[ad_1]

Hyatt has just announced a major acquisition. This is likely to be quite polarizing, with some consumers being super excited and others totally indifferent.

Hyatt buys Apple Leisure Group for $ 2.7 billion

Hyatt has entered into a definitive agreement to acquire Apple Leisure Group (ALG), which is a hotel, travel and hospitality management services group. ALG is acquired for $ 2.7 billion in cash from KKR and KSL Capital Partners, and the transaction is expected to close in the fourth quarter of 2021.

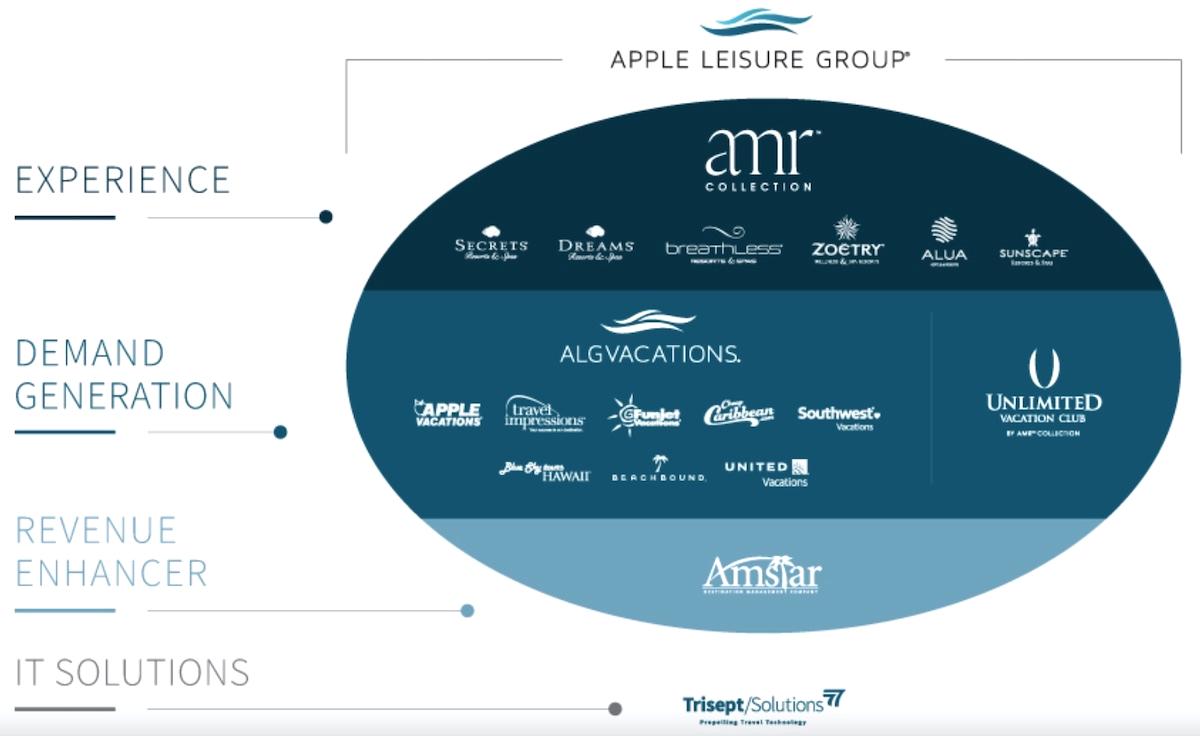

For those unfamiliar with ALG, this is a business largely focused on selling package vacations, as well as managing resorts across the Caribbean, Mexico, Europe and beyond. ALG manages AMResorts, which includes Alua, Breathless, Dreams, Secrets, Sunscape, etc. ALG also has over a dozen subsidiaries, including Apple Vacations, CheapCaribbean.com, Southwest Vacations, United Vacations, Unlimited Vacation Club, and more.

ALG’s portfolio includes more than 33,000 chambers operating in 10 countries. The portfolio has grown at a rapid pace, growing from nine resorts in 2007 to around 100 resorts by the end of 2021, with 24 more transactions executed in the pipeline.

How Hyatt explains the acquisition of Apple Leisure Group

Hyatt is spending a huge amount of money on this acquisition. For comparison, in 2018 Hyatt acquired Two Roads Hospitality (which brought us brands like Alila and Thompson) for $ 480 million. Today, the company spends more than five times as much on Apple Leisure Group.

