[ad_1]

Federal Reserve Chairman Jerome Powell testifies during a hearing of the United States House Oversight and Reform Subcommittee on the coronavirus crisis, on Capitol Hill in Washington, June 22, 2021.

Graeme Jennings | Swimming pool | Reuters

For the Federal Reserve, implementing the simplest monetary policy in the institution’s history was difficult enough. Going out won’t be a treat either.

This is what the central bank faces on its way.

On Friday, investors will learn more about what Fed Chairman Jerome Powell thinks about the economy, and they also expect to get at least some more clues as to how he will guide the exit from the central bank. of the steps she has taken to save the nation from the Covid-19 pandemic. He will be speaking at the Fed’s annual Jackson Hole conference, which will be held virtually again this year.

The first on the Fed’s record is the withdrawal of money printing – the roughly $ 120 billion in bonds it buys each month in an attempt to stimulate demand and lower long-term interest rates. term.

After that, the road becomes more difficult.

At some point, the Fed will look to raise short-term interest rates from the near zero anchor point where they have been since March 2020. The return to normal rates did not end well for the Fed the last time it tried to do this from 2015-18 because it had to stop mid-cycle amid an economic downturn.

The markets could therefore be excused for being at least a little nervous this time around. The Fed not only needs to reverse its most aggressive easing policies ever, it needs to do so with precision and hopes not to break anything in the process.

“Every change in the Fed’s monetary policy is important,” said Priya Misra, global head of rate strategy for TD Securities. “But I think it’s particularly significant today because we know growth is slowing and the Fed is trying to pull out.”

Indeed, the economy is still well in a strong recovery from the depths of the pandemic, which resulted in the steepest but shortest recession in U.S. history. But the rebound appeared, if not declining, at least stagnating. The Citi Economic Surprise Index, which measures actual data against Wall Street estimates, was at an all time high in mid-July, but has now fallen to levels last seen in June 2020, in the early days. of Covid-19.

Fed officials themselves expect significantly slower growth in the coming years at a time when monetary and fiscal policies will be tighter. This raises more questions about whether Powell and his cohorts can get the right exit.

Doubts in the market

“Are they coming out in the right place? Are they coming out at the right time, at the right scale? Given the downturn in the economy, we have questions on both, ”Misra said. “The market is evaluating a policy error.”

What Misra means by policy error is that the current pricing of federal funds futures, the market that trades around Fed rate moves, indicates that the Fed will only be able to raise its rate a few times. times up to maybe 1.25%, then will have to stop while the growth stops.

Such low rates frighten Fed officials as they leave them little room for maneuver to relax their policies in times of crisis. This was roughly where the funds rate was at the start of the pandemic crisis, down substantially from the 2.25% to 2.5% target range where the Fed ended its last round of hikes. rates in December 2018.

The calculation of how to manage all of this will be up to Powell from a communications standpoint and the rest of the Federal Open Market Committee in terms of the actual mechanics.

“The tapering is important because it is a very good measure not only of the credibility of the Fed, but in terms of communication, the quality of the strategy and its transparency,” said Deepak Puri, chief investment officer for Americas at Deutsche Bank Wealth. Management. “In 2013, the Fed made mistakes in the way it communicated on tapering.”

This 2013 episode – the so-called Taper Tantrum as it’s known now – is the only model the market has for how the Fed might proceed.

Misra, the TD Securities strategist, pointed out that the Fed is already showing that it has learned a lesson from the previous episode in that it is now facilitating the market downturn. The 2013 proclamation by then Fed Chairman Ben Bernanke was seen as blunt and drove interest rates and stocks down for several months before those trends reversed.

“They do a good job in the sense that they are really trying not to surprise the markets. It avoids a mistake they made in 2013. It’s positive,” said Shawn Snyder, head of investment strategy at Citi US Consumer Wealth Management. . “They are in a bit of a difficult position because the delta variant acts like a wild card.”

According to the Fed

The Fed and the markets have been hip joints for a long time, but especially in the era of quantitative easing and zero interest rates that began in 2008. Stocks collapsed sharply at the start of the pandemic, but then rebounded as soon as the Fed skyrocketed. until the purchase of bonds.

During the first cut, the market eventually recouped its losses even after the cut began and throughout the rate hike cycle – until the end of 2018, when a series of communication missteps from Powell shocked investors.

