[ad_1]

The Dow Jones Industrial Average gained more than 500 points on Tuesday (and continued this rebound on Wednesday) after Federal Reserve Chairman Jerome Powell opened the door to a rate cut that traders were demanding for fear Economy slow down.

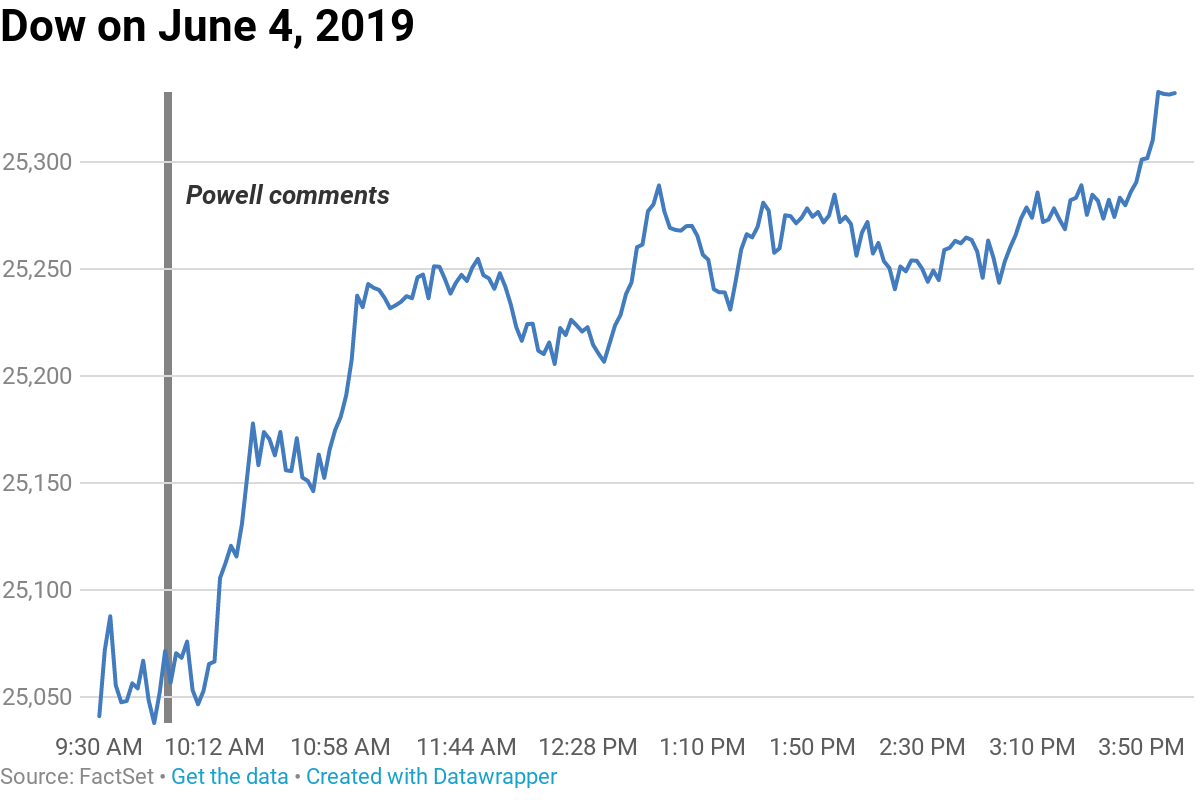

Their love of Powell's pivot is evident in this Dow graph:

"We will act appropriately to support the expansion," Powell said, but that was enough to make the market jump.

