[ad_1]

There has been a noticeable change in appetite for Zynga Inc. (NASDAQ: ZNGA) in the week since its quarterly report, with the stock falling 19% ahead of the market to US $ 8.11. We want to take a look at Zynga’s growth prospects and put them in context with long-term expectations.

Starting with the latest earnings report, we highlight the direction the CEO of Zynga sees the company heading:

“… we are investing in hyper-casual gaming, cross-platform gaming, international expansion and ad technology – all of which have the potential to significantly increase Zynga’s total addressable market and further enhance our competitive edge.” and our growth. “

Zynga isn’t backing down from growth and new products, their business model demands continuous improvements and the launch of exciting new titles – the direction of the company makes perfect sense going forward. It also appears that they are using a more focused portfolio of stocks, perhaps influenced by the poor performers of the past. This approach makes sense from a profit standpoint, but also increases the risk of drying up as they have fewer opportunities to market securities.

To continue its growth, Zynga anticipates two new candidate titles:

- FarmVille 3 in T4

- Star Wars: Hunters (no reliable launch date)

Zynga has an upbeat growth story and a few key titles that helped performance in 2021: Toon Blast, Toy Blast, Rollic’s hyper-laid back wallet, and Harry Potter: Puzzles & Spells.

They also expressed a positive outlook for the 2021 financial year:

- Revenue of $ 2.7 billion

- Net loss of $ 135 million

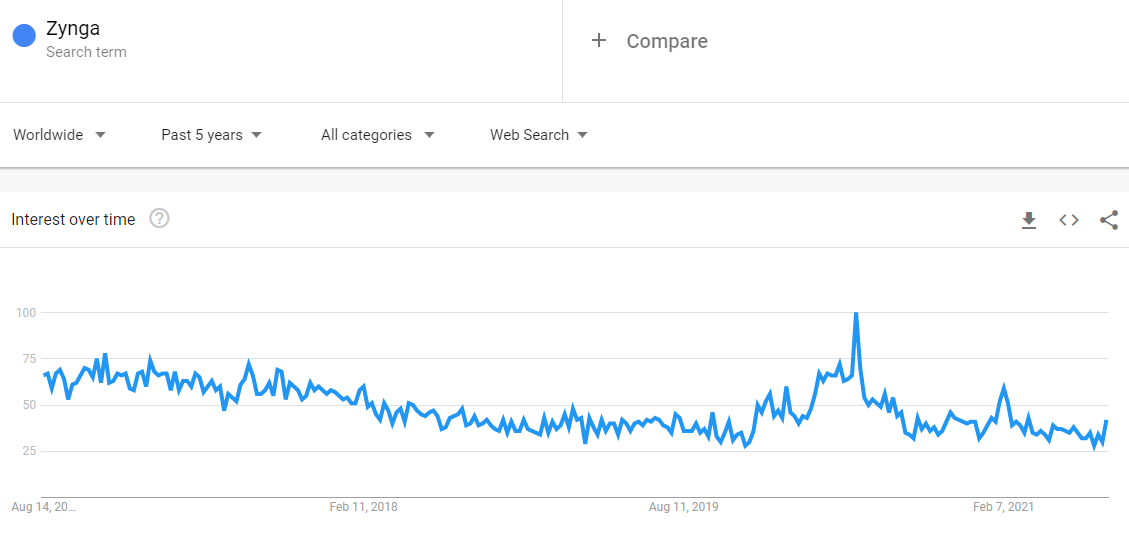

However, the company comments that these estimates may have a wider range of results, among other things, due to Apple’s privacy changes. It should also be noted that the research interest is not favorable to Zynga and that it slowly tends to decline:

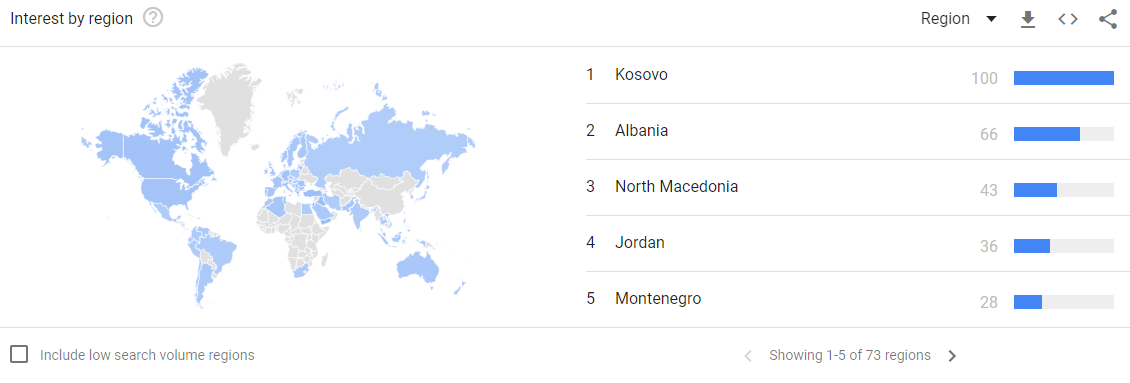

This is compounded by the fact that the highest volume of research comes from low-income developing countries:

If you want to explore the results of Google Trends, you can find them HERE.

