[ad_1]

Day traders are credited with starting a revolution on Wall Street, helping to revitalize the shares of GameStop Corp. GME,

and AMC Entertainment Holdings AMC,

and undermine the foundations of segments of the hedge fund industry in the process.

Now a group of data providers are betting that financial markets will never be the same again and that investors with deep pockets will shell out big bucks to monitor discussions on message boards like Reddit’s r / wallstreetbets and media platforms. social media like Discord for mentions of listed companies.

“We think this is kind of a watershed and maybe irreversible moment,” Boris Spiwak, chief marketing officer for alternative data firm Thinknum, told MarketWatch in an interview Monday. Thinknum’s plans were mentioned in a Barrron article this weekend.

Spiwak said he envisions clients using the services of companies like Thinknum as a way not only to profit from chatting on social media platforms, but also as a form of crisis management, while klatching Individual investors come together on platforms to coalesce around investment ideas. .

“It’s very new and we see it as a crisis management buy, as an insurance policy and a way to increase returns and minimize losses,” he said for clients.

Thinknum’s service, which started last week, is one of the most expensive it offers customers, costing just under $ 25,000 a year, to track the number of calls from publicly traded companies. New York and those of the Nasdaq. on sites like r / wallstreetbets or other Reddit subreddits.

“The demand has been massive – we’ve had over 100 incoming requests for hedge funds in the past few days,” wrote Thinknum’s marketing director.

So far, interest in these expensive products has come from fund managers, but the company says it is also responding to requests from institutional investors looking for an “insurance policy to protect themselves from Reddit.” .

The alternative data company’s moves come in as video game retailer GameStop and other companies, such as movie chain AMC Entertainment and headset maker Koss Corp. KOSS,

have seen a parabolic surge in stock values over a short period of time, as investors flocking to sites like Reddit’s r / wallstreetbets poured millions into heavily bypassed companies to trigger a rally of these. actions.

The recent rise in heavily sold stocks targeted by the army of individual investors appears to be a source of pain for hedge funds.

Melvin Capital Management, one of the hedge funds seen at the center of the confusion on GameStop, lost 53% on its investments in January, the Wall Street Journal wrote, citing people familiar with it. WSJ also said that another hedge fund Maplelane Capital ended January with a loss of around 45%.

Meanwhile, Andrew Left, founder of Citron Research, a famous short seller last Friday, changed his strategy, saying his company would no longer publish short selling reports. Left has been seen drawing the wrath of individual investors for his negative views on GameStop – a physical retailer he said was only worth around $ 20 amid a growing shift in digital video game sales.

“Young people want to buy stocks. He’s the zeitgeist, ”Left said of his decision to quit the business of identifying companies he thinks are overvalued and publicly announcing that he’s betting his stocks are going to sink.

“They don’t want to sell stocks, so I’m going to help them buy stocks,” Left said of his focus on long investing.

Other companies, including SimilarWeb, are also trying to promote tools that allow investors to follow investments and discussions on popular social media sites and some of the popular trading platforms.

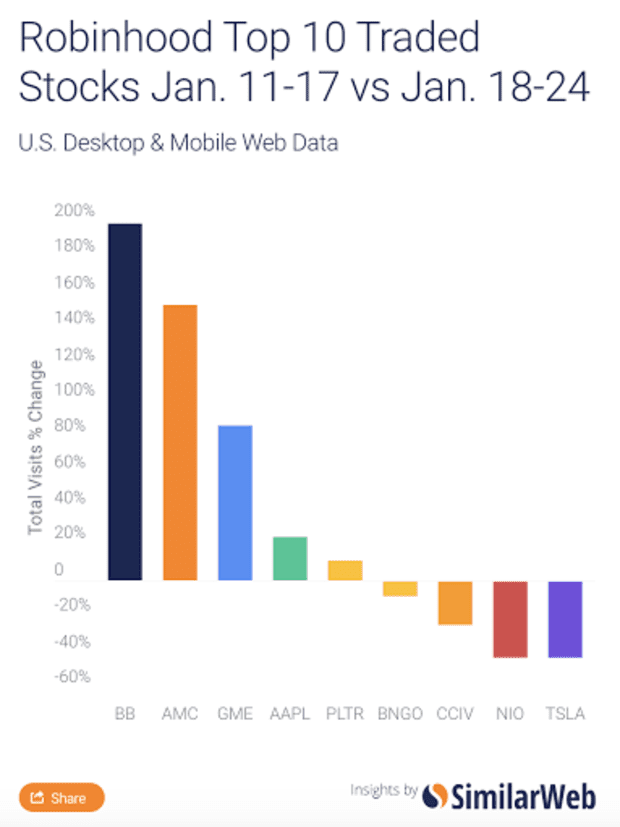

SimilarWeb says it can track stock symbol searches among mobile app users and desktop users on the Robinhood Markets platform, for example. SimilarWeb says the research activity can be indicative of actual trading and can help clients identify trends early, according to Ed Lavery, director of investor solutions at SimilarWeb.

SimilarWeb

SESAMm, which markets itself as a leading provider of analytics and artificial intelligence for investment professionals, has also developed or is working on services that could help identify social media trends, Spiwak said. .

SESAMm, which recently secured some $ 7.5 million in venture capital funding from NewAlpha Asset Management and global investment firm The Carlyle Group, did not immediately return an email for comment.

Meanwhile, the liquidation of profitable long positions by hedge funds and other investors who needed cash to cover losses from losing short positions was blamed on the Dow Jones Industrial Average DJIA,

the S&P 500 SPX index,

and the Nasdaq Composite Index COMP,

recording their worst weekly losses since October last Friday.

Markets were trying to recoup those losses early Monday, triggering what is expected to be a turbulent February.

[ad_2]

Source link