[ad_1]

Oil prices turned positive on Tuesday, reflecting a recovery in global equity markets as Brent crude rallied after a four-month low earlier in the session.

Global equities rebounded after comments by US Federal Reserve Chairman Jerome Powell prompted expectations of interest rate cuts.

Oil gains were triggered by higher shares following comments from the Fed, said Andrew Lipow, president of Lipow Oil Associates in Houston.

Brent futures in the first month were up 73 cents, or 1.2%, to $ 62.01 around 14:25 (ET) (18:25 GMT). Brent fell to $ 60.21 earlier, its lowest since January.

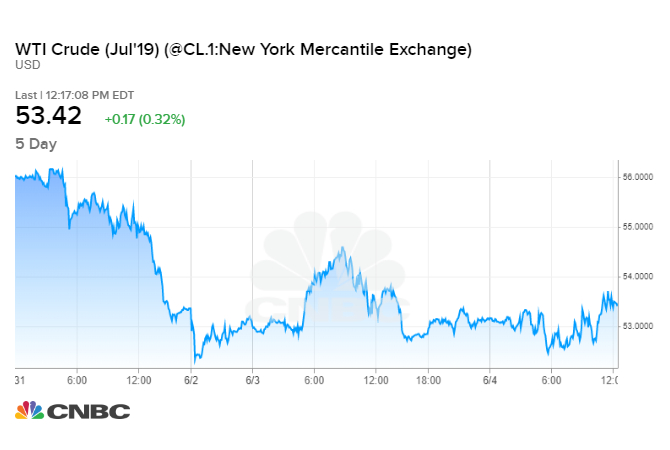

The West West Intermediate's futures contracts in the United States were $ 53.48 per barrel, up 23 cents to $ 52.43, a sitting low.

Earlier in the session, the oil market was weighed down by concerns over slowing global growth and comments from Russia's largest oil producer that it would oppose the extension of joint cuts. with the OPEC until the end of the year.

Financial traders sell energy markets because of growing concerns about the outlook for the global economy in the context of the US-China trade war and US tariff threats on Mexican imports .

"As long as US tariff issues with China and Mexico remain unresolved and a 5% wide tariff will be applied in Mexico next week, the speculative liquidation of the oil space could be maintained" said Jim Ritterbusch of Ritterbusch and Associates.

Oil futures are trading at around 20% below the peaks reached in 2019, reaching the end of April, with May posting the largest monthly declines since November.

Other energy prices, such as coal and gas, are also being hit hard by the economic downturn.

To prevent oversupply and support the market, OPEC, along with its allies, including Russia, has halted its supply since the beginning of the year.

The group plans to decide later this month or early July whether to maintain the supply restrictions.

Saudi Energy Minister Khalid al-Falih said on Monday that a consensus was emerging among producers to continue to work "to maintain market stability" in the second half of the year. year.

However, on Tuesday, the head of Russian state producer Rosneft, Igor Sechin, said that Russia should pump as it pleases and that it would seek compensation from the government if the cuts were extended.

Producers worry that the economic downturn will reduce fuel consumption.

Pressure on oil prices and OPEC efforts to tighten the market have reached record levels of production, which has led to an increase in US crude oil exports.

US crude inventories also rose last month to reach their highest level in two years. However, analysts in a Reuters poll forecast that stocks of reserves would have been reduced for the second week in a row before weekly reports. The American Petroleum Institute industrial group will release its data at 4:30 pm, followed by the government's report on Wednesday.

"There is plenty of crude oil stocks, and unless there is a general drop in inventories, crude and product prices will remain under pressure," said Lipow.

– CNBC's Tom DiChristopher contributed to this report.

[ad_2]

Source link