[ad_1]

If you're looking for a fuel-efficient vehicle that can refuel, take a look at USA Compression Partners LP (USAC).

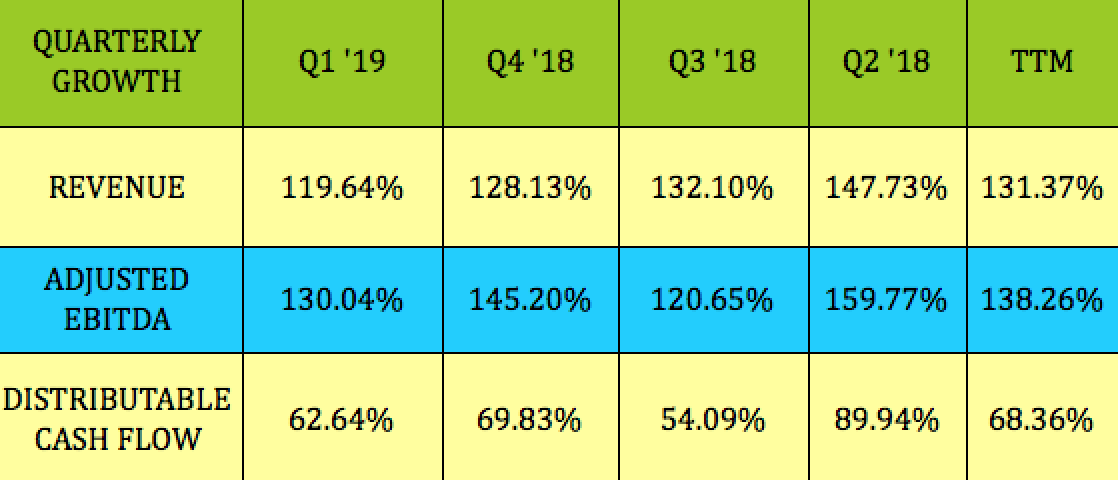

It is a niche leader in the compression services business in the United States and, with a major acquisition in 2018, USAC has seen impressive growth in recent quarters:

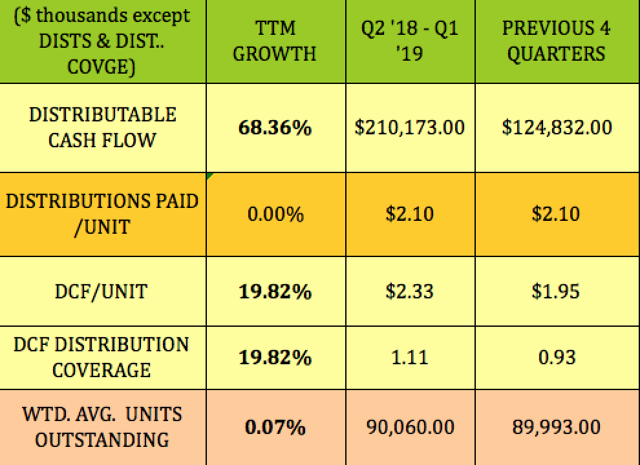

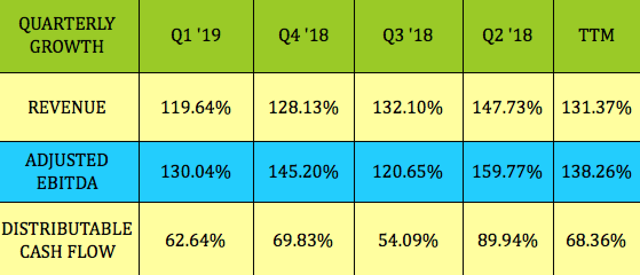

Although sequential growth may be a little chaotic on a quarterly basis, the trend is fairly clear for USAC: revenues increased by 131%, adjusted EBITDA by 138% and DCF by 68% over the last four quarters.

Founded in 1998, USA Compression is a third-party supplier of compression services essential to oil and gas customers. Our compression equipment allows our customers to transport natural gas via the national pipeline network.

We also provide specialized compression applications that facilitate the production of crude oil. We are one of the largest independent suppliers in the United States. (Source: USAC website)

Since its inception, USAC has focused primarily on high-power applications (typically over 1,000 HP), which have significantly increased demand from key players in the US energy industry. It has 4,500 compression units deployed in 19 states.

