[ad_1]

The following is taken from a recent edition of Deep Dive, Bitcoin Magazinethe premium markets newsletter. To be among the first to receive this and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

“We are committed to investing $ 500 million of our cash and cash equivalents in a diversified portfolio of crypto assets. Going forward, we will also allocate 10% of quarterly net income to this same portfolio. “- The Coinbase blog

In a tweet from Coinbase CEO Brian Armstrong On Thursday evening, it was announced that Coinbase will buy $ 500 million in a “diversified portfolio of crypto assets”, and an interesting note is that the allocation of the wallet will be decided based on the custody balances of the assets held on Coinbase by its consumers.

“Our investment allocation in crypto assets will be determined by our aggregate custodial crypto balances, which means our clients will drive our investment strategy. Our investments will be rolled out continuously over a multi-year window using an average cost dollar strategy. ”

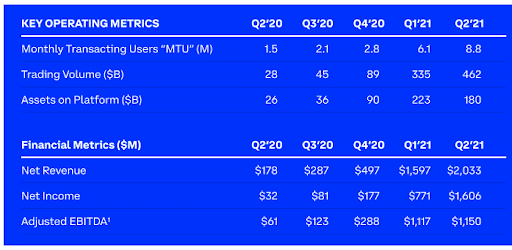

By digging deeper, we can make estimates on the size of the bitcoin allocation that will be made by Coinbase using the exchange balances and numbers shown in the company’s recent second quarter earnings report. .

The second quarter report which was just released on August 10, 2021 and whose figures end on June 30, 2021.

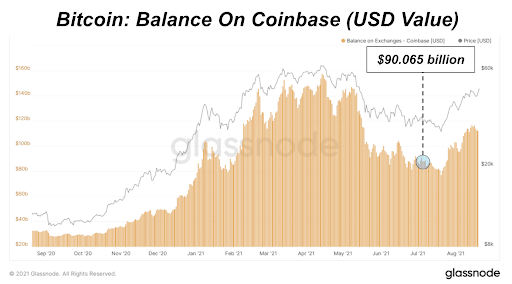

The company said it had $ 180 billion in assets held on the platform at the end of the second quarter, and using data from Glassnode, we can see that there was around $ 90 billion in bitcoin held on Coinbase on the same date.

While this number is most certainly dynamic, it would mean that Coinbase will allocate 50% of the $ 500 million committed to bitcoin and 5% of quarterly net income to bitcoin quarterly.

In the last quarter, Coinbase generated net profit of $ 1.6 billion, which would translate into a purchase of around $ 80 million.

[ad_2]

Source link