[ad_1]

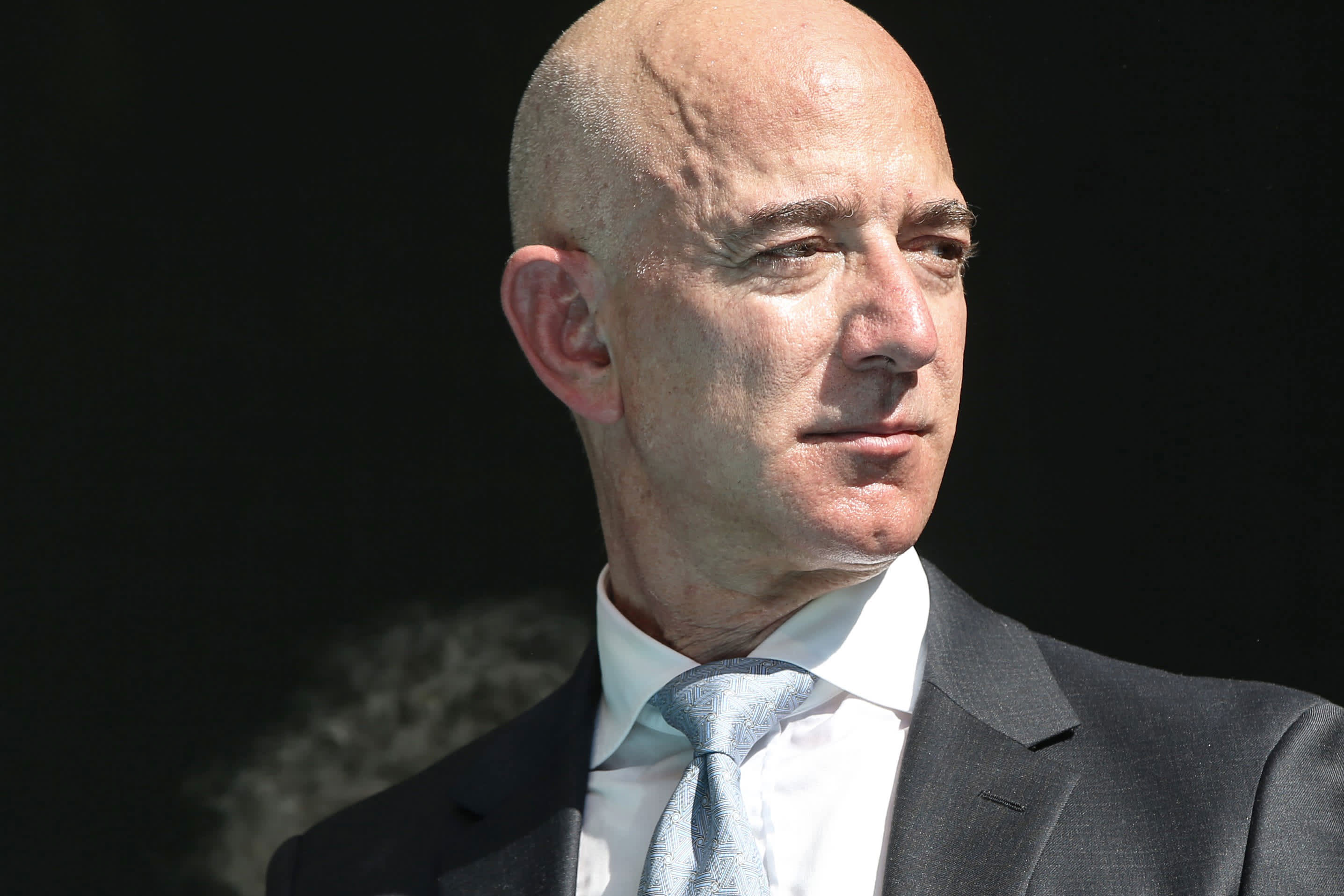

Amazon CEO Jeff Bezos, October 2, 2019.

Elif Ozturk | Anadolu Agency | Getty Images

Amazon faces renewed pressure to answer questions about its use of third-party seller data after European Union regulators filed antitrust charges against the company on Tuesday.

Europe’s leading antitrust watchdog, the European Commission, has accused Amazon of violating competition law by using non-public data collected from third-party merchants to compete unfairly with them. She also opened a second investigation into Amazon’s business practices related to the Prime label and the “Buy Box,” which offers customers a one-click button to add a product to their cart.

Amazon has dismissed the European Commission’s accusations and said it supports thousands of businesses in Europe.

The European Commission is still investigating, but if it finds that Amazon has violated antitrust rules, the investigation could provide new evidence to strengthen similar antitrust cases pending against Amazon in the United States.

Congress and the Federal Trade Commission are also investigating Amazon’s treatment of third-party sellers. It’s unclear what the scope of the FTC’s investigation is, but the agency interviewed third-party sellers as part of the investigation, Bloomberg reported last September. The Judicial Chamber’s antitrust subcommittee released the results of its 16-month investigation into Amazon and other tech giants last month, where it discovered Amazon had a monopoly on third-party sellers in the market.

The two investigations are at different stages. After publishing a detailed report on the competitive practices of Amazon, Apple, Google and Facebook, lawmakers are expected to pass legislation based on their policy recommendations.

Meanwhile, the EU has yet to file legal action against Amazon, so it could be years before announcing sanctions. He could also come to an agreement with Amazon or abandon the case altogether.

Shared concerns

Regulators in Europe and the United States have objected to Amazon’s dual role as market operator and seller, arguing that it could foster anti-competitive behavior.