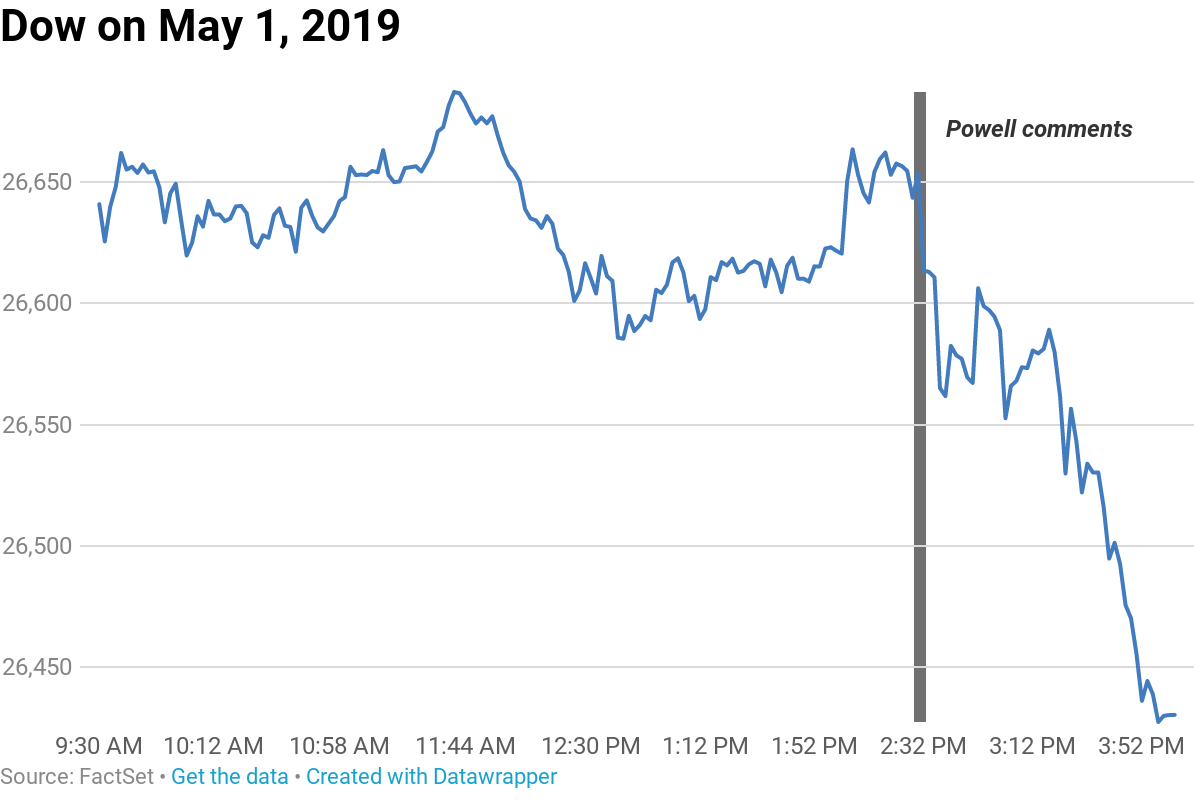

In contrast, this contrasts with what happened on May 1 when Powell disappointed investors by appearing to minimize the chances of a rate cut by saying that he believed a slowdown in inflation was probably "transient".

The Dow lost 150 points during this session.

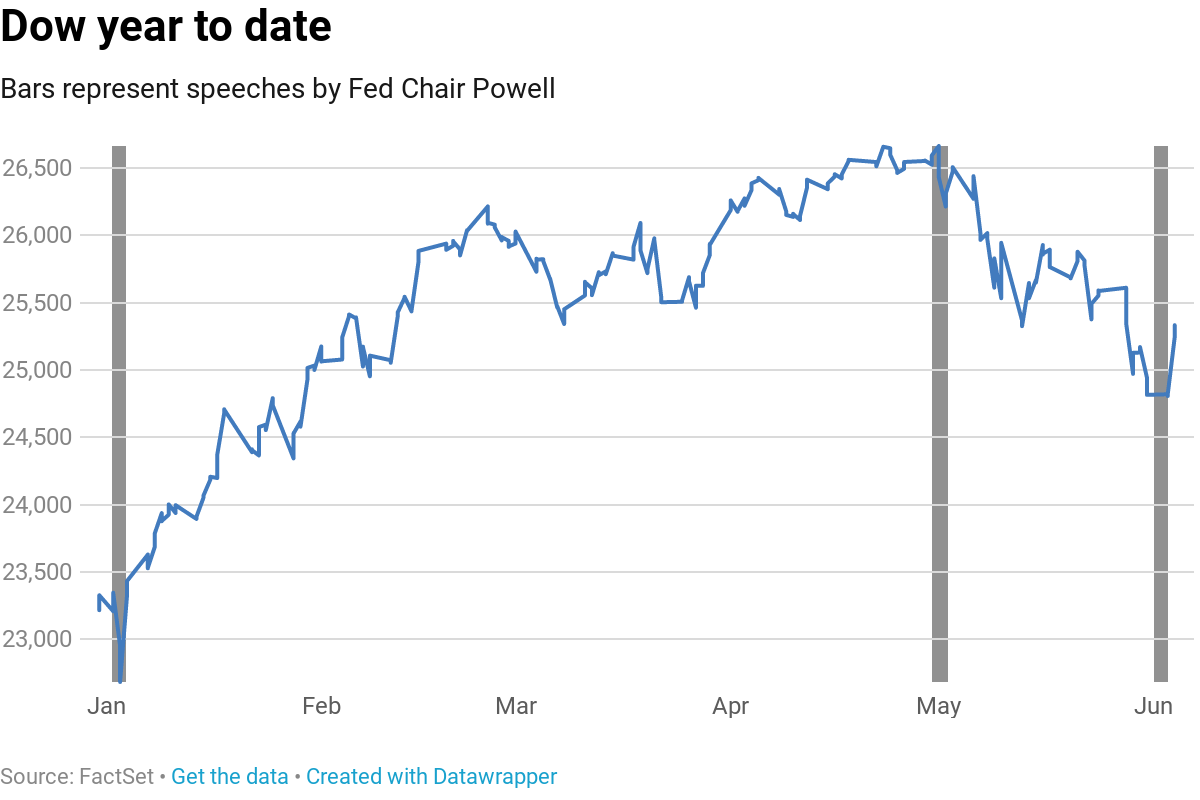

What difference does a month make when there is a vicious sale of risky assets.

"Powell's assurance that the Fed would act appropriately to support the expansion" confirms that not only is a rate cut on the table, but that it is approaching the horizon "said Ian Lyngen, head of US rate strategy at BMO. an email. "Risky assets have improved as a result of the dovish nuances, at least this aspect of Tuesday's price action fits our broader understanding of the world."

"A preventive reduction has been taken into account, suggesting that if the Fed does not follow up, the risk will be removed," he added.

– CNBC Jeff Cox Contributed reports.

[ad_2]

Source link