[ad_1]

After a decline of about 35% in the last twelve months, GameStop shares (GME) lost an additional 27% after the last quarterly announcement. In this article, I will review the highlights of the latest announcement and propose my two arguments against dividend reduction. I will do that by looking at the balance sheet and looking at the financial history here. I think the new management team has demonstrated very hostile behavior for shareholders. They say they want to save $ 157 million by eliminating the dividend, which will improve their "faculty". We have seen what happens when the owners have given this team options in the past (remember the $ 1.015 billion reduction last year?). I will conclude with a brief discussion of what people should do, in my opinion.

With my apologies to Orwell

Ah, the stock market, where all animals are equal, but some animals are more equal than others. Nowhere is this more apparent than the transactions that take place around the earnings announcement. When I entered the business world a few years ago, it was said that companies announce results after hours so that everyone has the time to digest the news and negotiate just the next day. We do not even claim to believe it anymore. Now the big institutions are trading with each other after normal hours while retail investors are watching helplessly. As I type, GameStop shares are down about 30% after normal trading hours. Obviously, modern financial capitalism is not bad. Everything is fine. It is very good.

Now that I've been very cynical about modern financial capitalism, I'm going to talk about GameStop itself and its latest results.

Highlights of the announcement of the results

- Total worldwide sales decreased 13.3% to $ 1.5 billion, resulting in a 10.3% decrease in same-store sales.

- Gross profit margin decreased by approximately 11% while selling, general and administrative expenses decreased by only approximately 5.5%, resulting in a 62% decrease in operating income per annum. compared to the same period of the previous year (including Spring Mobile).

- The increase in sales of the Nintendo Switch console was hampered by lower sales of the Xbox One and Playstation 4, resulting in a decline in new equipment sales of 35%.

- Newer, slower titles led to a 4.3% decline in new software sales, while second-hand sales declined 20.3%.

- Collectibles remained bright with sales up 10.5% to $ 157 million.

- GameStop generated earnings of $ 7.5 million, or $ 0.07 per share from continuing operations in the first quarter, down $ 20.4 million or $ 0.20 per share for the same period last year. 39, previous year.

- The company claims to be able to make about $ 100 million in operating profit improvements through a number of initiatives, including supply chain efficiency, price optimization and promotion.

- The company plans to spend about $ 100 to $ 110 in investment spending during the 2019 fiscal year.

- Before going into my arguments against the reduction of the dividend itself, I will look at the graduation of some off-balance sheet items in the last quarter. I think these are relevant because they represent an attempt (regrettably, I can not think of any other word) of "ridiculous" by management to justify its decision to reduce the dividend. On page 32 of the most recent 10-K, operating leases are off-balance sheet contracts. During the last quarter, the Company recorded approximately $ 800 million of operating lease liabilities in the balance sheet ($ 552 million long-term, $ 250 million outstanding). The fact that these reports appear neither in the annual report nor in last year's B / S report is revealing in my opinion. He suggests that the company may be warning critics of its decision to reduce the dividend. For my part, I do not buy that as a reason to reduce, because the company has generated about $ 200 million in free money every year after making the lease payments.

Argument 1 against the reduction of the dividend: who is the capital, in any case?

Management has decided to eliminate the dividend in "an effort to strengthen the company's balance sheet and provide greater flexibility and financial options". According to management, this should save shareholders about $ 157 million a year. The presumption of movement is embarrassing in my opinion for two reasons. First, when this management team exercised various options before it, it undertook destructive efforts for shareholder wealth. Giving these people an "optional character" with shareholder capital has proven to be a disastrous strategy in the past. Perhaps the final decline may be slow, and management should have the wisdom to understand this and simply repay investors to their capital in the form of dividends.

Second argument against the dividend reduction: the balance sheet is quite strong and the cash flow remains robust

Compared to the same period a year ago, cash and equivalents more than doubled, from $ 242 million to $ 543 million. At the same time, long-term debt increased from $ 818.6 million to $ 469 million. This suggests that the balance sheet has improved considerably and that the reduction of the dividend is shocking in light of this.

It may be a bit short-sighted to look only at the most recent quarter. So I'm going to spend some time to put this last quarter in context. After all, it may seem extreme to blame management for reducing the dividend given that the company would only have $ 74 million after repaying all of its debt.

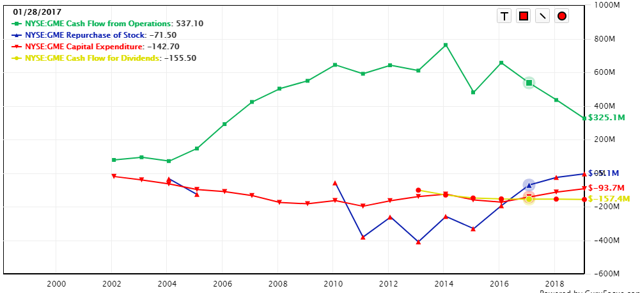

I think investors should remember that this company remains a pretty decent cash flow generator. For example, they generated operating cash flow of about $ 325 million in 2018 (note that this is a result of the "replenishment" of a $ 1.015 billion drawdown ). In addition, despite ongoing trends for online gaming, the company has managed to generate $ 435 million in 2017, $ 537 million in 2016, and so on. and share buybacks.

Source: Gurufocus

Given the above and the fact that shareholder friendly management is a prerequisite for a successful investment, I can not recommend buying at these (very depressed) levels. As long as management does not show willingness to engage in shareholder-friendly activity, I deeply suspect them.

Why I keep my little position

For those who have followed my articles on GameStop, you know I've traded that name for a while. I recommended taking profits when the price became too high, and I suggested buying after the collapse of the "strategic review" of last year. inferior.

Obviously, there are reasons to fear for the longevity of this business. The abandonment of physical disks will obviously have a considerable impact on GameStop. That said, bears seem to rely on a superficial story to examine this society. I have discussed this point in more detail in a previous article where I demonstrated that the comparison with Blockbuster is stupid. The downside seems to be that GameStop is doomed because of the move to online gambling. This trend has been going on for years and what has been the result? A decline in revenue at a CAGR of about 1.9%. Not great, but certainly not a spiral of death either. The negative forces that influence GameStop have existed for years and have led to a gradual loss of sales. Barely upsetting in my opinion.

Although I strongly disagree with management's decision to eliminate the dividend, I do not see any other solution for now than to wait and see. In my opinion, investors should understand that it is a very speculative investment at this point and that any capital deployed can fall to zero. For this reason, I think investors should act according to what they can afford and their own risk tolerance. I am more comfortable with risk and capital loss than most people. If you are like me and are a shareholder, I recommend you keep it. All others should avoid until we have some visibility on the plans of this management team that I am currently very suspicious.

Disclosure: I am / we are long GME. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link