[ad_1]

Investment thesis

It is increasingly difficult for the market to value all General Motors (GM) companies fairly. The company's corporate name still recalls that of an old dinosaur in the auto industry, evoking feelings of polluting ICE vehicles, bankruptcies and bailouts.

In reality, however, the company has truly reinvented itself by significantly reducing and restructuring its traditional businesses and investing the proceeds from its highly profitable SUV & Truck business into future mobility platforms. Not only do GM's businesses evolve rapidly to these platforms, but they do so while retaining their leadership in their traditional activities.

Although the electric vehicle revolution is unfolding quickly, it is unclear whether the adoption of electric vehicles would be in a straight line or whether it would face misfires all the way. Other technologies, such as fuel cells, could also find their place in the automotive industry of tomorrow. Whatever it is, GM seems to be well positioned to become a future leader.

Meanwhile, if GM's (Cruise) self-driving activities are excluded, the rest of GM's business is offered at a very low price. History has shown us that when a high quality asset activity is combined with a fast-growing emerging business, the market often has trouble putting a fair price on the combined entity. This, in my opinion, represents an interesting opportunity.

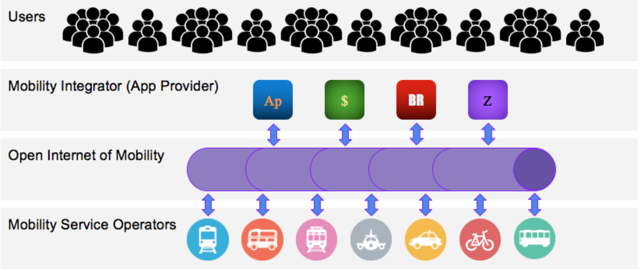

Some Thoughts on Transport as a Service (TaaS)

Source: travelspirit.foundation

The integrator (application provider)

Starting from the end consumer, robotaxis would compete for one of the rarest digital resources: the space on the screen. A well known and trusted application offering all kinds of mobility solutions in the world would have a significant competitive advantage.

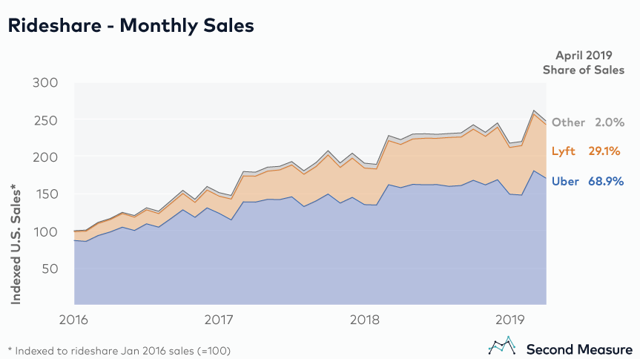

Source: secondmeasure.com

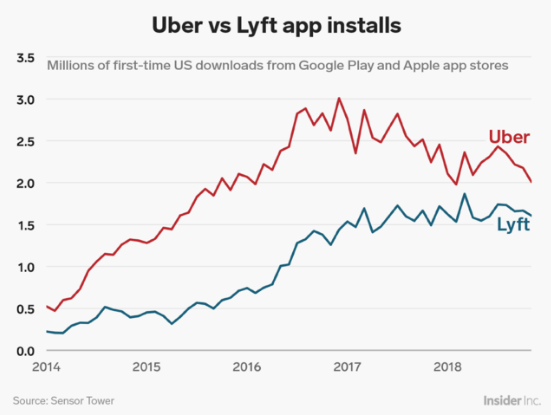

This is the main reason why companies such as Uber (UBER) and Lyft (LYFT) compete fiercely, despite huge losses and speculation that carpooling would never be profitable in its current form.

In addition to carpooling, gaining market share in adjacent segments such as food and parcel delivery would be equally important.

Source: buildfire.com

That said, ecosystem businesses such as Google (NASDAQ: GOOG) (NASDAQ: GOOGL) and Apple (NASDAQ: AAPL) would also have a significant competitive advantage. Last month, Google launched its Waymo app and could easily upgrade it simply by preinstalling it on all Android phones. Apple is another player who could easily introduce a platform competing with Uber and Lyft, if the company was successful with its standalone projects.

