[ad_1]

- L / # EUR / USD lost a lot of ground this week.

- The level to beat for bears is support 1.1074.

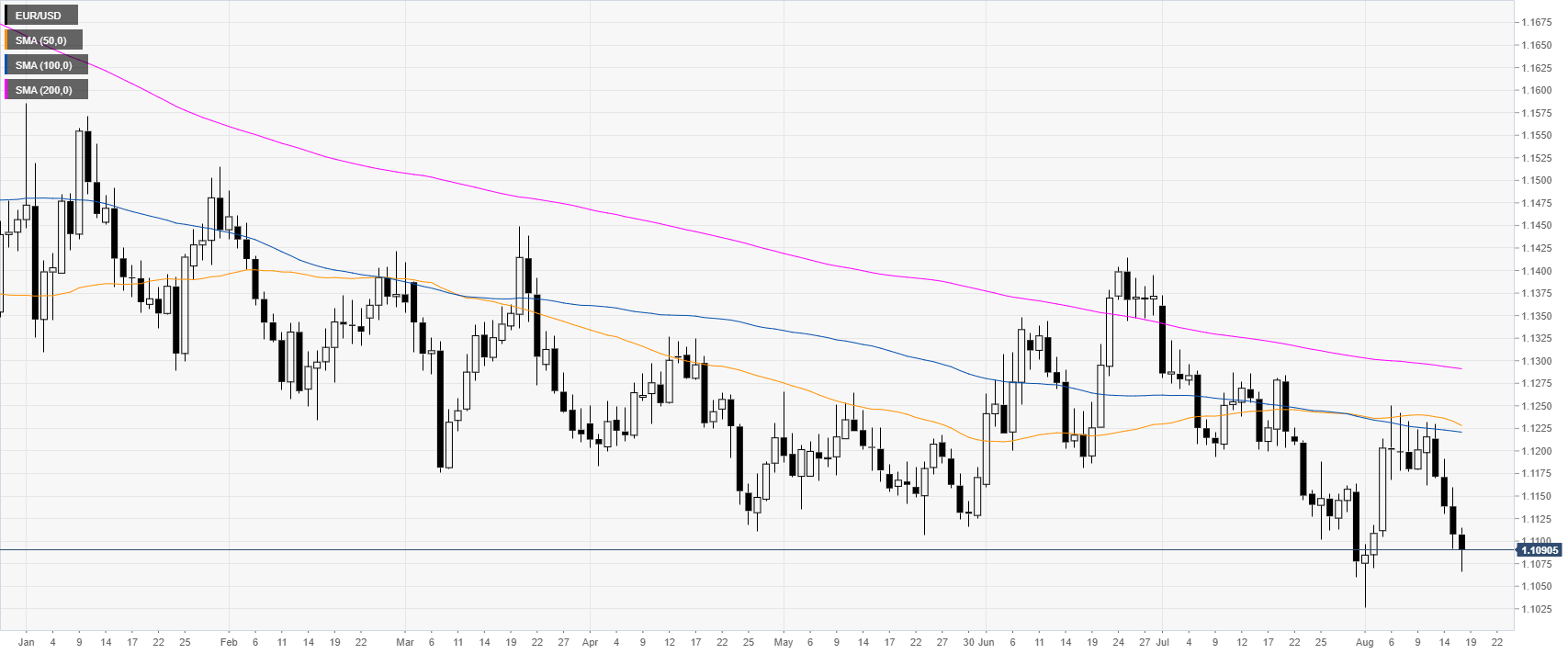

Daily chart EUR / USD

Over the daily period, the common currency trades in a bearish trend lower than the simple daily moving average (DSMA). Recent data in the United States has helped maintain accountability. Inflation and the retail sales control group were positive. In addition, the easing of trade tensions between the United States and China also supports the greenback. Meanwhile, ECB member Olli Rehn said Thursday that the ECB's stimulus package may exceed expectations in September. The comment dovish was perceived as bearish for the euro. On Friday, US consumer confidence was below expectations.

