[ad_1]

Photographer: Soichiro Koriyama / Bloomberg

Photographer: Soichiro Koriyama / Bloomberg

Treasury yields and the dollar rose Thursday after a report said President-elect Joe Biden was forecasting a Covid-19 relief package of around $ 2 trillion. In Asia, Japanese equities outperformed.

Biden’s advisers recently briefed Congressional allies on the cost of the package, according to the report. Biden is expected to announce his economic support plans later today. Yields had previously stabilized after falling from their highest levels since March, after two strong bond auctions this week.

An indicator for Asia-Pacific stocks edged higher, on track for another record high. US and European equity futures were higher. Tech stocks led Wall Street’s gains on Wednesday, with the Nasdaq 100 outperforming the S&P 500.

Alibaba Group Holding Ltd. and Tencent Holdings Ltd. climbed after the United States decided not to ban U.S. investments in Chinese tech giants. Oil held losses and Bitcoin changed little at around $ 37,500.

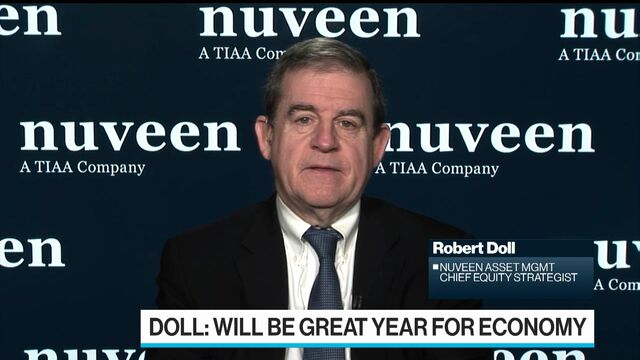

“It will be a great year for the economy and earnings, but just a great year for the stock market,” Bob Doll, chief equity strategist at Nuveen, said on Bloomberg TV. “In other words, I think the multiples are held back a bit due to the slight rise in interest rates and inflation.”

Investors are betting on an economic recovery this year and are tolerating strained stock valuations, in part on expectations of further US tax spending and better control of the pandemic through vaccines.

The latest comments from policy makerIts also heightened expectations for a loose monetary policy. Fed Governor Lael Brainard rebuffed suggestions the central bank could cut its bond buying program this year, while European Central Bank board member Francois Villeroy de Galhau said the ECB would keep an easy position for as long as needed.

Federal Reserve Chief Jerome Powell is due to discuss topics such as the Fed’s policy framework later Thursday. Previously, the House of Representatives voted to impeach President Donald Trump for the second time. A Senate trial for Trump is unlikely to begin until his term ends on January 20.

On the virus front, the UK has reported the most deaths in a day since the start of the pandemic. Johnson & Johnson’s single-dose Covid-19 vaccine may not be cleared until March, weeks later than U.S. officials suggested.

Bob Doll, chief equity strategist at Nuveen, says US economic growth and corporate earnings will be “out of this world” this year.

Here are some key upcoming events:

- JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. is one of the companies that declares their profits.

- US President-elect Joe Biden plans to present tax support proposals Thursday.

- Federal Reserve Chairman Jerome Powell takes part in a webinar Thursday.

- The first data on jobless claims in the United States is due on Thursday.

- US retail sales, industrial production, business inventories and consumer sentiment figures are expected on Friday.

Here are some of the main movements in the markets:

Stocks

- S&P 500 futures gained 0.3% at 12:27 p.m. in Tokyo. The gauge rose 0.2% on Wednesday.

- The Japanese Topix index added 0.9%. The Nikkei 225 rose 1.4%.

- The Hang Seng index gained 0.5%.

- Shanghai Composite lost 0.3%.

- South Korea’s Kospi index rose 0.1%

- The Australian S & P / ASX 200 index rose 0.5%.

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%.

- The euro bought up $ 1.2142, down 0.1%.

- The yen slipped 0.2% to 104.07 per dollar.

- The offshore yuan traded at 6.4689 per dollar.

Obligations

- The yield on 10-year Treasuries rose about three basis points to 1.11%.

Basic products

- West Texas Intermediate crude fell 0.2% to $ 52.81 per barrel.

- Gold was at $ 1,838 an ounce, down 0.4%.

– With the help of Dave Liedtka, Vildana Hajric, Benjamin Purvis, Claire Ballentine, Cormac Mullen and Joanna Ossinger

[ad_2]

Source link