'une récession car sa longue duration (18) signifie qu'une baisse de 1% des taux à long terme (rendements sur 10 ans) entraîne une appréciation du capital d'environ 18%. Cela signifie que, lors d'un marché baissier, les VGLT s'apprécieraient probablement encore plus que les bons du Trésor à 10 ans, qui ont extrêmement bien fonctionné lors des récessions précédentes.

Je n'ai pas l'intention de passer de MINT à VGLT une fois qu'ils sont achetés. Les deux sont susceptibles de rester stables ou de s'apprécier pendant la panique des marchés (fuite vers la sécurité et baisse des taux d'intérêt), ce qui signifie que lorsqu'un marché baissier deviendra enfin officiel (l'indice S & P 500 se ferme à -20% de ATH), j'aurai accumulé des dizaines de Des milliers d’actifs que je peux vendre avec un profit faible à modeste pour acheter des actions de dividendes de premier ordre négociés à des évaluations vraiment absurdes.

Choses à garder à l'esprit

Il y a trois choses à retenir de la stratégie de récession de mon portefeuille de retraite. Premièrement, il s’agit d’une stratégie globale à long terme qui me permet de tirer profit de tout ce que le marché fait.

Si l'économie est en croissance, j'achète opportunément des valeurs sous-évaluées, dans le but de faire progresser les objectifs de mon portefeuille (maximiser les revenus sûrs à long terme tout en travaillant sur des objectifs de diversification à long terme).

Si l'économie semble en difficulté (par rapport au marché obligataire et aux indicateurs économiques avancés), je continue à augmenter mes revenus (via l'achat de FNB obligataires) et à me préparer pour des opportunités d'achat encore meilleures à l'avenir.

Notez ce que je ne fais pas. Je n'essaie pas de planifier la vente de ce que je possède déjà (plus de 260 000 dollars d'entreprises de qualité) en fonction du potentiel d'une récession. Même si la courbe des taux devait s'inverser pendant un trimestre consécutif, cela ne garantit pas qu'un marché baissier se préparera bientôt.

C'est là qu'intervient le risque et les opportunités futures avec une stratégie à forte probabilité (rappelez-vous que les actions sont le meilleur atout à long terme). Comme le souligne Peter Lynch, les cours à court terme sont une distraction.

Concentrez-vous toujours sur les fondamentaux à long terme. Tant qu'une entreprise est bien gérée (et une bonne entreprise), les flux de trésorerie et les dividendes vont augmenter avec le temps. Les cours des actions sont finalement fonction des flux de trésorerie. Le marché peut rester irrationnel pendant longtemps (j'ai vu des industries entières se stabiliser jusqu'à six ans).

Mais à la longue, la hausse des flux de trésorerie et des dividendes amène toujours les actions à s’approcher de la juste valeur (et souvent même à la surpasser). Les industries et les entreprises se désagrègent avec le temps, c'est la nature du marché et ce sur quoi comptent les investisseurs à revenus à valeur contrarienne comme moi.

Tant que vous avez un portefeuille bien construit (diversifié avec une allocation d'actifs adaptée à vos besoins), la valeur de votre portefeuille n'a littéralement aucune importance, ni au jour le jour, ni même d'année en année.

Les actions dans un marché baissier pluriannuel et vous êtes à la retraite et devez vendre des actifs pour payer les factures (comme les retraités sur la règle des 4%)? C'est pourquoi vous devez posséder suffisamment d'équivalents de trésorerie et d'obligations. Celles-ci resteront probablement stables ou s’apprécieront dans un krach boursier.

En effet, à l’ère moderne (inflation basse et taux d’intérêt bas), les obligations ont tendance à être inversement corrélées aux actions. La règle des 4% ne dit pas de vendre aveuglément 4% de tout ce qui se trouve dans votre portefeuille dans des proportions égales.

L'argent stable est ce que vous vendez en premier. Quand ce sera parti, vous vendez des obligations en cours d’appréciation. Les dividendes des actions (plus les intérêts des obligations) permettent de maximiser le temps nécessaire pour éviter de vendre des actions de qualité à des niveaux historiquement sous-évalués.

Si vous construisez correctement votre portefeuille, vous pouvez adopter une approche de placement zen, ce qui, selon Buffett et Lynch, est le secret de la réussite d'un investissement à long terme.

Vous devez aborder l'investissement avec un Vulcain comme le manque de compassion (renoncer à l'émotion au profit de la logique) et rechercher le contentement, pas la joie ou l'euphorie. C'est ce que je m'efforce de faire en m'entraînant à ignorer les fluctuations sauvages et irrationnelles du marché.