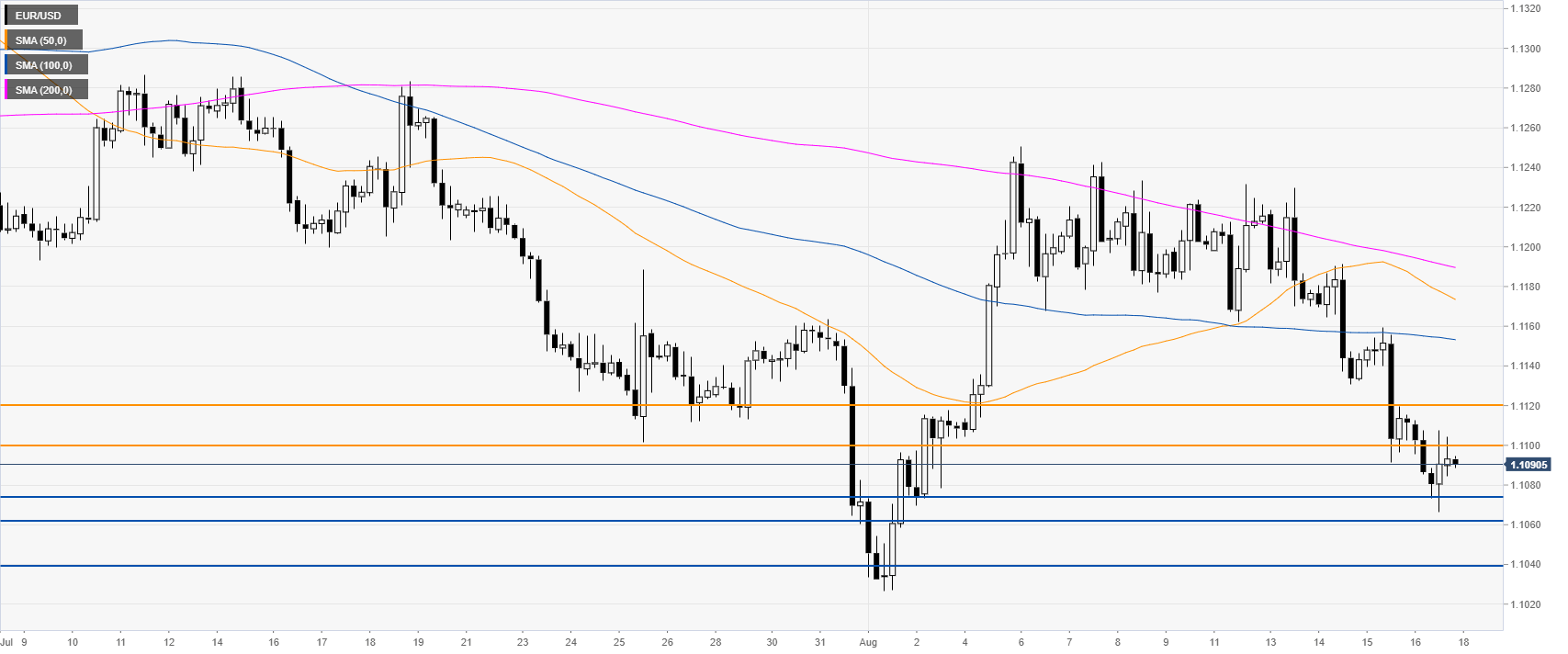

EUR / USD chart over 4 hours

The euro trades below the 1.1110 resistance and its major currencies, suggesting a bearish bias in the medium term. Bears need a break below 1.1074 to reach the 1.1062 and 1.1039 levels.

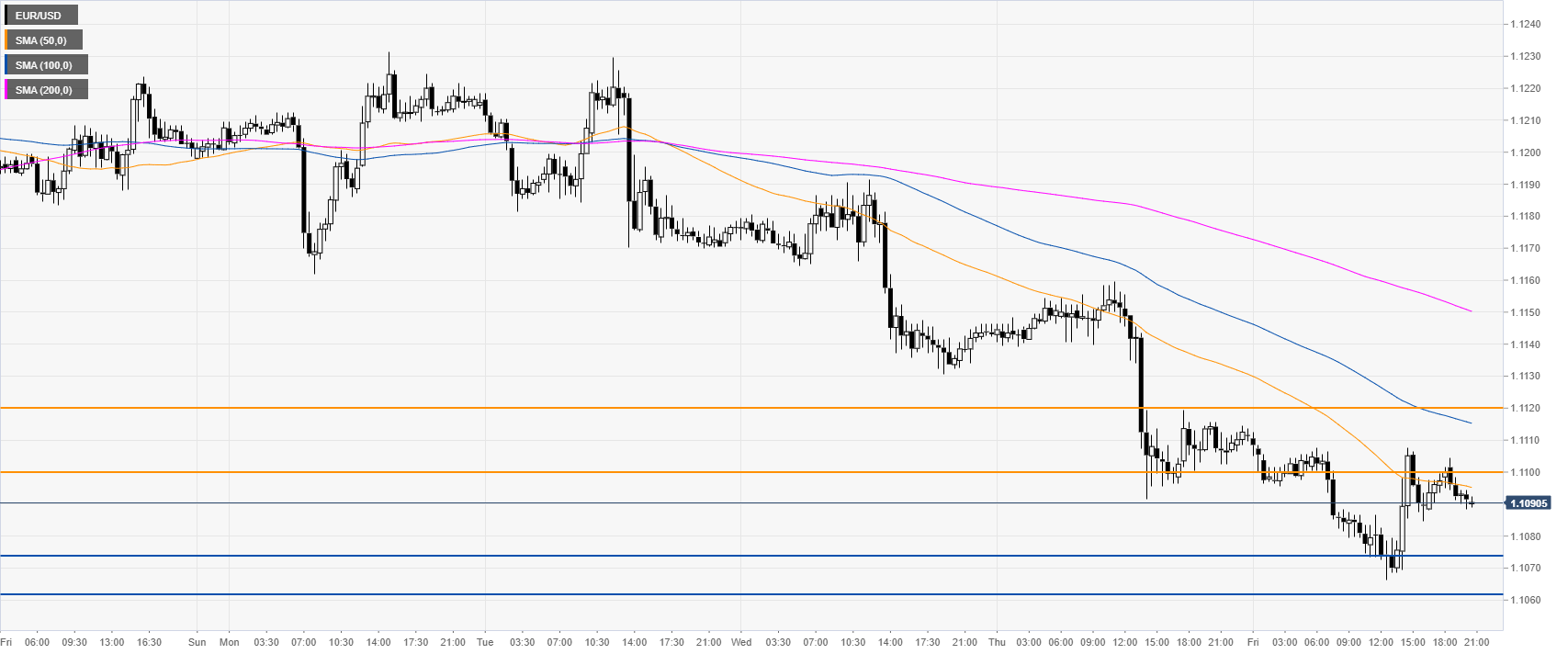

EUR / USD 30 minutes chart

Additional key levels

[ad_2]

Source link