A major agreement in 2018 also eliminated IDRs:

USAC closed the acquisition of CDM on 4/2/18. CDM was the compression services arm of Energy Transfer Partners LP and Energy Transfer Equities, which merged to become Energy Transfer LP (ET). CMD has been valued at around $ 1.8 billion. This agreement included the following elements:

1. The contribution of the subsidiaries of ETP, CDM Resource Management LLC and CDM Environmental & Technical Services LLC, to USAC.

2. The cancellation of incentive distribution rights, IDR, in USAC.

3. The conversion of the general partner's interest in USAC into a non-economic general partner interest. As part of the transaction, ETE acquired the interest in the USAC General Partner and approximately 12.5 million USAC common units from USA Compression Holdings.

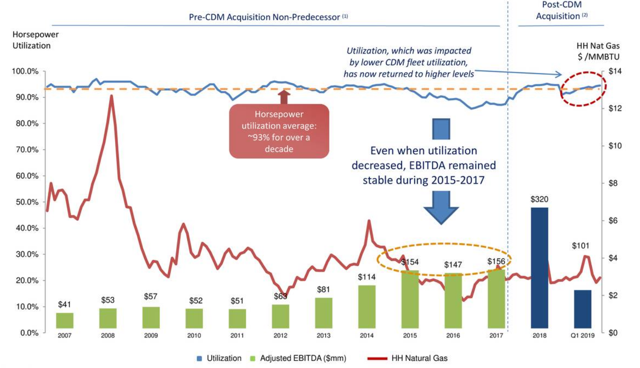

USAC operates in the United States. One of the good points of its large compression units is that they are "tacky". These larger units tend to have the power to stay with customers for whom it can be expensive to relocate. This has led to relatively stable utilization rates for the USAC fleet, during the cycles of expansion and slowdown of the energy sector.

Usage reached 94.2% in the first quarter of 19 and has averaged about 94% in the long run.

USAC management also handled customer credit very well – the company had only 0.06% bad debt / sales since inception.

His clientele includes many long-term relationships, many of which have been around for over 10 years:

distributions:

USAC pays in the usual cycle of February / May / August / November discs for discs and issues a K-1 at the time of imposition.

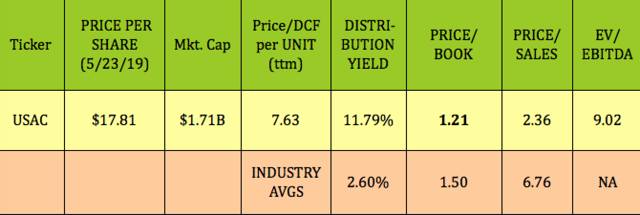

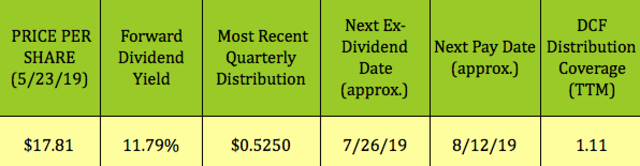

At $ 17.81, it still yields 11.79%, which is one of the highest returns we've ever seen for an energy-related company having made so much progress.

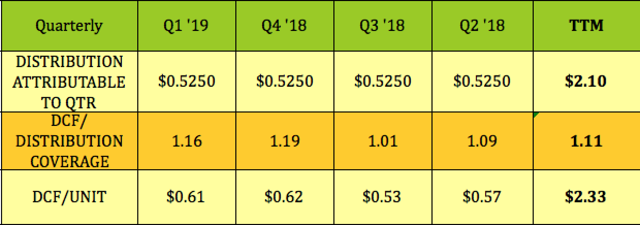

The USAC's coverage improved significantly in Q4, 18 and Q1, reaching 1.19X and 1.16X, respectively:

The 68% growth of DCF over the last four quarters increased by 19.8% DCF / Units and the hedge, with management maintaining the quarterly distribution of $ 0.525, while the number of units was stable:

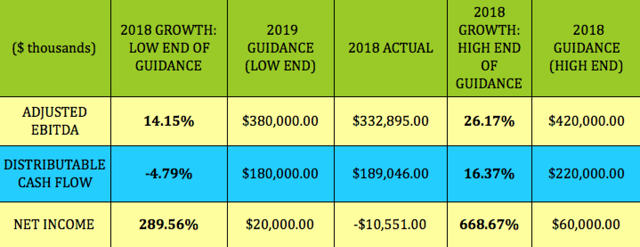

Management has reiterated its guidance for 2019. Compared to USAC's published actual figures for 2018, EBITDA is expected to grow from approximately 14% to 26%, while DCF's is expected to grow at a lower rate from – 4.79% to 16.37%.

