[ad_1]

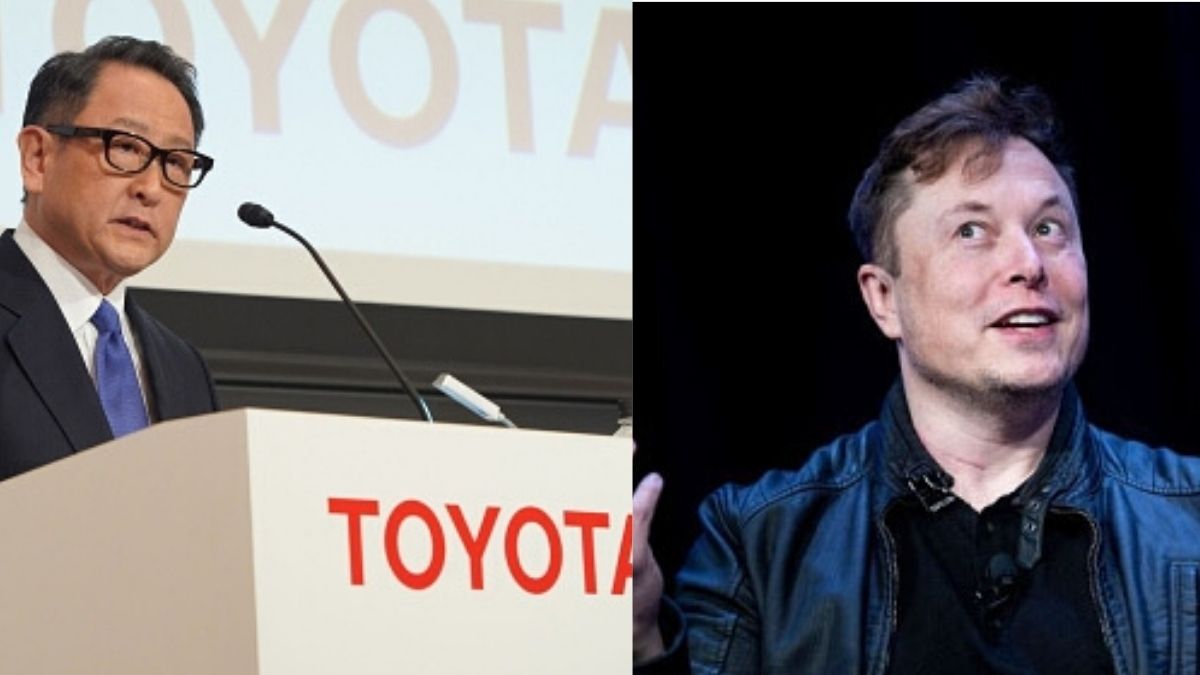

Choi Won-seok reports in Korean news outlet Ghosun Libo that, according to a Japanese auto industry official, Toyota and Tesla have been examining the partnership since last year and are approaching the final step.

Here are some of the highlights of the partnership with Toyota Tesla. When the partnership with Toyota is established, Tesla will be able to launch a low-cost compact EV SUV using the Toyota platform.

The Ghosun IIbo is SK’s largest newspaper. Tesla source Sawyer Merritt tweets that it was said that “the reporter in the story is also highly regarded. We’ll see if that’s true.”

Toyota supplies the vehicle platform to Tesla, and instead Tesla supplies Toyota with some of the electronic control platform and software technology installed in its vehicle.

When the partnership with Toyota is established, Tesla will be able to launch a low-cost compact SUV electric vehicle using the Toyota platform. In addition, Tesla’s sales in Japan, which are around 1,000 units per year, are expected to increase significantly.

Tesla CEO Elon Musk said during Battery Day in September last year that Tesla “will release a compact and affordable $ 25,000 electric car in 2023. However, among experts, there were several opinions that it would be difficult for Tesla to find.a way to sell electric cars at such low prices. Especially considering that Tesla already developed the Model 3 in 2017, the electric crossover model in 2020, the Cybertruck’s exoskeleton and work on the semi truck, at the moment, we have no idea about Tesla’s affordable compact vehicle, which now appears to be partnered with Toyota, if this report is true.

I think it’s a smart move for Tesla and Toyota. Some people may be skeptical of a Tesla Toyota partnership, but remember Tesla helped build the Toyota RAV4 in 2012. I’m sure you remember when Toyota sold its Tesla stock in 2017.

What’s in this for Toyota?

Toyota can also significantly reduce the resources and time spent on innovation of its vehicle’s integrated electronic control platform (ECU) and operating system (OS) using Tesla technology. Toyota assesses that the integrated ECU and operating system technology that can control and improve vehicle functions through wireless (Over The Air) updates lags behind Tesla. In other words, through the cooperation between the two companies, Tesla can reduce the cost and development period of small electric SUVs, and Toyota’s advantage is the gain in the development of the ECU and the system. operation. It aims for a win-win effect by reducing the time it takes for both companies to compensate for each other’s weaknesses, allowing them to focus more on their own strengths.

Tesla and Toyota have already teamed up. The two companies agreed to jointly develop electric vehicles in 2010 and in 2012 released Toyota’s RAV4 electric vehicle equipped with Tesla’s battery system. However, for various reasons such as weak sales, the alliance between Toyota and Tesla ended in 2017. Still, the close relationship between Musk and Toyota CEO Akio Toyoda was maintained, leaving room for a reunion. between the two companies in the future.

Tesla’s Fremont Plant is an automobile manufacturing plant in Fremont, California, operated by Tesla. But the facility opened as General Motors Fremont Assembly in 1962, and was then operated by NUMMI, a former GM-Toyota joint venture. Tesla took possession of it in 2010.

Last year Toyota sold 9.35 million vehicles, overtaking Volkswagen and returning to the world’s bestsellers in five years. Toyota, along with Isuzu and its Hino truck subsidiary, plans to accelerate electric and autonomous driving of commercial vehicles. Previously, Toyota had also established a hydrogen fuel cell development joint venture with five Chinese automotive and technology companies, including Tsinghua University, Beijing, Cheil, Dongfeng and Guangzhou Motors. The jointly developed hydrogen fuel cell system will be installed on Chinese trucks and buses from 2022. In addition, Toyota is working to maximize the economies of scale associated with electrification and autonomous driving, including successive alliances in capital with its rivals Mazda and Suzuki.

Meanwhile, Tesla CEO Elon Musk wrote on Twitter on March 27 that “the probability that Tesla will soon become the world’s largest company is over 0%.” While the context is unclear, it was also written “probably in a few months,” which can be interpreted as referring to a period, and was quickly deleted. Currently, Tesla’s market capitalization is around $ 590 billion, or one-third of the world’s largest market-capitalization company, Apple.

Tesla’s share price has continued to rise even after overtaking Toyota, which was the industry’s top market capitalization at the time, in July of last year. Tesla, in particular, is tasked with achieving economies of scale, with just 500,000 vehicles sold last year. If the alliance with Toyota is established, it can receive great power to expand mass production faster and at lower cost.

Armen hareyan is the founder and editor-in-chief of Torque News. He founded TorqueNews.com in 2010, which has since published expert information and analysis on the automotive industry. It can be reached at Torque News Twitter, Facebok, Linkedin and Youtube.

[ad_2]

Source link