[ad_1]

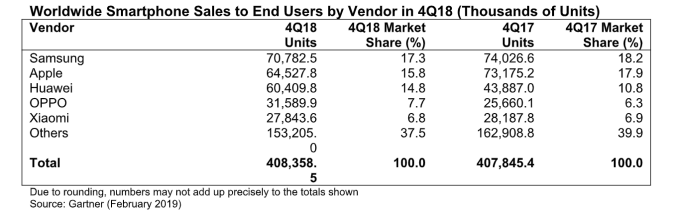

Gartner's Smartphone market share data for the vacation quarter just out of date highlights the challenge for device makers to head to the world's largest mobile phone show that debuts in Barcelona next week: analyst data show that global smartphone sales are slowing in the fourth quarter of 2018, with growth of only 0.1% during the 2017 and 408 holiday quarters, 4 million units delivered.

tl; dr: high-end handset buyers have decided not to worry about upgrading their glossy touch-glass tiles.

Gartner says Apple recorded its worst quarterly decline (11.8%) since the first quarter of 2016, although the iPhone maker retained its second place with a market share of 15.8% behind the market leader Samsung (17 , 3%). Last month, the company warned investors to expect a reduction in revenue for the first quarter of its fiscal year, before reporting a 15% drop in iPhone sales. compared to the previous year.

The South Korean mobile phone maker has also lost shares year-on-year (down about 5 percent), with Gartner reporting that high-end devices such as the Galaxy S9, S9 +, and Note9 have struggled generate growth, even as their Chinese rivals share.

Huawei was one of the Android rivals causing a headache for Samsung. It has resisted the downtrend on the part of major vendors by reducing the gap on Apple since its third niche: more than 60 million smartphones were sold during the holiday quarter and its share went from 10.8% in the fourth quarter of 2017 to 14.8%.

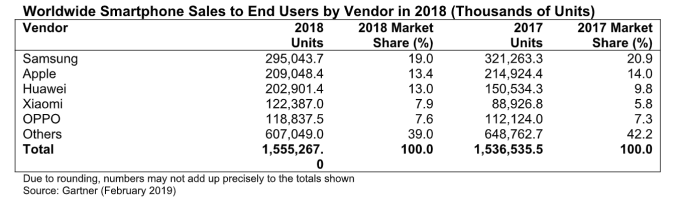

Gartner has described the year 2018 as "Huawei's Year," claiming that the group had the fastest growth among the top five smartphone vendors and that it had progressed throughout the year. # 39; year.

This growth has not only manifested itself in Huawei's "bastions" of China and Europe, but also in the Asia-Pacific, Latin America and the Middle East, thanks to in pursuit of investments in these regions, noted the analyst. Although its expanded series of Honor Medals enabled the company to capitalize on growth opportunities in the second half of the year, "particularly in emerging markets".

In contrast, Apple's double-digit decline made it the worst-ever quarterly vacation performance among the top five smartphone vendors in the world, with Gartner stating that iPhone demand has fallen in most parts of the world. exception of North America and the mature Asia / Pacific region.

IPhone sales fell mainly in Greater China, where Apple's market share fell to 8.8% in the fourth quarter (compared to 14.6% in the corresponding quarter of 2017). For 2018, iPhone sales fell 2.7%, reaching just over 209 million units, he added.

"Apple should not only deal with buyers who delay upgrades while they expect more innovative smartphones. It also continues to face high-priced, medium-priced smartphone alternatives offered by Chinese suppliers. These two challenges limit Apple's growth prospects for unit sales, "said Anshul Gupta, senior director of research at Gartner, in a statement.

"The demand for entry-level and mid-priced smartphones has remained strong in all markets, but demand for high-end smartphones has continued to slow in the fourth quarter of 2018. The slowdown in the market has been slow. Incremental innovation at the high-end, coupled with rising prices, has discouraged the decisions to replace the end of smartphones, "he added.

Further down the ranking of smartphones, the Chinese operator, Oppo, has increased its share of the global smartphone market in the fourth quarter to supplant the Chinese newcomer, Xiaomi, and fourth place – taking 7.7% vs. 6.8% of Xiaomi for the holiday quarter.

According to Gartner data, Gartner's overall fourth quarter was neutral, with a slight drop in the number of units delivered, highlighting Xiaomi's motives for the dual-fold smartphone.

Because, well, with the unbelievable innovation stuck among the usual suspects (who, nevertheless, increase the prices of high-end handsets), there is at least one opportunity for buccaneering losers to break, grab attention and catch bored consumers.

Or it's the theory. Consumer interest in 'foldable' has not been tested yet.

According to the analyst, global smartphone sales to end users increased 1.2% year-over-year in 2018, with 1.6 billion units delivered.

The worst decreases of the year were recorded in North America, mature Asia / Pacific and Greater China (6.8%, 3.4% and 3.0% respectively). ), he added.

"In mature markets, the demand for smartphones is largely based on the appeal of the flagship smartphones of the three biggest brands – Samsung, Apple and Huawei – and two of them have seen a decline in 2018," said Gupta.

Overall, the Samsung smartphone market leader took 19.0% market share in 2018, compared to 20.9% in 2017; Apple, second, took 13.4% (compared to 14.0% in 2017); the third, Huawei, took 13.0% (against 9.8% the previous year); Xiaomi, fourth, took a share of 7.9% (against 5.8%); and Oppo is ranked fifth with 7.6% (vs. 7.3%).

[ad_2]

Source link