[ad_1]

U.S. officials deliberated but ultimately decided not to ban U.S. investments in Alibaba Group Holding Ltd. and Tencent Holdings Ltd., said a person familiar with the discussions, removing a cloud of uncertainty over Asia’s two largest companies.

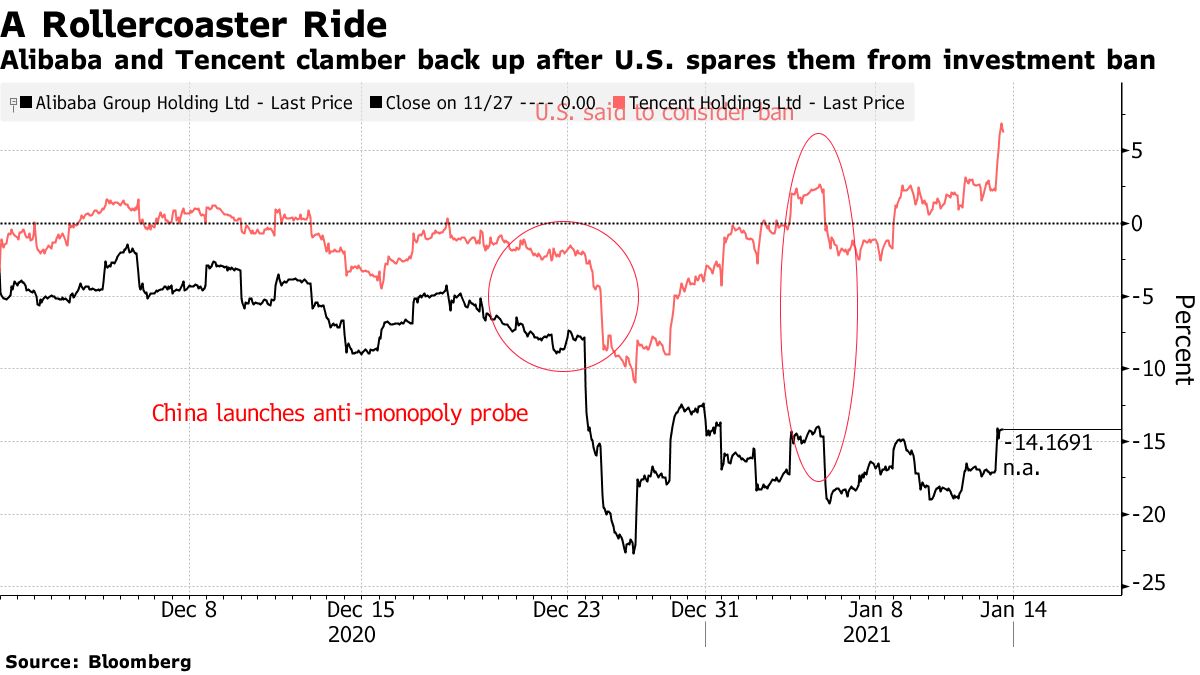

The Treasury Department blocked a Pentagon effort to add the two internet companies on the grounds that they had aided the military, the person said, asking not to be identified while discussing private discussions. Officials also debated blocking the research leader Baidu Inc., but abandoned the plan, the person added. Alibaba’s Hong Kong stock climbed 3.9% while Tencent rose nearly 5% on news of the reprieve, which was first reported by The Wall Street Journal. Their dollar bonds spread tightened Thursday morning.

The move removes uncertainty over Chinese social media and video game leader Tencent and Alibaba, the e-commerce titan founded by billionaire Jack Ma who is now under intense regulatory scrutiny by regulators in Beijing. President Donald Trump has signed an amended version of his executive order banning investments in Chinese military-related companies, the White House said in a statement Wednesday that did not mention any company by name.

Imposing a ban on the pair would have marked the most dramatic escalation to date by the outgoing administration, given the sheer size of the two companies and the difficulty in unwinding positions. At over $ 1 trillion, their combined market value is almost twice the size of the Spanish stock market, while the companies together account for about a tenth of the weighting of MSCI Inc.’s benchmark for emerging markets.

Read more: Alibaba’s Jumbo Bond deal goes silent with Ma out of sight

Citing national security, Trump previously signed an executive order in November demanding that investors pull out of Chinese companies linked to that country’s military. The Defense Department will add more companies to the list, the person said without giving further details.

It would further shatter the relationship between the world’s two largest economies, which have clashed over everything from Covid-19 to Hong Kong. Authorities in Washington have stepped up efforts to deprive Chinese companies of U.S. capital in the final months of the Trump administration, adding to economic tensions as President-elect Joe Biden prepares to take over this month.

Hasty measures have sometimes confused markets and caused price swings, such as when the New York Stock Exchange twice reversed course on a decision to delist three Chinese telecommunications companies. The NYSE is now proceeding with its initial delisting plan after US Treasury Secretary Steven Mnuchin disagreed with his decision to grant a stay of business.

Trump’s order banned trading in the affected securities from January 11. If Biden leaves Trump’s executive order in place, U.S. investment firms and pension funds would be required to sell their holdings in companies linked to the Chinese military by November 11. determines that other companies have military ties in the future, US investors will have 60 days from this decision to divest.

– With the help of Catherine Ngai

(Updates with Hong Kong action and second paragraph chart)

[ad_2]

Source link