[ad_1]

(Bloomberg) – Texas Instruments Inc. has given a revenue forecast for the current period that has disappointed some investors, raising concerns that an increase in demand for chips caused by the pandemic is short-lived. The title fell as part of the extended trade. Sales will rise to $ 4.4 billion to $ 4.76 billion in the period ending September, Texas Instruments said in a statement on Wednesday. Earnings will be $ 1.87 to $ 2.13 per share, the company said. On average, analysts predicted earnings of $ 1.97 per share and sales of $ 4.59 billion, according to data compiled by Bloomberg.

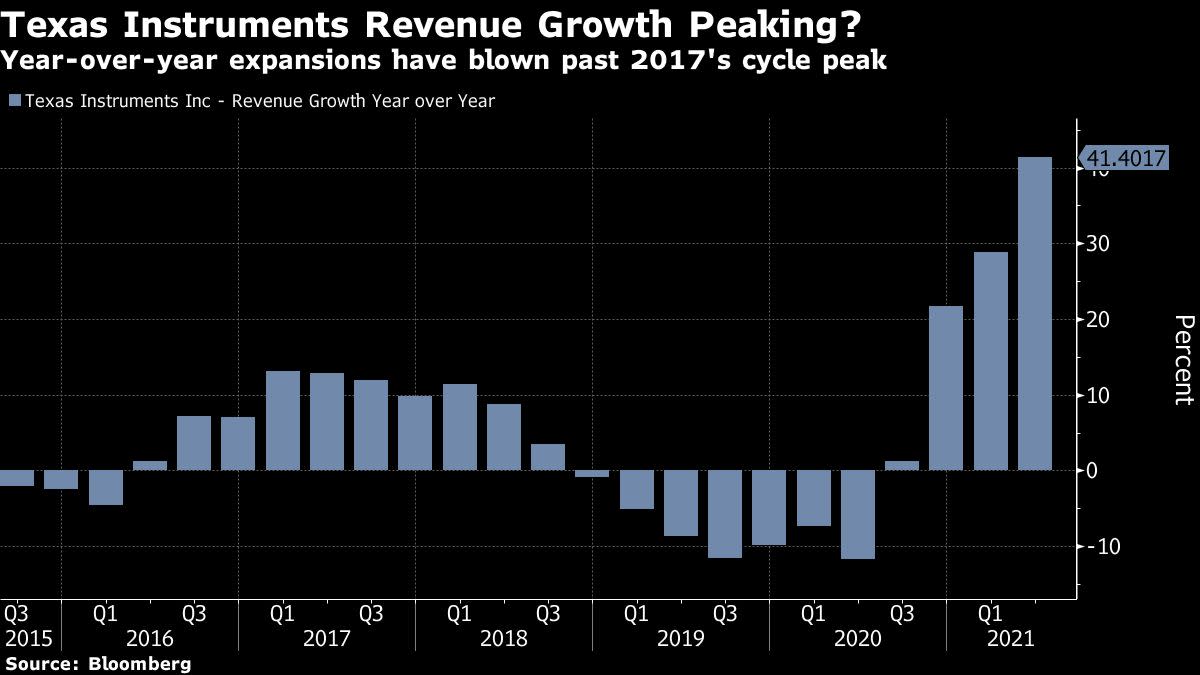

Like other chipmakers, Texas Instruments posted several quarters of double-digit percentage revenue growth, driven by demand for a wide variety of devices containing its tiny electronic components. The rapid surge has sparked speculation among analysts and investors that some of the orders reflect panic buying by customers who have become worried that they will not be able to get enough supply. Such behavior in the past has caused accidents.

The Dallas-based company has tens of thousands of products and more than 100,000 customers who manufacture everything from phones to military equipment. This position as the largest manufacturer of analog and integrated processing chips makes the company an indicator of demand for electronics. A large part of its products go into industrial machinery.

Texas Instruments management said the amount of in-house inventory fell to 111 days in the quarter, well below the 130-190 days the company likes to have on hand. Delivery times, the period between placing an order and delivery to customers, have grown longer for an increasing number of products. Despite numerous questions on a conference call with analysts, management declined to say whether they believe demand is peaking or whether growth at current levels is sustainable.

“Our job is not to predict the future, it is to prepare the business so that we can manage everything and we have done it,” CFO Rafael Lizardi said in an interview. “Some would say this time it’s different, but it’s a dangerous argument.”

Lizardi pointed out that Texas Instruments’ high level of in-house manufacturing has made the company more agile in meeting increasing demand. When competitors cut production last year, his company increased production and built up inventory. Many chipmakers outsource much of their manufacturing, and some have never had their own factory. Texas Instruments has factories that supply approximately 80% of its own needs.

Shares of Texas Instruments have followed the overall advance in chip stocks this year, gaining 18% to $ 194.24 at the close. The stock fell about 4.2% in extended trading after the results were announced.

In the second quarter, net income reached $ 1.93 billion, or $ 2.05 per share, from $ 1.38 billion, or $ 1.48 per share, a year earlier. Revenue increased 41% to $ 4.58 billion. Analysts have estimated an average of $ 4.36 billion.

Earlier this month, Texas Instruments announced the purchase of a factory in Lehi, Utah, from Micron Technology Inc. for $ 900 million. The company is taking the lead in using relatively advanced factories for chips that typically did not require the kind of production needed for Intel Corp’s microprocessors. or Micron’s computer memory. This gives Texas Instruments an advantage in terms of costs and control over its own supply, the company argued.

(Updates with CFO comments in sixth paragraph.)

More stories like this are available at bloomberg.com

Subscribe now to stay ahead with the most trusted source of business information.

© 2021 Bloomberg LP

[ad_2]

Source link