[ad_1]

A customer is seen in a Target store in the Brooklyn neighborhood of New York.

Brendan McDermid | Reuters

Looking for reasons to be optimistic about the US economy? Try the aisles of the target.

Target shares climbed more than 20% to a record $ 103 a share on Wednesday, after the retailer announced a 17% profit increase in the second quarter, higher sales and a brighter outlook for the whole year. In-store pickup services attracted more customers.

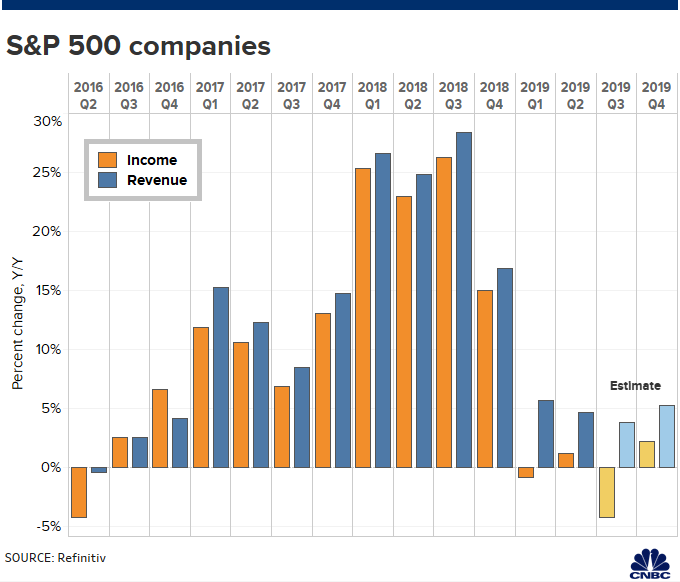

The retailer and some of its big competitors like Walmart stand out in what should be a season of mediocre results for US companies overall. The S & P 500, with more than 94% of its companies reporting their most recent quarterly results, is on track to record a 1.2% increase in quarterly profits over the previous year, according to the data compiled by Refinitiv on Wednesday afternoon. Sales of the largest 500 publicly traded US companies rose 4.7% on average in the last quarter, the lowest growth rate since the third quarter of 2016.

Unwanted news

This performance is bad news at a time of stock market volatility. When forecasters reduce the prospects for economic growth, trade tensions intensify and drive up the cost of imported goods. Economists are scrambling to find out if we are headed for a recession.

"We have reached a very high plateau, but it's a plateau," said David Kelly, chief global markets strategist at JP Morgan Asset Management. "The economy is slowing down."

The US economy grew 2.1% in the second quarter, its lowest rate since the first quarter of 2017 and down from 3.1% in the first three months of this year. Federal Reserve members voiced concerns last month about weak sectors of the economy such as manufacturing. According to the minutes of the Fed's July meeting, the trade uncertainties associated with the government-China trade battle, coupled with worries about global growth, continue to weigh on business confidence and investment projects. 39, business investment.

At this meeting, the Federal Reserve lowered interest rates for the first time in ten years, but the minutes released Wednesday said that this decision should not be considered a "pre-established path" for investors. future cuts, preventing companies rely on borrowing at lower rates.

However, strong job growth, rising wages, even if they are slow, and robust consumer spending are fueling the economy and some pockets of solid gains.

"The economy does not seem to sink into a recession because the consumer is still strong," said Jeremy Zirin, head of equity for the Americas at the Chief Investment Office of UBS Global Wealth Management.

Consumers continue to spend but growth has slowed

US consumer spending, which accounts for the lion's share of the economy, is increasing but at a slower pace. In June, consumer spending in the US rose 0.3%, down from the 0.5% monthly increase in May, the Commerce Department said late last month. However, a host of retail results show that businesses continue to grow as their weaker competitors struggle with the changing buying habits of US consumers.

"The underlying US consumer is doing well, making more money, working and, most importantly, spending more money," said Brian Moynihan, CEO of Bank of America, in an interview with CNBC. Tuesday, adding that customers are spending more. "The US consumer continues to spend, which will keep the US economy healthy."

American airlines, for example, who earn money traveling by air and selling frequent flyer miles to banks offering rewards to customers spending on co-branded or other credit cards, are in good shape. way for a 10th consecutive year of profitability. Leaders of major carriers said last month during a conference call on financial results that the strength of the US economy helped them boost their revenues.

Not all retailers are equal

But the booty is not distributed evenly.

At the retail level, department stores like Target and Walmart, which have invested in their companies to better compete with Amazon, have posted solid results.

"There are clearly winners and losers in the industry today … and the winners are companies like Target investing in the stores," said Target CEO Brian Cornell. during a call to the press after announcing his profits on Wednesday. He did not name the companies specifically, but said there are "donors" contributing to Target's performance.

The stores that anchor US shopping centers such as J.C. Penney and Macy's are still struggling, while fewer and fewer consumers are looking for such big shopping complexes to buy clothes, accessories and other products. Unique destinations, such as Target and Walmart, are attracting more consumers with their refurbished internal brands, wide selection of national brands, fast delivery options and US-based real estate, bringing them closer to home.

The shares of J.C. Penney fell below the dollar last month, risking delisting by the New York Stock Exchange.

"These retailers illustrate the bifurcation that occurs in retail between major capitals, off-mall chains and mall retailers facing a chronic decline in traffic," said Ken Perkins, founder of Retail Metrics. He said that many clothing chains are the ones that "still struggle".

Urban Outfitters announced this week a 35% decline in profits in the second quarter and a slowdown in sales. L Brands, the parent company of Victoria's Secret lingerie company, posted higher-than-expected profits this week, but weaker sales. Barneys New York has filed for bankruptcy protection this month and has announced plans to close stores in Chicago, Las Vegas and Seattle.

Even executives of companies that are doing well are cautious. Home Depot home improvement giant beat its profit forecast this week, but has reduced its outlook due to the potential impact of rates on its business.

Weak patches

There are however weak points in the economy.

Falling fuel prices hurt energy company performance in the final quarter, while global trade tensions, weaker growth and tariffs weigh on the materials and industrial sectors. The Boeing 737 Max crisis, caused by two fatal accidents, prompted the company to record its biggest loss in the second quarter. It also slowed production and halted deliveries, affecting several suppliers, including General Electric, already in trouble, which manufactures engines for besieged jets with its French joint venture partner Safran.

"I think it's always better when the economy is in full swing," said Kate Warne, chief strategist at Edward Jones, who noted that companies in general "have had more headwinds this year. year".

However, earnings growth seems weak compared to last year, when large companies reported higher profits after corporate tax cuts, she said.

Fragile business confidence

While profits have picked up in the 10 years since the US emerged from the recession, workers are demanding better wages and benefits, forcing some companies to pay higher wages, just like businesses seek to increase their results.

"The level of profits is spectacular, but it's very difficult for companies to generate profits from here," said JP Morgan & Kelly. "When you reach very high profit levels, workers all know it and the demands of" paying more or giving up, "tend to grow."

What needs to be kept in mind is business confidence, even more so than consumer confidence, because it will dictate future employment levels, he added.

"There is a certain fragility in business confidence, and we think we can avoid a recession, but the situation is getting closer and closer," Kelly said.

_CNBC & # 39; s Lauren Thomas and Jasmine Wu contributed to this report.

[ad_2]

Source link