[ad_1]

Beyond Meat President, Ethan Brown (C), celebrates with his guests after ringing the opening bell of the Nasdaq MarketSite on May 2, 2019 in New York.

Drew Angerer | Getty Images

Shares of meat alternative company Beyond Meat rose more than 6 percent on Tuesday after the Wall Street Journal reported that herbal burgers struggled to keep pace with rising demand.

Due to their limited production capacity, the two leading suppliers of meat substitutes, Beyond Meat and Impossible Foods, were unable to respond to the high frequency of restaurant orders adding meatless menus to their menus.

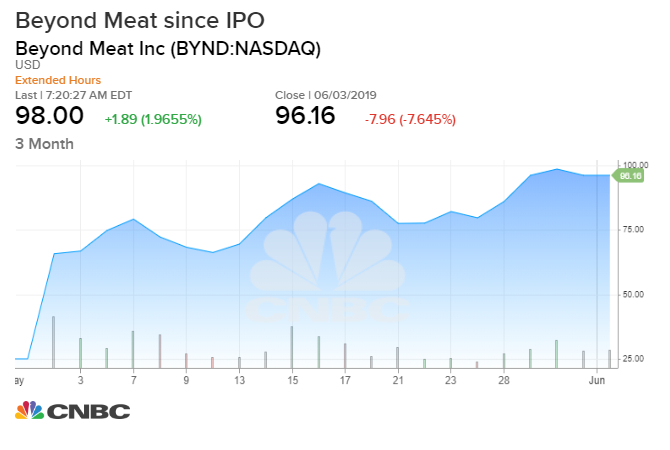

Beyond Meat's shares are now trading up 2%, up nearly 300% since its IPO in May.

Beyond the meat and impossible, food is served in nearly 20,000 restaurants across the country, according to the report. TGI Fridays, Del Taco and Red Robin restaurants have joined the list, adding pea or soy burgers to their meat-rich menus.

Burger King and White Castle have also added meat substitutes to their menus to attract more customers, the newspaper said.

The growing popularity of planetary burgers has not only attracted the eyes of restaurant chains.

Barclays has predicted that the alternative meat industry could grow to $ 140 billion over the next decade and food giant Nestle plans to launch its own herbal burger in the US via its brand Sweet Earth.

Beyond meat soared 163% on the first trading day of Nasdaq on May 2nd. The day before, the company had set the price of its shares at $ 25 a share, but had opened at $ 46 a share. The stock has almost quadrupled its price since the IPO.

Beyond Meat will release its first quarter results after the bell Thursday in the company's first earnings report since it's become a public company.

– Read the full story of the Wall Street Journal right here.

[ad_2]

Source link