But perhaps the self-driving service would initially be limited to a handful of predetermined and mapped routes. For example, city centers at airports, bus stations, etc. In this case, companies like Uber and Lyft, already having carpool services already developed, could compete more easily. The software could simply decide to affect your trip to a Waymo or Cruise self-drive car or a regular taxi. The longer delays than expected in driverless cars, however, are jeopardizing current Uber and Lyft business models.

Lyft has already announced autonomous driving services using Waymo in Phoenix and Aptiv (NYSE: APTV) in Las Vegas. It's a little harder to predict if cruise services in San Francisco will soon be added to the Lyft app because Uber could be Cruise's favorite platform.

Although GM owns nearly 7% of Lyft's capital, SoftBank, Cruise's second largest shareholder, owns 12.8% of Uber's share capital, making SoftBank the largest shareholder of Uber.

Whatever the case may be, GM's collaboration with Lyft and Uber would allow it to compete with ecosystem players such as Google and Apple.

Vehicles purposefully built

With regard to robotaxis, vehicles built for this purpose would have a considerable advantage over vehicles with normal interior. A good analogy could be made with Geely's subsidiary (OTCPK: GELYF) manufacturing the famous black taxi cabs in London. The London-based company specializing in electric vehicles offers purpose-built electric vehicles that offer plenty of space and give a glimpse of what we might expect from the future purpose-built robotics.

This is perhaps also the reason why Waymo chose the Chrysler Pacifica Hybrid minivans for its audio-visual offering.

Source: alphr.com

Honda's engineering experience would play a key role in Cruise's strategy in purpose-built vehicles. Cruise founder and technical director Kyle Vogt recently commented:

Should not the car of the future have giant TV screens, a mini-bar and elongated seats? Maybe it should. Over the past two years, we have silently designed a revolutionary new vehicle, totally free from the stresses associated with the presence of a driver behind the wheel.

Although GM suffered a setback a few days ago following its request to launch a car without driving control, a purpose-built robotaxi is probably the way to go and that's what Cruise is focusing on.

the brand image

Another very important point to consider is the branding strategy. The brand association is undoubtedly the key in consumer buying behavior.

So, now imagine how a customer of a given brand would feel if the car was widely available for use as a taxi. How excited are you today to own one of London's VE Black Cabs as a personal car? Although the technology behind this technology is state of the art, it simply does not work when it comes to becoming a homeowner.

This is probably one of the main reasons why the Chevy brand has been removed from all the latest Cruise vehicles (and possibly from an upcoming IPO):

Source: autonews.com

A few words about Tesla

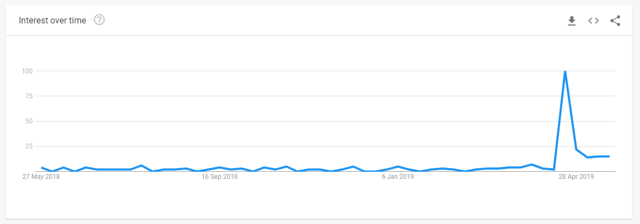

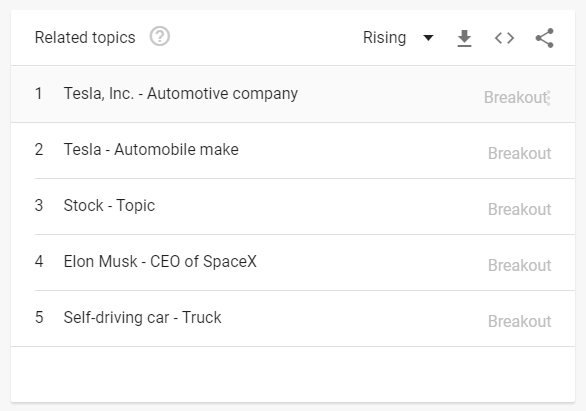

Despite all the developments of the industry, Tesla (TSLA) is still cited by many as the absolute leader in audiovisual technology. Google's trends show a massive jump in searches for the word "robotaxi" at the time Tesla was holding its autonomous driving event:

Source: Google Trends

Not only that, but all related topics have something to do with Tesla.