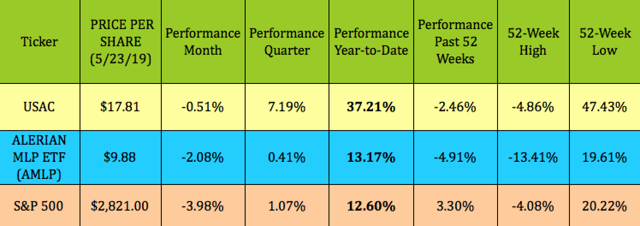

USAC outperformed both the Alerian MLP ETF (AMLP) and the benchmark market by a large margin over the month, quarter and December last year. It increased by 37.21% in 2019, against 13.17% for AMLP 12.60% for the S & P 500:

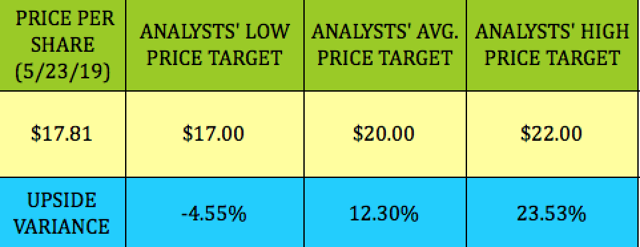

This outperformance has propelled it above the target of $ 17.00 based on the lowest analyst price, but the USAC still remains 12.3% lower at the same time. target of 20.00 USD set on average.

The 11.79% yield of the USAC exceeds the average of 2.60% of the oil services sector, but its prices / pound and price / sales of 1.36X remain below the industry average. Its price / DCF of 7.63X is also much lower than the valuations we have seen from other high-yield energy-related companies, which averaged about 9X-plus in 2019.

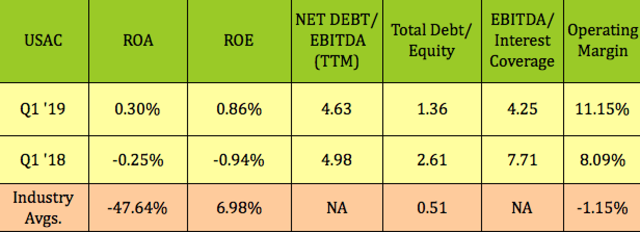

USAC EBITDA growth has improved its net debt / EBITDA leverage over the last four quarters to 4.63X. starting from 4.98X. Leverage on equity also improved considerably from 2.61 to 1.36, as did its operating margin, which rose from 8.09% to 11.15%.

ROA and ROE look thin at first glance, is not it? This is due to the significant non-cash amortization expense associated with all of these new assets, which has resulted in a drop in net income. The industry averages for the ROA are not too sporty either, at -47.64%, but are much higher for ROE, at 6.98%.

As at 31/03/19, USAC had outstanding borrowings on the revolving credit facility of $ 361.4 million, an available borrowing base of $ 1.2 billion, borrowing capacity $ 492.7 million and was in compliance with all covenants of its $ 1.6 billion revolving credit facility. The aggregate principal amount outstanding of the Company's 6.875% Senior Notes due 2026 and 6.875% at 2027 was $ 725 million and $ 750 million, respectively.

The USAC leverage has reached 5.4X over the past 3 years, but has remained below 5X since the second quarter of 2017.

options:

We offer option trades for USAC in our former DoubleDividendStocks.com service, which we will not disclose here, but if you are new to selling options, we have a glossary of options that defines the different terms you will encounter. in the options. trade.

Summary:

We continue to rate USAC as a purchase, based on its highly attractive performance, which has significantly improved coverage, continued growth and niche leadership.

All tables in DoubleDividendStocks.com unless otherwise noted.

Disclaimer: This article is for informational purposes only and does not constitute personal investment advice. Please exercise due diligence before investing in any investment vehicle mentioned in this article.

Our Marketplace service, Hidden dividend stocks more, focuses on undervalued and undervalued sources of income and high-yield special situations.

We travel the US and global markets to find strong revenue opportunities with dividend yields ranging from 5% to 10% and above supported by strong earnings.

We publish weekly exclusive articles containing investment ideas for the HDS + site that you will not see anywhere else.

Discover now how our portfolio beats the market in 2019.

Disclosure: I am / we have been USAC for a long time. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link