[ad_1]

Since their invention, automobiles have driven the global economy.

Used by millions of people to commute to work, transport goods and travel, the modern automobile has become ubiquitous in our daily lives. So much so that a huge 92 million cars were produced in 2019 only.

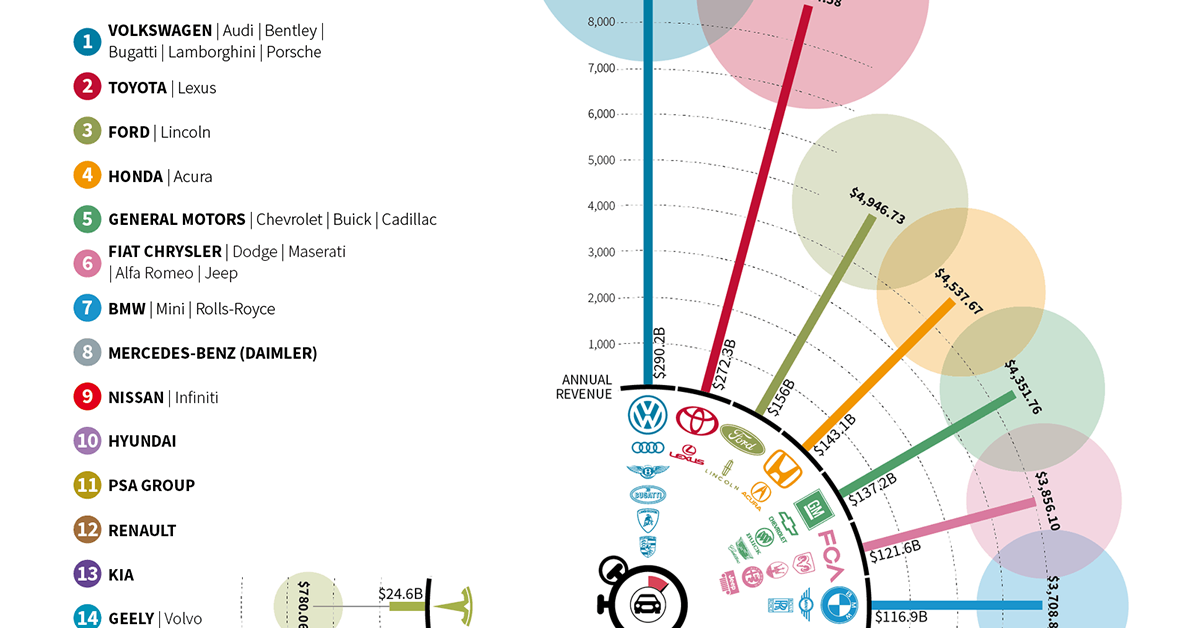

To help us understand the power of the auto industry, this infographic from Parts Geek breaks down the revenues of 19 major automakers by an interesting metric: revenue per second.

The complete list of car manufacturers

Below are the earnings for the 19 automakers featured in the infographic.

The Volkswagen group claims first place with $ 290.2 billion in gross sales, resulting in $ 9,202.88 per second. The world’s most valuable automaker, Tesla, which generated relatively smaller production $ 24.6 billion in gross income, or $ 780.06 per second.

| Car manufacturer | Gross income 2019 ($) | Gross revenue per second in 2019 ($) |

|---|---|---|

| Volkswagen | $ 290.2 billion | $ 9,202.88 |

| Toyota | $ 272.3 billion | $ 8,634.58 |

| Ford | $ 156.0 billion | $ 4,946.73 |

| Honda | $ 143.1 billion | $ 4,537.67 |

| General Motors | $ 137.2 billion | $ 4,351.76 |

| Fiat Chrysler | $ 121.6 billion | $ 3,856.10 |

| Bmw | $ 116.9 billion | $ 3,708.89 |

| Mercedes-Benz (Daimler) | $ 104.6 billion | $ 3,316.84 |

| Nissan | $ 92.0 billion | $ 2,918.81 |

| Hyundai | $ 90.8 billion | $ 2,879.25 |

| PSA Group | $ 84.0 billion | $ 2,664.17 |

| Renault | $ 62.4 billion | $ 1,979.84 |

| This | $ 50.0 billion | $ 1,585.49 |

| Geely | $ 45.9 billion | $ 1,457.70 |

| Tata Engines | $ 43.7 billion | $ 1,385.72 |

| Suzuki | $ 34.8 billion | $ 1,104.86 |

| Mazda | $ 32.1 billion | $ 1,017.88 |

| Subaru | $ 28.5 billion | $ 904.05 |

| You’re here | $ 24.6 billion | $ 780.06 |

A clear conclusion from this data is that Volkswagen and Toyota have a significant lead over the rest of their peers. Let’s take a closer look at how these two companies work.

The Volkswagen group

The Volkswagen Group has a comprehensive portfolio of brands and services and has been the world’s largest automaker in terms of sales for three years.