Users searching for your term have also searched for these topics.

Source: Google Trends

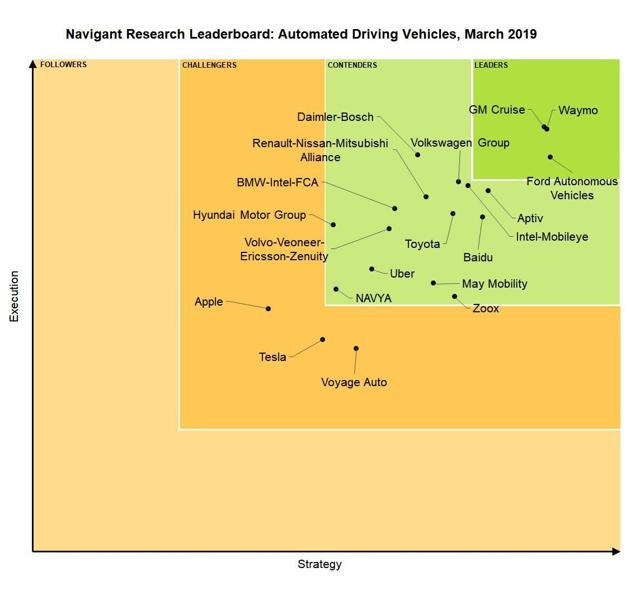

All this clearly shows the absolute hype around Tesla's capabilities and AV strategy. Quite surprisingly, industry reports show exactly the opposite.

Source: Forbes

As has been the case in recent years, Google's Waymo and GM's Cruise are still leaders in terms of execution and strategy, while Tesla seems to be lagging behind.

Not only that, but I see other problems with Tesla 's very enthusiastic approach:

- Redundancy – Tesla's approach has been very controversial due to the lack of lidar in Tesla vehicles.

The planes are perfectly capable of flying with one engine. However, all commercial aircraft use at least two. Why? Redundancy.

I am not an expert in any of these areas, but audiovisual systems being full of redundancy systems, this seems to be the most logical approach.

The logic that underlies the idea that lidar is expensive and therefore not necessary seems imperfect. Electric vehicles are expensive too, but that does not mean that cheaper ICE cars are the future. It is precisely the demand that drives innovation and reduces prices. As a result, lidar prices have dropped considerably.

Only time will tell whether or not Musk 's approach is the right one. Until then, I would prefer to stick to the more logical approach.

- the brand image – Like Apple in smartphones, Tesla is successfully exploiting its high-end brand in electric vehicles.

It's not just the technology of the cars, but the feeling of being different that made Tesla so attractive. Again, this does not fit well with Tesla which offers a taxi service under its brand.

- Funding – Unless big investors like Apple intervene, Tesla will have a hard time supplying huge fleets of audio-visual equipment while increasing its manufacturing capabilities.

The idea that Tesla owners would use their personal cars as robotaxis seems, too, flawed. Not to mention how Tesla cars would compete with spacious taxis built purposefully.

Cruise

Source: getcruise.com

Commercial value

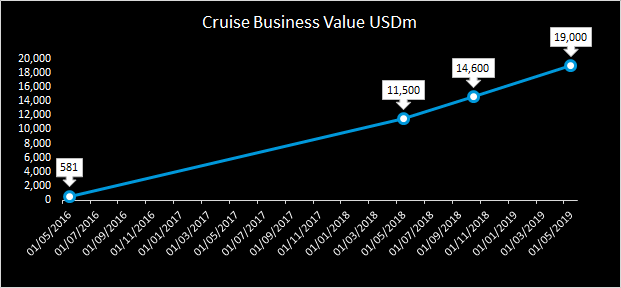

General Motors acquired the San Francisco-based start-up Cruise in May 2016 for a total amount of $ 581 million, of which $ 291 million was paid in cash and $ 290 million with shares.