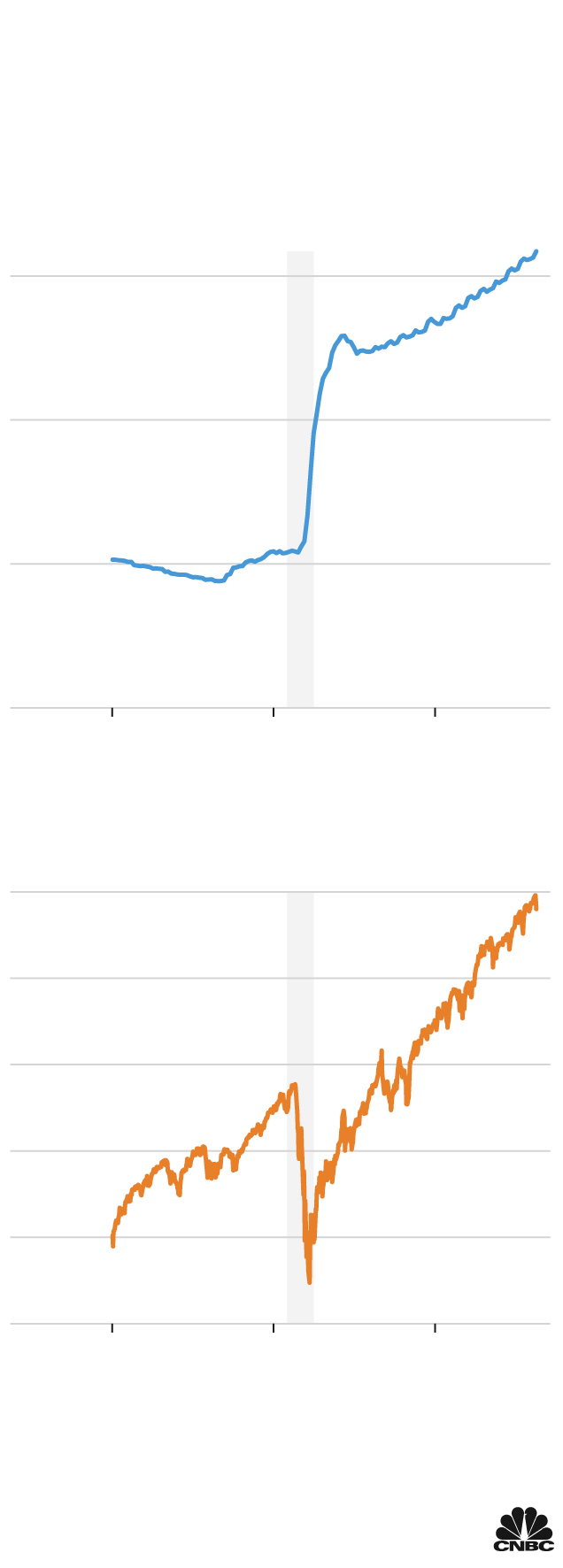

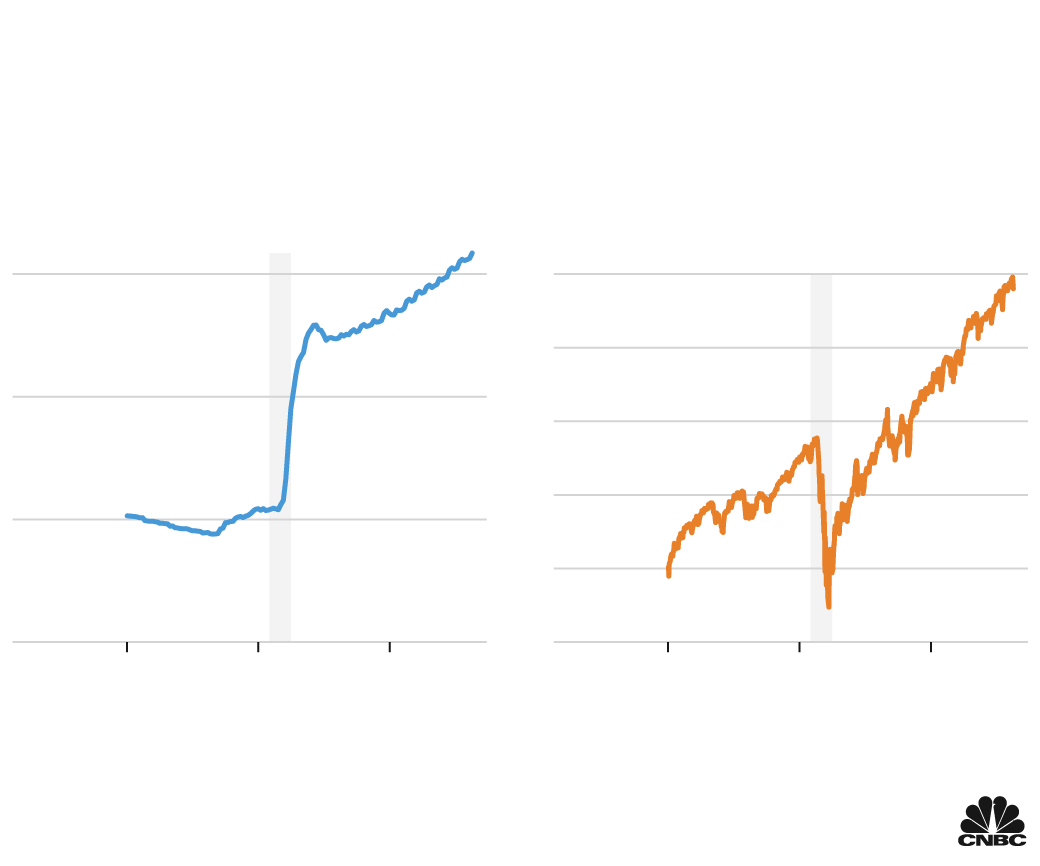

Balance sheet of the Fed, the stock market takes off

As the Federal Reserve builds its balance sheet, the S&P 500 index rebounded

of the Covid crash to reach record levels

Total Federal Reserve Assets

Note: The shaded area represents the recession in the United States. The Fed’s balance sheet data is not adjusted.

Source: Board of Governors of the Federal Reserve System, via the Federal Reserve Bank of St. Louis

(assets), FactSet (S&P 500). Data as of August 18, 2021.

Fed balance sheet, stocks take off

As the Federal Reserve built up its balance

leaf, the S&P 500 index rebounded

of the Covid crash to reach record levels

Total Federal Reserve Assets

Note: The shaded area represents the recession in the United States. fed

balance sheet data are not adjusted.

Source: Federal Reserve Board of Governors

System, via the Federal Reserve Bank of Saint-Louis

(assets), FactSet (S&P 500). Data as of 08/18/21.

Balance sheet of the Fed, the stock market takes off

As the Federal Reserve built its balance sheet, the S&P 500 Index

rebounded from the Covid crash to reach record levels

Total Federal Reserve Assets

Note: The shaded area represents the recession in the United States. The Fed’s balance sheet data is not adjusted.

Source: Board of Governors of the Federal Reserve System, via the Federal Reserve

Bank of Saint-Louis (assets), FactSet (S&P 500). Data as of August 18, 2021.

On the economy, Fed officials have placed less emphasis on their policies and more on tax assistance and the trajectory of the virus.

The Covid strain casts doubt on the direction of growth. But several regional Fed chairmen who spoke to CNBC this week said the virus appears to have little impact on growth and so far is not weighing on their economic forecasts.

“Consumers and businesses are becoming more adaptable, more resilient, and I think people expect that [the virus] is going to go in spurts, ”said Dallas Fed Chairman Robert Kaplan, one of those in favor of slowly removing accommodation policies.

The informal consensus now in the market is that the Fed will start slowing down before the end of the year and complete the process in eight to 10 months. After that, it will assess where things stand before moving on to rates.

Landmines for Powell

Tricky political dynamics both inside and outside the Fed complicate things for Powell.

The growing hawkish tendency of regional presidents such as Kaplan and James Bullard at the St. Louis Fed is clashing with more conciliatory members such as Gov. Lael Brainard and San Francisco Fed President Mary Daly.