Starting with passenger cars and motorcycles, its many brands reported the following results for 2019.

| Mark | Vehicle sales | Sales revenue * ($) | Average income per vehicle ($) |

|---|---|---|---|

| Volkswagen | 3,677,000 | $ 99.1 billion | $ 26,960 |

| Audi (includes Lamborghini and Ducatti) | 1,200,000 | $ 62.4 billion | $ 52,028 |

| PITY | 1,062,000 | $ 22.2 billion | $ 20,912 |

| SEAT | 667,000 | $ 12.9 billion | $ 19,326 |

| Porsche | 277,000 | $ 29.2 billion | $ 105,491 |

| Bentley | 12,000 | $ 2.3 billion | $ 195,480 |

* Based on an exchange rate of 1.12 EUR / USD (December 31, 2019)

Source: Volkswagen

The other sources of income were from Volkswagen $ 44.5 billion commercial vehicle company, its $ 4.7 billion electrical engineering activity, and finally its $ 44.4 billion financial services division.

In total, the Volkswagen group has barely delivered 11 million vehicles in 2019, exceeding its 2018 deliveries by 1.3% and setting a new record for the group. While the majority of these vehicles were produced in Europe, the group operates a global production network with a significant presence in Asia.

| Region | Number of locations | Share of total production |

|---|---|---|

| Europe | 36 | 49% |

| Asia | 19 | 38% |

| South America | 6 | 5% |

| North America | 4 | 7% |

| Africa | 4 | 1% |

Source: Volkswagen

The German automaker has invested billions in China, the world’s largest auto market, to expand its electric vehicle (EV) production capabilities.

Toyota Motor Corporation

Toyota Motor Corporation operates a much more concentrated brand portfolio, Toyota and Lexus being its two most prominent names. This strategy seems to be working well, as Toyota was ranked ninth most valuable brand in 2019 and was the only automaker to place in the top ten.

A testament to Toyota’s global influence is its relatively balanced distribution of 2019 revenue by regional market:

- North America: 30%

- Japan: 25%

- Asia: 18%

- Europe: 11.5%

- Other: 15.3%

For comparison, here are Volkswagen’s 2019 revenue by region, which leans heavily towards Europe:

- Europe (excluding Germany): 42%

- Germany: 19%

- North America: 17%

- South America: 4%

- Asia-Pacific: 17%

The popularity of the Japanese automaker in foreign regions is likely a result of its reputation for reliability and affordability. It may also explain why Toyota trucks are commonplace in harsh environments such as conflict zones in the developing world.

In total, Toyota and its subsidiaries have sold nearly 9 million vehicles in 2019, setting a new record for the company, but only 0.1% higher than its 2018 figure. Like Volkswagen, the majority of Toyota vehicles are produced in its region of origin, the remainder being built around the world.

| Region | Share of total production |

|---|---|

| Japan | 50% |

| North America | 20% |

| Asia | 17% |

| Europe | 8% |

| Other | 5% |

Source: Toyota

Outside of Japan, Toyota has significant production capacity in the United States, where it manufactures everything from pickup trucks to sedans. In 2016, the Toyota Camry made headlines after being named America’s most manufactured car – over 75% of its parts originated in the country.

Alternative sources of income

While the automobile represents the main activity of these companies, many of them have alternative sources of income. Honda, for example, produces motorcycles, boat engines, lawn mowers and even personal jets.

Porsche takes a slightly different approach with its accessories and licensing subsidiary, Porsche Design. Since 2003, a variety of lifestyle items including eyewear, smartphones and watches have been sold under the Porsche name. His most notable project is the Porsche Design Tower Miami, a residential skyscraper with a robotic car lift.

Finally, manufacturer of electric vehicles (EV) You’re here generates additional revenue by selling carbon credits to other automakers who fail to meet government-imposed quotas on EV sales. Since Tesla only produces electric vehicles, it does not need its credits and is free to sell them. In the second quarter of 2020, Tesla won $ 428 million from the sale of carbon credits, representing 7% of its total revenues over the period.

The road ahead

Additional revenue streams continue to open up as automakers incorporate new technologies into their cars.

Cadillac and You’re here, two American brands, have both announced that their autonomous driving capabilities will eventually become a paid subscription service. Meanwhile, German automakers are expanding into wireless services. Bmw says it will become the first automaker to offer 5G connectivity in its cars, while Mercedes now sells downloadable software packages to enhance the driver experience.

While it is too early to say whether or not these services will have a significant impact on an automaker’s bottom line, forecasts indicate that this so-called “connected car market” will be worth $ 166 billion by 2025. To put that into perspective, that’s more than half of Volkswagen’s gross revenue in 2019, or $ 5,264 per second.

Thank you!

The given e-mail address is already registered, thank you!

Please provide a valid email address.

Please complete the CAPTCHA.

Oops. Something went wrong. Please try again later.

[ad_2]

Source link