[ad_1]

Fintech funding continues to arrive at a rapid pace, due to the huge change underway in the way consumers spend and manage their money. In the latest development, Revolut – the London-based financial ‘superapplication’ that provides banking, investing, currency transfer and other money management services to some 16 million users worldwide – confirmed this morning that she had raised $ 800 million. The company said this E-Series round of funding valued Revolut at $ 33 billion.

This makes Revolut the UK’s most valuable fintech, as well as one of the largest large-scale startups backed by the private sector, not only in Europe, but globally. It also follows in the footsteps of Klarna, the Swedish buy now and pay later startup that is also branching out into a wider range of other services for consumers and the businesses that integrate it. Klarna raised $ 639 million last month valued at just under $ 46 billion. Stripe in the United States earlier this year raised to a valuation of $ 95 billion.

This latest Series E is co-led by Softbank Vision Fund 2 and Tiger Global, who appear to be the sole backers of this round. This follows rumors earlier this month Revolut was lifting big. Revolut last lifted about a year ago, when it closed a Series D at $ 580 million, but what’s astonishing is how much its valuation has changed since then, multiplying by 6 (it was $ 5.5 billion last year).

“The investments from SoftBank and Tiger Global are an endorsement of our mission to create a global financial superapplication that enables clients to manage all of their financial needs through a single platform,” said Nikolay Storonsky, Founder and CEO of Revolut, in a statement.

For further reference, when Revolut released financial figures for 2020 last month, it noted that it had made $ 361million in revenue (£ 261million) in the fiscal year, an increase by 57% compared to 2019 revenue of $ 229m (£ 166m). Gross profit for the period was $ 170m (£ 123m) last year, although it still operates at a net loss, with the first quarter of 2020 seeing an adjusted operating loss of $ 76m (£ 55million), with $ 277million (£ 200.6million) in operating losses for the full year. In other words, the large sum of money placed now, and this large valuation, are long term bets.

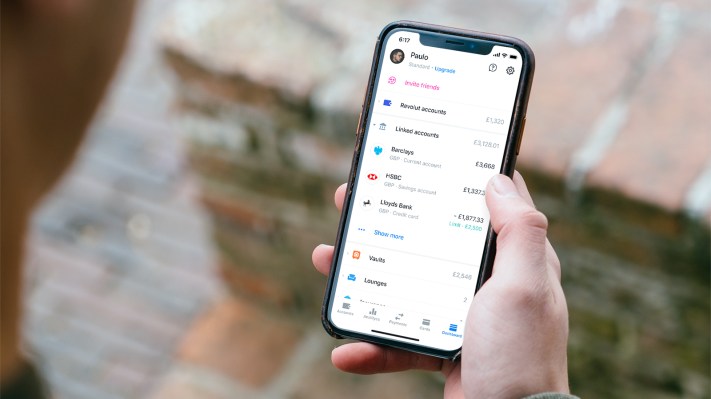

Revolut now has over 16 million customers and records over 150 million transactions / month, and the plan will be to offer a wider range of services and promotions both to grow this base and to get its users to spend more. money and time to apply. . It will also include exploring new areas like insurance and a deeper dive into investment and trading, and possibly a significant increase in credit services (which have been a major growth engine for other neobanks and financial technology companies). Revolut will also do more to develop its user bases in the United States and India, he said.

Like other “neobanks” that have emerged in recent years, Revolut was built around the idea of leveraging an already built banking and financial services infrastructure, which it uses through APIs and integrates into its service. Revolut then focuses on creating a smooth and user-friendly experience both within its application and with its customer service.

The goal of its technology is therefore to improve the personalization of the service and to create new tools that are not so commonplace, such as budgeting tools and other financial management features.

“We believe Revolut’s superior customer experience and focus on rapid product development places the company in a strong position to continue to grow in existing and new geographies,” said Scott Shleifer, Partner of Tiger. Global, in a press release. “We are excited to partner with Nik and the Revolut team as they build the next generation of financial services. “

This particularly appealed to younger users, who not only are more comfortable with digital services, but will be less experienced in all things finance.

But it will be interesting to see how and if Revolut integrates more basic financial infrastructure into its application, or if integrated finance reigns supreme. (Applying for a banking license like Revolut did earlier this year in the UK could be a sign of what it could build in the future. It has also parted ways with some of its third-party vendors over the years. years to build its own infrastructure.)

In the meantime, investors believe that there is a lot of room for the development of the technology in its current model.

“Revolut’s rate of innovation has redefined the role of financial services, placing [Revolut] at the forefront of the emerging neobanking sector in Europe. The company’s rapidly growing user base reflects sustained demand for Revolut’s expanding range of services, ”Karol Niewiadomski, senior investor for SoftBank Investment Advisers, said in a statement. “We look forward to supporting Nikolay and his team in continuous product innovation and bringing their services to new markets globally.”

[ad_2]

Source link