[ad_1]

Shares of Affirm Holdings Inc. nearly doubled Wednesday after the fintech company debuted on the stock market.

Affirm AFRM actions,

open at $ 90.90 Wednesday after listing on the Nasdaq, with the first trade at 12:20 p.m. ET. The company valued its initial public offering at $ 49 a share on Tuesday night, above a range already raised from $ 41 to $ 44 a share. Stocks recently changed hands to just under $ 98.

The company raised at least $ 1.2 billion through the offer. The underwriters have access to an overuse of 3.7 million shares in excess of the 24.6 million shares initially sold by Affirm when it went public. Affirm reportedly delayed its IPO at the end of last year due to large day one stock movements at Airbnb Inc. ABNB,

and DoorDash Inc. DASH,

Affirm, led by PayPal Holdings Inc. PYPL,

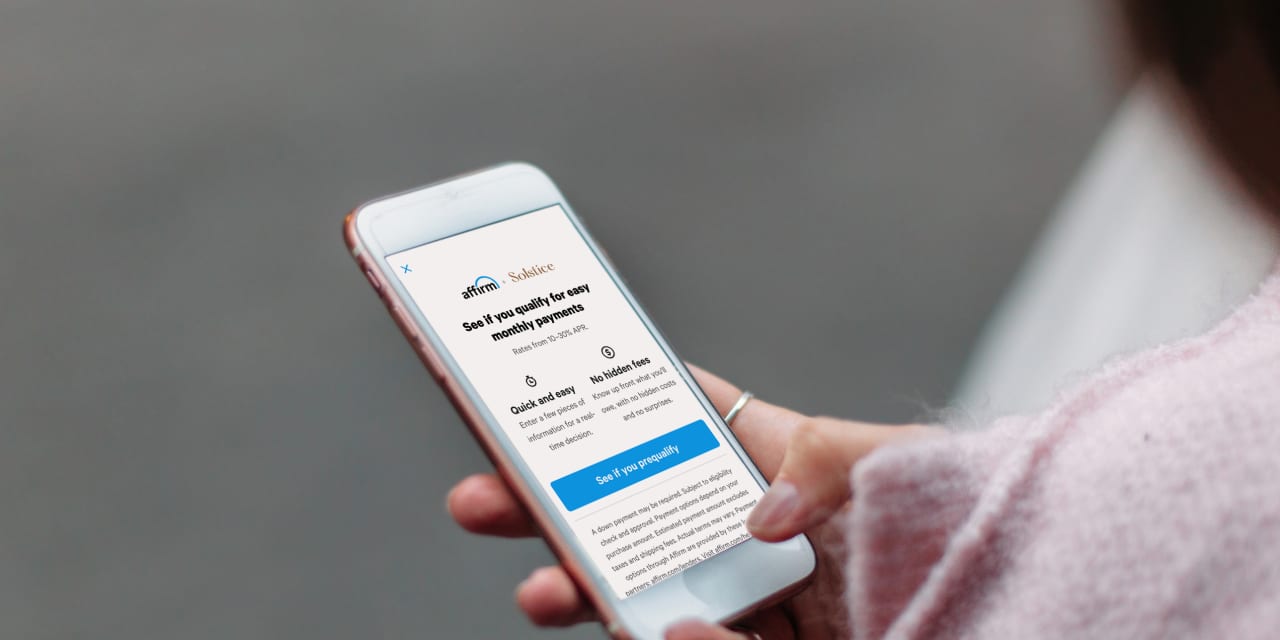

co-founder Max Levchin, offers payment options that allow people to shop online in installments. The business receives compensation from merchants when customers opt for one of Affirm’s loan options. Affirm offers an interest-free “0% APR” offer as well as a “simple interest” loan product through which it is also paid on the consumer side of a transaction.

Levchin told MarketWatch that transparency in terms of how much consumers will ultimately pay for a given purchase is becoming “a required characteristic and not a good thing to have” among the generations who are currently “financially active” and those to follow. .

“Revolving credit is a tool that is not as useful as it is dangerous,” he said in an interview after the transactions started. Levchin predicted that the majority of established players would switch to simple interest products rather than compound products.

Affirm the IPO: 5 things to know about the fintech shaking up online credit

The company’s biggest customer is Peloton Interactive Inc. PTON,

which represented approximately 28% of Affirm’s revenue in its most recent fiscal year which ended in June. Affirm reported revenue of $ 509.5 million in its most recent fiscal year, up from $ 264.4 million a year earlier. The company recorded a net loss of $ 112.6 million, compared to a loss of $ 120.5 million in the prior year period.

“The pandemic has created an enabling environment as more value-conscious buyers seek ways to finance their online purchases transparently,” Rohit Kulkarni, analyst at MKM Partners, wrote in a pre-IPO note to clients.

Affirm works with banking partners who originate many of the company’s loans.

Levchin sees great opportunities ahead, arguing that we are “still in the early days of what payments and money look like”, and calling the financial services industry perhaps the world’s largest with energy. . Affirm has expanded its merchant base, which now boasts more than 650,000 brands, and the company has entered into deals with companies such as Walmart Inc. WMT,

and David Yurman who incorporate in-store fundraising elements alongside online elements.

Another potential area is that of customer loyalty. “I’ve learned not to pre-advertise products the hard way,” Levchin said, noting that there is “a huge opportunity to reward customers who bring their money to merchants they love.”

The offer comes as the IPO of the Renaissance IPO ETF,

has gained 22% in the last three months and as an S&P 500 SPX,

increased 8.5% over the same period.

[ad_2]

Source link