[ad_1]

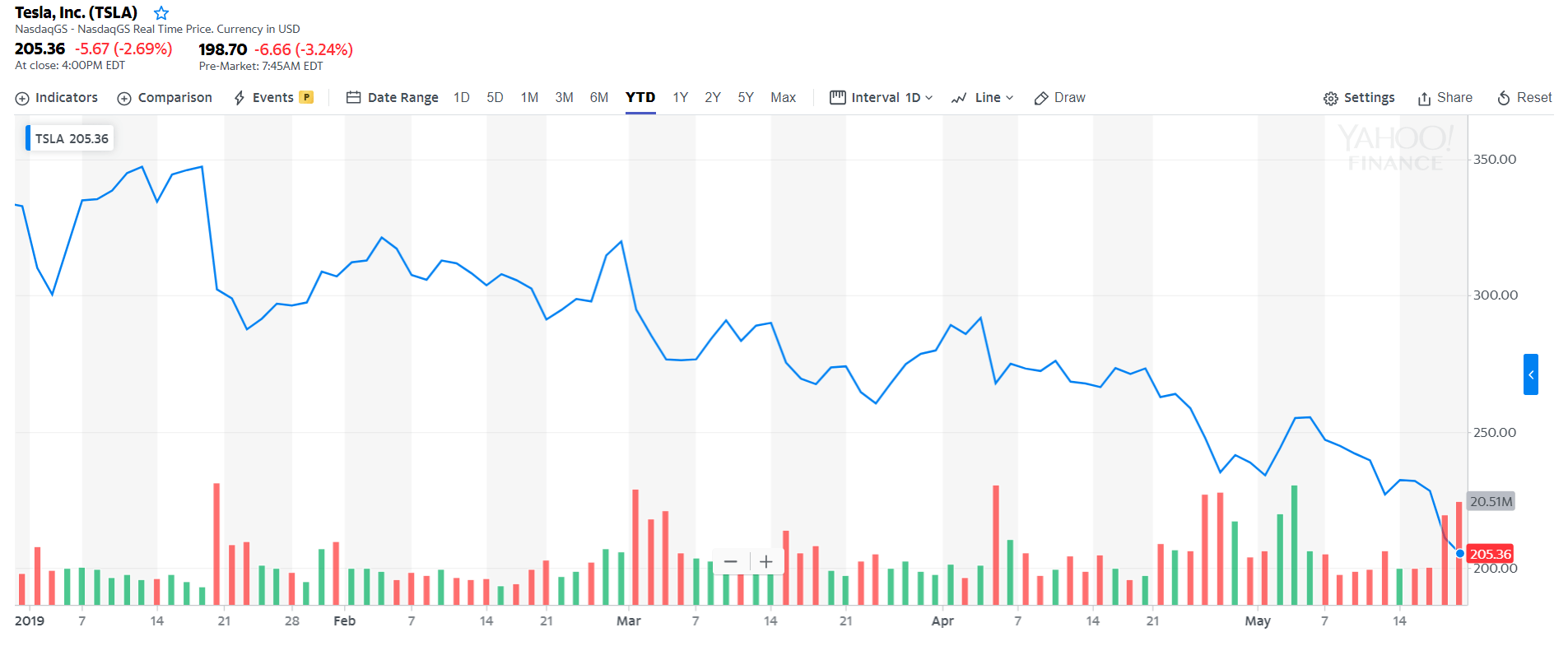

Tesla stock crumbles day after day as Wall Street turns against the stock | Source: Yahoo! Finance

But Wall Street is not convinced, since another analyst firm has joined the chorus against Elon Musk and has reduced its price target for Tesla shares.

Elon Musk's distractions hurt Tesla's stock

Daniel Ives, an investment analyst firm, Wedbush Securities, was bullish on Tesla shares once upon a time. But Elon Musk's antics have forced him to sing a different tune recently.

Last month, Ives lowered its price target for Tesla to $ 275 from $ 365 to $ 275. He said his company "can no longer look investors in the eye and recommends to buy this action". .

The Wedbush analyst has now reduced its target price of Tesla shares to $ 230. Ives expressed his concerns in a research note addressed to clients:

With a red code situation at Tesla, Musk & Co. is expanding its activities in the areas of insurance, robotics and other science fiction projects. the structure of spending in our opinion with headwinds abound.

This is the second time in less than a month that Ives has asked Musk to focus on the fundamental problems of the electric vehicle manufacturer. The Wedbush analyst believes Tesla is facing "a herculean task" to reach its 360,000 to 400,000 vehicle delivery forecast, as Musk had predicted earlier this year.

This means that the annualized production rate at the end of 2019 should be around 500 000, or 10 000 cars / week. Deliveries for the year are still estimated at approximately $ 400,000.

– Elon Musk (@elonmusk) February 20, 2019

This clearly shows that the market is not buying the tricks of the South African billionaire to inflate the course of action of Tesla. Wall Street now wants results and Musk is far from delivering them because of his antics.

Musk is looking into the problem, but is it too late?

Elon Musk himself has been pompous for a good part of the year, promising Tesla investors around the world. He made absurd claims, such as the launch of a million robots by next year, and he also told Tesla vehicle owners that the price of their cars would increase once that the complete update of the autonomous driving software would be complete.

Musk then said the $ 2 billion capital that the company raised would help develop self – driving cars and allow Tesla 's action to reach new heights. But eventually, Musk had a brave face while Tesla was in shambles.

He is now forced to admit that the company has only a few months to operate, which has prompted Musk to rationalize its spending aggressively.

Musk will review all Tesla expenses in the new cost reduction plan https://t.co/lftMYvH3LF pic.twitter.com/9zZdnSsH9Z

– Top Reuters News (@Reuters) May 16, 2019

But it remains to be seen if Tesla's CEO is awake at the right time. Or is it behind in its realization that the VE manufacturer might be sinking?

The responsibility lies squarely with Musk, who has divided his time between his interstellar dreams, his hyper-loop, the boring company and God knows what else. The CEO's attention to these science projects distracted him from Tesla's events.

As Tesla shares are crumbling day by day, due to the negative sentiment of Wall Street and the renunciation of key investors, Musk finally abandons any rhetoric for sincerity. But will that prevent Tesla from going bankrupt? Only time can tell us.

[ad_2]

Source link