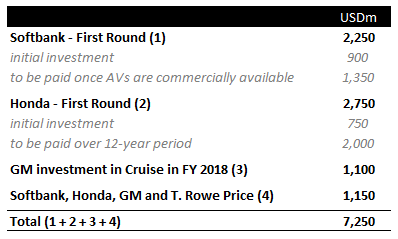

In May 2018, SoftBank announced a $ 900 million investment in Cruise, with an additional $ 1,350 million commitment when commercially available antivirus products are available. This allowed SoftBank to hold 19.6% of the company's capital and to value Cruise at approximately $ 11,500 million.

Given that the second installment was not received at that time, in one of my previous articles, I was arguing that this should give GM Cruise a lower value because we have to take into account the time value of money. I've calculated that the value of cruise activities should be about 10,083 million dollars, instead of 11,500 million dollars. However, for the sake of consistency, throughout this article, I will use the latter.

Four months later, Honda (NYSE: HMC) followed with a 5.7% stake, consisting of $ 750 million in cash and an additional $ 2,000 million commitment over 12 years. This cruise worth 14,600 million dollars.

Then, in May 2019, another round of financing followed by Softbank, Honda, GM and T. Rowe Price for a total amount of $ 1,150 million, valuing Cruise at around $ 19,000 million.

Cruise funding is $ 7,250 million, broken down as follows:

Source: various sources of publication

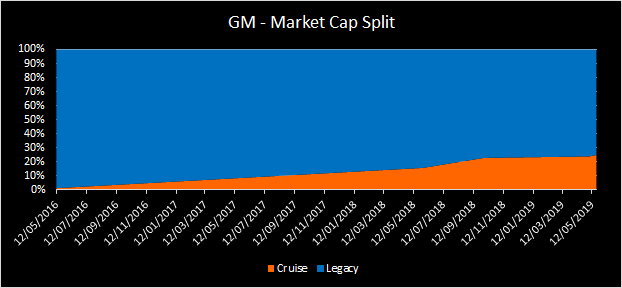

Assuming GM has committed a minimal amount of about $ 100 to $ 150 million over the last round, I think it should hold at least 69% of Cruise's capital. On the current valuation of $ 19 billion, this gives GM about $ 13 billion in shares in Cruise, or about 25% of its total market capitalization.

Source: Author's calculations based on Yahoo data Finance and various sources of publication

The agreements reached have led to key strategic partners such as Uber's largest shareholder, SoftBank, and Honda, which will bring its engineering expertise. Thanks to these agreements, Cruise has also been able to grow exponentially and attract key talent.

In 2016, Cruise had about 40 employees.

Source: Fortune.com

By June 2017, according to Mary Barra, that number would have risen to 200, and GM's latest Twitter account gives insight into the growth of the workforce.

Source: twitter.com

In summary, GM's cruises sector:

- is the leader in the audiovisual sector, with Waymo

- got the right partnerships and the right financing with $ 7.25 billion raised up to now

- was recognized by the right partners, bringing the overall valuation to $ 19 billion, while bringing technical and engineering expertise

- is working on the development of a robotaxi vehicle built for this purpose with GM and Honda engineers

- was one of the fastest growing companies in the sector

It's hard to speculate whether or not Cruise retains its leadership position. Nevertheless, GM has managed to make Cruise, a small company, one of the main contenders for the audiovisual aviation market.

How much are GM's other activities worth?

In addition to GM Automotive, in traditional activities, I also included:

- GM Financial which provides auto loan financing through auto dealerships in the United States and Canada.

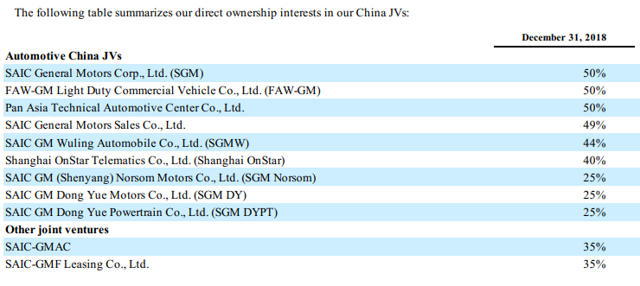

- All joint ventures in China

Source: GM.com

Source: General Motors Ranking 2018 10-K

- A number of small companies, subsidiaries and investments, such as ACDelco, GM Defense, Lyft equity stake, have recently reduced Maven, and so on.