Le marché est en hausse? Je suis content parce que quelque chose de grand est toujours en vente afin que je puisse acheter régulièrement; pendant ce temps, mes dividendes sûrs et en croissance exponentielle progressent.

Le marché est en baisse? Je suis content parce que je peux acheter d’excellentes entreprises avec des remises encore plus folles à la juste valeur (obtention de rendements plus élevés et de meilleurs rendements à long terme). Pendant ce temps, mes dividendes sûrs et en croissance exponentielle progressent.

Marché commercial plat? Je suis content parce que je continue à acheter de façon opportuniste (les aristocrates à dividendes s'effondrent parfois de plus de 10% par jour) et que mes dividendes sécuritaires et en croissance exponentielle arrivent.

Notez le thème commun ici? Les dividendes sûrs et croissants sont mon objectif principal. Littéralement, la raison de mon portefeuille de retraite est ce graphique.

Dividendes annuels du portefeuille de retraite

(Source: Dividendes Simply Safe)

Quatre mois par an, mes dividendes correspondent presque à ma pension de retraite volontaire. Le mercredi 15 maith, J'ai reçu près de 800 $ de dividendes. Le mercredi avant ces 500 $. Le 1er juinst I'm getting almost $400 from Enbridge (NYSE:ENB).

I work very hard for my money, and sometimes make $650 in a day but that takes 12 hours and writing three articles. To get paid a similar amount (and more every single year), even if I were to take a day off? Well, that's my idea of the American dream.

My goal is to treat my portfolio into a business (a holding company with partial stakes in other companies). Thus I have a long-term mentality which doesn't care about short-term capital gains, but long-term income.

Quality first, valuation second, and then it becomes just a matter of time until you succeed.

As for my specific recession protocol for new savings? Are those perfect? Almost certainly not. But I don't need to have the exact formula figured out for when to stockpile cash and when to put it to use. As Lynch said, you only have to be right 60% of the time, and then let your winners run and make you rich.

Risk management via diversification and asset allocation, not market timing, is how you protect yourself during inevitable but unpredictable recessions and bear markets.

Finally, I need to point out that my 100% stock allocation (which will likely always be above 80% or higher) is merely right for me. The asset allocation that's right for you will be different since you likely have neither my time horizon (I'm 32 and have 50+ years to let this strategy play out) nor my high savings (about $10,000 per month I can invest).

Here's a useful table for estimating what mix of stocks/bonds (cash equivalents are like bonds) you should have. 40% to 60% in bonds is what most financial advisors recommend as a rule of thumb, due to studies the 4% rule is based on (William Bengen's famous 1994 paper).

Consult a fiduciary financial advisor if you want to get highly specific or pick an allocation that offers the right mix of long-term historical return, and a worst year decline that won't cause you to lose sleep at night.

Bottom Line: Good Investing Requires Balancing Risk/Opportunity And Having A Reasonable Plan That Fits Your Personal Financial Goals

When it comes to the question of how much dry powder to hold I tend to lean towards the dollar-cost-averaging crowd. Decades of market studies (by Vanguard and others) show that time in the market matters far more than timing the market (which very few can do well). This is why I consider a bird in the hand (great undervalued blue-chip on sale today) to be worth more than two birds in the bush (possibility of buying that blue-chip at an even greater discount during a possible bear market).

Thus as long as recession remains unlikely I'm happy to be putting my money to work opportunistically into undervalued blue-chips, each purchase advancing my overall portfolio goals of an ever more diversified stream of safe and exponentially growing passive income.

But I'm also not blind to the risks of a future correction and bear market (both are inevitable). This is why I'm willing to take a page from Buffett's book (about 30% cash position over the last few years) and stockpile dry powder for future bargain opportunities if a recession becomes a high probability event.

That's where my cash equivalent and bond ETFs (MINT and VGLT, respectively) come in. Right now I don't own any, but should the macroeconomic outlook turn sufficiently negative, I will.

But note that I will not sell a quality dividend stock unless it becomes obscenely overvalued or the thesis breaks. I buy my companies purely for safe and growing dividends.

As long as they continue to deliver those then I'm content to let the market river wash over my portfolio and opportunistically grab the best opportunities it brings my way.

Ultimately, smart investors can disagree about the specific nuances of capital allocation (precisely how much you buy, of what, and when). But the time tested core strategies of Buffett, Lynch, Graham, Dodd (and many other legendary investors) remain the same:

- Quality companies

- At good to great prices (fair value or better)

- hold for years or decades

My two favorite Buffett quotes of all time summarize the true secret to investing successfully

We don't have to be smarter than the rest. We have to be more disciplined than the rest."

"The stock market is designed to transfer money from the active to the patient."

Disclosure: I am/we are long AOS, BTI, MMM, WBA. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link