Knowing this, it will take extra effort on the part of the company to deliver in the long term.

For now, let’s see what analysts are expecting from Zynga and put the results into perspective.

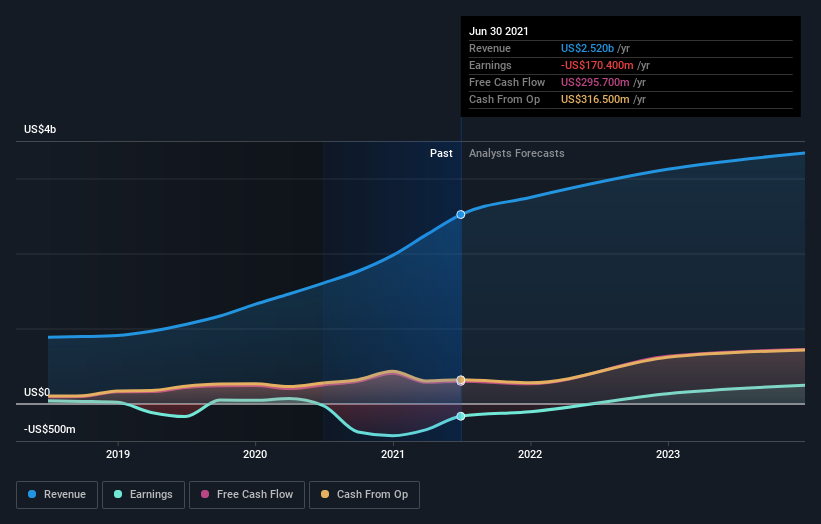

Zynga exceeded expectations by 5.9% with revenue of US $ 720 million. It also surprised on the earnings front, with an unexpected statutory profit of US $ 0.02 per share, a nice improvement over losses predicted by analysts.

Following the result, analysts updated their earnings model, and it would be good to know if they think there has been a strong change in the outlook for the company, or if it is like habit.

Take the latest post-earnings forecast to see what the estimates suggest for next year.

See our latest review for Zynga

Following the latest results, Zynga’s eleven analysts are now forecasting revenues of US $ 2.75 billion in 2021. That would represent a decent 9.0% improvement in sales from the past 12 months. Loss per share is expected to decline significantly in the near future, narrowing 40% to US $ 0.094.

Prior to this latest report, the consensus expected revenue of US $ 2.73 billion and US $ 0.096 per share in losses. So it looks like there has been a moderate improvement in analyst sentiment with the latest consensus release, given the upgrade to loss per share forecast for this year.

The consensus price target fell 9.3% to US $ 12.14 despite lower losses expected next year. It appears that the persistent lack of profitability is starting to weigh on valuations. TThe more bullish analyst values Zynga at US $ 15.00 per share, while the most bearish the price at US $ 9.00. Analysts certainly have different opinions on the company, but the estimates mainly suggest a benefit to the company.

There is an anticipation that Zynga’s revenue growth will slow, revenue by the end of 2021 is expected to grow 19% on an annualized basis. This is compared to a historic growth rate of 26% over the past five years. Conversely, the industry is expected to grow at 16% per year, which means Zynga is not expected to exceed its targets.

The bottom line

Zynga has a focused portfolio of performing games, but it could be difficult to sustain growth rates if trends change in the future.

The company is fighting an uphill battle where search interest from the public slowly wanes and app stores introduce restrictive rules for Zynga’s business model. They will have to become much more efficient in their approach or find a new niche for growth.

In the short term, analysts reconfirmed their revenue estimates, with the company expected to grow at roughly the same rate as the industry as a whole.

In addition, analysts have also lowered their pricing targets, suggesting that the latest quarterly report has led to greater pessimism about the company’s intrinsic value.

That said, the company’s long-term earnings trajectory is much bigger than next year. We have estimates – from several Zynga analysts – up to 2023, and you can see them for free on our platform here.

That said, we still have to consider the ever-present specter of investment risk. We have identified 1 warning sign with Zynga and understand that this should be part of your investment process.

Promoted

When trading Zynga or any other investment, use the platform considered by many to be the gateway for professionals to the global market, Interactive Brokers. You get the cheapest * trading on stocks, options, futures, forex, bonds and funds from around the world from one integrated account.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no positions in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our aim is to bring you long-term, targeted analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price sensitive companies or qualitative material.

*Interactive Brokers Ranked Least Expensive Broker By StockBrokers.com Online Annual Review 2020

Do you have any feedback on this item? Are you worried about the content? Contact us directly. You can also send an email to [email protected]

[ad_2]

Source link