[ad_1]

Samurai Messenger Service is preparing to deliver a packaged mattress from the Casper Bed Distribution Company in New York.

Yana Paskova | The Washington Post | Getty Images

Gone are the days when one dropped on a mattress after another on a clogged showroom floor.

Online mattress manufacturers who deliver to your home state that finding the perfect bed takes just a few clicks. But experts warn that it's important to look under the sheets. They say that many mattresses sold are actually very similar – despite the way they are marketed.

"The products you buy – there are many similarities and only a few minor differences," said Seth Basham, an analyst at Wedbush Securities, which covers the mattress business. He said that the core mattresses of different companies often use the same foam. "The different layers – what happens above what, may differ, but the big difference is in the way they are sold and marketed."

According to Michael Magnuson, founder of the GoodBed.com Mattress Review website, there are currently about 175 active bed-in-a-box companies. Their sales account for According to Basham, 12% of the mattress industry, worth $ 16.5 billion, although only the 10 largest companies in the world suffer a sharp deterioration. Key players include brands such as Purple, Casper, Nectar, Leesa and Tuft & Needle.

Mattress giants like Tempur Sealy and Serta Simmons should be nervous, said Peter Keith, an analyst at Piper Jaffray. The average sales units in these companies have decreased by 5% in the last two years.

A survey by the International Sleep Products Association revealed that 45% of mattresses purchased last year were online, compared to 35% for purchases in 2017.

Purple is the only public bed-in-box company, after merging with a public investment screen company in 2018, for a valuation of $ 1.1 billion. Its stock has dropped 40% since the merger and the company is currently valued at $ 355 million. Like many other bed-in-box companies, according to Basham, Purple has not yet made a profit. In 2018, the company achieved a turnover of $ 285 million and a net loss of $ 19.6 million.

The benefits are difficult to obtain because, according to Basham, the ease of creating an online mattress business makes the market competitive. "The barriers to entry are low, but the barriers to profitability are high," he said. "It does not take a lot of things to design a mattress, a marketing campaign, create a website, and let one of these big companies like Carpenter take care of the fulfillment for you," he said, referring to one of the leading mattress manufacturing companies. .

A purple mattress wrapped on the threshold of a door.

Source: Purple Innovations

Ease of manufacture

According to Magnuson, from GoodBed.com, the majority of bed-in-a-boxes outsource their manufacturing. "None of these guys, with a few exceptions, make their own mattresses," he said. "They literally call the producers:" We need a finished product and here is what the product should look like. "Sometimes they do not even know what they want to look like."

Companies manufacturing their own mattresses include Brentwood Home, Brooklyn Bedding and Purple, Magnuson said. Many of the larger beds-in-beds research and develop mattresses themselves, which differentiates their feelings. And companies like Tuft & Needle, Casper and Leesa have foam layers with exclusive formulas, which means that they are not identical to each other.

According to Dan Schecter, Executive Vice President of Sales and Marketing at Carpenter, most subcontractors only cover four major manufacturers. He said his company makes mattresses for 40% of the mattress industry in 60 factories across the country. This includes about 14 brands of bed-in-a-box, as well as all traditional actors like Tempur Sealy.

"The customer comes to us … he says that he wants a mattress that does these things against the body, and he would like these features and benefits to be part of his marketing story." We then create mattresses that will Harmonize with what the vision is, "he said.

Akrum Sheikh, CEO of Layla, said that companies that manufacture their own products are "at a disadvantage because they may be limited to using their own technologies and capabilities."

"In order for Layla customers to truly benefit from the product, we believe in a business model combining the use of licensed technology and the capabilities of many manufacturers, coupled with our own proprietary inventions bundled into a superior product. "Sheikh said. "This model allows us to innovate and create without restrictions."

Schecter stated that Carpenter's mattresses did not have the same foam formulations and that the company was only committed to designing and manufacturing mattresses that were scientifically based.

Purple emphasizes the science behind its mattresses, especially its "Smart Comfort Grid" layer, which helps relieve the pressure on your body during sleep. Eight Sleep is another state-of-the-art company that boasts the application of temperature control and sleep tracking of its mattress.

Such innovations help brands differentiate themselves, according to Keith.

"For a while, there were a lot of similarities, but you're starting to see big companies diversifying their offerings," he said. For example, some brands now sell luxury and less expensive versions, or hybrid models that include both foam and springs.

Marketing confusion

But all offers could well overwhelm consumers, said David Srere, co-CEO of the advertising agency Siegel + Gale.