On top of that, Powell is running for a new appointment in February, as are several other Fed officials, and President Joe Biden has yet to make his preferences known. Powell already knows what it’s like to lean to keep rates low after his experience with former President Donald Trump, but he will still have to some extent to round up cats to maintain a Fed consensus as economic and pandemic conditions are changing.

An image of US President Joe Biden is shown on a screen after his address to the nation regarding the situation in Afghanistan as traders work in the trading floor of the New York Stock Exchange (NYSE) in Manhattan, New York City, States United, August 17, 2021.

Andrew Kelly | Reuters

“The concern for both the Fed and the economy is the danger of exerting political pressure to achieve the desired results on the political spectrum, and thus of undermining the independence of the Fed,” CNBC Charles Plosser, former president of the Philadelphia Fed. . “Powell is in a tricky place.”

For his part, Powell used his 2020 Jackson Hole speech to describe a sea change in policy regarding the way the Fed views inflation. The new framework reflects a desire to achieve inclusive full employment, even if that means high inflation, and politics has been blamed in some neighborhoods for soaring prices this year.

“We are in a period when monetary and fiscal policy is at its most stimulating level that we have seen in 75 years,” Plosser said. “They have to ask themselves what role does politics play in making this inflation more persistent than it would otherwise be.”

Powell’s speech on Friday is unlikely to result in such major breakthroughs in the Fed’s approach, instead focusing on current and future expected conditions with a little clue as to how he and his fellow policymakers will try everything. to manage.

But that will likely set the stage for the central bank to return to normal, so the pressure will still be there.

“The real question for me is what will happen next year,” said Snyder, the Citi strategist. “Have we found ourselves considering moderation in the economy and in inflation, which will make it difficult for the Fed to get rates to take off? … I think people are very worried that it might not work out as we expected. . “

Become a smarter investor with CNBC Pro.

Get stock picks, analyst calls, exclusive interviews, and access to CNBC TV.

Sign up to start a free trial today.

[ad_2]

Source link