So what is the rationale? As described, here is what Hyatt hopes to gain by acquiring ALG:

- Expanded presence in luxury and resort travel – this acquisition expands Hyatt’s presence in luxury leisure travel as it will double the number of resorts managed by Hyatt and allow Hyatt to offer the largest portfolio of all-inclusive luxury resorts in the world

- Major expansion in Europe – this will increase Hyatt’s European footprint by 60% and allow the Hyatt brand to enter 11 new European markets

- Expanded Platform for Growth – ALG’s developer and owner base to expand Hyatt’s relationships with engaged partners in key complementary geographies

- Hotel owners will benefit – Apple Leisure Group resort owners will have access to a much larger collection of brands (in other words, we could see some of these hotels rebranded under one of Hyatt’s existing brands) , as well as supporting Hyatt’s global distribution, sales and marketing

- More options for World of Hyatt members – as you might expect, members will have access to more hotels whether they are looking to earn or redeem points

- This will expand Hyatt’s end-to-end leisure travel offerings – ALG Vacations is one of the largest travel package providers and leisure travel distribution platforms in North America, so Hyatt could go further in the package travel industry.

- This allows Hyatt to develop its light asset strategy – ALG is light asset, and with Hyatt continuing to sell real estate assets, the company hopes to increase the percentage of revenue generated by fees.

Here’s how Hyatt CEO Mark Hoplamazian describes the acquisition:

“With the acquisition of the asset-reducing Apple Leisure Group, we are delighted to bring a highly desirable independent resort management platform to the Hyatt family. The addition of ALG properties will immediately double the global footprint of Hyatt resorts. ALG’s portfolio of luxury brands, leadership in the all-inclusive segment and broad portfolio of new resorts will expand our reach into existing and new markets, including Europe, and further accelerate our net growth of leading rooms. Of the industry. Importantly, the combination of this value-creating acquisition and the $ 2 billion increase in our asset sales commitment will transform our earnings profile, and we expect Hyatt to achieve 80% profit based on fees by the end of 2024. “

My opinion on the Hyatt acquisition

When we heard that Hyatt was looking to acquire a hotel brand in order to expand in Europe, I was excited. It appears to be Hyatt’s answer to that goal, and now I’m a little less excited. Some thoughts:

- This reflects that Hyatt is looking to expand into the leisure market, which perhaps makes sense at this point, given that anyone can guess when business travel will return to 2019 levels.

- It’s a huge buy – Hyatt’s market cap is $ 7.3 billion, and it’s a $ 2.7 billion acquisition, so proportionally it’s almost like when Marriott bought Starwood

- The emphasis on all-inclusive packages is going to polarize – some people like all-inclusive packages (especially those with families and those who like hanging out at resorts), while others don’t like this type of package. holidays.

- I think it might be a stretch to suggest that all / most of these properties are ‘luxury resorts’ as I would say most of these properties are more of a mid-range.

- Assuming there is no major rebranding of existing resorts, Hyatt is getting worse than Marriott here in terms of the number of hotel brands it will have.

- Going through the Apple Leisure Group portfolio, there isn’t a single hotel that jumps out at me and makes me say “Can’t wait to stay / redeem points here!” (Which isn’t to say I won’t stay in one, but it’s not like when Hyatt acquired Two Roads Hospitality, and suddenly I saw a dozen hotels I desperately wanted to stay at)

- I really wish Hyatt’s acquisitions were a little more strategically focused on consumers in terms of growth on its core value proposition; although I’m not a huge fan of IHG, I love how IHG wanted to expand into the luxury space and then I acquired Kimpton, Regent, and Six Senses, all of which are big brands ( my God, I would have loved it if Hyatt bought Six Les Sens instead!)

- One can’t help but wonder the long-term impact on World of Hyatt for acquisitions like these, especially since they largely prey on those who book package vacations; presumably these hotels have a lower fee structure and feel that they don’t need to offer as many rewards as that might not be what motivates people to book one of these properties

At the end of the line

Hyatt acquires Apple Leisure Group in its largest acquisition to date. This will significantly expand Hyatt’s presence in the all-inclusive resort market, particularly in the Caribbean, Mexico and Europe. For consumers who enjoy all-inclusive properties, this is great news. For others, it’s probably a little less exciting.

What do you think of Hyatt’s acquisition of Apple Leisure Group?

[ad_2]

Source link