Multiple P / B

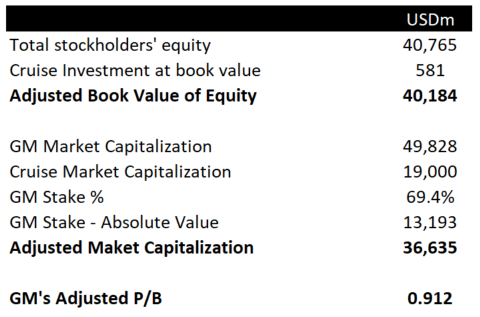

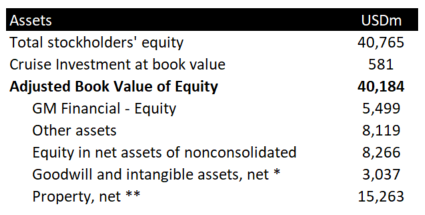

To calculate the multiple P / B of the company inherited from GM, we have to adjust the current market capitalization based on the above estimated market value of Cruise, as well as the book value of equity with l & # 39; initial investment made in Cruise.

According to GM's 10-K 2016 ranking:

Of the total consideration, $ 130 million was allocated to intangible assets, primarily ongoing research and development with an indefinite useful life, until fully developed and commercialized, $ 39 million. deferred income tax liabilities, net of other assets, and $ 490 million in related assets. non-tax deductible goodwill in Corporate mainly related to the synergies expected from the acquisition.

It is therefore fair to assume that all of the $ 581 paid for Cruise should be excluded from the carrying amount of GM's equity.

We then subtract $ 13 billion from GM's current market capitalization.

Source: Author's calculations based on Yahoo data Finance and General Motors: 10th Quarter Ranking of 2019 for the First Quarter of 2019

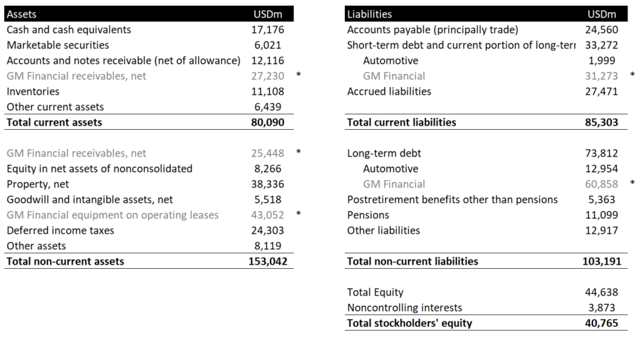

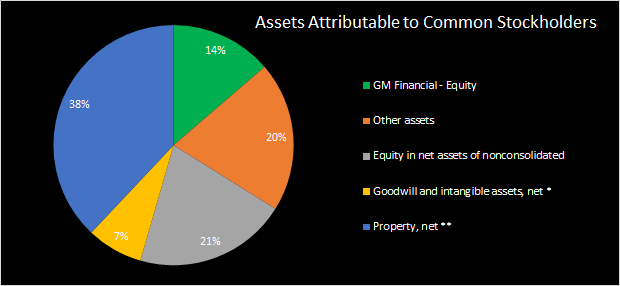

The market therefore believes that the assets of General Motors attributable to the shareholders have a value lower than their book value. Let's take a look at what kind of assets are these:

GM Balance Sheet 2019

Source: General Motors ranking for the first quarter of 2019, 10 Q

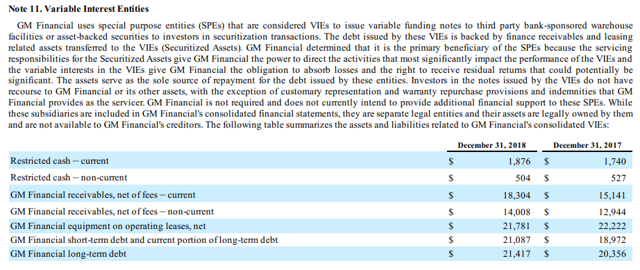

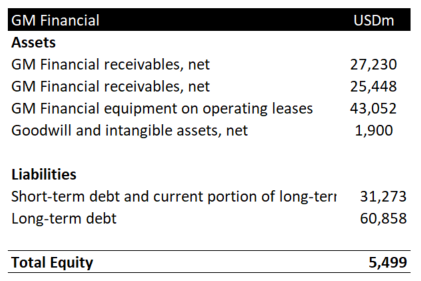

Assets and liabilities in light gray are attributable to GM Financial, which uses securitization vehicles. I will explain below the purpose of these transactions and the reason why most retail investors are terribly mistaken when they calculate the burden of GM's debt or its exposure to the price of rented vehicles . For the time being, these amounts would be deducted from each other to calculate the carrying amount of GM Financial 's equity.

Source: General Motors 2019 Q1 10-Q and 2018 Deposits 10-K

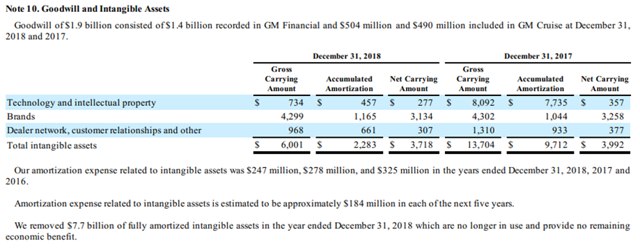

According to GM 2018 10-K Filing, a $ 1.9 billion acquisition gap is attributable to GM Financial for the acquisition of Ally Financial Inc. in 2015.

Source: General Motors Ranking 2018 10-K

Now that we have established the carrying amount of GM Financial's equity, we could begin allocating assets that should be owned by equity holders (assuming a liquidation scenario). We would normally do this starting with the riskiest assets, since the least risky and most liquid assets would normally belong to creditors and other stakeholders.

First, we would exclude all current assets because they are the most liquid and the least risky. While acting non-current assets, the riskiest seem to be:

- Equity attributable to GM Financial due to severe deterioration in credit quality and residual value of leased vehicles

- Other assets such as these include all types of non-operating assets and derivative instruments

- Participation in GM's Chinese joint ventures

- Goodwill and intangible assets, a breakdown of these assets is provided in excerpt 10 K above.

- The rest that I have allocated to property, plant and equipment

* Residual goodwill and intangible assets after recognition of Cruise and Ally Financial

** Property, plant and equipment up to the adjusted carrying amount of equity

Source: Author's calculations based on the first quarter filing of 2019 by General Motors

The acquisition of all these assets at 91 cents a dollar is a rare opportunity in today's highly prized market.

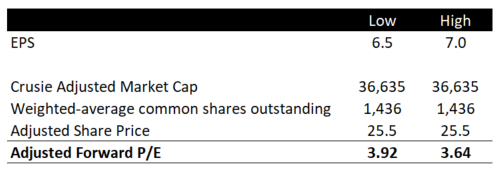

P / E Multiple

During the first quarter of fiscal year 2019, GM's chief financial officer, Dhivya Suryadevara, reiterated the forecast for GAP for the year:

Before closing, I wanted to reiterate our outlook for the calendar year. We continue to expect strong diluted EPS adjusted in 2019 of between $ 6.50 and $ 7 and free cash flow adjusted between $ 4.5 and $ 6 billion.

Source: Author's calculations based on Yahoo data Finance and General Motors, first quarter 2019, ranking 10-Q

Assuming that GM is bottoming out, its traditional business is still trading at a P / E multiple of less than x4.0.

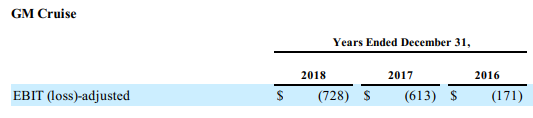

These estimates remain cautious, as losses related to GM Cruise should also be taken into account.

Source: General Motors Ranking 2018 10-K

While some valid arguments support the low valuation of GM's traditional businesses, they are by no means sufficient to support a multiple P / B of x0.9 and a P / E of less than x4.0.