"It's the amount of information, there is too much," he said. "If you go online, not only are they alike, but they all talk about their different products.If I tell you that my mattress is special because it's infused with copper gel, does that tell you anything? "

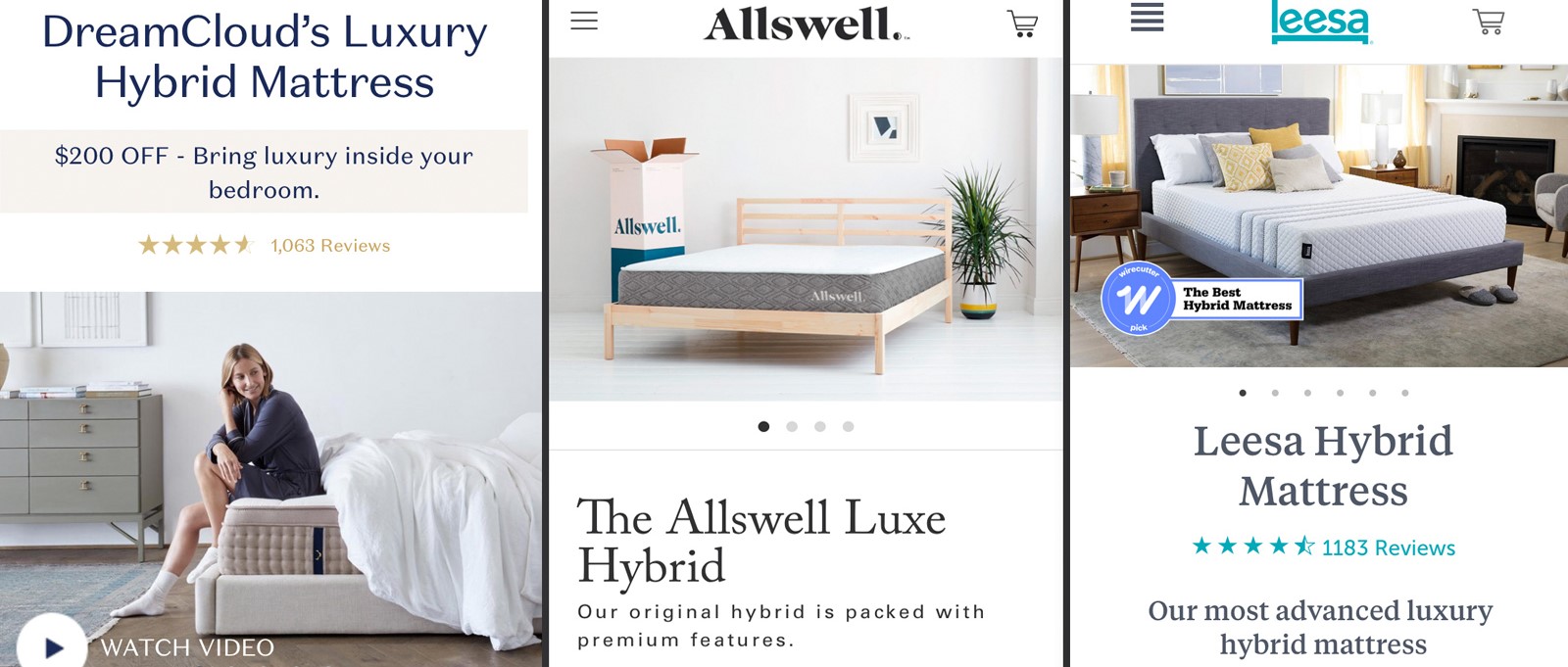

Layla, Sleep Science and Propel from Brooklyn Bedding all sell copper-based mattresses. DreamCloud, Leesa and Allswell, owned by Walmart, are just some of the brands offering hybrid mattresses.

Brentwood Home and Sleep Science were not immediately available for comment.

And the similarity between companies also applies to their marketing identity and brand, according to Armin Vit, co-founder of graphic design company UnderConsideration. He sees similarities in the colors, fonts and commercials of companies. "You can see a similar approach," he said. "In my mind, Casper was first, so I think they set the tone, they played well and others followed."

Casper, founded in 2014, was one of the first bed-in-a-box companies to make themselves known. Their logo, which is navy blue with a sans serif font, has similarities with Leesa's, launched in 2015, Nectar's, founded in 2016, and Purple's, also created in 2016.

Lives said the resemblance between logos and marketing could be intentional. "The goal is that something looks familiar," he said, as it is possible for consumers to mix the recommendations of someone on the mattresses with those of another. society.

"It's not ideal, it's not the most creative thing or the most authentic thing to do, but it's a bit like getting sales and confusing the customer market." . "

The messaging of each company is not much better. For example, Casper claims that its memory foam mattresses are for "those who are looking for a" just "feeling if you sleep on your back, side or stomach", while the firmness of the Nectar mattress is also "perfectly adapted" and offers "optimal comfort and support – whether you sleep at the front, rear or side".

Lives said: "There is some comfort in doing what the prosperous society does.Someone takes the lead and everyone says," Hey, that sounds good, let's go. "It's not exciting, but it's a little clever."

[ad_2]

Source link