They pointed out that Amazon’s role as a marketplace service provider gives it privileged access to non-public data from third-party sellers, such as order volume history, shipping data, and past performance of vendors. vendors, which are not available to merchants.

EU officials and House Democrats on the Antitrust Judicial Subcommittee share the view that this data from third-party sellers is used to inform Amazon’s first-party business decisions, such as which products to sell. introduce and where to set the price.

The snapshot “allows Amazon to focus its offerings on top-selling products across all product categories and adjust its offerings based on non-public data from competing sellers,” the EU said in a statement Tuesday.

Likewise, the antitrust subcommittee included in its investigation testimony from third-party sellers who said their businesses were damaged when Amazon launched competing products. For example, a retired third-party merchant was forced out of his business as a seller after Amazon allegedly copied his products, “down to the color scheme”, reduced the price to him, and “took over the Buy Box for its ads, “killing its sales,” the antitrust subcommittee said, citing an interview with the seller.

Amazon has long argued that it does not look at the data of individual sellers to create private label products, as this would violate internal policies. The company has acknowledged, however, that it may refer to aggregate data in the process of building its own products.

Amazon has also refuted claims by regulators that it is exploiting its control over the “Buy Box” to give preferential treatment to its own products and those presented by sellers who use its logistics and delivery service, called Fulfillment By Amazon. . The “buy box” refers to a section on the side of a product page where sellers compete for their offers to be shown.

Amazon argued that the Buy Box presents the offer it thinks customers will prefer, while taking things like price and speed of delivery into account. During a July hearing before Congress, CEO Jeff Bezos acknowledged that the Buy Box algorithm “indirectly” promotes offers that can be shipped with Prime to determine which sellers are featured.

The House of Commons antitrust subcommittee investigation and the EU investigation have raised questions about the ability of third-party sellers to reach Prime users.

In the October report, U.S. lawmakers said they spoke to third-party sellers who feel they have “no choice” but to pay for Fulfillment by Amazon, which makes their products eligible for Prime, in order to “maintain a favorable position in search results, reach over 112 million Amazon Prime members and win the Buy Box.”

Winning the Buy Box is crucial for the success of third-party sellers’ products. The antitrust subcommittee estimated that about 80% of Amazon’s sales go through the Buy Box and “the percentage is even higher for mobile purchases.”

Prime members are also an important source of income for third-party sellers, as they tend to generate more sales in the Amazon Marketplace than non-Prime users, the European Commission has said. Prime members not only spend more money per purchase, but they also tend to buy more frequently from the site.

As the EU and US question Amazon’s market power over sellers, it is now up to Amazon to provide proof that it treats traders fairly.

The company categorically challenged the findings of the House antitrust subcommittee, calling them “fringe notions.” Amazon can respond to the Commission’s findings in writing or through a hearing.

“The ball is in Amazon’s court to refute these claims,” said Shaoul Sussman, a lawyer at the Institute for Local Self-Government, a non-profit organization.

And after

The EU and the US have identified similar issues with Amazon’s treatment of sellers, but the potential penalties and remedies they could address are likely to be different.

Democratic staff members of the House Judiciary Subcommittee on Antitrust have recommended a wide range of remedies, including requiring companies to prove that mergers would not hurt competition and divide different business units. For Amazon, this could cause the third-party market to split from its core retail business.

Regarding the FTC investigation, Amazon could be fined or the company could come to an agreement with the agency in which it accepts certain trade restrictions.

Likewise, the EU has a range of sanctions it could propose, including a fine of up to 10% of Amazon’s annual global revenue, or up to $ 28 billion based on 2019 figures.

The EU could also offer behavioral remedies, which attempt to preserve competition by forcing companies to refrain from certain business practices. But behavioral remedies can be “hit and miss” in terms of effectiveness, as some companies may find it “more profitable to violate the remedy and simply pay the fines if found in violation again,” Sussman said.

The most aggressive tool in the EU’s arsenal would be to recommend a separation of business lines, Sussman said. For Amazon, that could mean that the EU is ordering it to stop selling its private labels in Europe.

“This type of decision will not affect the United States or any other market in which Amazon sells these products, but they could mean that if you are transacting in Europe, you are not allowed to be a brand owner or manufacturer. and operator of the platform, ”Sussman said.

Sussman and other antitrust experts have said they remain skeptical whether the United States will succeed in bringing a lawsuit against Amazon and even if antitrust officials do, remedies will likely be limited. In contrast, European regulators have stepped up efforts to crack down on big tech companies like Facebook, Google and Apple in recent years, earning them a reputation for being more aggressive.

The United States and Europe have different approaches to assessing whether a company is engaging in anti-competitive behavior.

US antitrust law centers on the consumer welfare standard, which relies heavily on rising prices as an indication of harm. This standard has been difficult to apply to tech companies, as many of the products and services offered are free or low cost in the case of Amazon.

In the United States, a company like Amazon can argue that any harm to its competitors is outweighed by any benefit to consumers, which is lower prices and greater selection, Sussman said.

This argument is more difficult to prove before European antitrust authorities. The EU takes a broader view when determining whether a company’s business practices are anti-competitive, including prejudices to consumer choice, potential competitors and innovation.

As a result, it may be easier to bring antitrust action in the EU than in the United States, said Eleanor Fox, a law professor at New York University. This is part of the reason the United States is trying to catch up with EU regulators, said Fox, who have led a crackdown on US tech giants including Google, Facebook and Apple.

“This difference is what we struggle with and it’s why the United States has been so slow to make statements,” Fox said.

[ad_2]

Source link