Some of the risks include:

- GM's traditional activities consist mainly of a decrease in ICE vehicles.

While this is true, most people tend to wrap themselves up.

First of all, GM is fully committed to electric vehicles and, in fact, owns some of the best clearing vehicles for 2018:

Source: greentechmedia.com

GM's luxury brand, Cadillac, is set to become the company's leading brand of electric vehicles.

I see no problem for GM to progressively transition its ICE vehicle business to electric vehicles, while continuing to reap the benefits of its highly profitable sport utility and heavy vehicle business.

Secondly, the rate of EV adoption over the next two years is not entirely clear. Many problems still need to be solved before EVs take over those powered by ICE. Other technologies such as fuel cells could also offer acceptable solutions. Once again, GM seems to be well placed in any future scenario.

- The ongoing trade war with China.

A fair point, likely to affect GM's business in many ways, is likely to get worse. GM's joint ventures in China could be in danger. The company is already feeling the effects of rising steel prices. US consumers would also be affected, and the overall risk of recession has increased significantly.

Nevertheless, these are factors that rarely worry me when I select individual equity investments. Trying to time the market has proven to be an unsuccessful effort, and political investors can not predict political decisions. This is why diversification within the stock portfolio and asset classes is crucial.

- High debt – where most individual investors are wrong.

GM's debt and the company's exposure to non-lease vehicle prices are confusing for most retail investors.

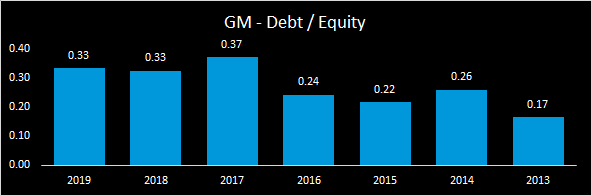

The total amount of GM's auto debt in the first quarter of 2019 was about $ 15 billion, or 33% of the book value of equity.

Source: Author's calculations based on Yahoo data Finance and General Motors Reports 10-K and 10-Q

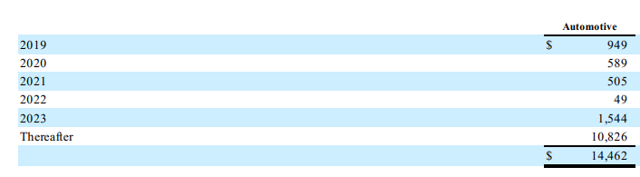

The debt payment schedule also does not seem to be a cause for concern:

Source: General Motors Ranking 2018 10-K

More importantly, GM Financial's debt is owned by variable interest entities that protect its assets:

Investors in the Notes issued by the VIEs may not use GM Financial or any of its other assets, except for the usual warranty surrender provisions and indemnities and indemnities provided by GM Financial as 39, server agent. GM Financial is not required and does not currently intend to provide additional financial support to these special purpose entities.

The full extract of the deposit is available below.

Source: General Motors Ranking 2018 10-K

Conclusion

Under the leadership of General Motors, Cruise has grown from a small start-up company to one of the world's leading autonomous vehicles. GM has also found the right partners, bringing both the technological and technical know-how necessary for the successful launch of the AV. As a result of all transactions, GM still holds nearly 70% of Cruise, which represents nearly 25% of its total market capitalization.

Taking out Cruise from the equation reveals the extremely cheap levels of other GM companies. These include GM's highly profitable automotive sector, joint ventures in China, GM Financial and a number of small businesses.

Inevitably, some key risks remain, but the company's competitive advantages, its extremely low valuation and its leading position in many disruptive technologies make GM an attractive investment opportunity for long-term investors.

Disclosure: I am / we have been GM for a long time. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: Please do your own due diligence and consult your financial advisor, if you have one, before making any investment decisions. The author does not act as an investment advisor. The author's views expressed in this paper address only certain aspects of potential investments in the securities of the companies mentioned and are not a substitute for a complete analysis of the investments. The author recommends to potential and existing investors to conduct their own investment research, including a detailed review of documents filed by companies with the SEC. Any opinion or estimate constitutes the best judgment of the author as of the date of publication and is subject to change without notice.

[ad_2]

Source link