[ad_1]

A buyer is carrying a Tiffany & Co. shopping bag on Fifth Avenue in New York City on May 30, 2019.

Victor J. Blue | Bloomberg | Getty Images

Luxury jewelery company Tiffany & Co. attributed disappointing quarterly results to the sharp drop in Chinese tourism, the company said on Tuesday.

After reducing the company 's earnings outlook for a full year to growth of 1 to 2 percent, Tiffany cited a "dramatic" reduction in tourism spending.

"Tourists in the United States represent a small double-digit percentage of our total US sales, and we have seen a sharp drop in sales to US tourists of the order of 25%. for Chinese tourists, "said Tiffany chief executive Alessandro Bogliolo said during the company's conference call.

Since the beginning of May, tensions between the United States and China have increased while the two largest economies in the world are struggling to reach a trade agreement. A broken trade agreement with China has led President Donald Trump to raise tariffs on Chinese goods worth $ 200 billion. In retaliation, China has applied tariffs on imports worth $ 60 billion.

China's Foreign Ministry on Tuesday warned Chinese citizens not to visit the United States, the state-owned CCTV television channel said. Beijing has warned those who work, study and travel in America.

Tiffany CFO and Executive Vice President Mark Erceg said Tiffany "was affected by the low spending of foreign tourists"; However, Tiffany is also affected by "the recent imposition of higher duty rates on the jewelry products we export from the United States to China and by our decision not to significantly increase our retail prices. China at the moment, "added Erceg.

For the first quarter, the jewelry maker's net profit decreased 12% to $ 125.2 million, or $ 1.03 per share. According to Refinitiv, analysts expected earnings per share of 1.02 USD.

Tiffany achieved a turnover of $ 1,003 billion, missing the forecast of $ 1,015 billion announced by analysts. Sales at the jeweler's remote stores missed estimates in all regions. In the United States, same-store sales fell 5%, compared to an estimated 1.2%.

The largest decline in comparable sales was in Europe, down 7% from the expected increase of 1.8%.

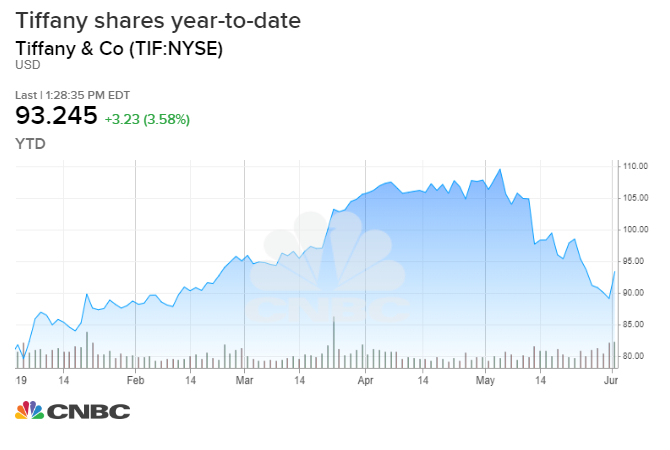

After falling before marketing, Tiffany's stock was 3% higher on Tuesday. Tiffany shares have increased by more than 16% so far this year.

WATCH: Tiffany publishes EPS beat and loss of profit

[ad_2]

Source link