[ad_1]

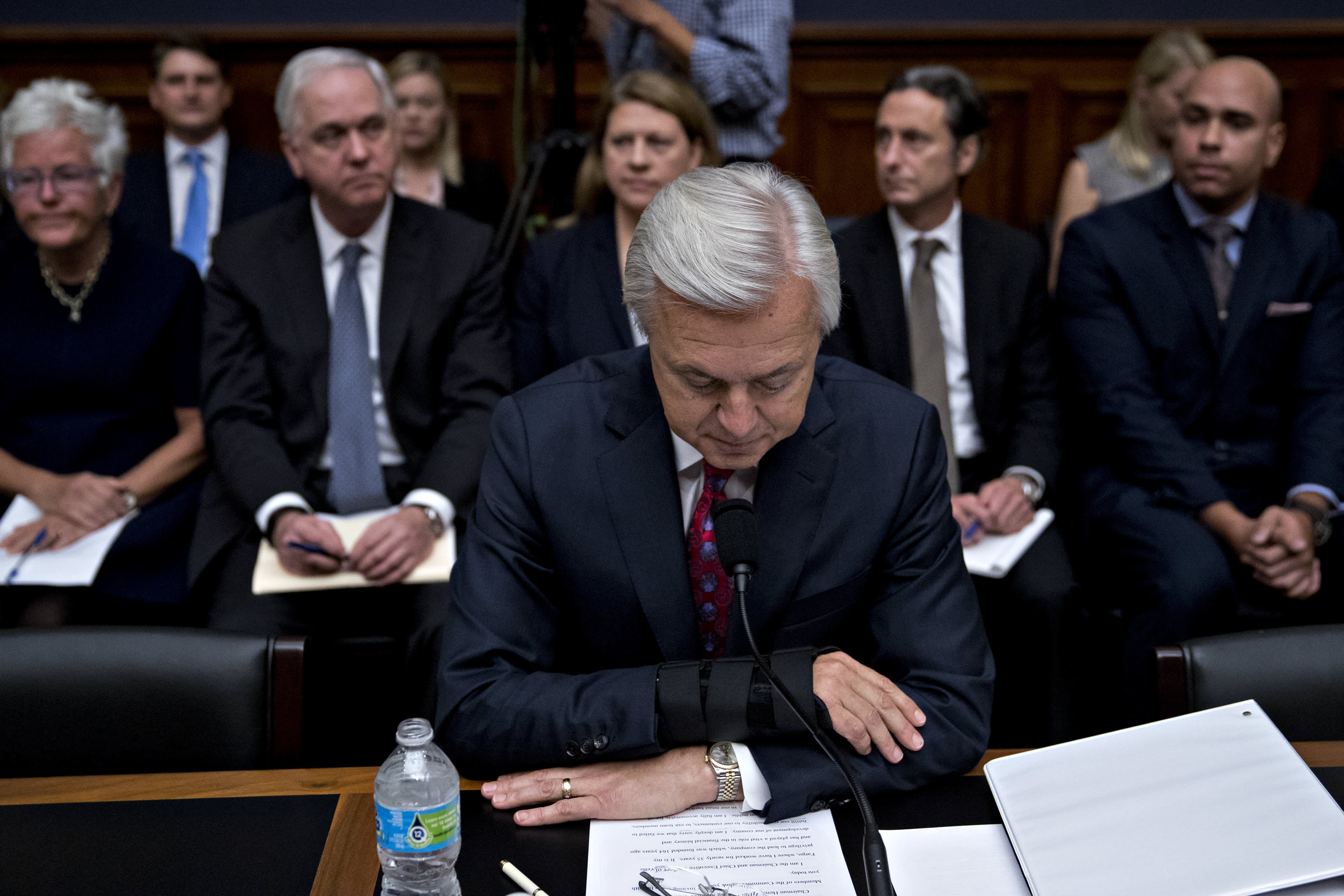

John Stumpf, Managing Director of Wells Fargo & Co., waits to begin a House Financial Services Committee hearing in Washington, DC, the United States, Thursday, September 29, 2016.

Andrew Harrer | Bloomberg | Getty Images

Former Wells Fargo CEO John Stumpf and former deputy Carrie Tolstedt have been accused by the Securities and Exchange Commission of misleading investors about the bank’s success in selling several products to its customers.

Stumpf has agreed to pay a civil penalty of $ 2.5 million to resolve the issue, allowing him to avoid admitting or denying the charges, the SEC said Friday.

The two executives had certified investor disclosures in 2015 and 2016 that touted the company’s supposedly robust “cross-sell” metric, despite knowing it was misleading, the SEC said in a statement. Metrics is an industry term for the number of products from a single customer.

Wells Fargo was later found to have inflated that metric by placing millions of customers in products without their consent, a scandal that cost Stumpf his job in 2016 and even that of his successor Tim Sloan. Current CEO Charlie Scharf took over a year ago and was tasked with overhauling America’s fourth-largest bank and meeting regulators’ demands for better controls.

“If executives are talking about a key performance measure to promote their business, they need to do it completely and accurately,” said Stephanie Avakian, director of the SEC’s Enforcement Division.

The SEC complaint, filed in California, accuses Tolstedt of fraud and calls for sanctions and prohibits him from being an officer or director of a public company.

According to the SEC complaint, Tolstedt publicly endorsed the company’s much-vaunted cross-selling metric from 2014 to 2016, despite being “bloated by unused, useless or unauthorized accounts and services.”

Earlier this year, Wells Fargo paid $ 3 billion to settle several U.S. polls in its operations, including a $ 500 million deal with the SEC. The regulator said it would distribute the money collected from Stumpf and the bank to investors.

[ad_2]

Source link